State of the Market and Setups going into the Week

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

June 29, 2025

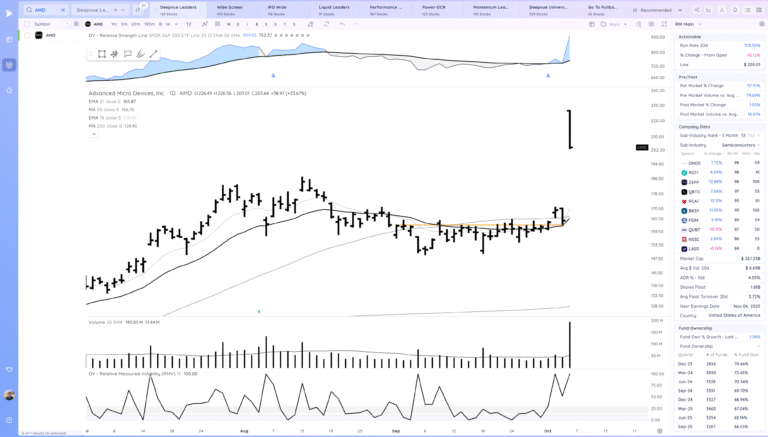

Market Action

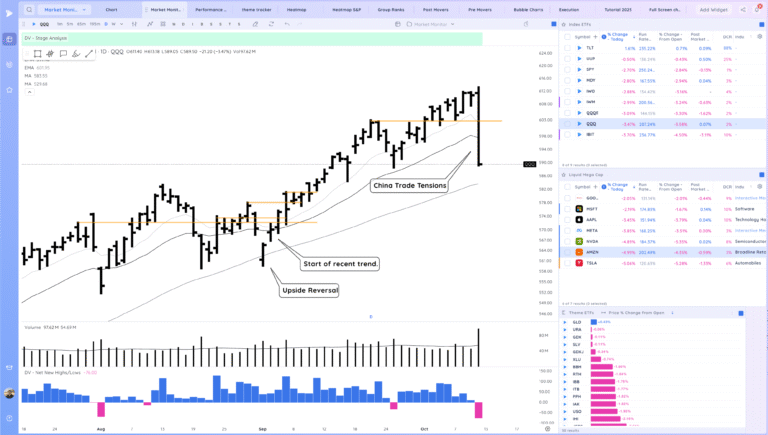

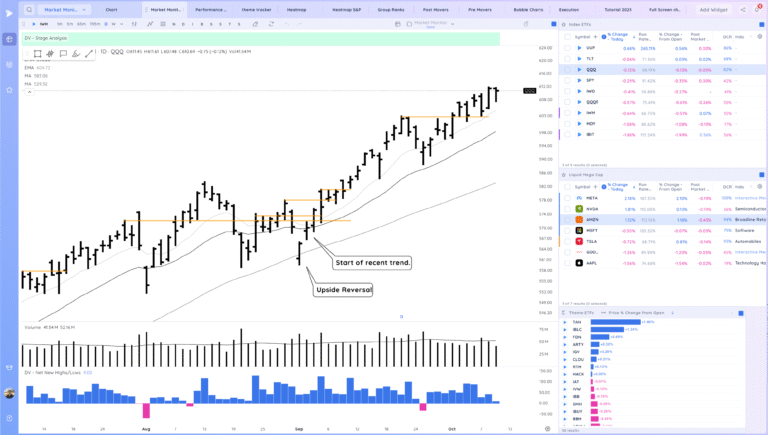

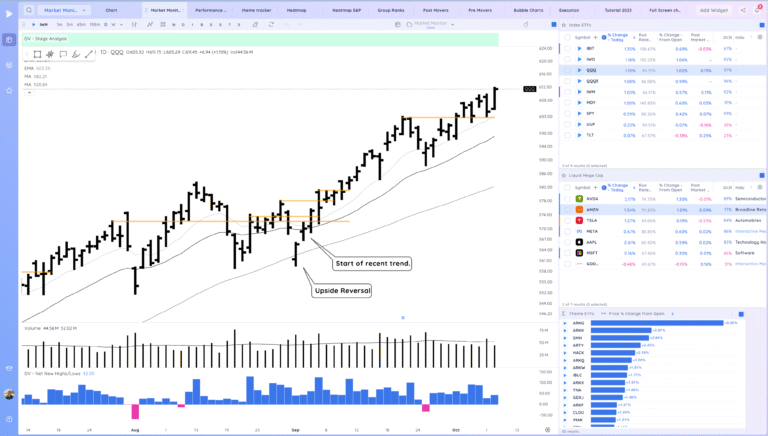

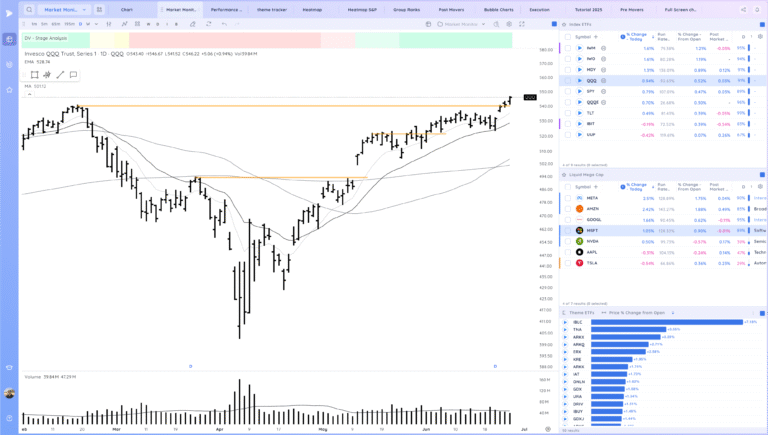

