Weekly Digest – Edition 8

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: August 31, 2025

7 min read

Weekly Subscriber Digest

“We are in one of the most powerful bull markets of all time. As far as I can tell we are still very early

in it. No matter what happens next week as long as you protect the downside first, there is no bad outcome.”

Key Trading Insights

Bull Market Optimism

“We are in one of the most powerful bull markets of all time… still very early in it.”

Determined to make the last 4 months of the year as profitable as possible and is VERY optimistic. Pullbacks will create even more opportunities.

Determined to make the last 4 months of the year as profitable as possible and is VERY optimistic. Pullbacks will create even more opportunities.

Protecting the Downside

“As long as we protect the downside that’s all that matters to be there for the upcoming opportunities.”

Hard stops on new positions, never exposing to more risk than initially planned. Stops always within 7% of entry, ideally much lower.

Hard stops on new positions, never exposing to more risk than initially planned. Stops always within 7% of entry, ideally much lower.

Highest Volume Ever (HVE) Signals

“That type of volume generally births new trends.”

WULF gapped up on its highest volume ever. SNOW also moved on HVE at end of 2024. These volume signatures often mark the beginning of significant moves.

WULF gapped up on its highest volume ever. SNOW also moved on HVE at end of 2024. These volume signatures often mark the beginning of significant moves.

Volume Drying Up Strategy

“Something I like to do is sort my watchlists by lowest volume to see what is quiet and volume is drying up.”

LMND found at top with almost no volume on retest. These quiet entries often become best positions before risk gets too wide.

LMND found at top with almost no volume on retest. These quiet entries often become best positions before risk gets too wide.

Buying Weakness vs Strength

“I think most people associate buying breakouts with direct feedback, but when you buy weakness properly and it bounces you get that direct feedback as well.”

Less stress is a major part of the approach. Buying at logical structure levels like the 10-week MA provides immediate feedback.

Less stress is a major part of the approach. Buying at logical structure levels like the 10-week MA provides immediate feedback.

Trading Clicked When…

“Trading clicked when I made sure that I removed the possibility of any setbacks… even after I was good at finding stuff and had big successful trades I never had any consistency because I ignored the importance of keeping losses small.”

Confidence comes from seeing consistency in your equity curve.

Confidence comes from seeing consistency in your equity curve.

Trade Activity

6 trades this week • 3 exits, 2 new entries, 1 add (stopped)

| Ticker | Trade Notes |

|---|---|

| WULF | Bought Tuesday: Entered position from universe list. “Directly inside the circle annotation I made last week… gap up on its highest volume ever (HVE). That type of volume generally births new trends.” |

| LMND | Bought Thursday: Started position using weekly lows to manage risk. Found by sorting watchlist by lowest volume – almost no volume on retest. “Risk/reward here is good and won’t come around again if it pushes out.” |

| HOOD | Sold Wednesday: Exited at -5% to reduce exposure before NVDA earnings. Still structurally fine on 10-week but had no cushion. “If I was long from original 40’s position I would still hold.” |

| UBER | Sold Wednesday: Portfolio shuffling to concentrate down to 5 positions. Nothing wrong with it, just smallest position that won’t move the needle. |

| RKLB | Added Wednesday: Added with tight stops on bounce attempt but was stopped out same day. Frustrated about ruining $41 cost basis (now $44.26). Best weekly close of all positions. |

| NVDA | Sold Friday: Exited before close to reduce exposure into long weekend. “Still structurally fine to reduce exposure into the long weekend.” |

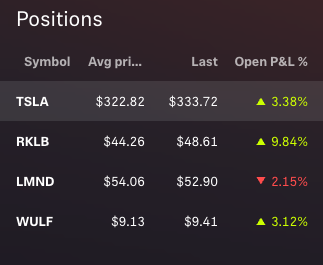

Current Holdings

4 positions after Friday’s adjustments

| Ticker | Status & Notes |

|---|---|

| TSLA | Largest position. “Checks every box for theme (robotics, AI, energy, autonomy).” Friday was not a good day but if the market holds up, it’s acting fine. If the market ends up pulling back TSLA will crack with it. |

| RKLB | Despite frustrating add/stop on Wednesday that ruined cost basis ($44.26 vs original $41), core position intact. Strong close Friday. |

| WULF | New position. Entered Tuesday from universe list. Gap up on highest volume ever (HVE) – “That type of volume generally births new trends.” |

| LMND | New position. Started Thursday using weekly lows for risk management. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Sunday | Weekend analysis shows abundance of setups – positive sign but can spread attention thin. “Countless stocks look buyable but key is focus.” Planning to concentrate on highest quality themes. |

| Monday | Good day with TSLA, NVDA, RKLB all performing well. Most leaders traded in tight range. “Makes me think I’m focused in the right names.” PLTR identified as buy opportunity at 10-week but not entered. |

| Tuesday | Bought WULF from universe list – gap up on HVE and low volume retest. |

| Wednesday | NVDA earnings day. Portfolio shuffling to concentrate – sold UBER (nothing wrong, just small), sold HOOD at -5% loss. Frustrating RKLB add that got stopped, ruining cost basis. |

| Thursday | Major gap up on SNOW earnings bringing life into the software group again. Software looks like a top group to watch again. “Trying to stay aggressive and heavily invested until proven otherwise.” Started position in LMND. |

| Friday | Brutal day with TSLA as biggest position. “Lots of weakness across the board.” Sold NVDA before close to reduce exposure into long weekend. Despite weakness, outlook unchanged – just reducing exposure to protect downside. |

← Swipe to see more →