Weekly Sub Digest – July Week 1

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: July 9, 2025

3 min read

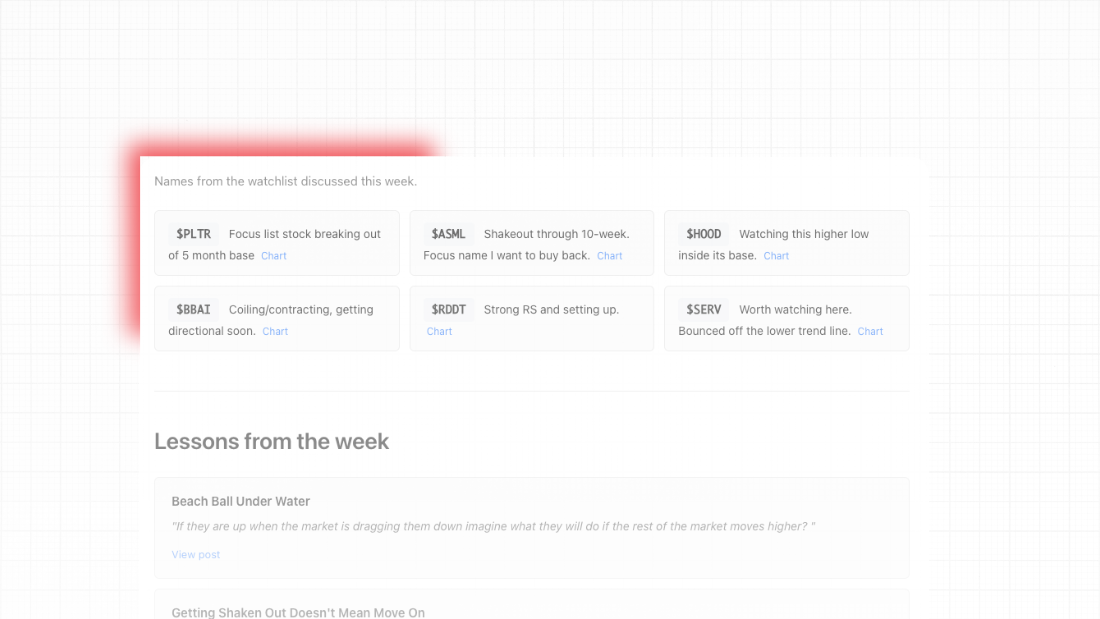

Weekly Subscriber Digest

Key Trading Insights

| Key Theme | Key Insight | Reference |

|---|---|---|

| Trade what you see | “I’ve been expecting a pullback for over a month now, if I didn’t trade what’s in front of me I’d be having an awful year. Trade what you see not what you expect!” | Jul 6 – Core philosophy |

| Structure > Setup | Focus on the underlying structure of a chart rather than waiting for perfect setups. Messy charts can become clean when you know what to look for. | Jul 6 – UPWK analysis View post → |

| Volume tells the story | Dry-up in volume during pull-backs/sideways action often marks quiet accumulation; sustained heavy volume on the way down or when consolidating can be a yellow flag. | Jul 1 – RBRK vs QUBT View post → |

| “Character Change” setup | After a high-volume thrust, wait for the first higher low before calling a true trend change. Patience beats premature entries. | Jul 1 – NKE discussion View post → |

| Group confirmation | When several stocks in the same industry build similar bases, odds of a successful breakout rise sharply. Think in themes, not in isolation. | Jun 30 – Quantum-tech View post → |

Trade Activity

| Ticker | Note |

|---|---|

| PLTR | Sold – Booked profits due to it underperforming for weeks at highs and failing to gain any further momentum. Not trying to predict, just trading what I see. |

| HOOD | Sold – First position to cross +100% YTD. Exited into strength due to vertical blast higher on enormous volume. Will likely base and offer re-entry. View post → |

| SMCI | Holding – Entry at $43.28, using 10-week MA (currently $41.65) as guide. Volume dried up completely, waiting for volume to come in and move. View post → |

Looking Ahead

Quantum Tech basket remains a strong theme.

Semi-conductors remain a developing theme with NVDA leading the way out of long consolidation. Eyeing NVDA and ALAB for entries (6-7% risk). View post →

Market Pullback Watch: Two leaders (HOOD & PLTR) showing short-term toppy action increases pullback probability. Remember: pullbacks are a feature, not a bug! And remember Trade what you see. Just because a pullback may come, you trade whats infront of you.

Re-deploying profits: Using the weekend to review universe and screen for fresh liquid-leader bases. No rush to be busy – waiting for setups that scream “buy me!”