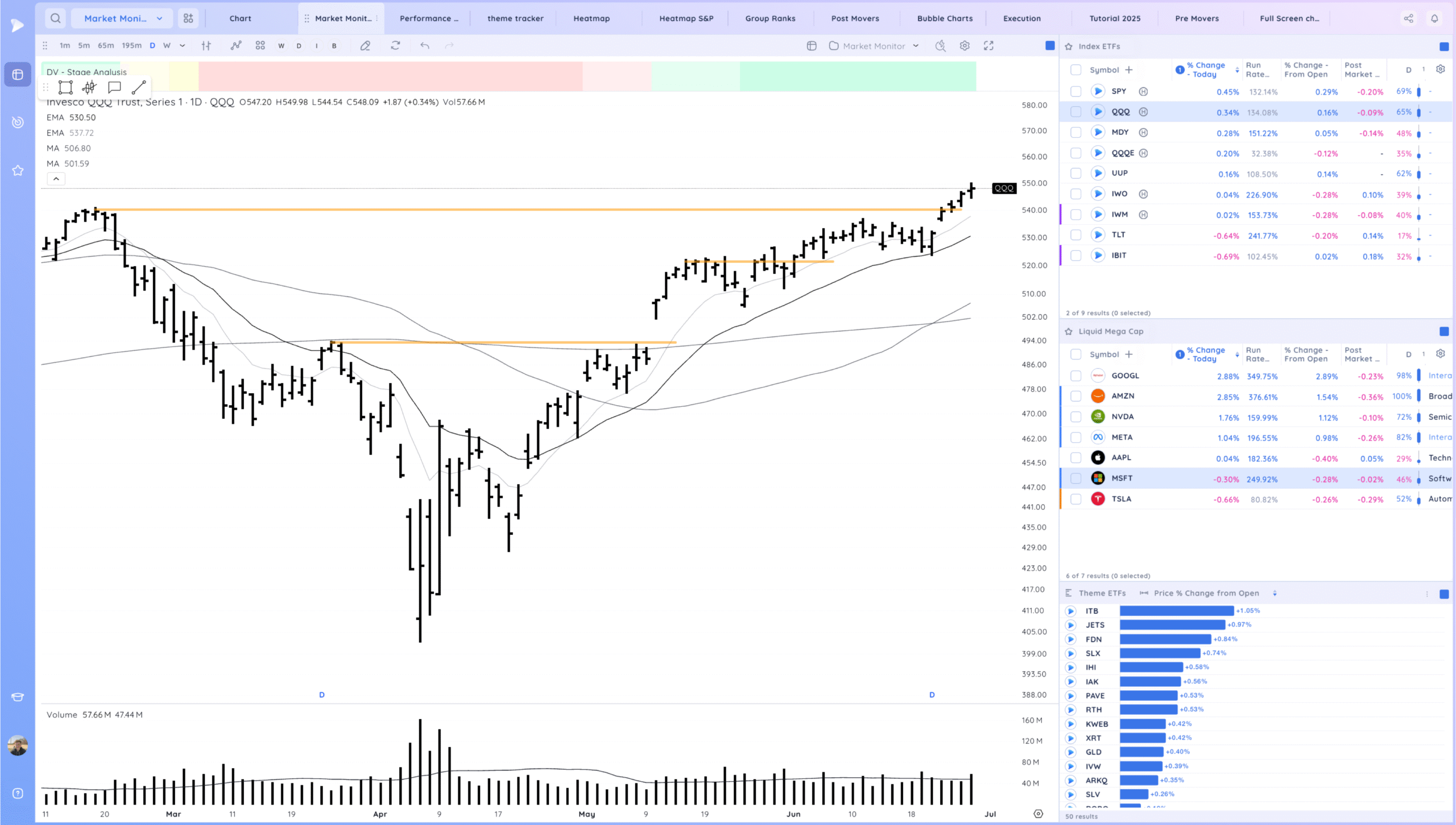

QQQ – Continued trend into new highs above the moving averages. Expecting shakes along the way. We are later in a market cycle.

Bulls want to see us keep trending above the 10ema

Bears want us to reverse and take out multiple lows at once

Daily Chart of the QQQ.

