Weekly Sub Digest – Edition 5

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: August 3, 2025

5 min read

Weekly Subscriber Digest

“Making $ in the market is not the hard part. The hard part is keeping it. And that doesn’t just mean

getting out before a crash, it means not forcing stuff and pushing even when there may be no crash but

feedback has been choppy.”

Key Trading Insights

| Theme | Insight | Reference |

|---|---|---|

| Distribution Pattern | “Strong opens -> weak closes is a hallmark of a weakening market.” Multiple days showing this pattern indicated caution. Big gap up that closed terribly was first real warning. | Jul 28-31 – Market behavior View post → |

| Lesson from Stan Weinstein | Heavy volume doesn’t need to show up on the downside. “When everything together is moving lower, even tho volume is light, it can just keep going lower and lower without heavy volume.” | Jul 28 – Key principle View post → |

| Leaders Breaking | Multiple leaders lost 10-week MA: SPOT, UBER, quantum names. “When a stocks trend is very strong it stays above the 10 week. So just a sign that some stuff needs to breathe.” | Jul 29 – Market feedback View post → |

| Equity Curve Warning | Per Ameet Rai: Days with biggest jump in equity curve usually line up with market pulling back shortly after. Nick was up 10% Monday morning – biggest single day of year. | Jul 29 – Pattern recognition View post → |

| Biggest Trading Mistake | “Only actual mistakes that screw up momentum is selling the leaders too soon.” Losses don’t matter with managed risk. Most performance comes from a couple trades. | Jul 31 – Key lesson View post → |

| FOMO Trap | Strong FOMO in first half of day before fade and opening lower next day. “Take note of that. That’s usually how it happens and makes it almost impossible to not stick to your plan.” | Aug 1 – Psychology View post → |

| Relative Strength Focus | “When the market keeps going up, everything looks like a leader. When we have pressure, the leaders stand out.” Names with RS during pullback are focus for next move. | Aug 1 – Selection process View post → |

Trade Activity

3 trades executed this week • 2 current holdings

| Ticker | Trade Notes |

|---|---|

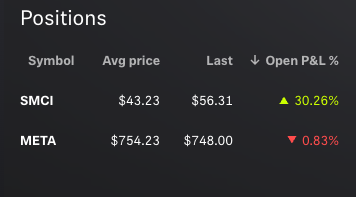

| SMCI | Partial Sell Monday: Sold 1/4 into strength. Position up 20% from 10-week MA, took partial profits to make managing easier. |

| TSLA | Stopped Thursday: Stop hit during market pressure. Remains on focus list. “Non stop bad news and earnings and is just not falling apart so far which is a big tell.” |

| META | Bought Thursday: Entered as it pulled back to prior highs with 3% position risk (0.5% account risk). Looking for potential washout but positioned if strength continues. |

Current Holdings

| Ticker | Status & Notes |

|---|---|

| SMCI | Continuing to hold despite market pressure. In the strongest group (semis/AI). Partial profits taken made position easier to manage. Showing clear relative strength. |

| META | New position using prior closing highs to manage risk. Part of narrowing strength in big cap AI names. Happy to be stopped if market goes lower for better opportunities. |

Market Context & Positioning

| Current Stance | Mostly cash with selective exposure. |

| Market Comparison | Similar to 2020 chop period. Using position feedback to avoid getting chopped up. “The best thing that can happen for bulls is this gets uglier and washes stuff out, resets sentiment.” |