Reversal Down. Reason for Caution?

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

July 16, 2025

Market Action

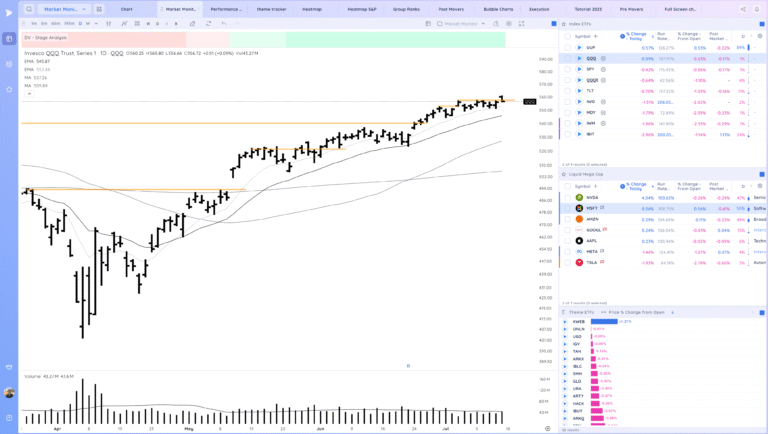

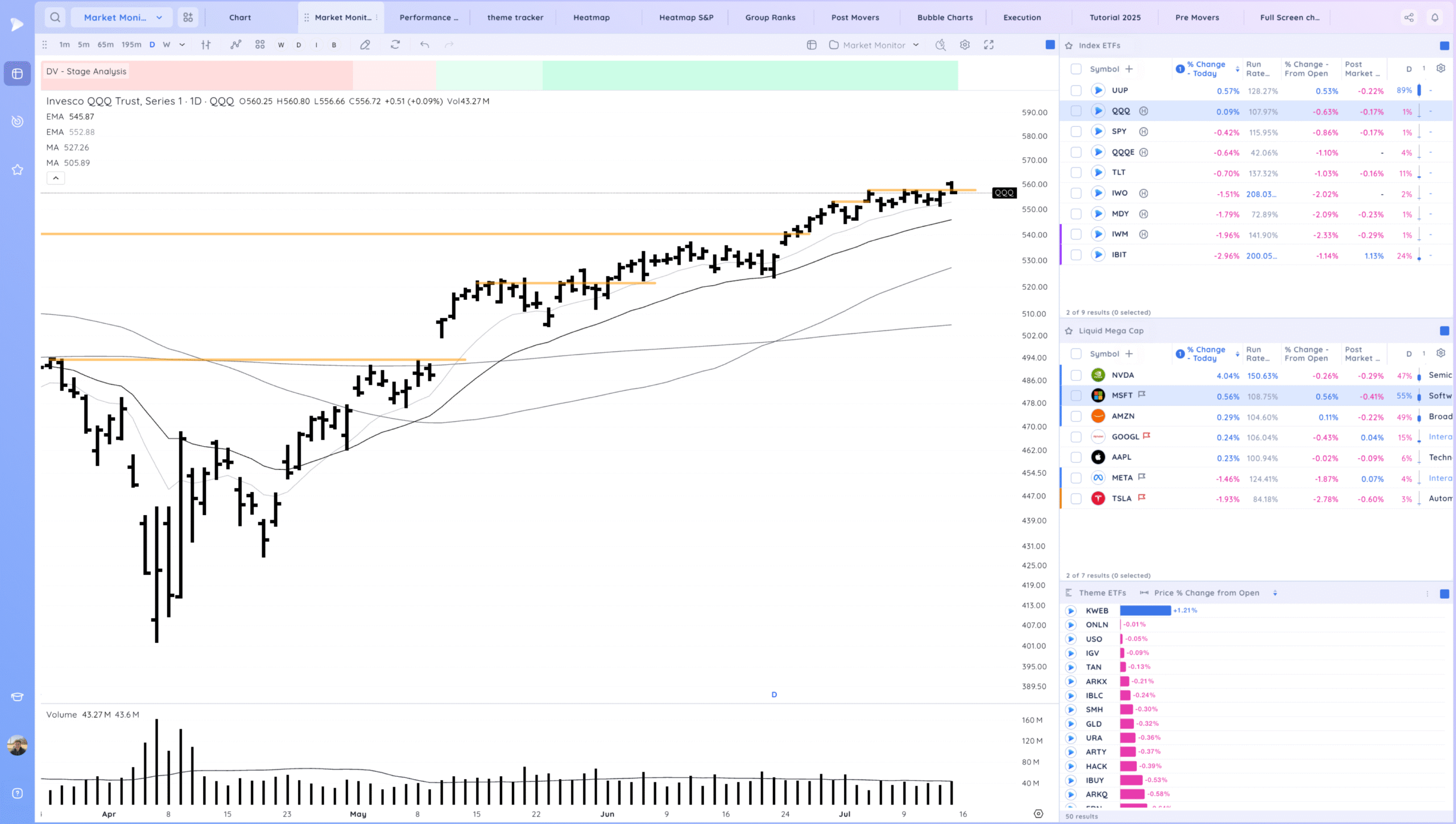

QQQ – Gap up and reversal down. How we act the next few sessions will be telling. Follow through down below the 10 and it suggest more caution. Recover and we continue trending

Bulls want to see us holds the moving averages and recover

Bears want to see follow through lower.

Daily Chart of the QQQ.

