MSFT META Gap Up After Hours

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

July 30, 2025

Market Action

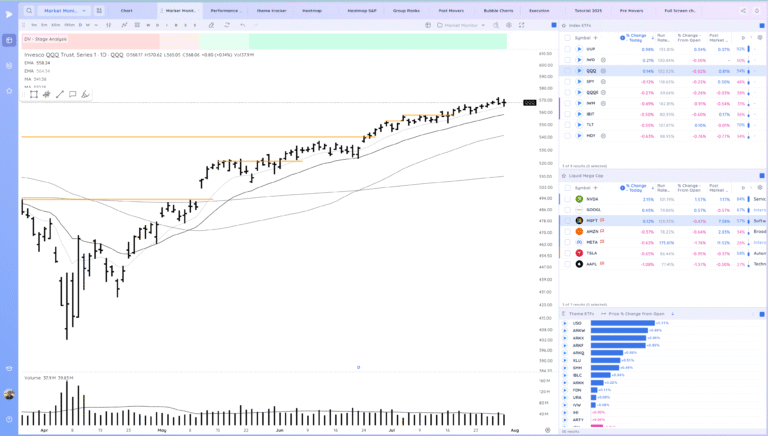

QQQ – mixed day with the Fed. We continue to surf the MAs

Bulls want to see us hold the 10ema area and continue to ride the MAs higher

Bears want to see follow through down breaking below the 10ema

Daily Chart of the QQQ.