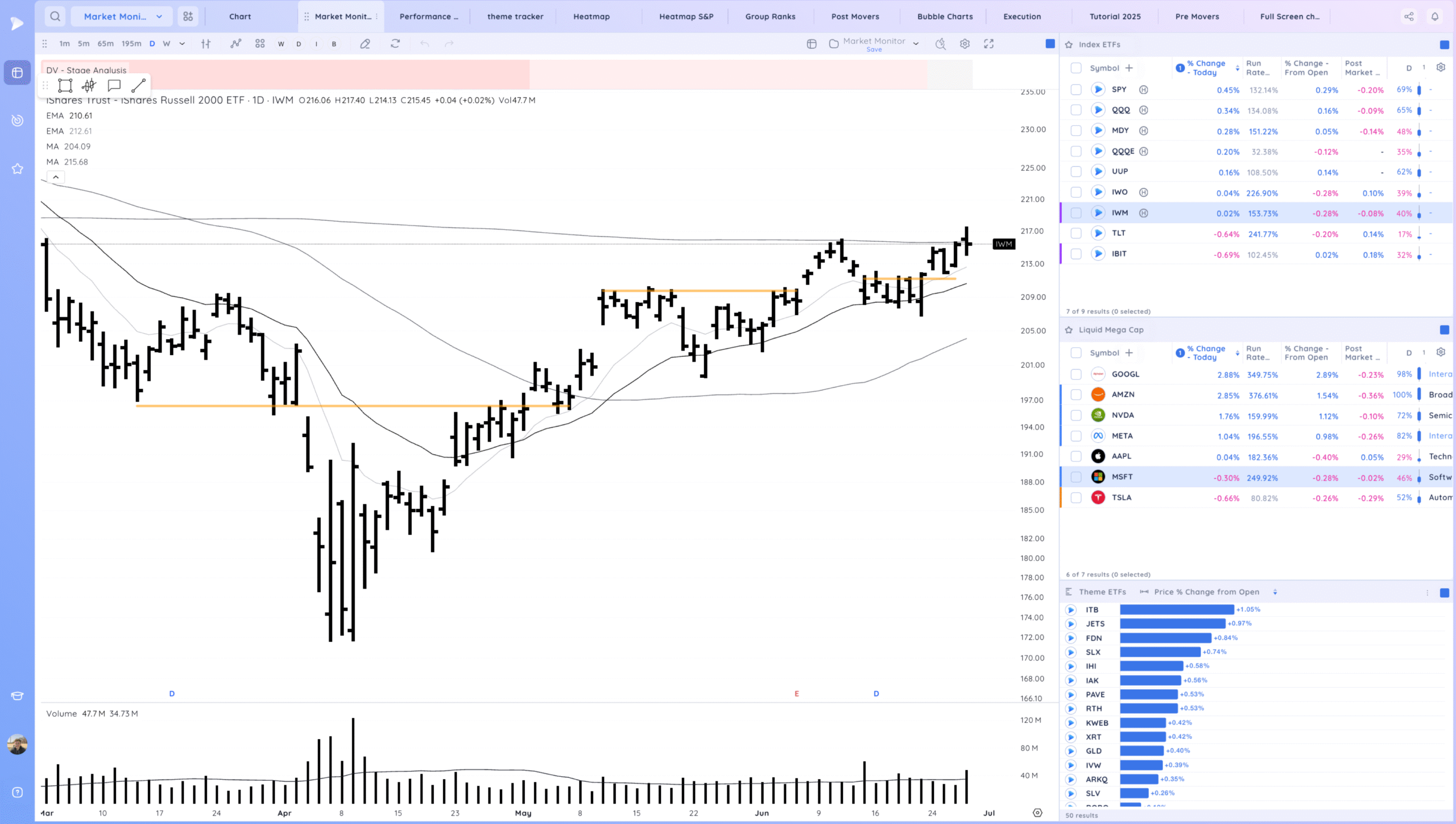

IWM – Some indecision at the 200 sma.