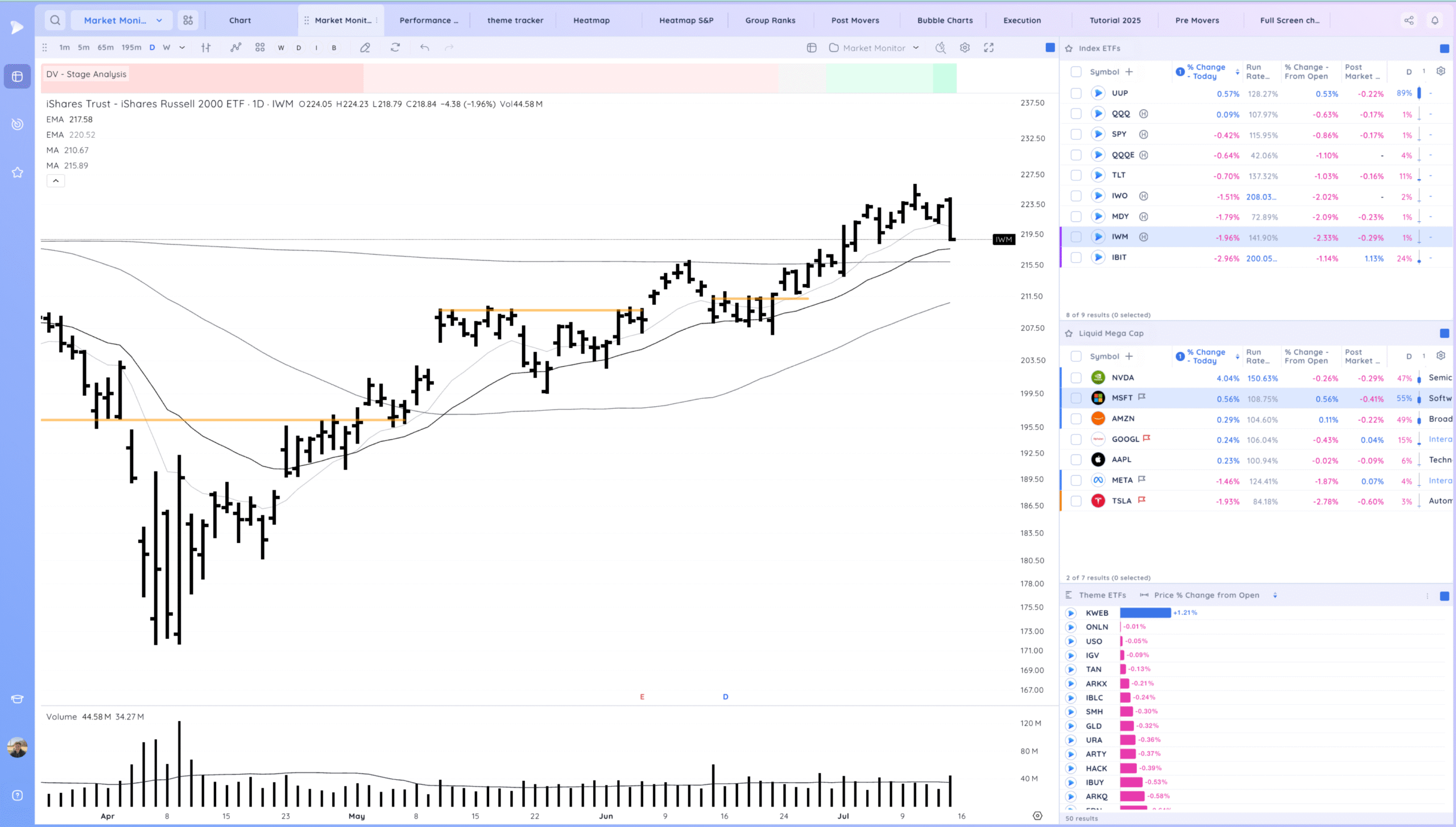

IWM – downside reversal

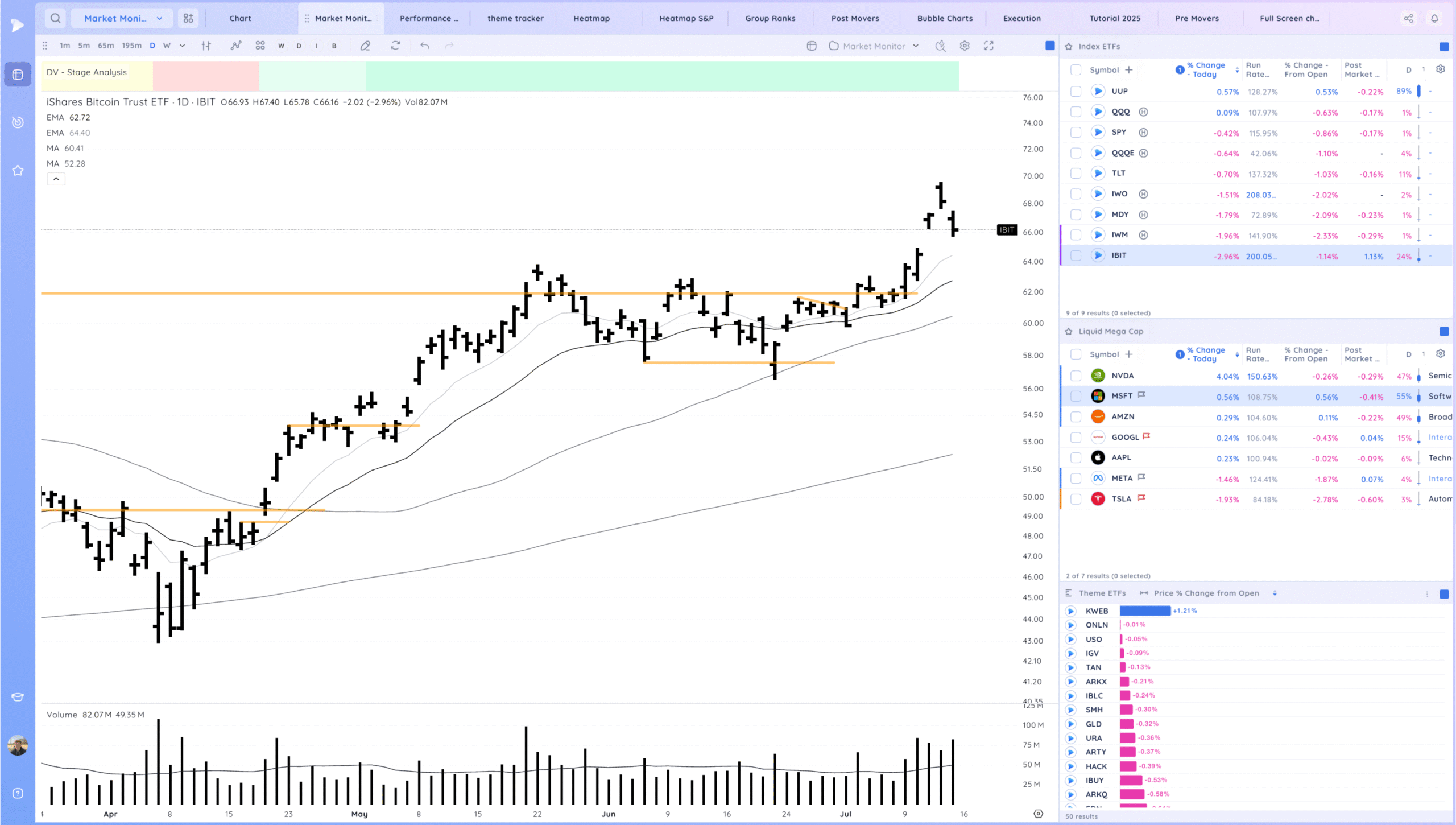

IBIT – follow through down. See if we can hold and start to build a range