IWM – pulling back into the 21ema

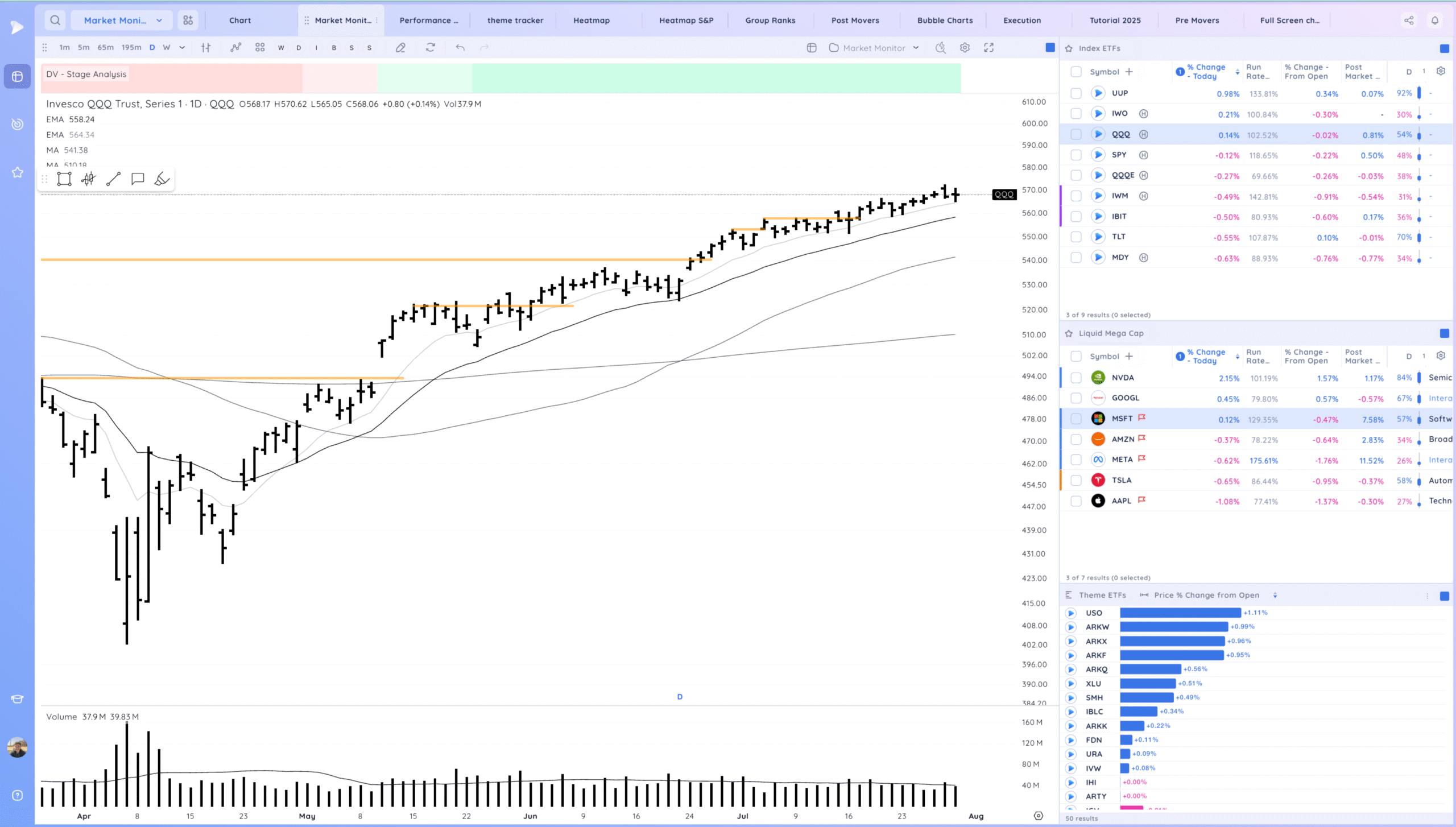

IBIT – Wide range day but still below this pivot

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

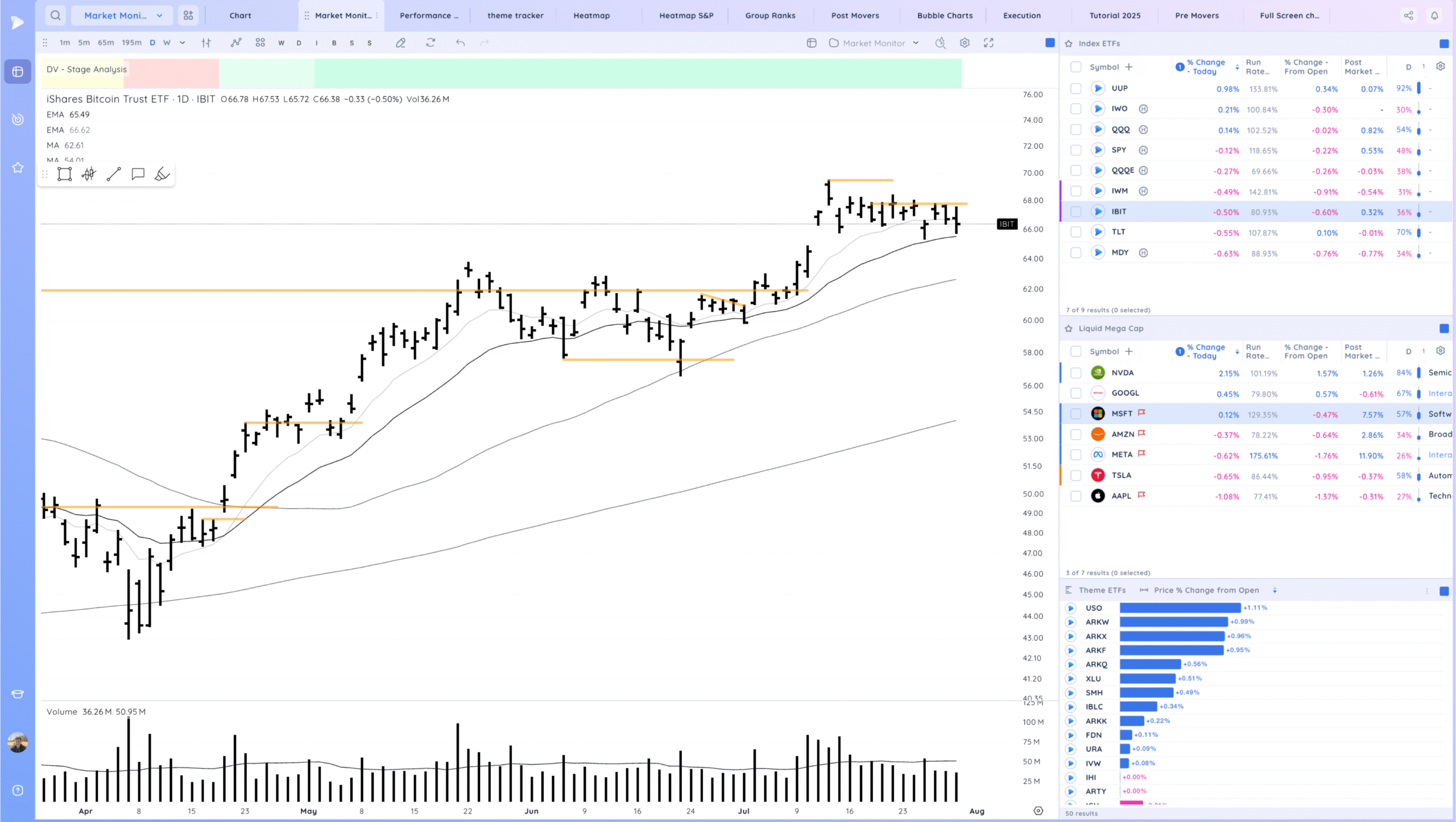

Groups/Sectors

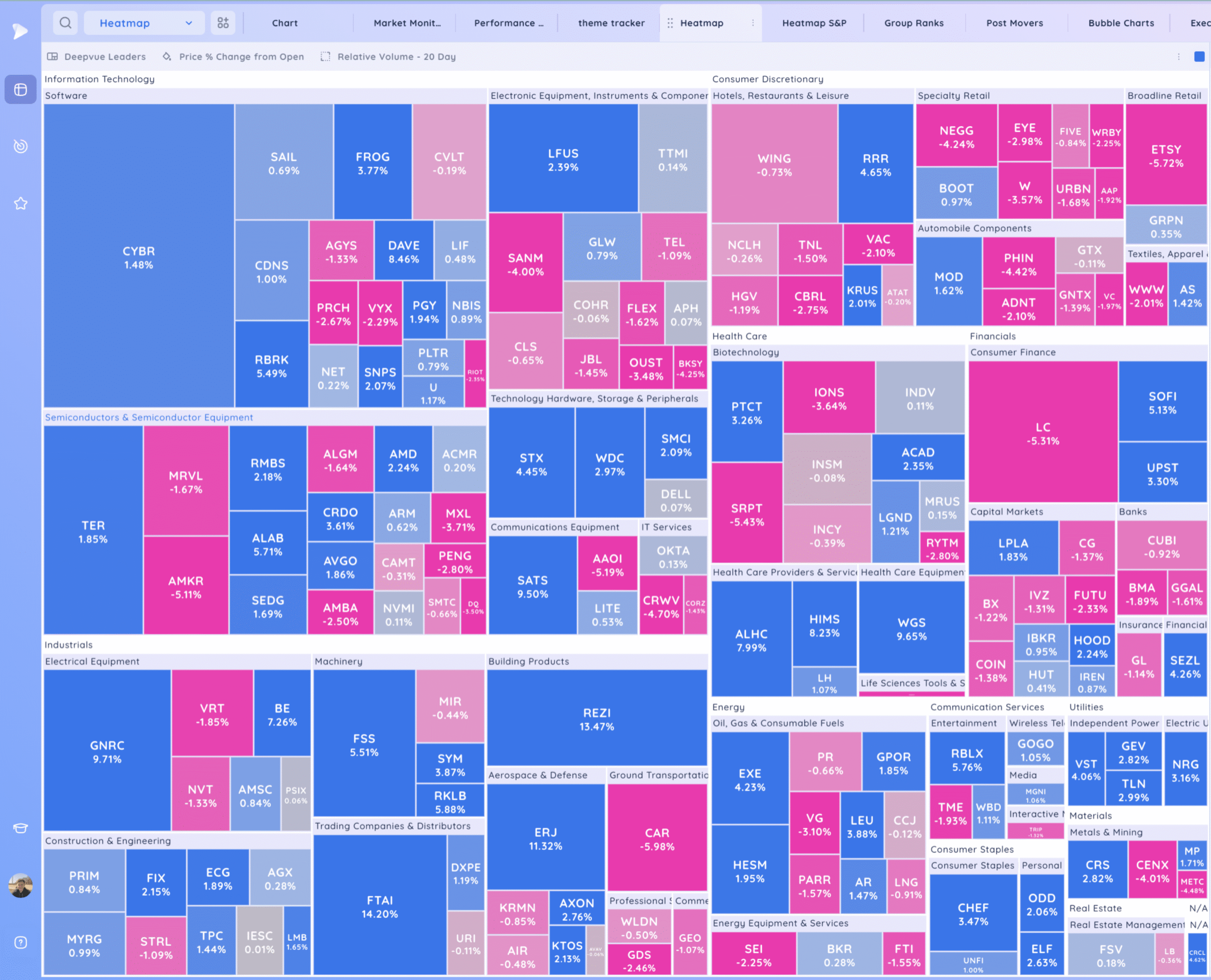

Deepvue Theme Tracker

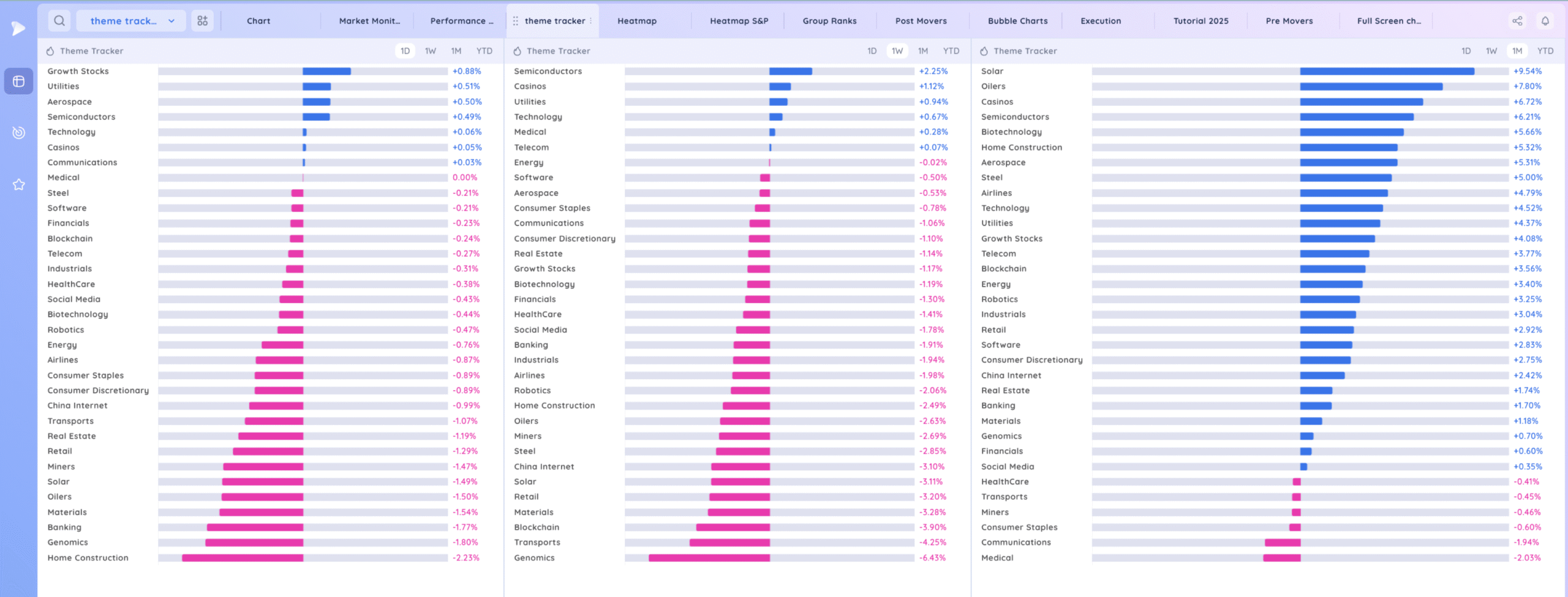

Deepvue Leaders Heatmap