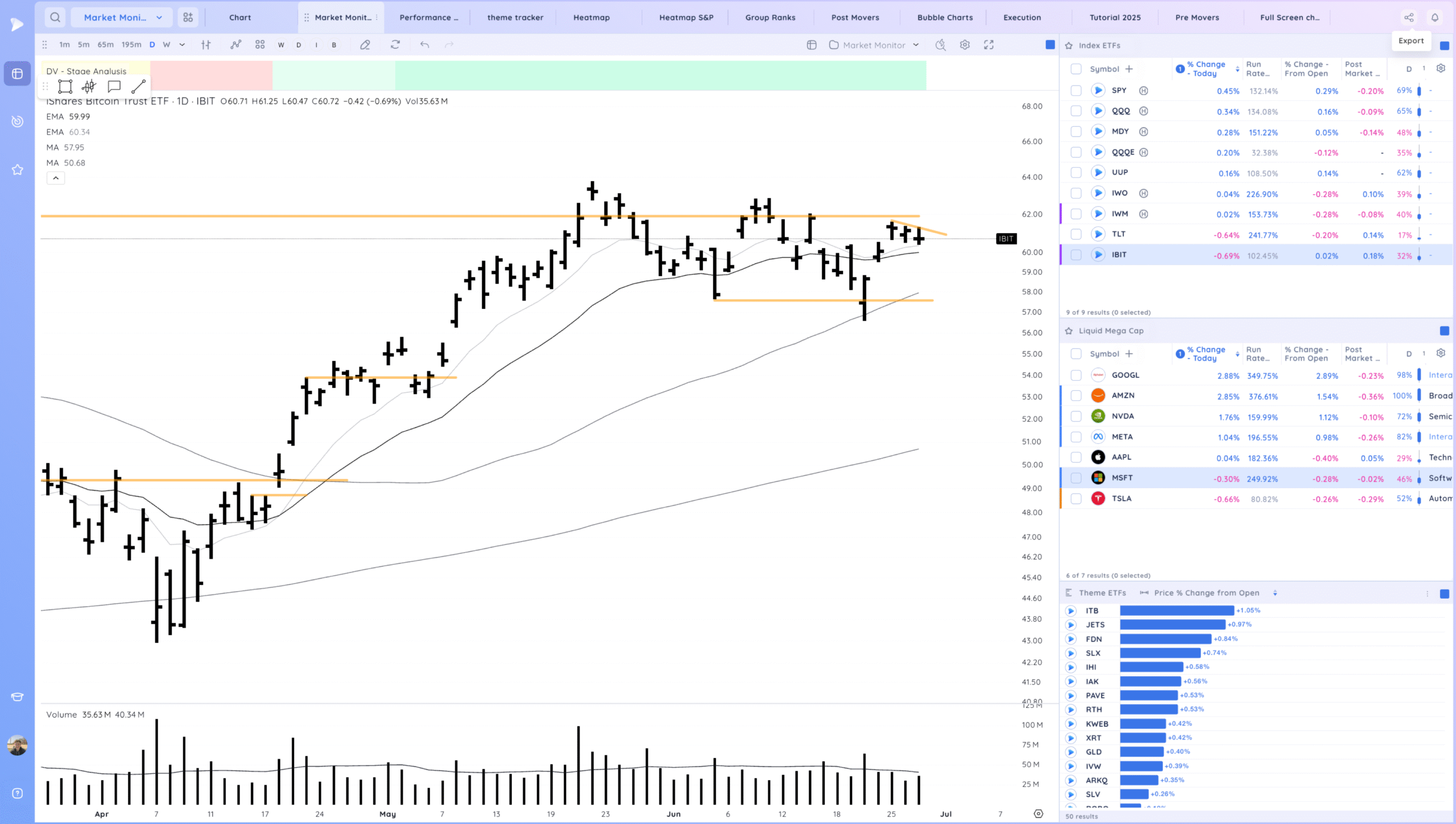

IBIT – In a short flag, good action after