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

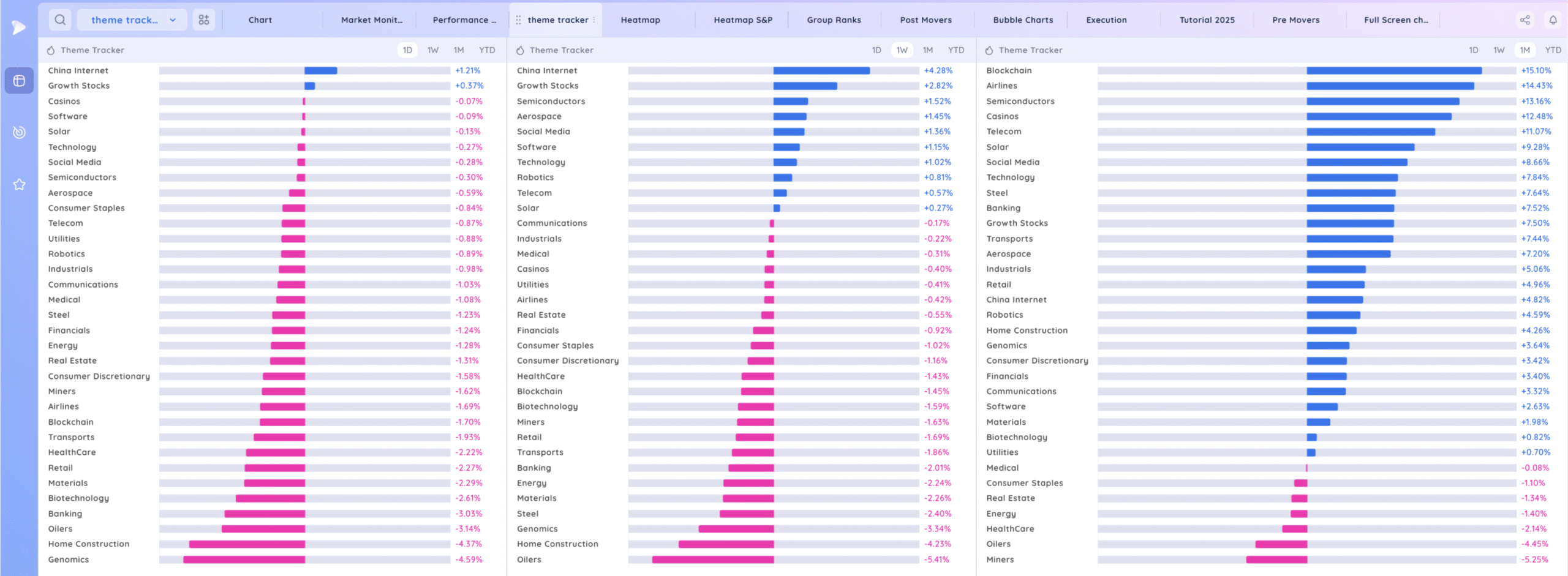

Deepvue Theme Tracker

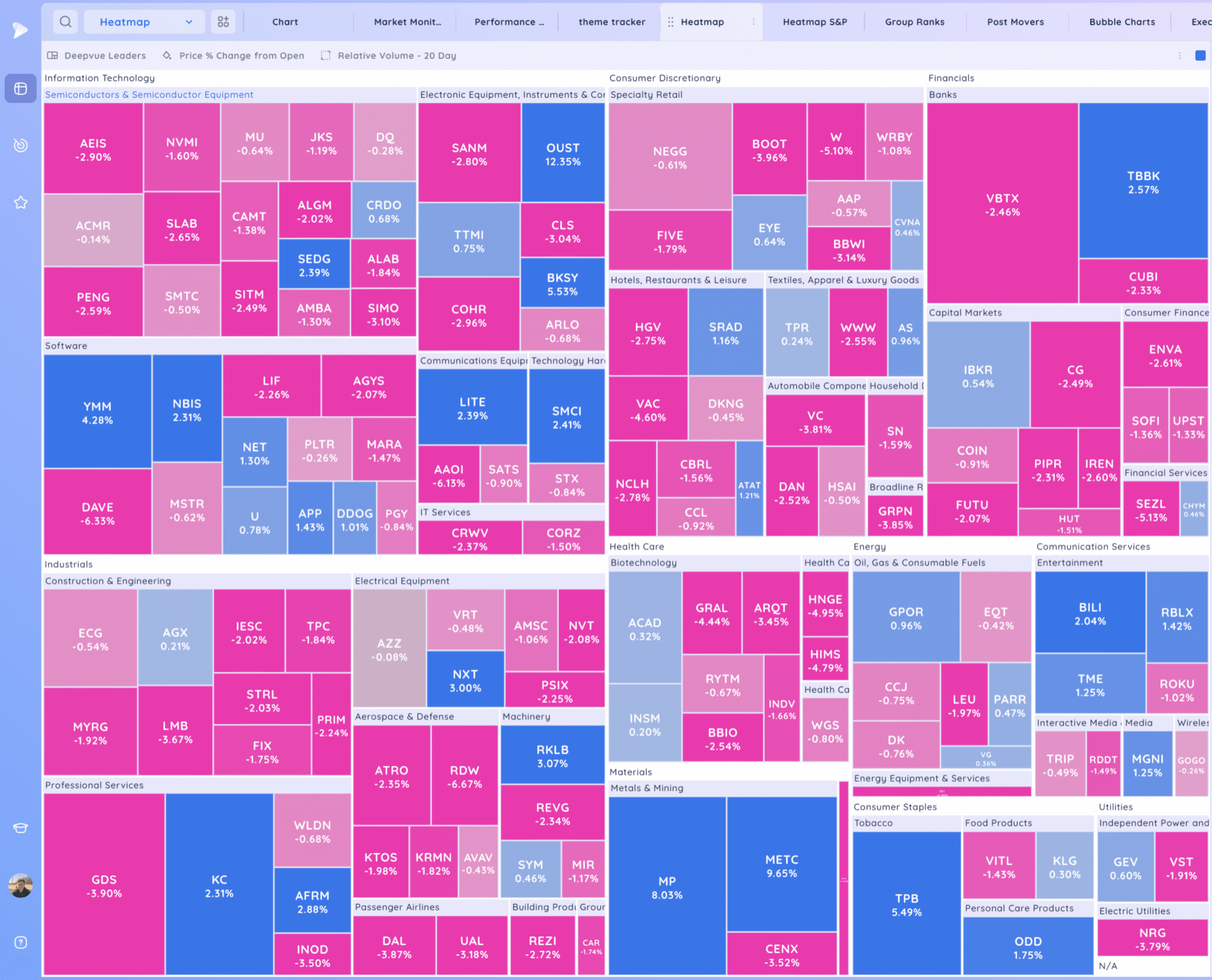

Deepvue Leaders Heatmap

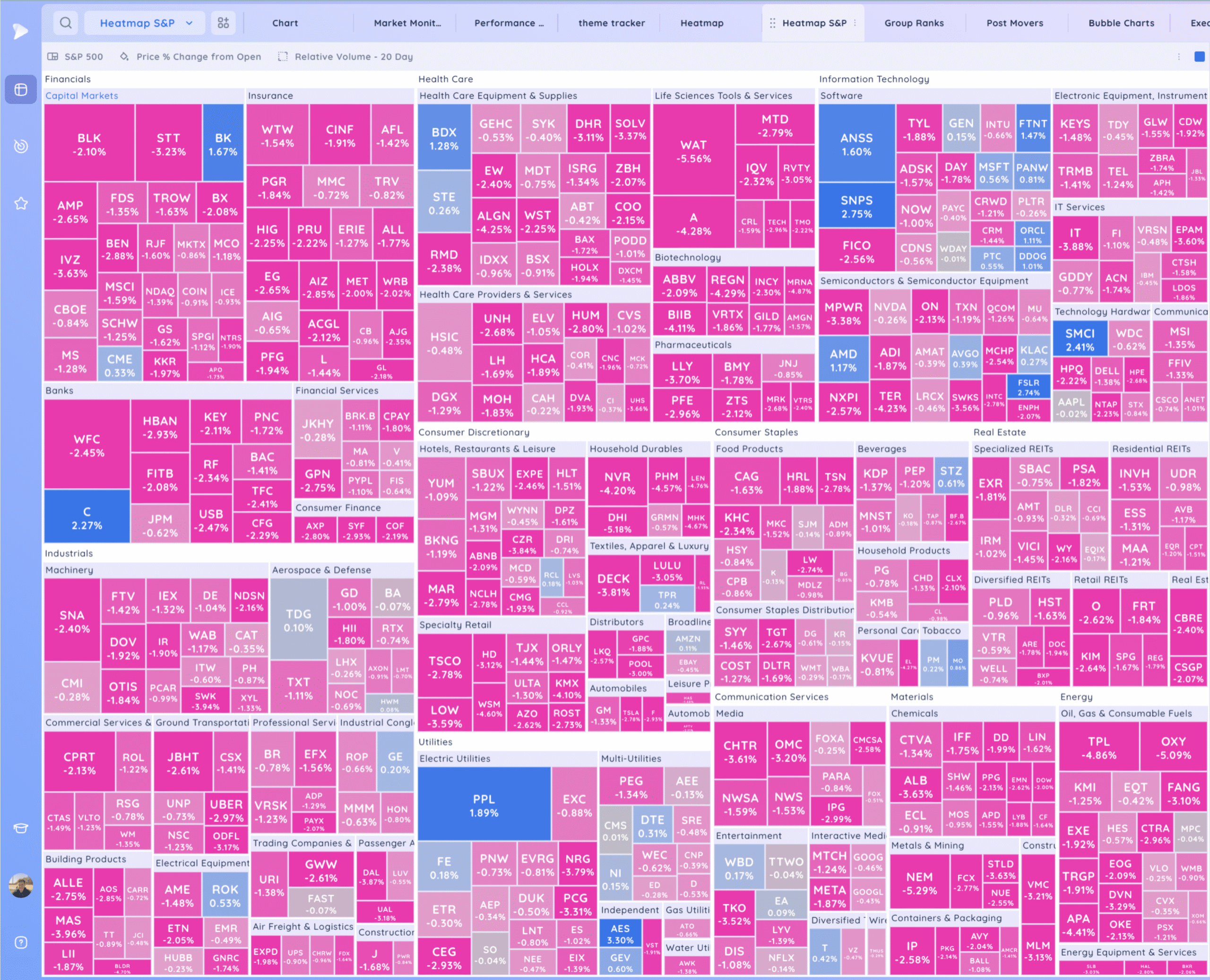

S&P 500.