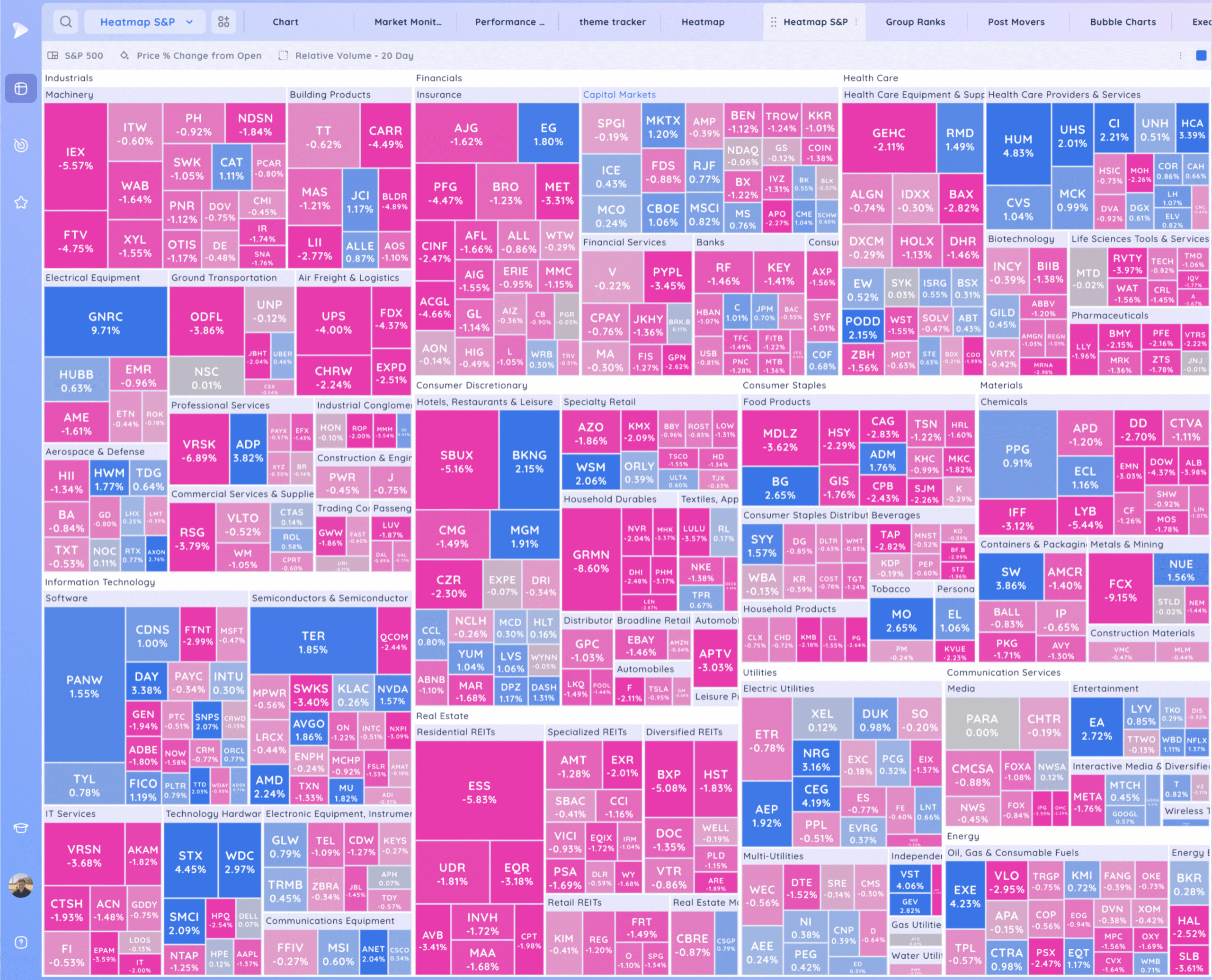

S&P 500. Rotation into reits and oil & gas

Leadership

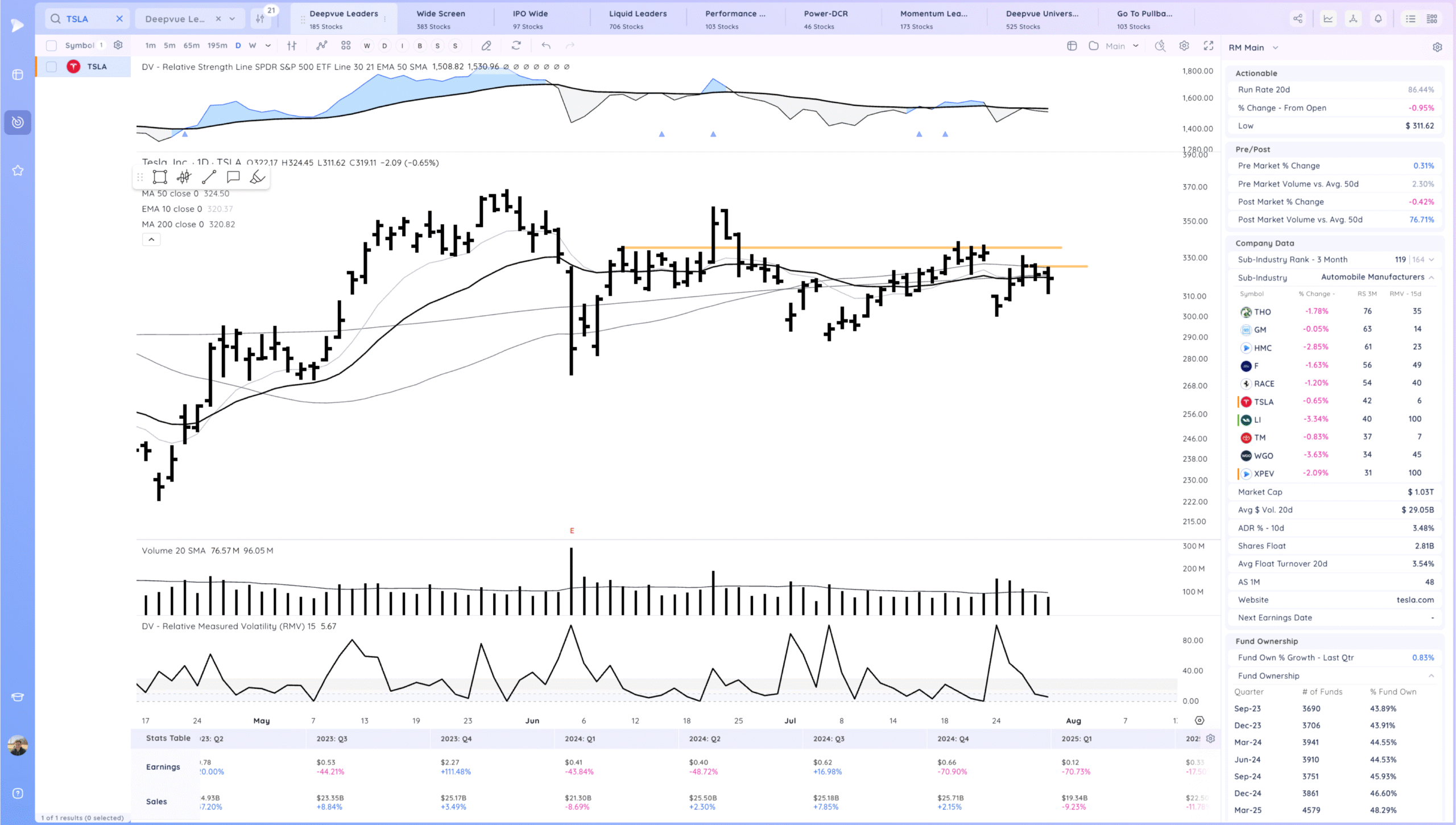

TSLA setting up a lower pivot after an upside reversal. Still lagging overall the market.

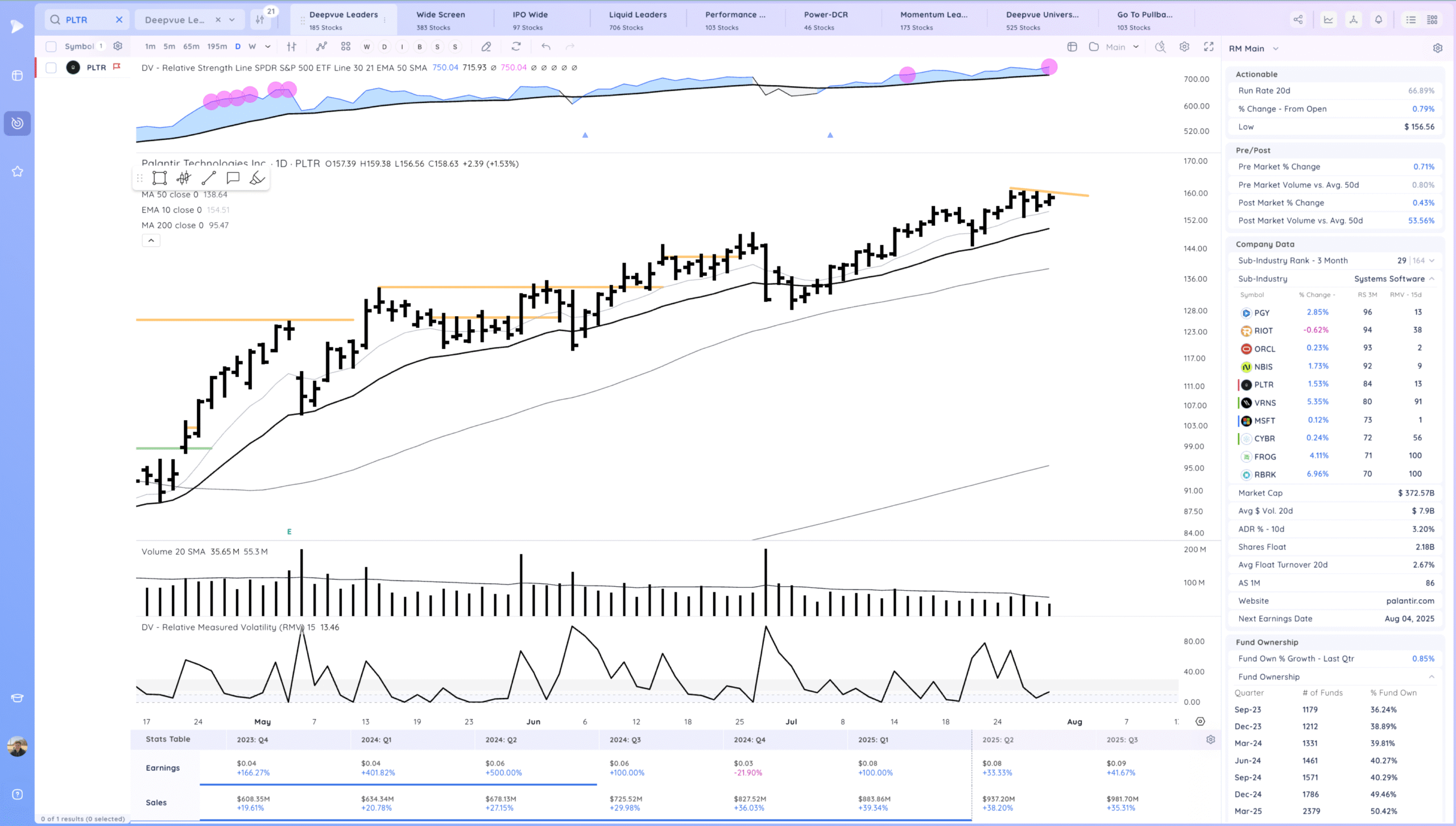

PLTR coiled in a tight range, likely won’t make a meaningful move before earnings.