the gaps up

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

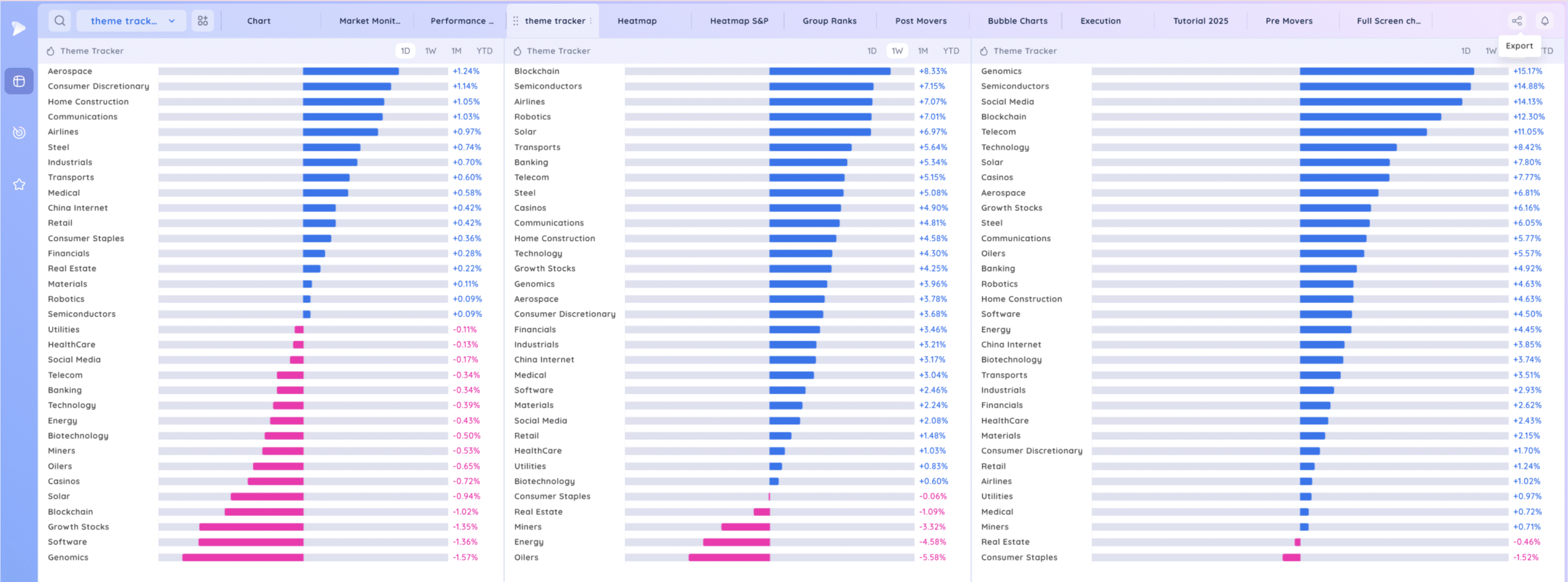

Deepvue Theme Tracker

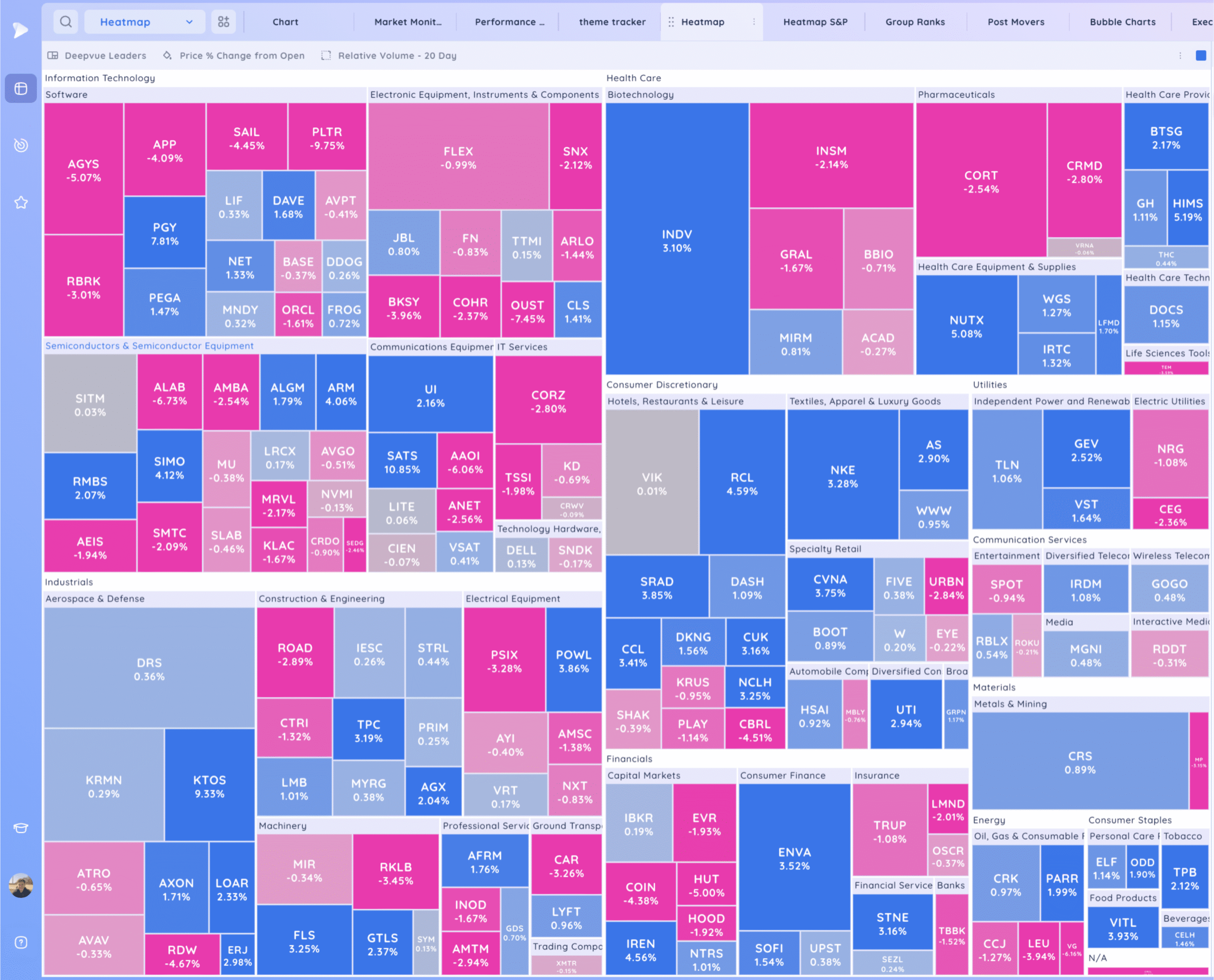