Leadership

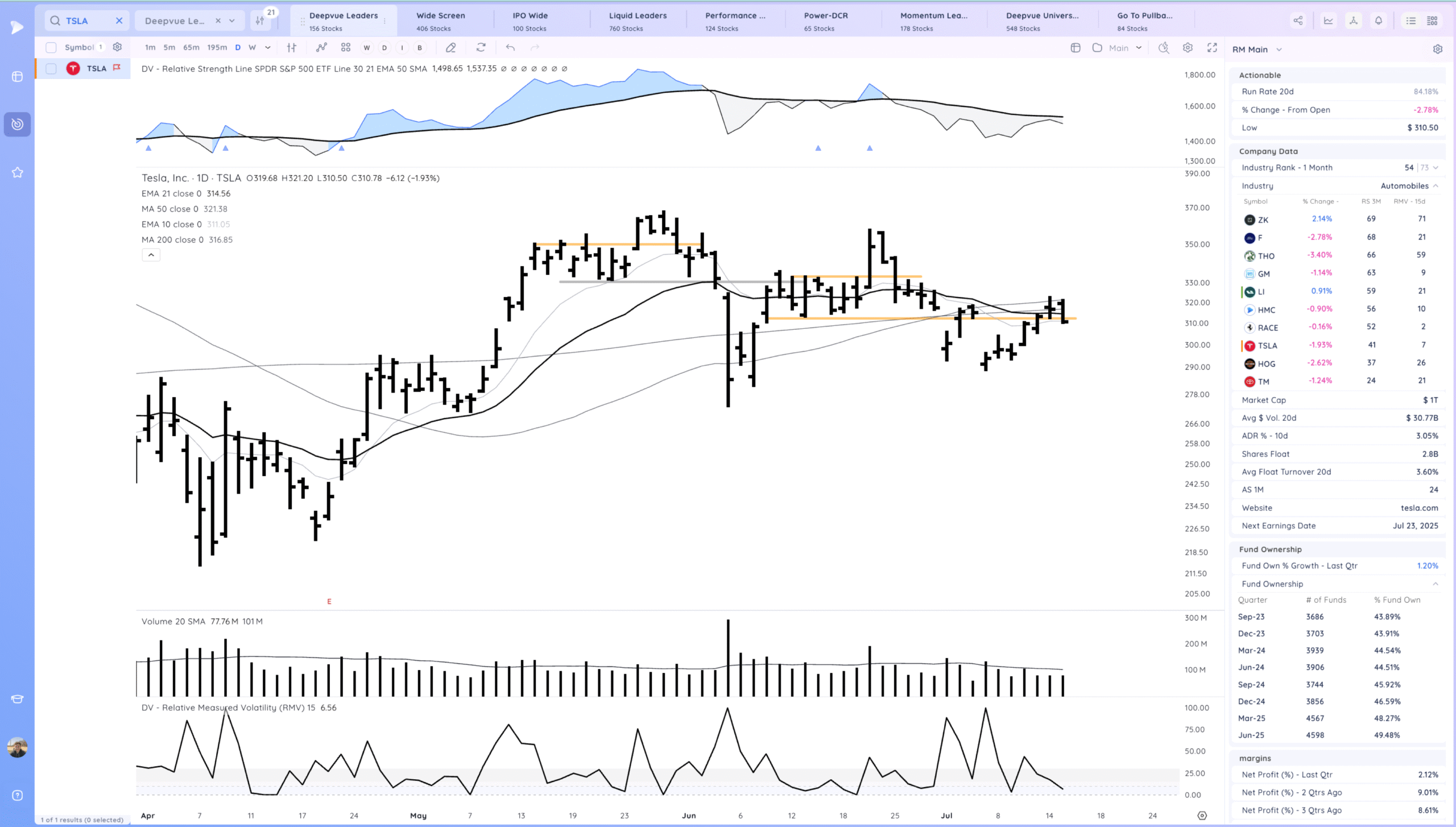

TSLA reversal back below the 21ema

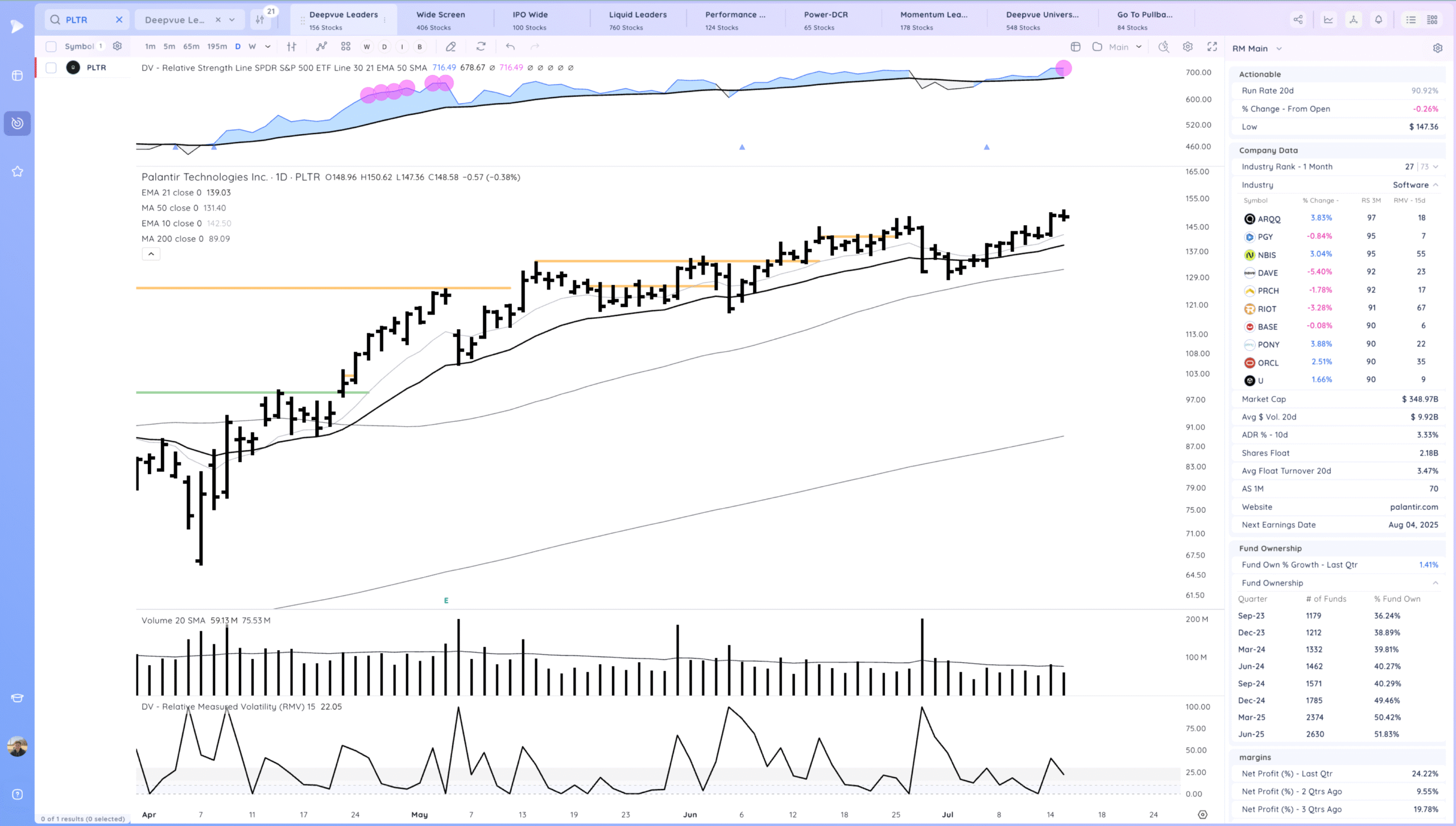

PLTR tight day

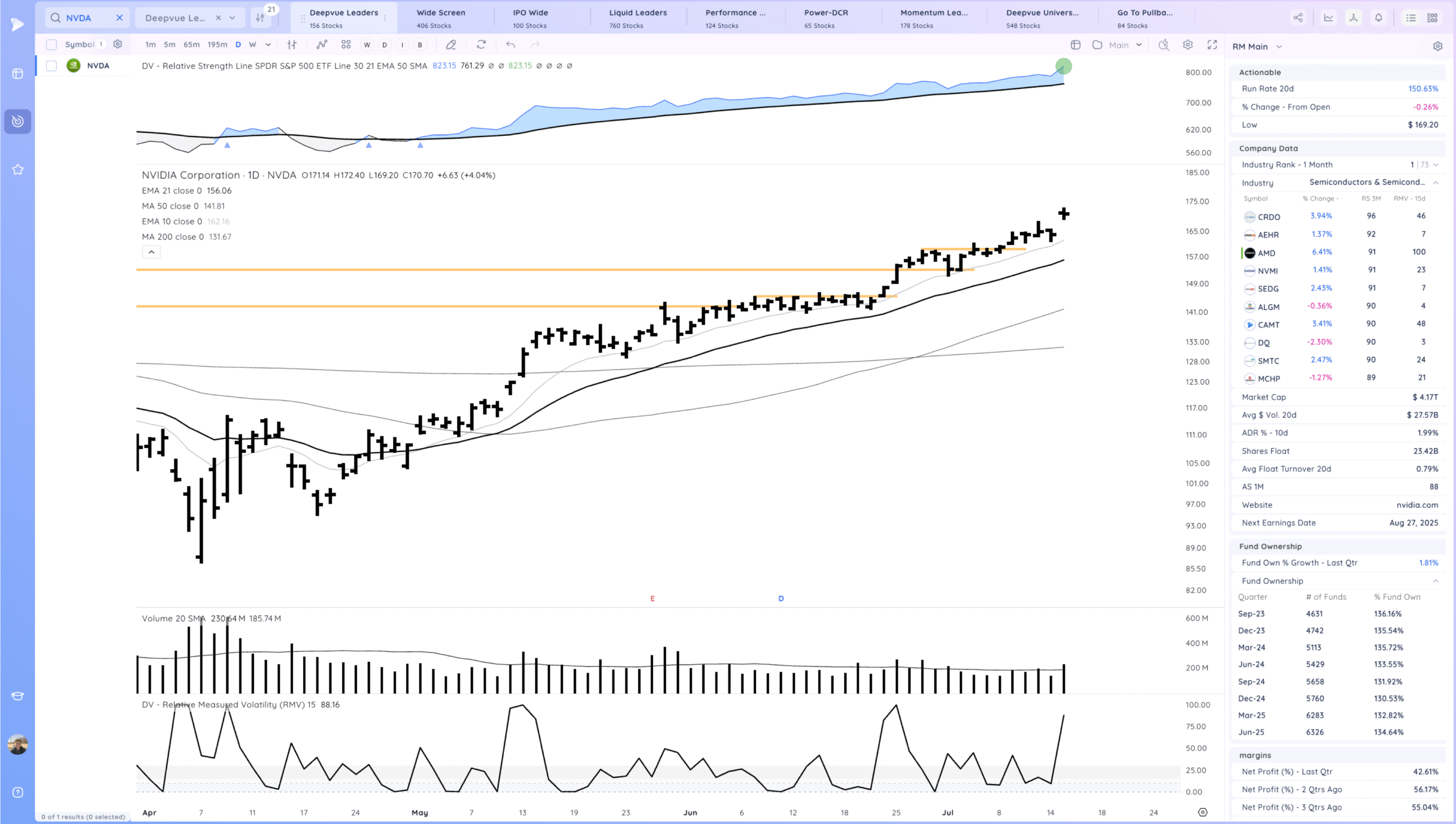

NVDA gap up and tight day

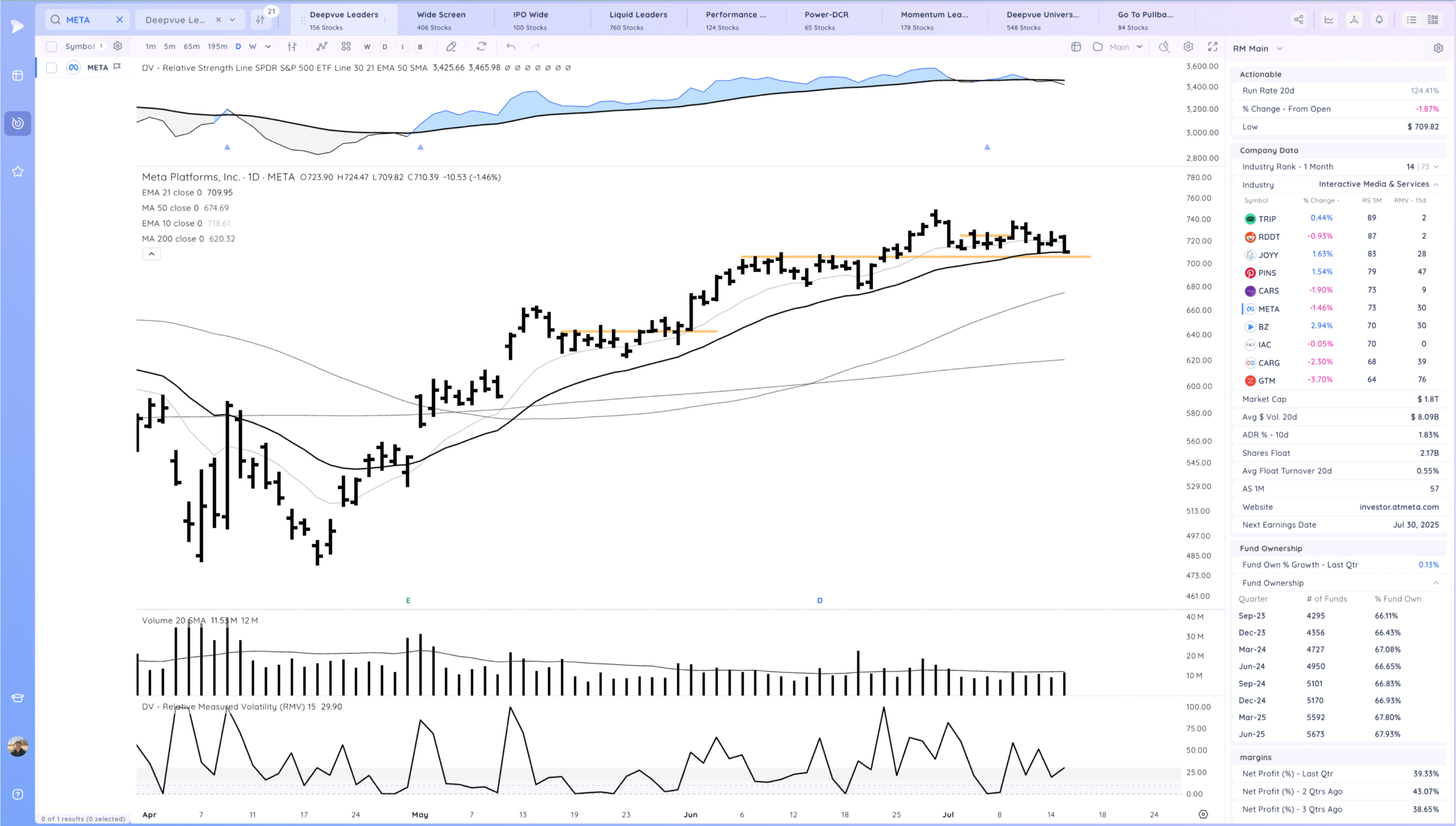

META testing the 21ema

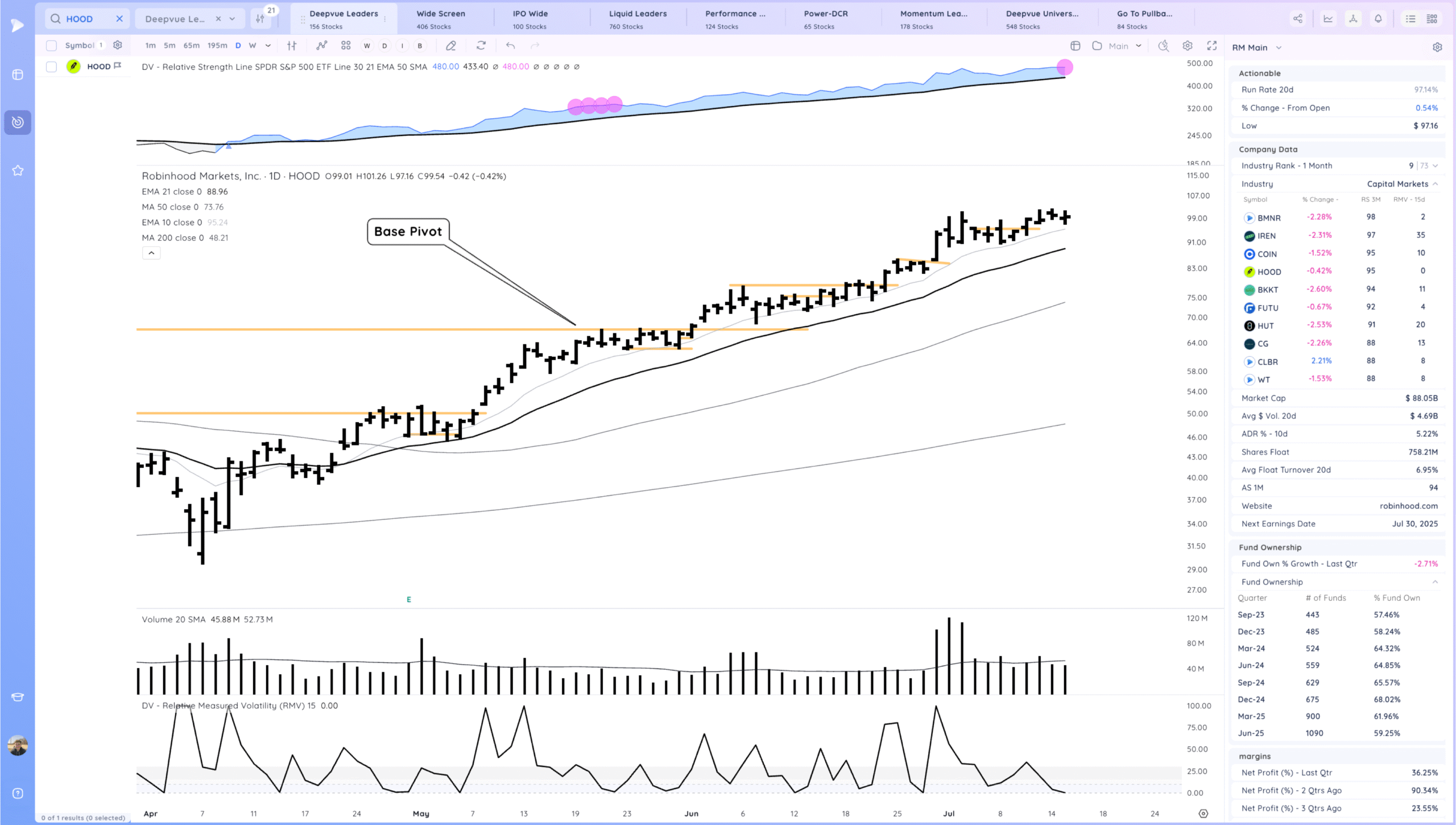