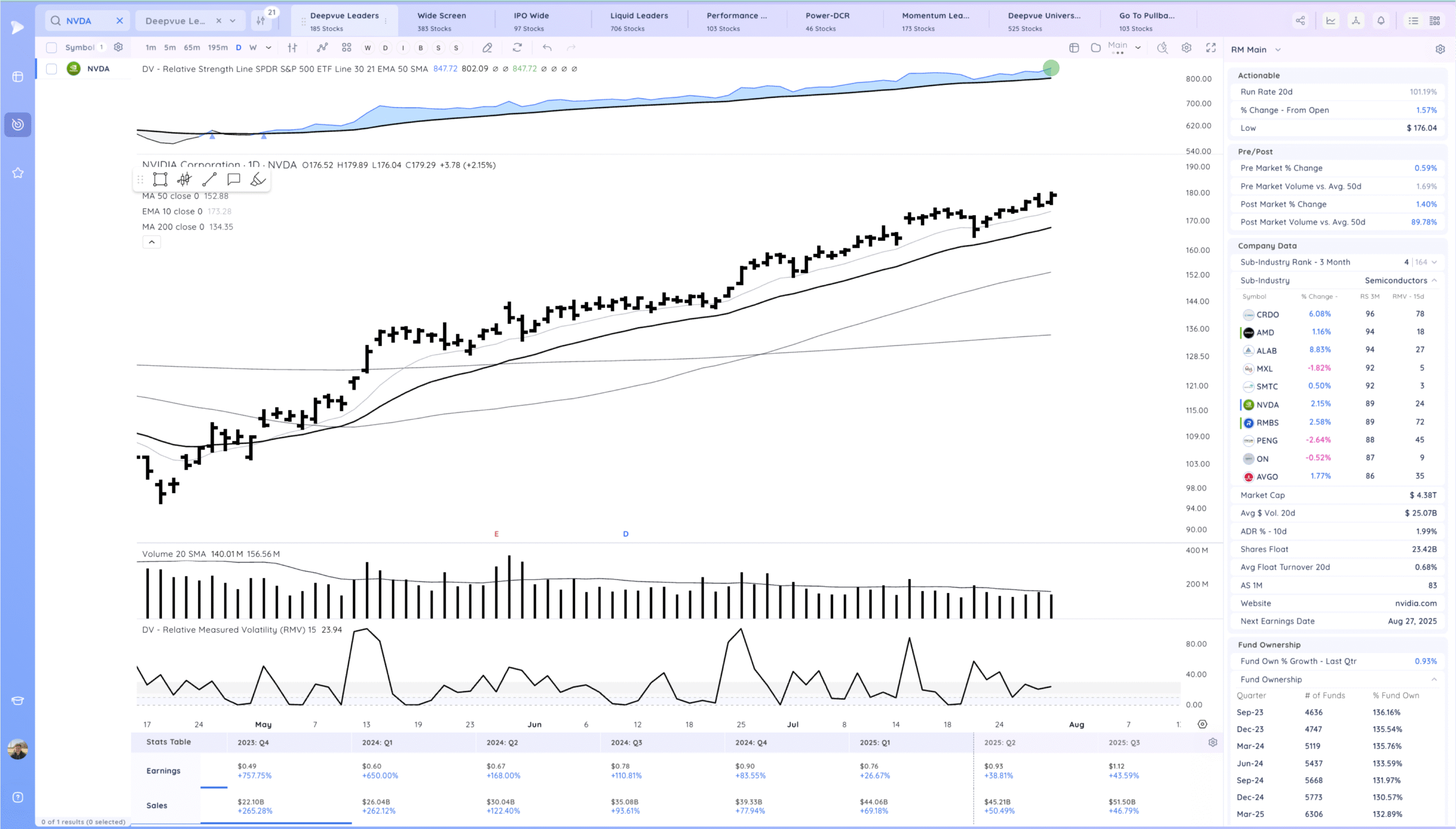

NVDA trending above the MAs

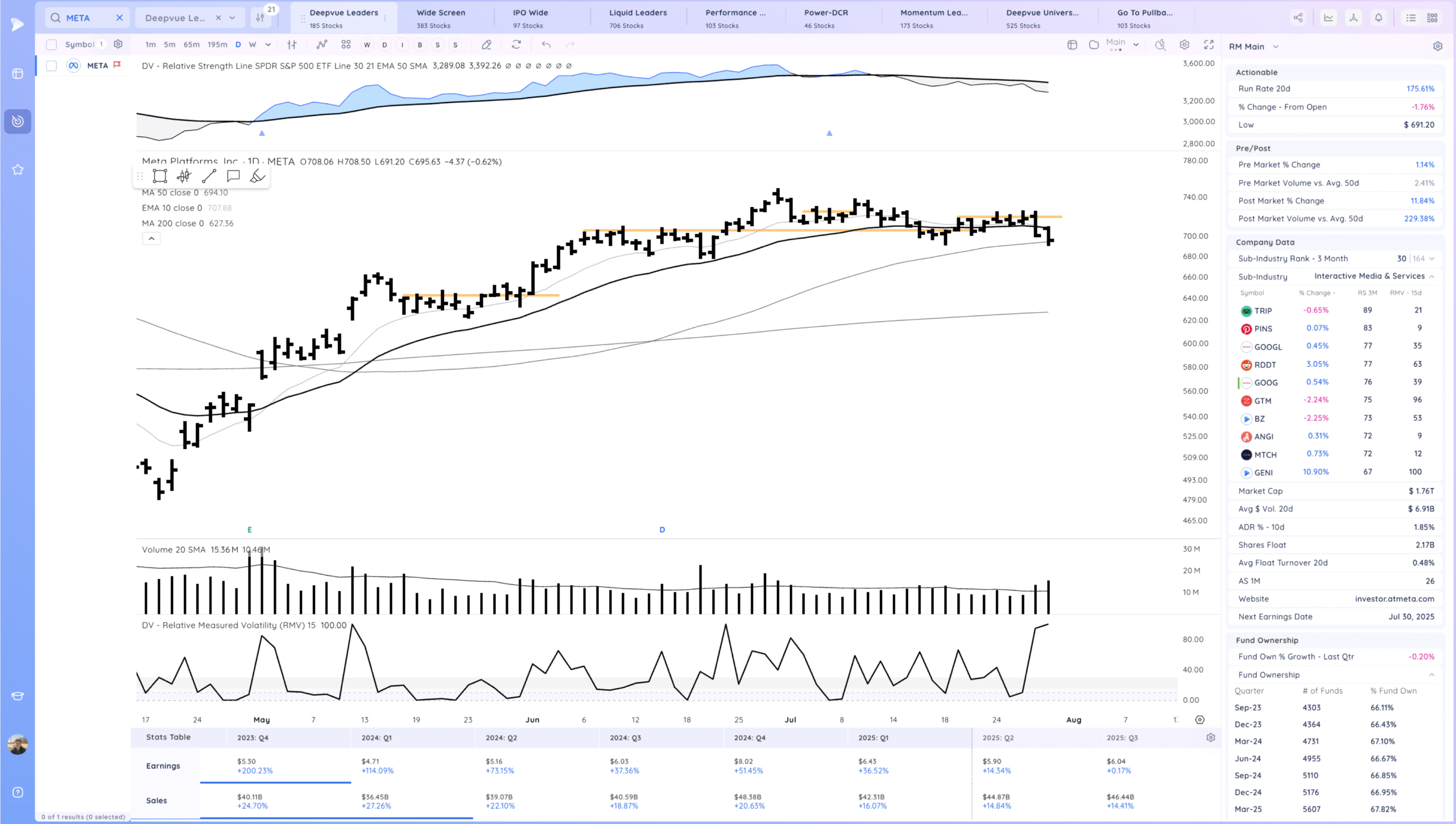

META strong action on earnings, gapping up.

