Trading Routine: How I Scan and Organize Stocks

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: July 27, 2025

Finding stocks that double or triple isn’t about luck—it’s about having a repeatable process. This guide breaks down the process I follow to identify high-probability opportunities, and monitor them until a trade opportunity develops.

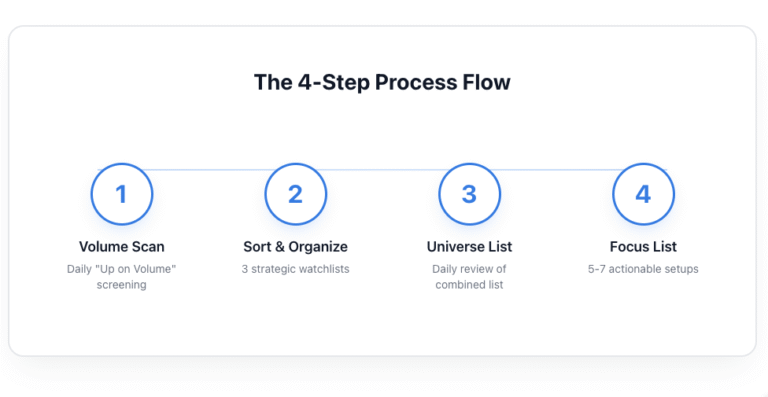

The 4-Step Process Flow

Why This Process Works

This helps me track different types of setups and stay organized while waiting for the charts to develop.

Daily Volume Scan

The Deepvue ‘Up on Volume’ scan is where 95% of actionable ideas originate. Any stock worth trading will eventually show up here. The key is adding it to the right watchlist and staying patient for the optimal setup.

Up on Volume Parameters:

• % Change Today: > 1.70%

• Price: > $10

• Daily Closing Range (DCR): > 50%

• Avg Vol 50d: > 200K

• Avg $ Vol 50d: > $1M

• Run Rate 50d: > 120%

Watchlist Organization

Every stock that passes the volume scan gets sorted into one of three watchlists based on specific characteristics. This systematic organization helps track different setup types and maintains focus while charts develop.

Basing Patterns

Stocks building large bases on weekly charts. These aren’t flashy yet, which is exactly why they’re valuable. Most traders overlook them during the quiet accumulation phase.

- Track base development on weekly timeframes

- Watch for tightening price action on the right side

- Monitor for higher lows before breakouts

- Entry often comes before obvious breakout points

While most traders weren’t focused on $SMCI during its basing phase, I was tracking it closely which allowed me to notice subtle cues.

Key Insight: “If I buy a breakout, for my system I am

late.”

The goal is positioning before the crowd notices.

Volume

When I see a massive volume surge, I don’t care what the chart looks like. It could be messy or extended. All I care about is that the volume surge tells me this stock will likely have legs eventually. I just need to be patient and wait for the setup.

- Add any stock with a big volume spike

- Ignore current chart messiness or extension

- Wait patiently for high-probability entry

- Best entries often come months after initial surge

I added $ONON to my Volume list after a huge volume spike. No entry in sight, but I knew the volume was a sign to track. 4 months later it offered a perfect entry on weakness I only saw because I was monitoring so long.

Key Insight: Volume surges like this mark the beginning of a new trend, but it doesn’t mean you have a trade yet. By keeping it in a list and watching it develop patiently, I was able to get an incredibly good R/R trade when to most people it still looked pretty awful.

Character Change (CC)

The go-to setup for entering new uptrends early. This setup is about recognizing when a stock is transitioning from a long downtrend to the early stages of an uptrend.

What Is the “Character Change” Setup?

It’s all about waiting for specific signals on the weekly chart that show it’s highly likely the long-term trend is now up. Here’s what to look for:

1. First Higher Low

After a long downtrend, look for the stock to make a higher low on the weekly chart. This alone isn’t enough but it’s the first piece of evidence that something might be up.

2. HUGE Volume with a Price Pop

Look for a big surge in volume with a strong price move. This shows real institutional interest. This is the second piece of evidence. You have a higher low + its first massive push. After this, there’s confidence the birth of a solid new trend is likely in place.

3. New 10 or 30 Week Respect

The way to get a low-stress entry with incredible R/R is by waiting now that you have the evidence of a true CC on your side.

Note: Steps 1 and 2 can happen in any order—you just want to see both before considering the setup valid.

Weekly character change pattern showing trend reversal signals

Daily Universe List Review

All three watchlists automatically combine into one master Universe List. This consolidated view gets reviewed daily to identify which stocks are developing actionable setups. The automated combination streamlines the review process and ensures nothing gets missed.

Focus List

When stocks show ideal entry characteristics (tightening ranges, pullbacks to support, etc.), they move to the Focus List. This list remains intentionally small—maximum 5-7 names.

The Complete Process Summary

Focus on quality over quantity. Stay disciplined. Let winners come to you.