HOOD forming a range

MSTR fade off highs

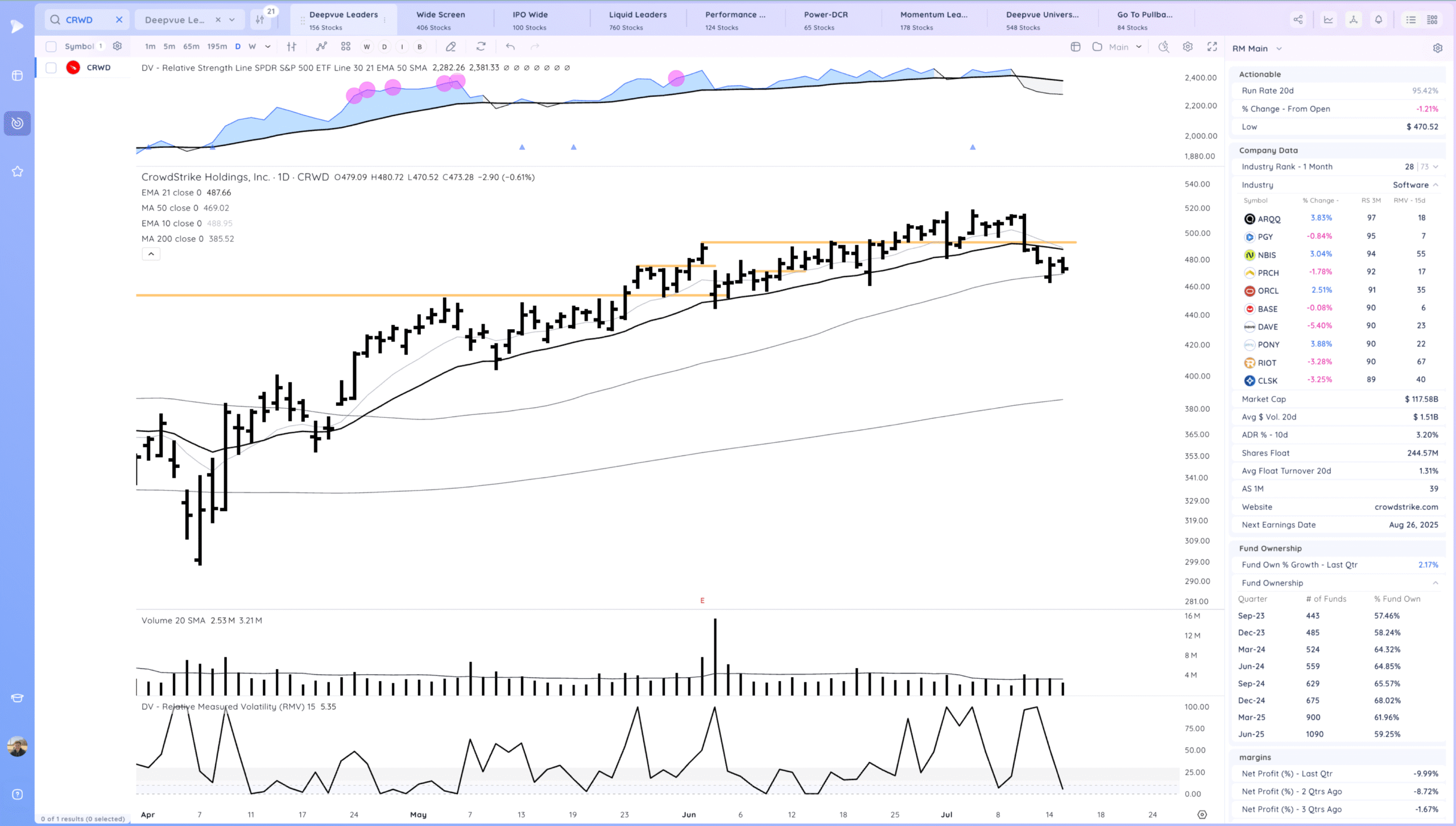

CRWD inside day, right above the 50

Key Moves

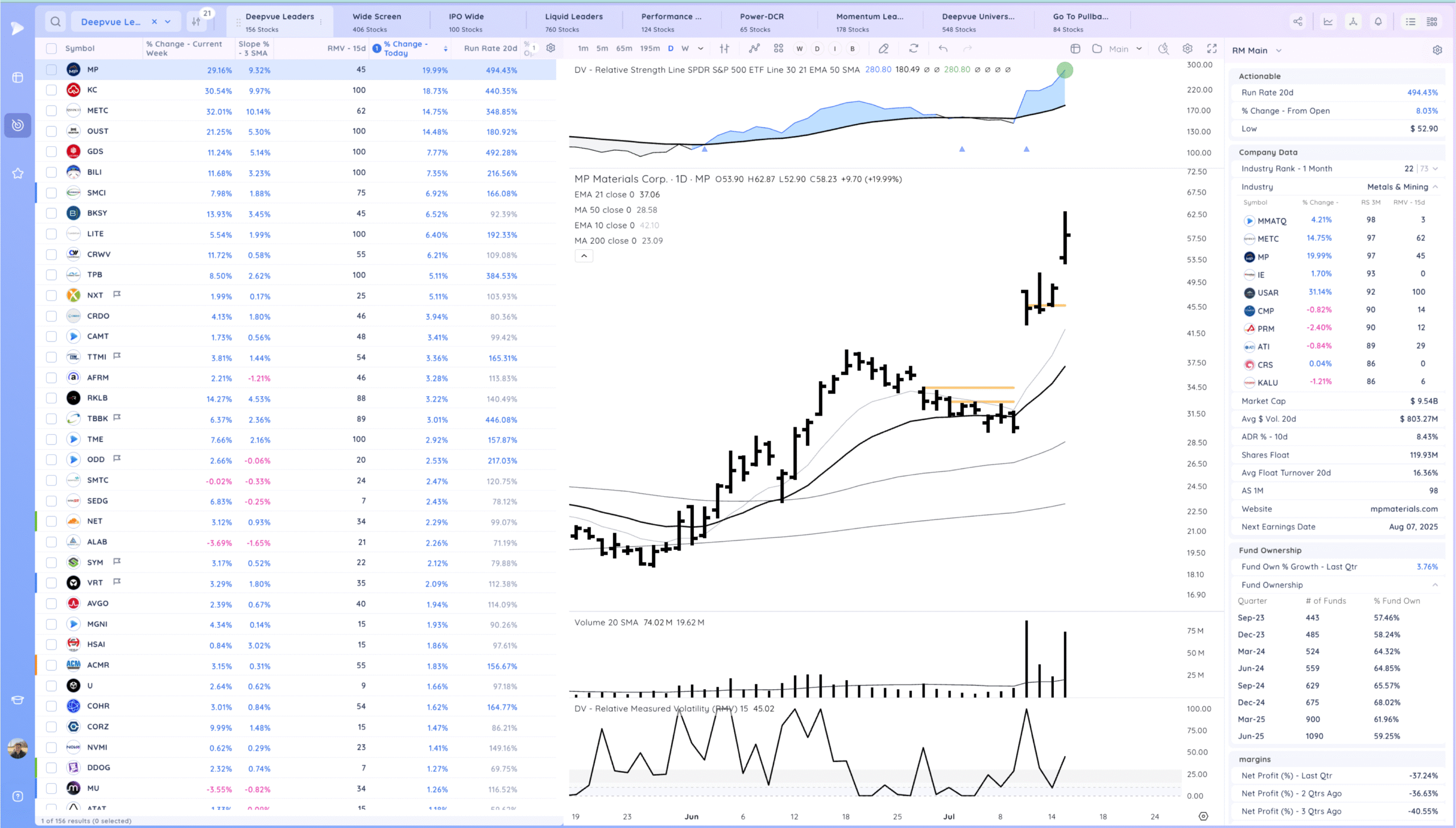

MP gap and go

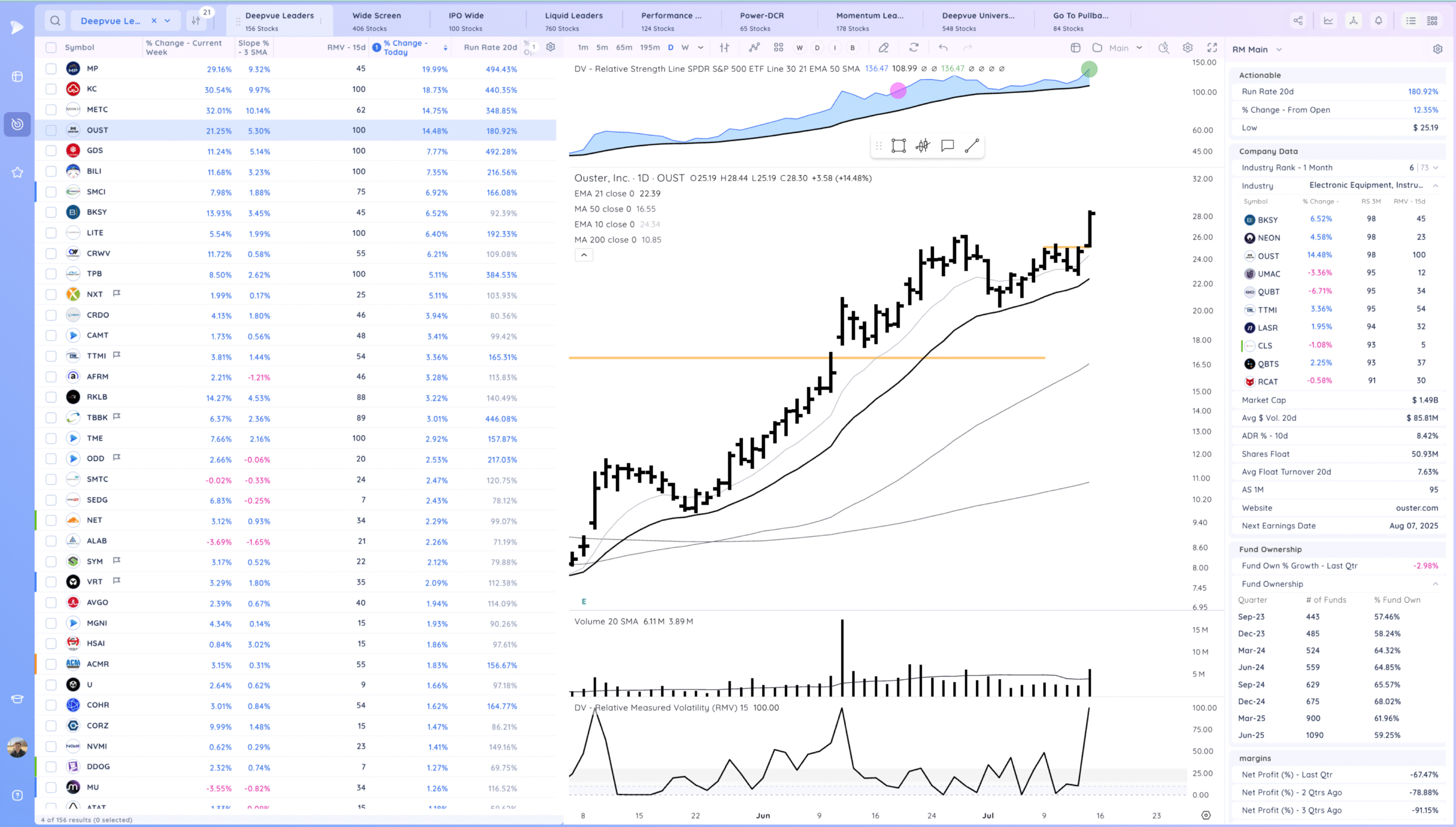

OUST Breakout

Setups and Watchlist

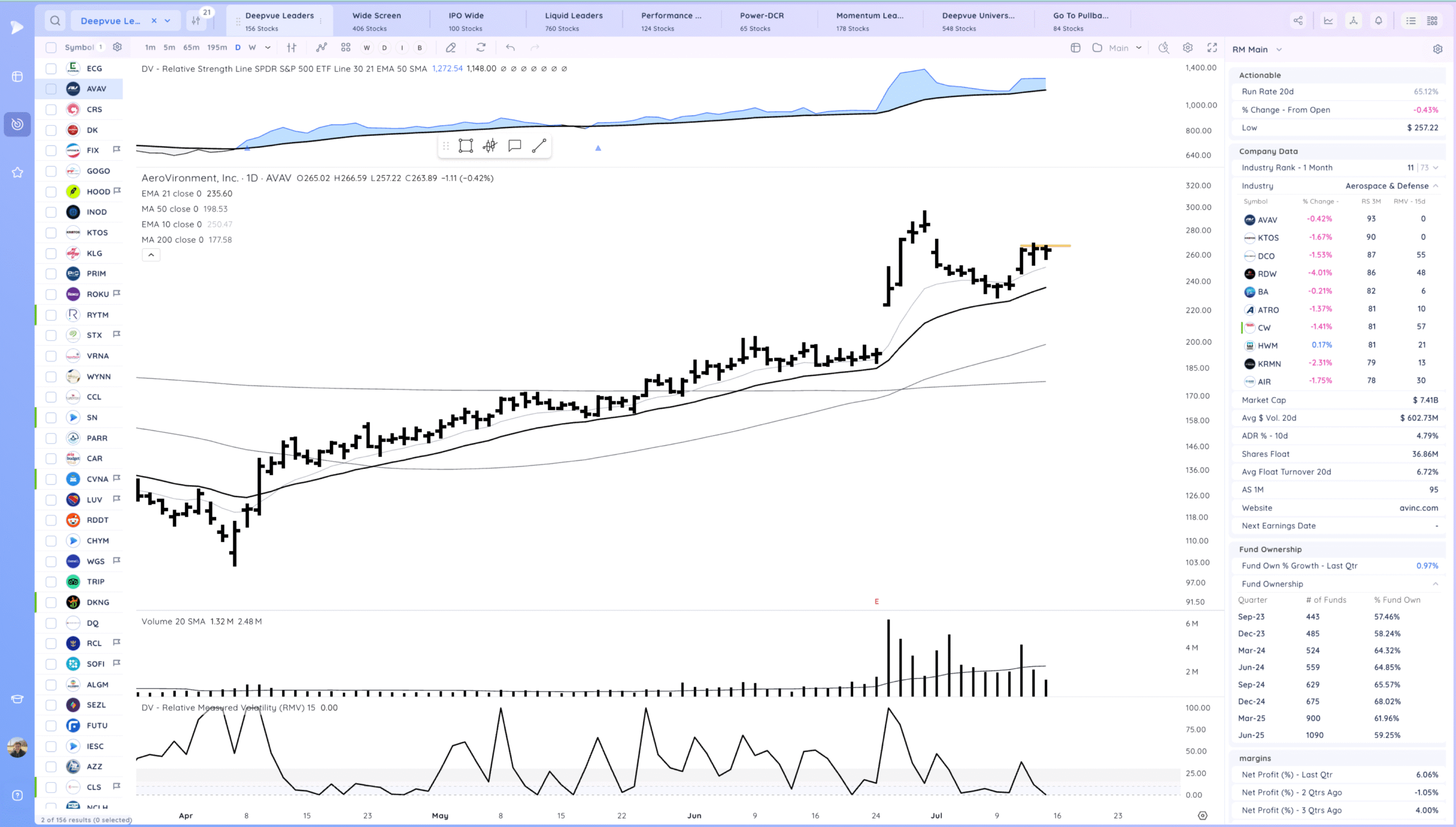

AVAV watching for a range breakout