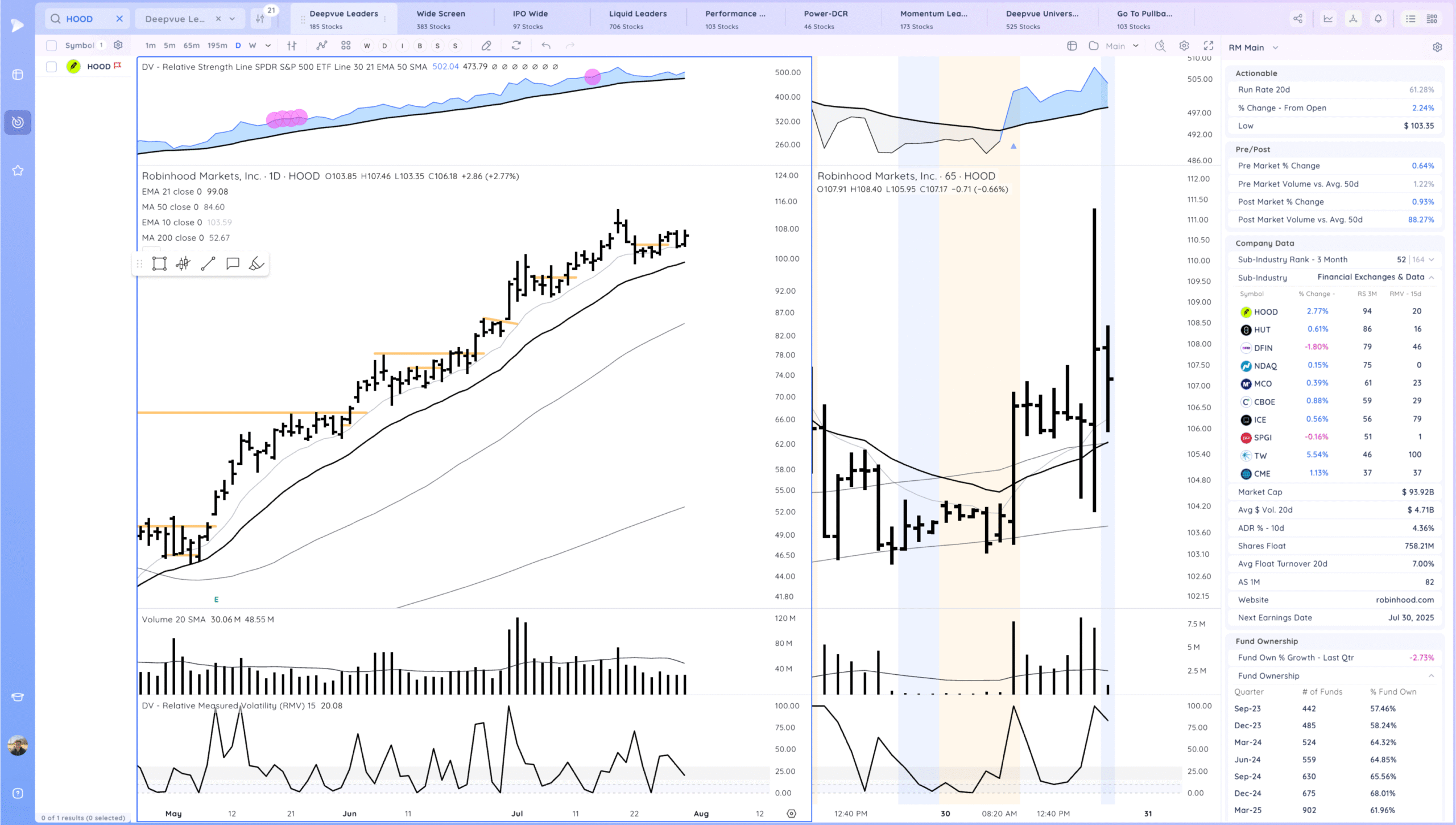

HOOD trending. mixed reaction on earnings so far

MSFT strong gap up. Trending

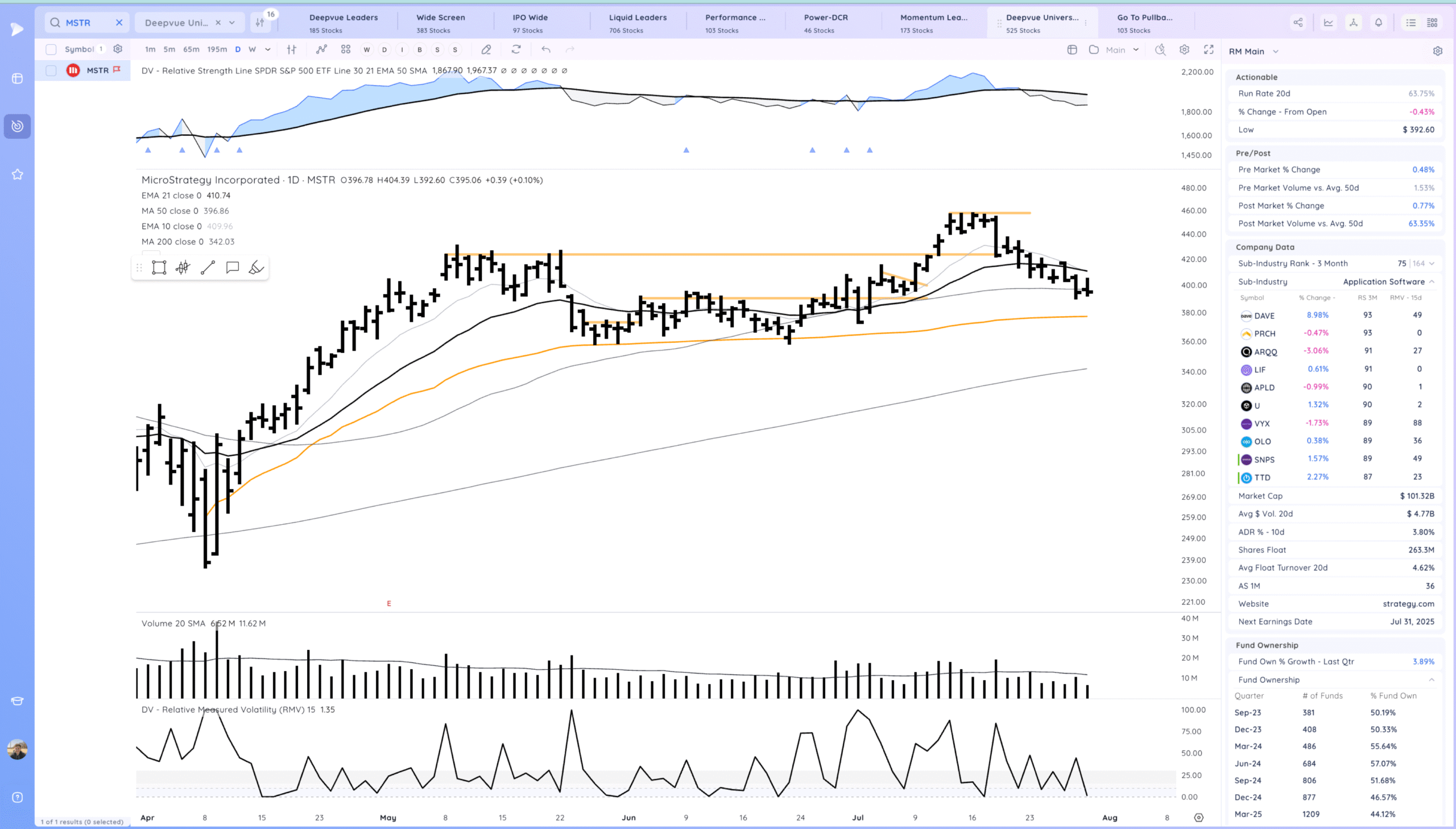

MSTR inside day within a pullback

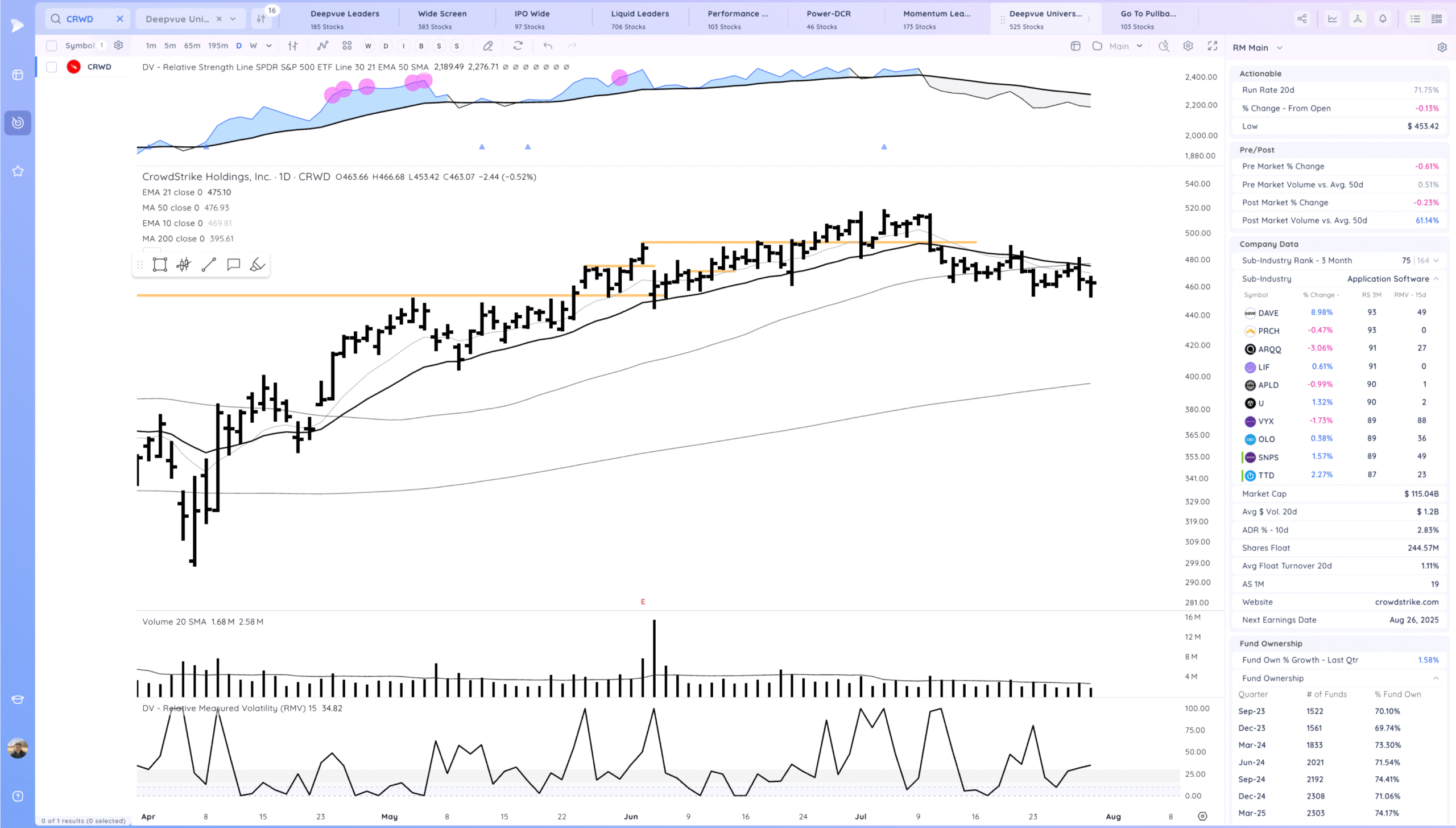

CRWD upside reversal

Key Moves

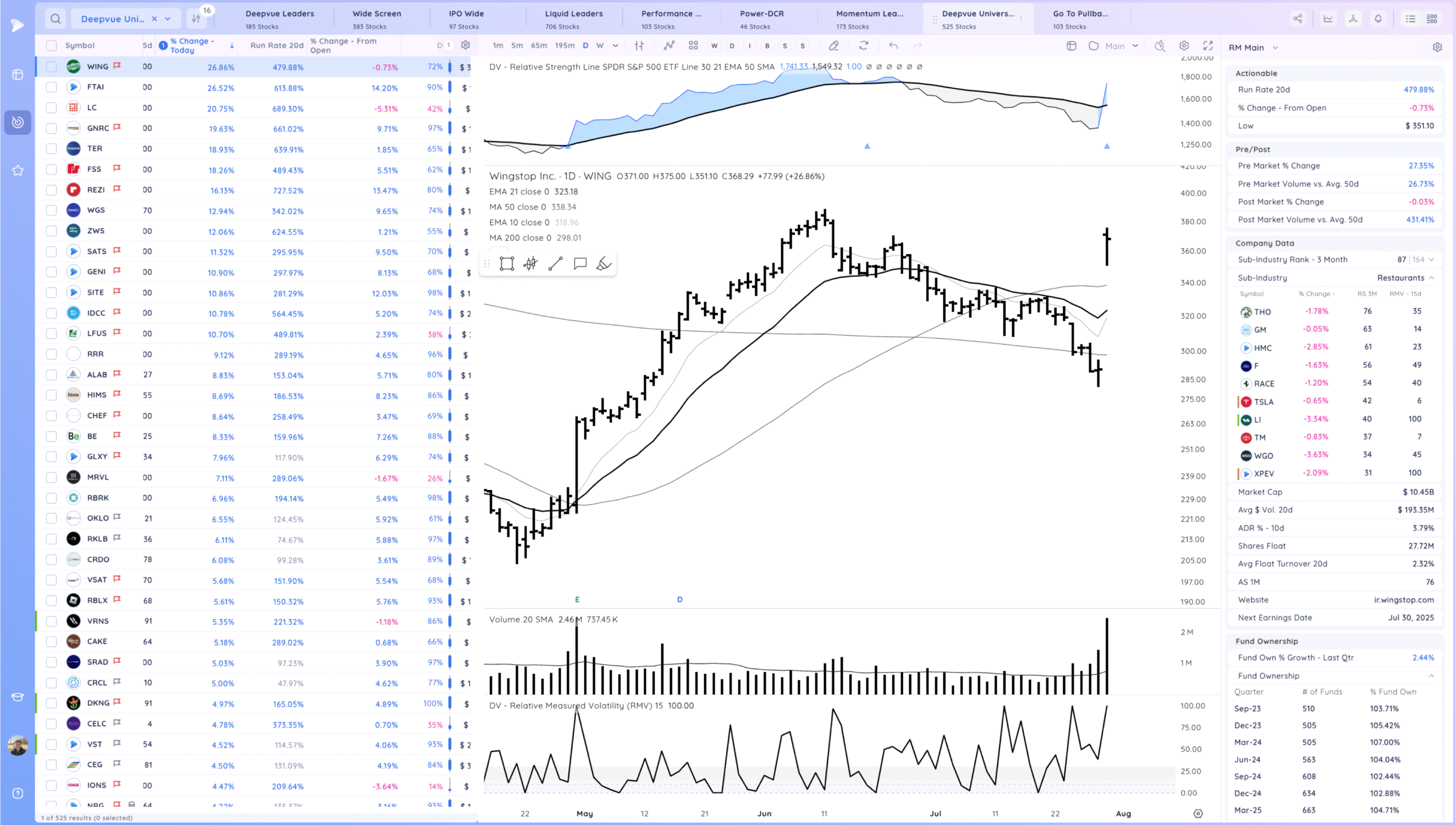

WING gap up on earnings

ALAB positive expectation breaker