Deepvue Leaders Heatmap

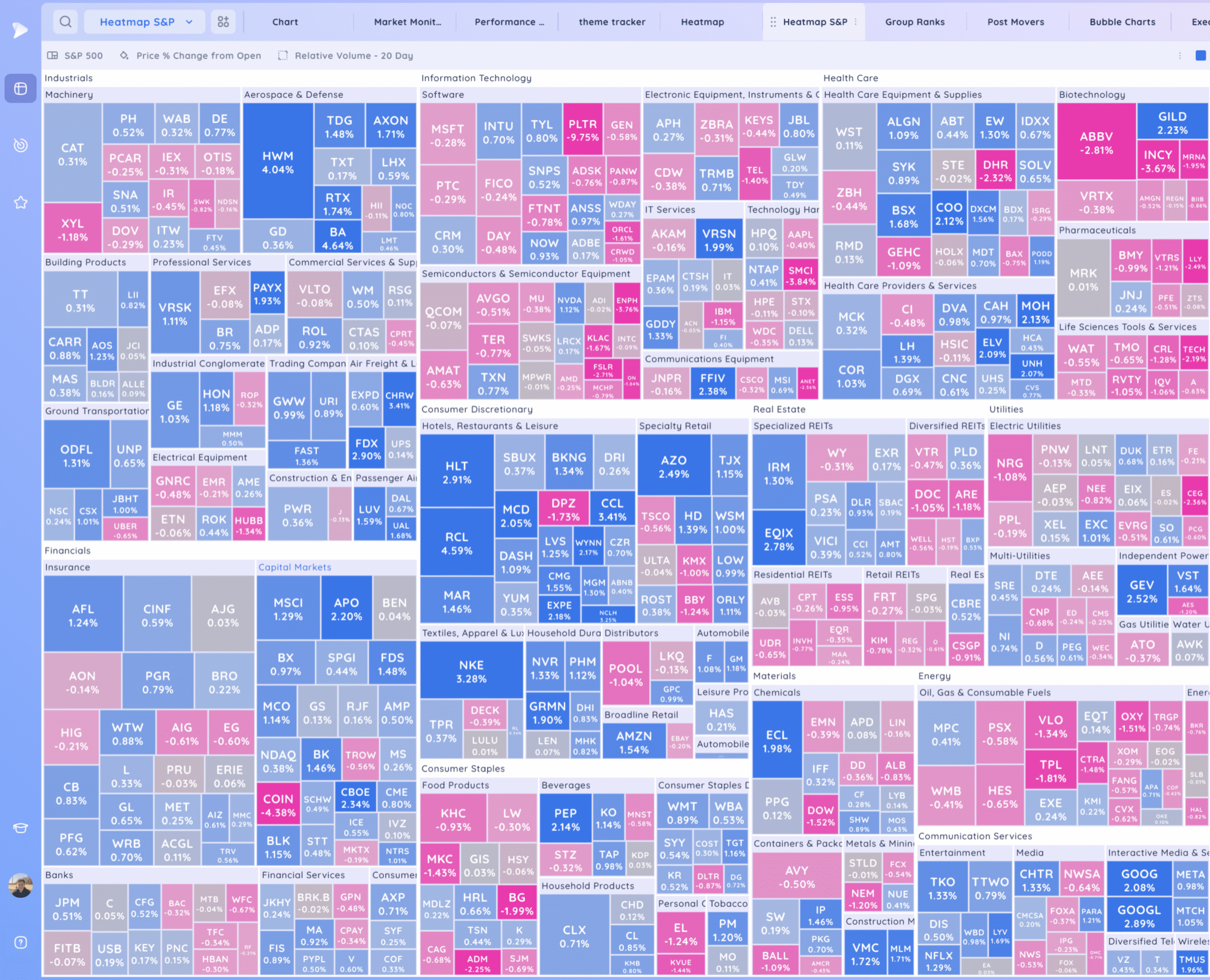

S&P 500.