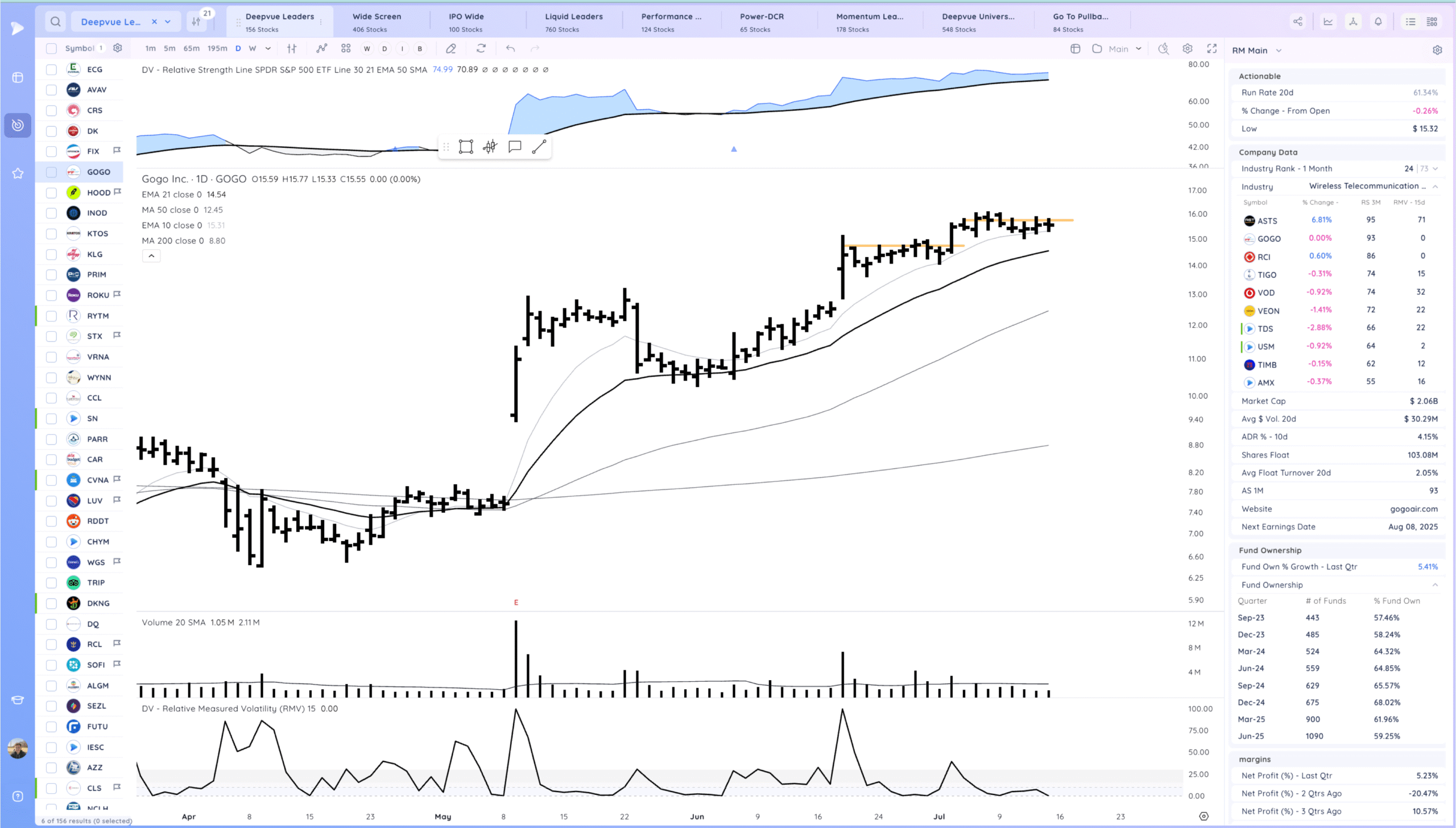

GOGO watching for a range breakout

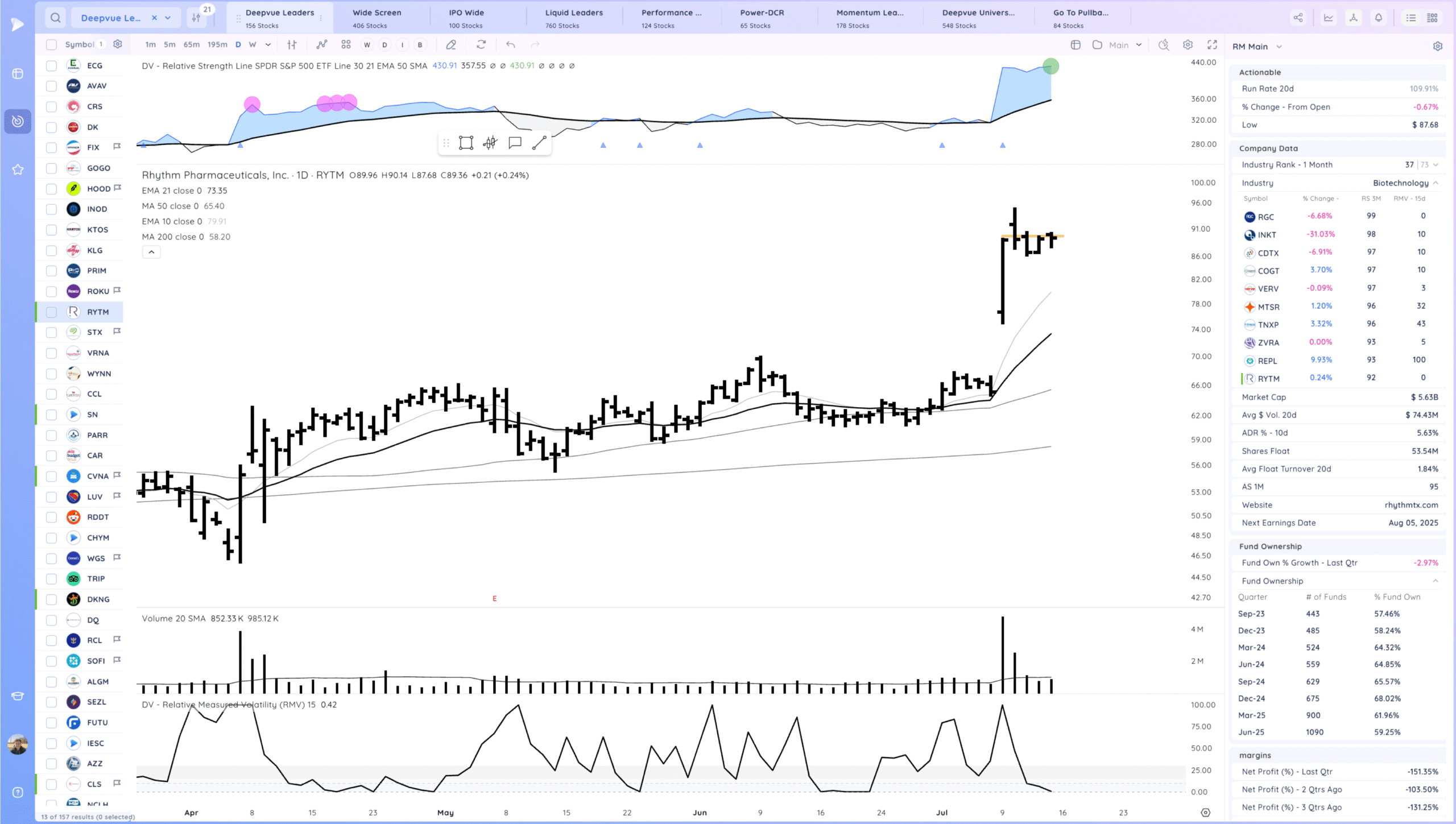

RYTM watching for a range breakout

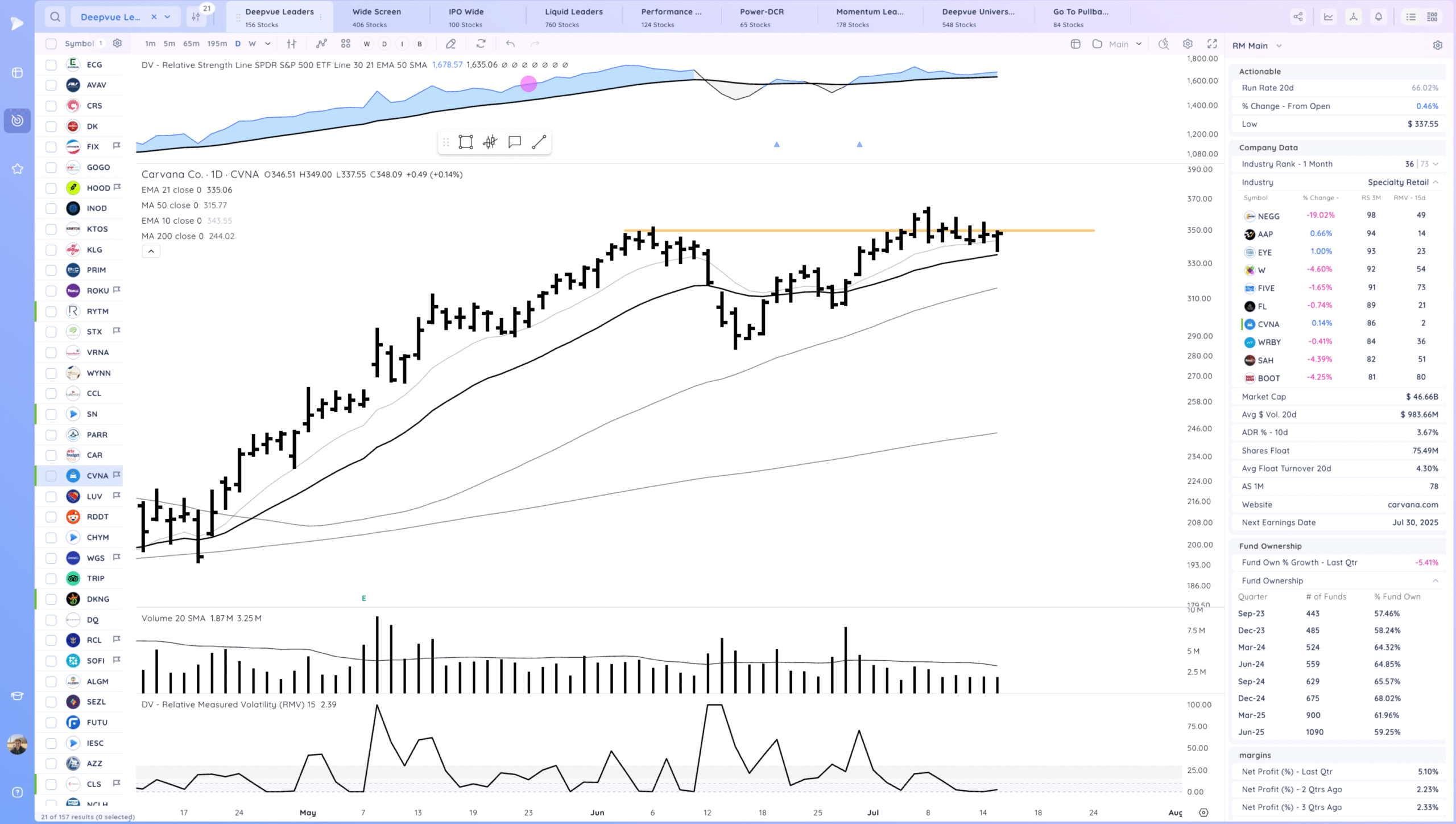

CVNA watching for a range breakout

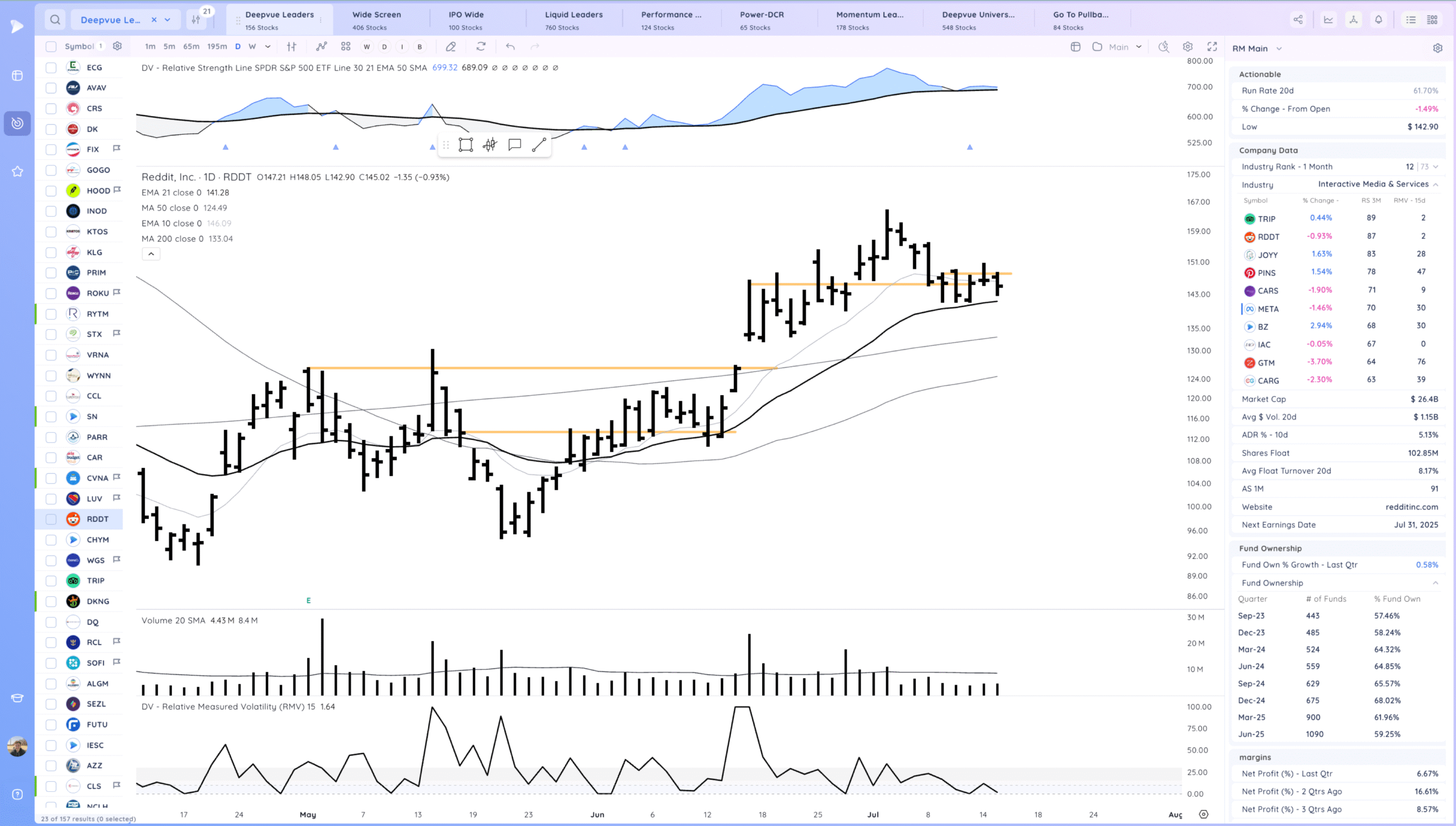

RDDT watching for range breakout