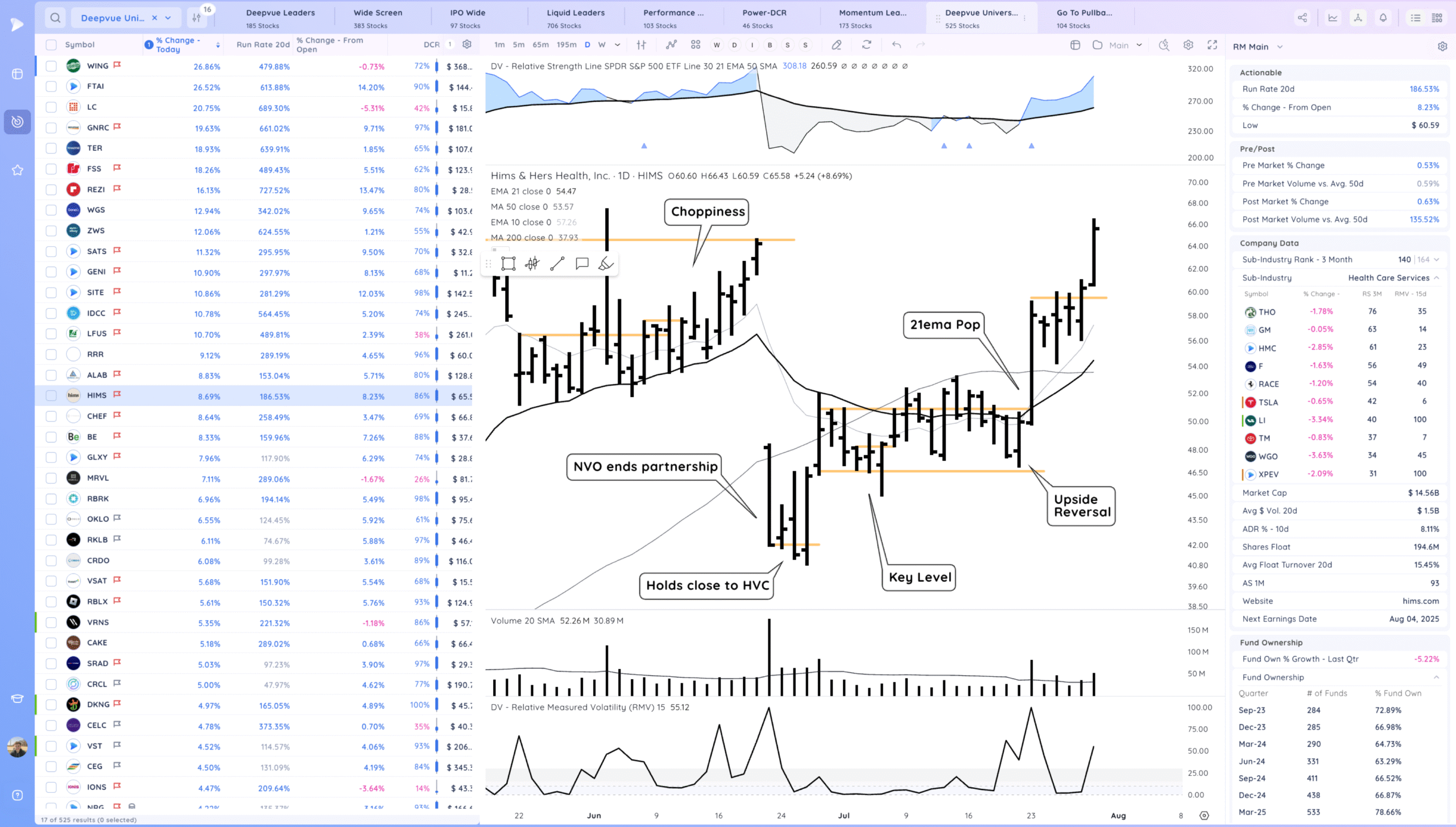

HIMS following through

Setups and Watchlist

CDTX biotech setting up for a potential range breakout. Higher risk

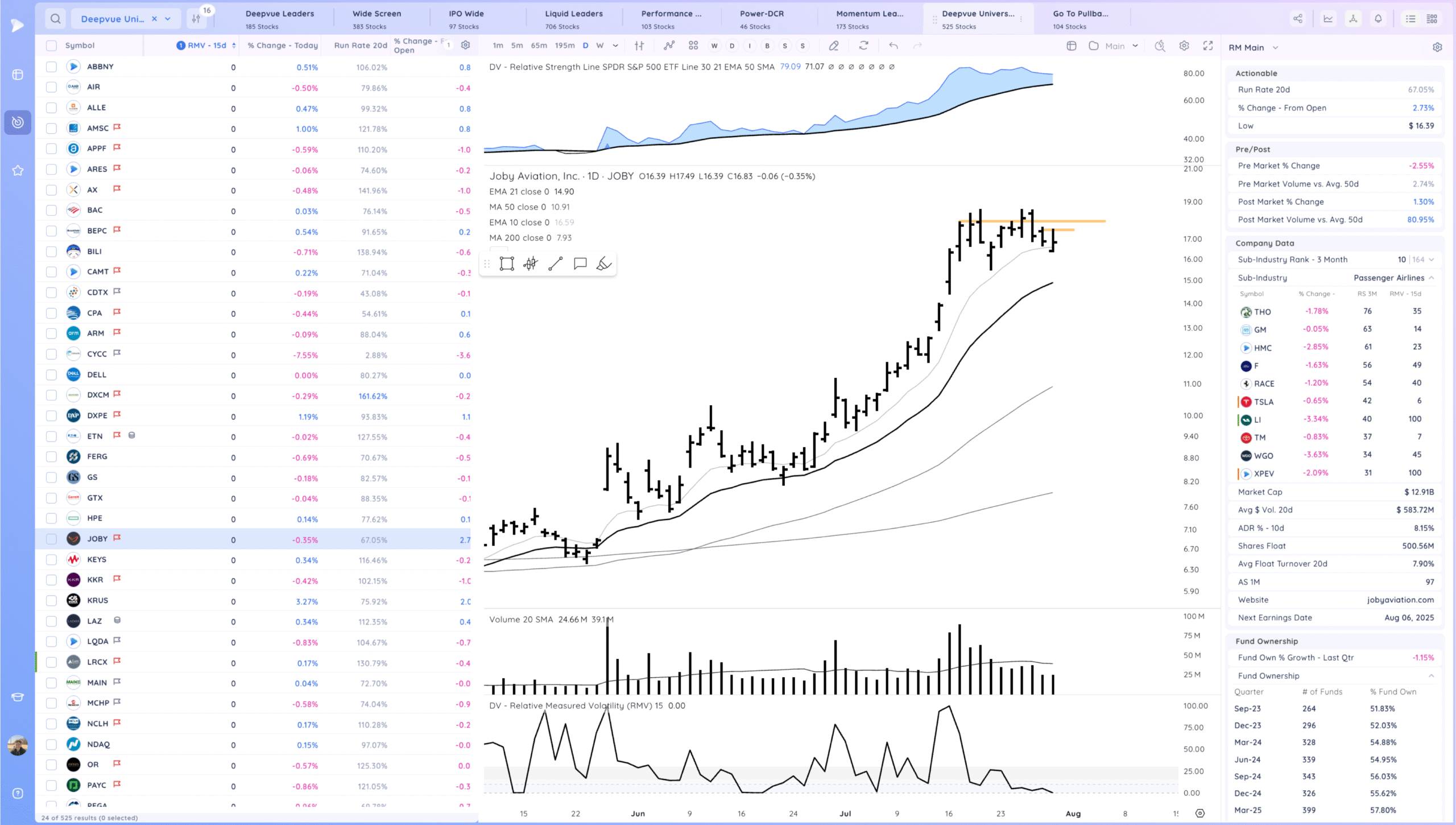

JOBY setting up a high tight flag. Could use a bit more development

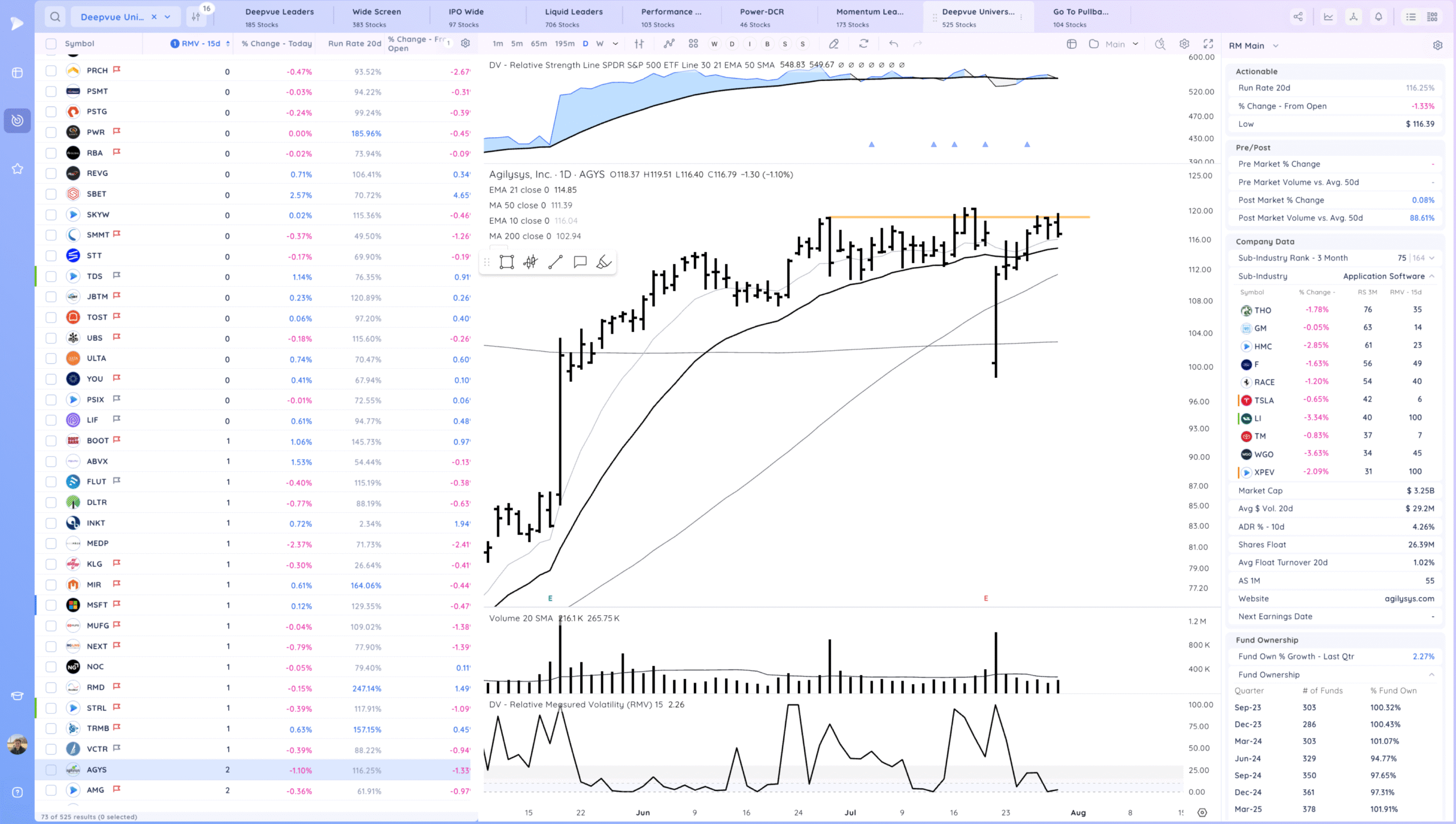

AGYS watching for a base breakout

