Weekly Sub Digest – July Edition 4

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: July 26, 2025

4 min read

Weekly Subscriber Digest

“There are windows and the edge is being aware of ease vs difficulty. Don’t press harder based on indexes

going up – press based on ‘easy’ wind at back feeling.”

Key Trading Insights

| Theme | Insight | Reference |

|---|---|---|

| Always Prefer Gap Down Opens vs Gap Ups | “Generally gap downs get bought up and gap ups get sold into.” Prefer gap down opens vs gap ups. All that matters is the close. Gap downs give better data – can see support coming in first 30 min. | Jul 21 – Market open dynamics View post → |

| Psychological Cycle | Being defensive protects progress AND confidence. Late exit = late to re-enter. If too slow to get defensive, become too nervous to get aggressive when it’s time. | Jul 21 – Portfolio management View post → |

| Watch Leaders | When stocks are selling off & indexes look strong, it’s usually a sign they’re being propped up. “We watch the leaders because the indexes are always late.” | |

| Selling at Open | “I NEVER want to be in a position where I need to sell within the first hour” (unless into strength). Need cushion or to peel profits off volatile names to wait for close. | Jul 23 – Key lesson View post → |

| Character Changes | Character changes like SEDG are developing new uptrends. When the first higher low is well above your entry it allows you to buy right sit tight. | Jul 23 – A+ setups View post → |

| Some Leaders Potentially Breaking | Multiple leaders losing 10-week MA: NFLX, CRWD, SPOT. | Jul 24 – Market feedback View post → |

| Weekly Low Strategy | Use weekly low as stop to manage risk. When stock gets momentum, lows of each week continually stay above previous week. | Jul 25 – SOUN example View post → |

Trade Activity

7 trades executed this week • 4 current holdings

| Ticker | Trade Notes |

|---|---|

| BULL | Bought Stopped Re-entered |

| ALAB | Sold Tuesday morning: Was up strong Monday diverging from NVDA being down. Lesson in being more aggressive with profits later in the market cycle. |

| RUM | Sold Tuesday morning: Pressure overwhelmingly down. Part of defensive stance after Monday’s weak close. |

| QUBT | Sold Re-entered Tuesday: “I would buy here but selling anyway.” Re-entered Wednesday seeing quantum group on 10-week. Using week’s low for risk management. |

| SOUN | Sold Tuesday: Part of defensive move to cash. |

| TSLA | Bought Thursday pre-market: After -5% on earnings with $299 stop. Thesis: trendline + major $300 level. Working well by Friday. |

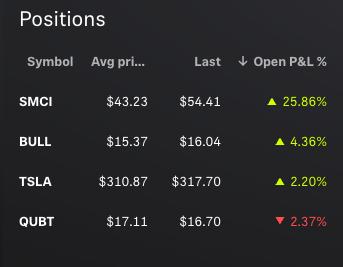

Current Holdings

| Ticker | Status & Notes |

|---|---|

| SMCI | “So far the rockstar of positions in terms of holding strong and not being too volatile.” Maintained throughout defensive selling. |

| TSLA | Buy working is “positive feedback so far and feeds into decision to push harder if continues.” Held $300 support level as expected. |

| QUBT | Volume extremely low on pullback. “Resting perfectly on 10-week” with rest of quantum group. |

| BULL | Looking for potential additional entry if closes lower on week for good risk/reward setup. |