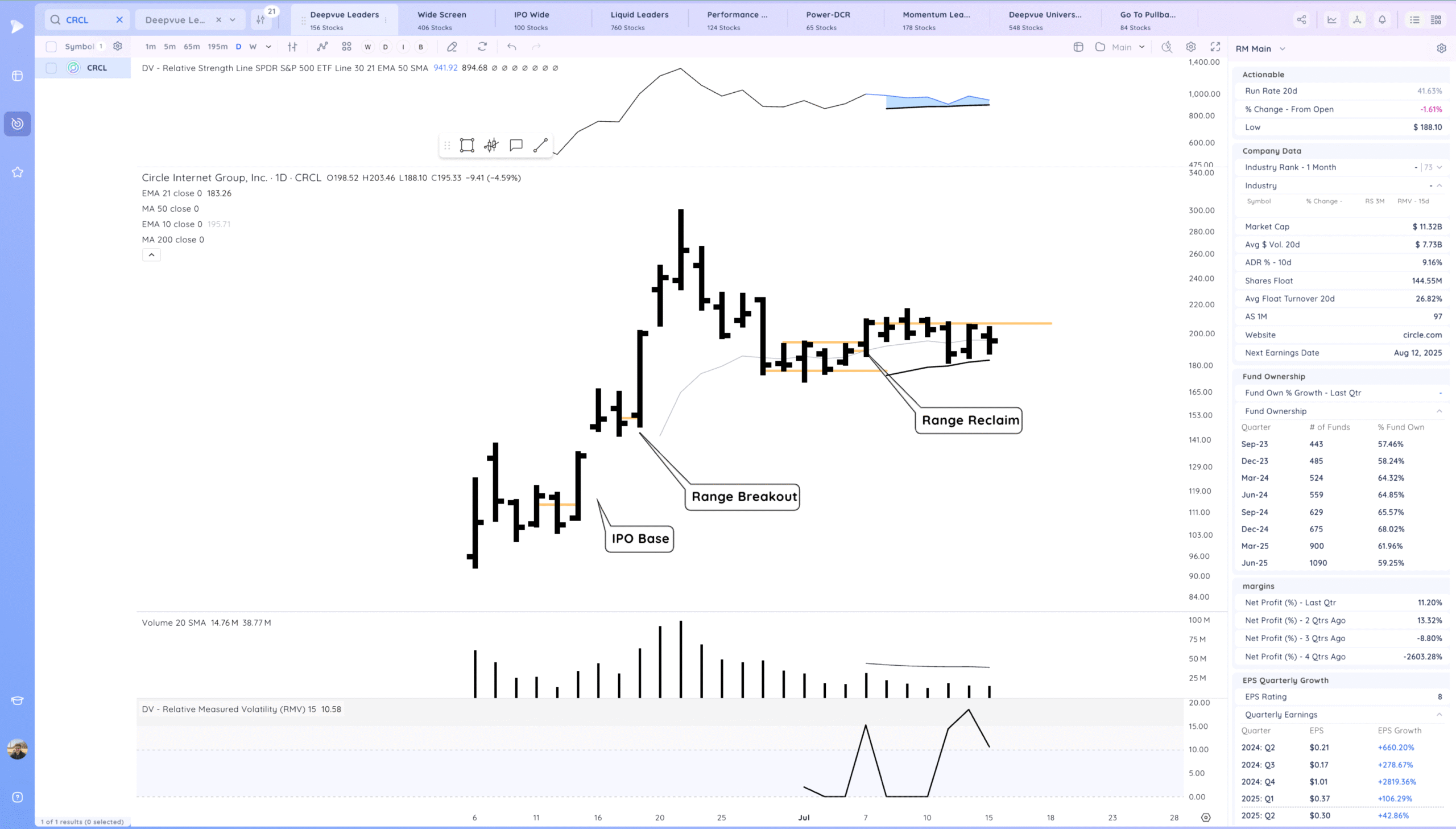

CRCL watching for range breakout.

ODD watching for follow through up

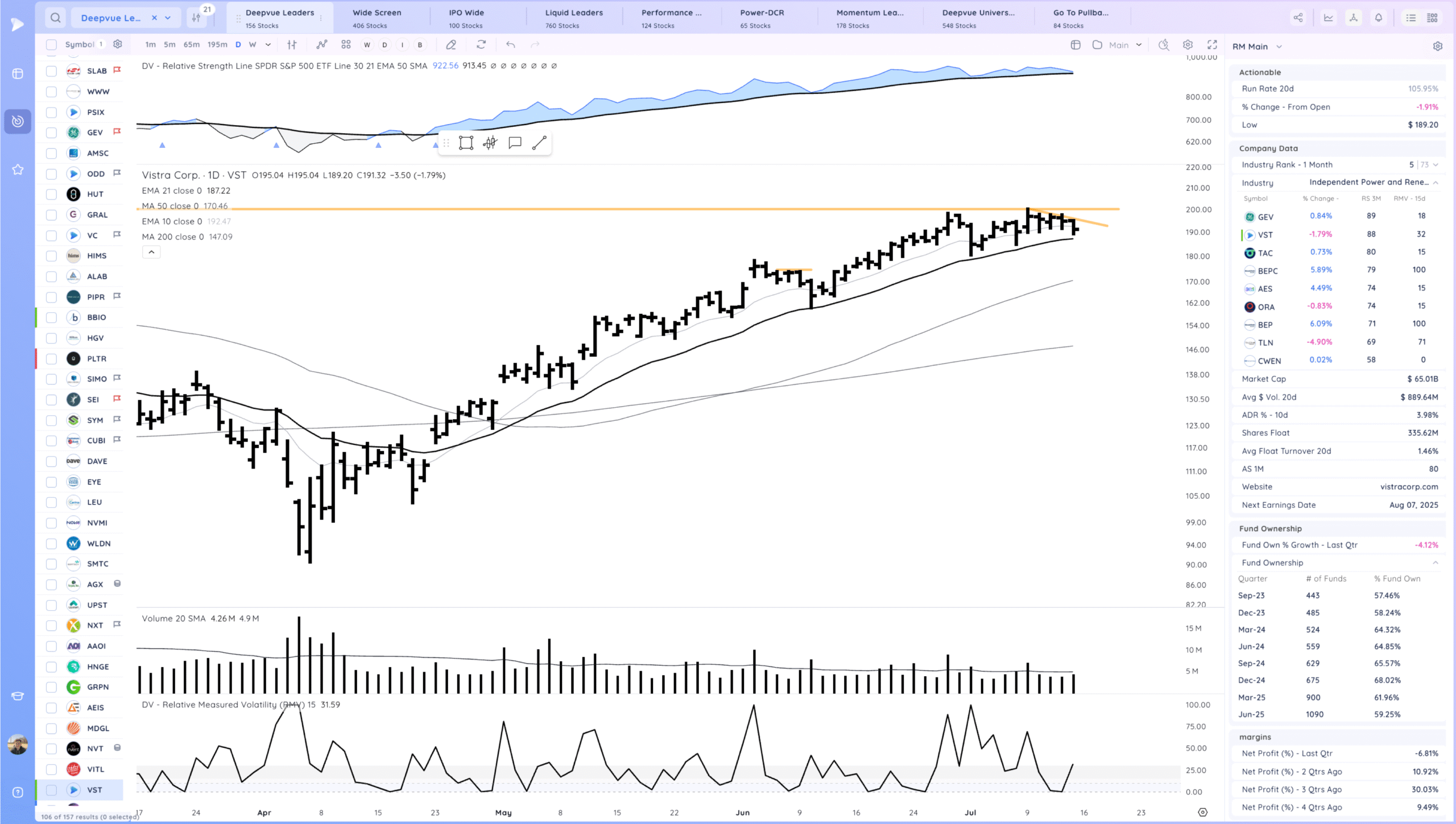

VST watching for a range breakout

Today’s Watchlist in List form

Key Names

NVDA, TSLA, META, PLTR, MSTR, CRWD UBER HOOD

AVAV GOGO RYTM CVNA CRCL RDDT ODD VST

Focus:

CRCL RDDT VST

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

Some reason to be thinking more cautiously given that we are later in this uptrend. However right now we are still trending above the moving averages. Crypto names were extended so this was somewhat expected.

Anything can happen, Day by Day – Managing risk along the way