COIN forming a range at the 21ema. Watching for a push higher

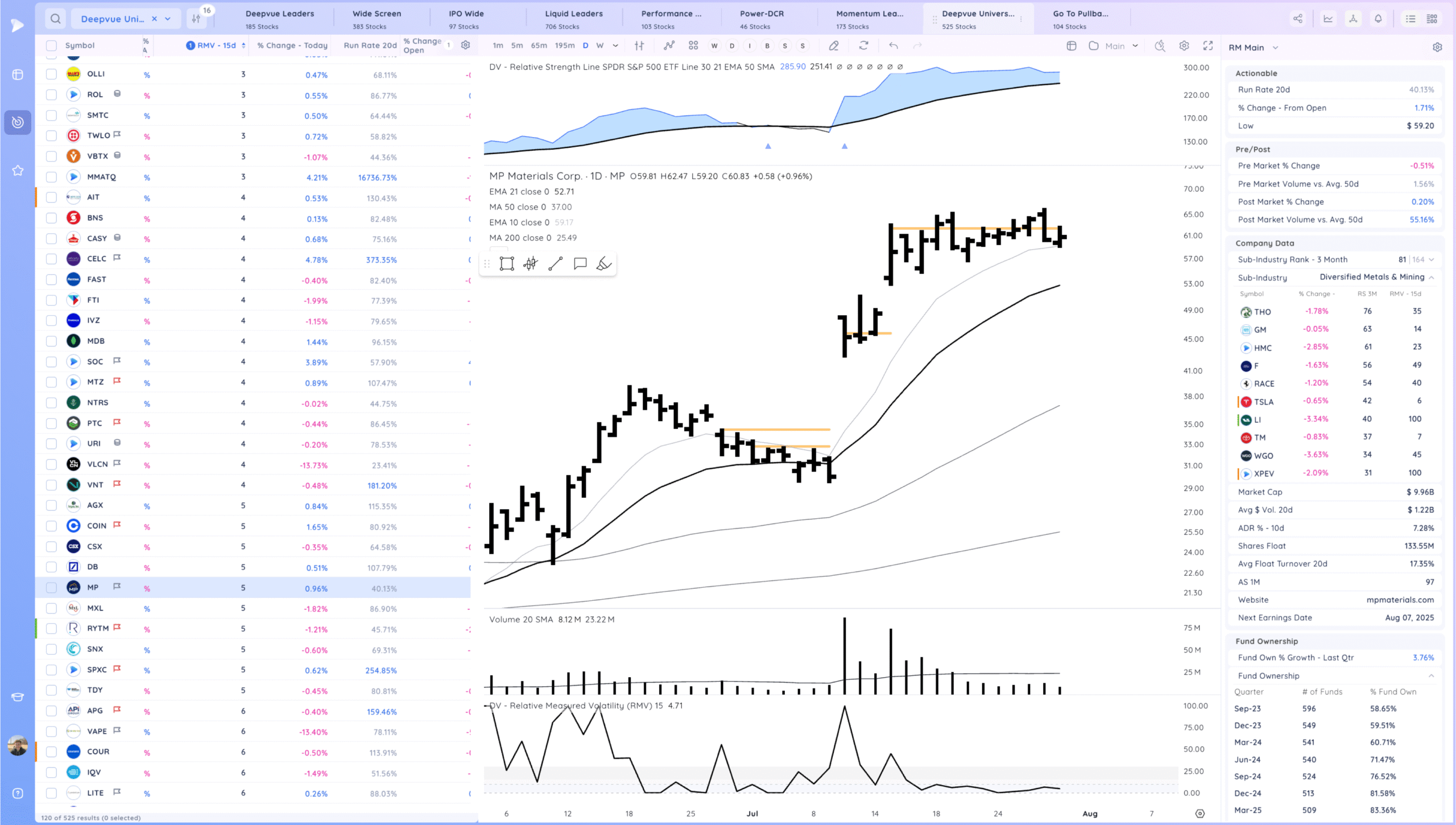

MP tight day, watching for a re-breakout

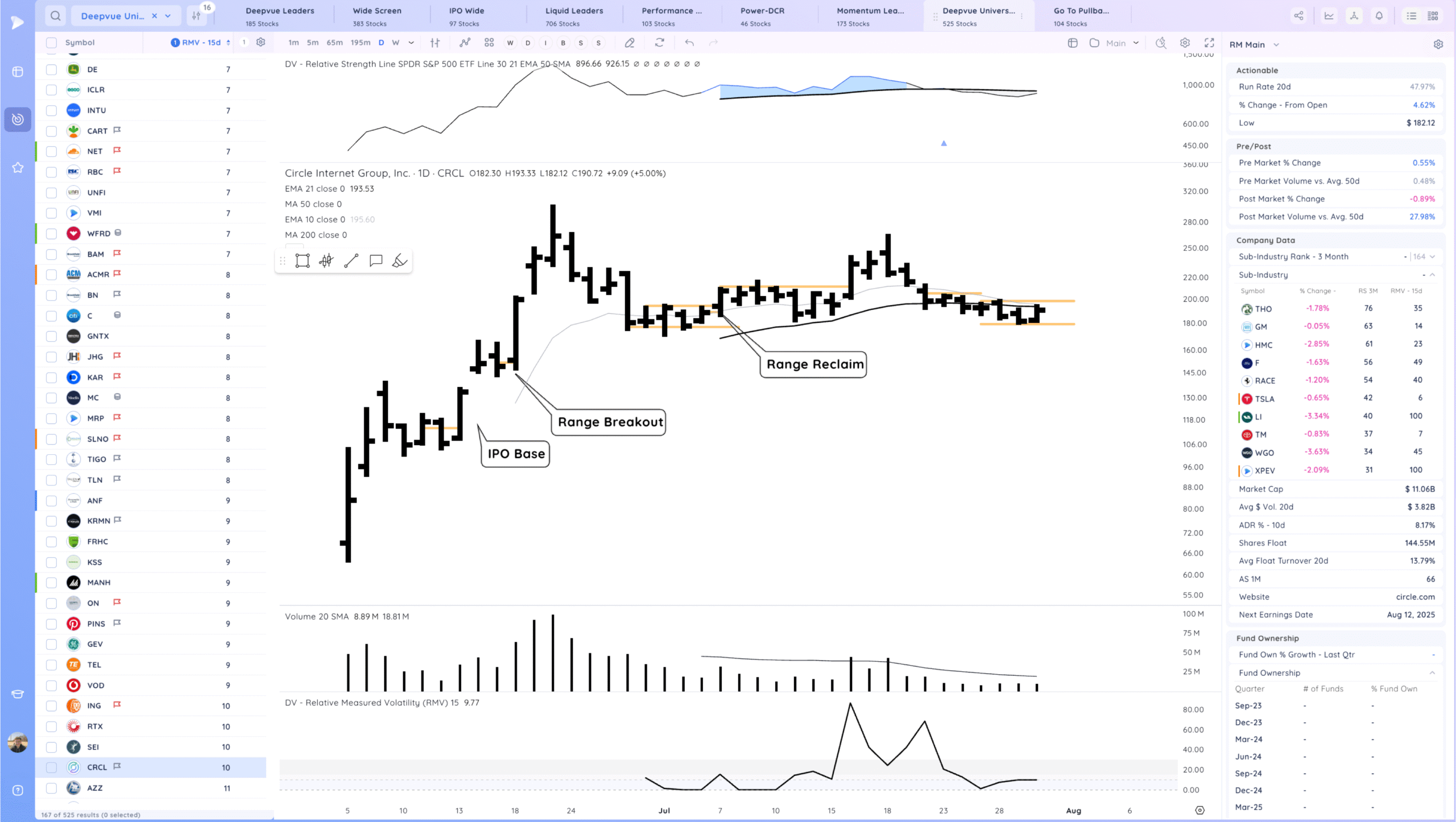

CRCL tight. Ripe for expansion. Watching for a 21ema pop or breakdown

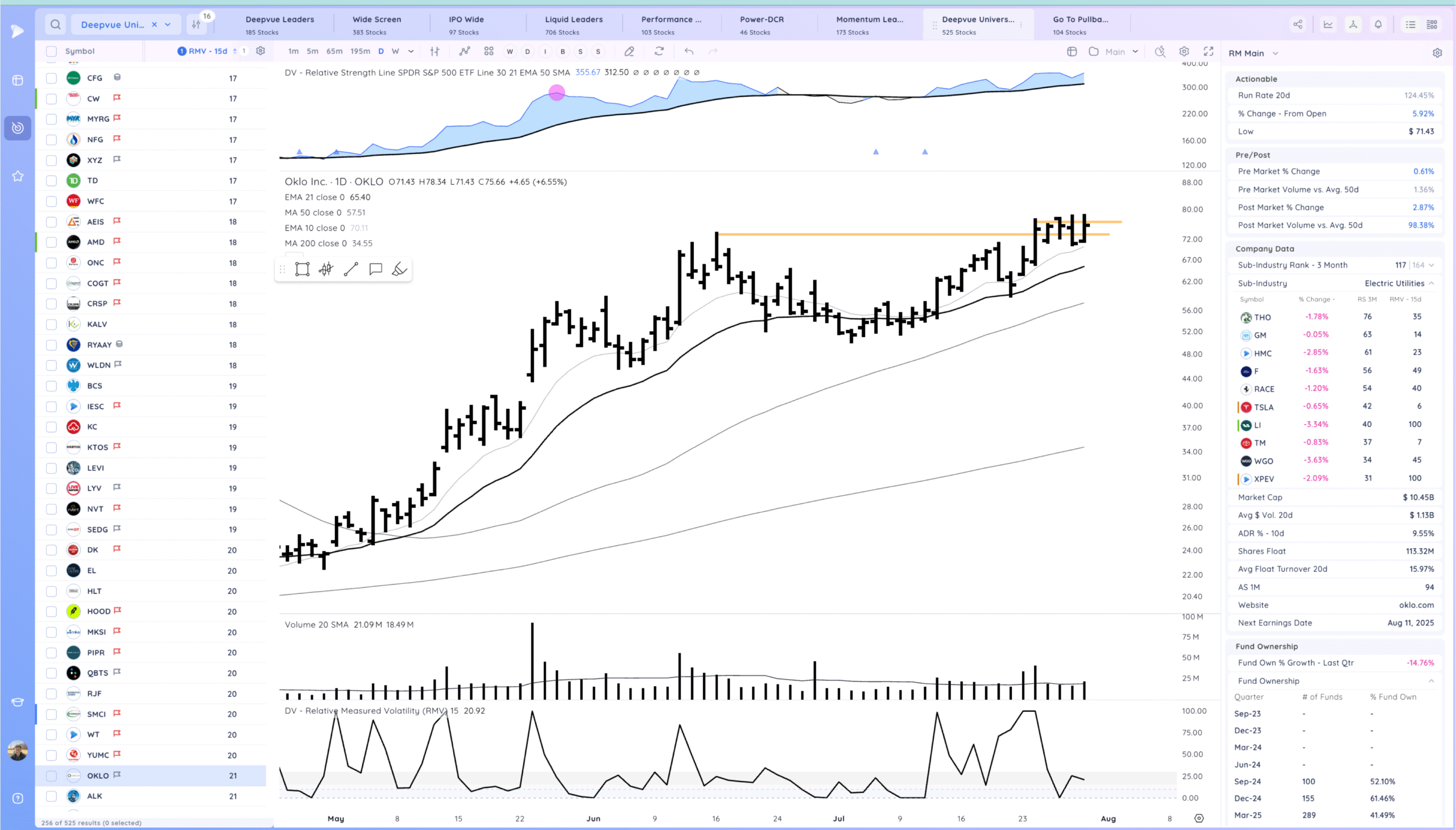

OKLO watching for a range breakout

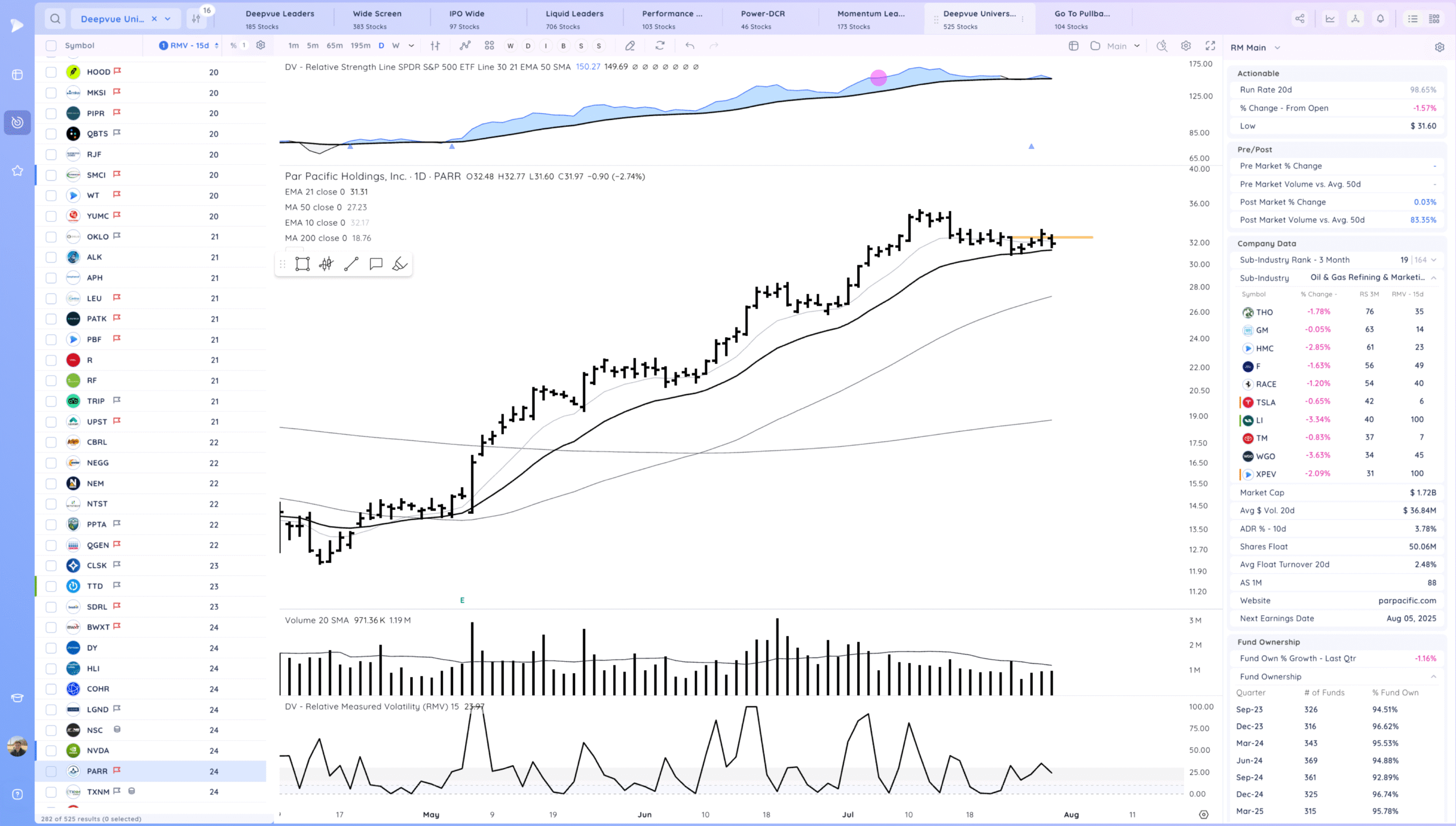

PARR watching for a range re-breakout

Today’s Watchlist in List form

Focus List Names

CDTX JOBY AGYS COIN MP CRCL OKLO PARR

Focus:

HOOD (Earnings Reaction) COIN MP OKLO

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

Interested in how HOOD acts tomorrow. Overall earnings reactions at large seem positive so far.

Anything can happen, Day by Day – Managing risk along the way