Leadership

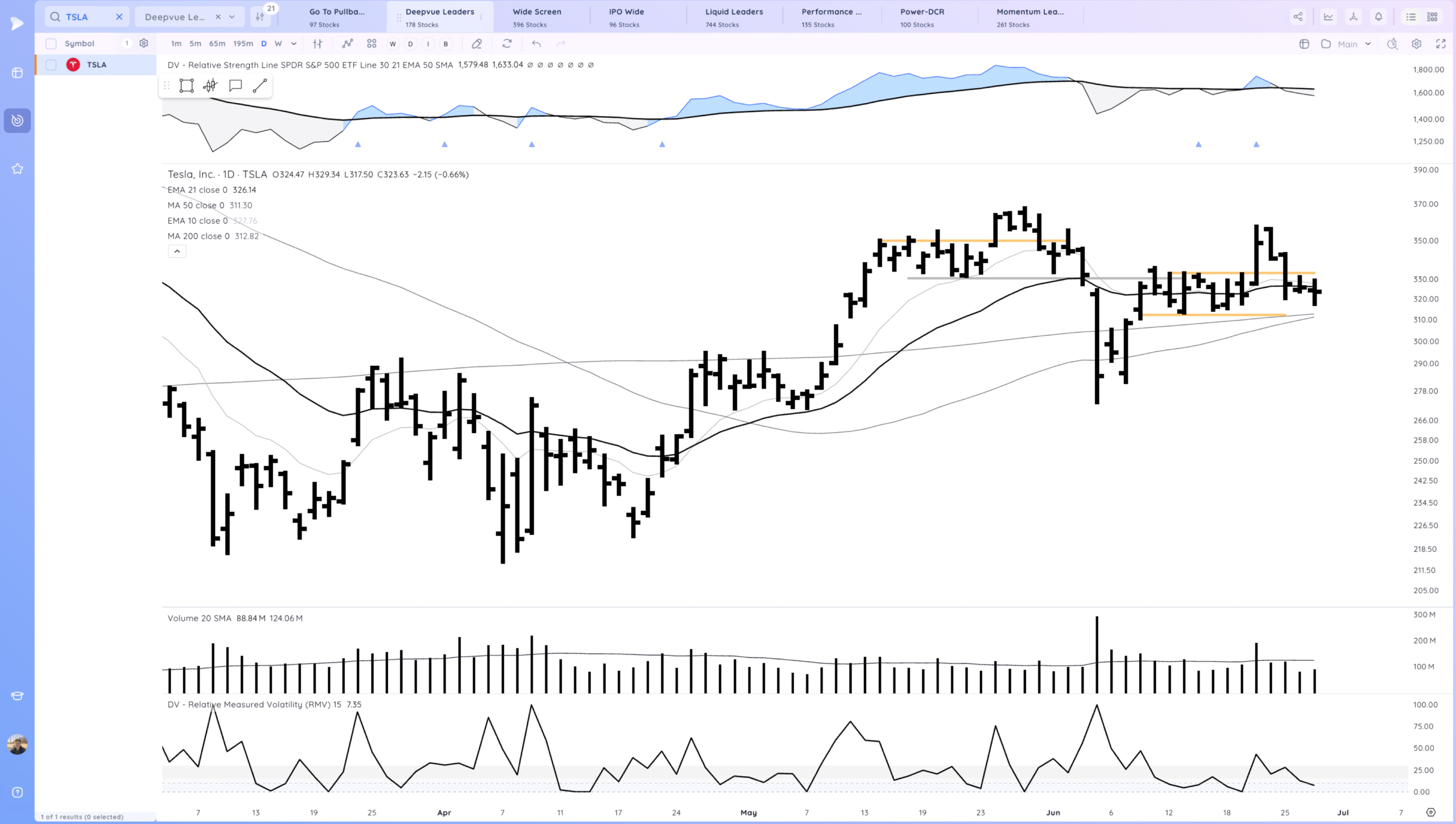

TSLA in the middle of the prior range, tightening, could go either way.

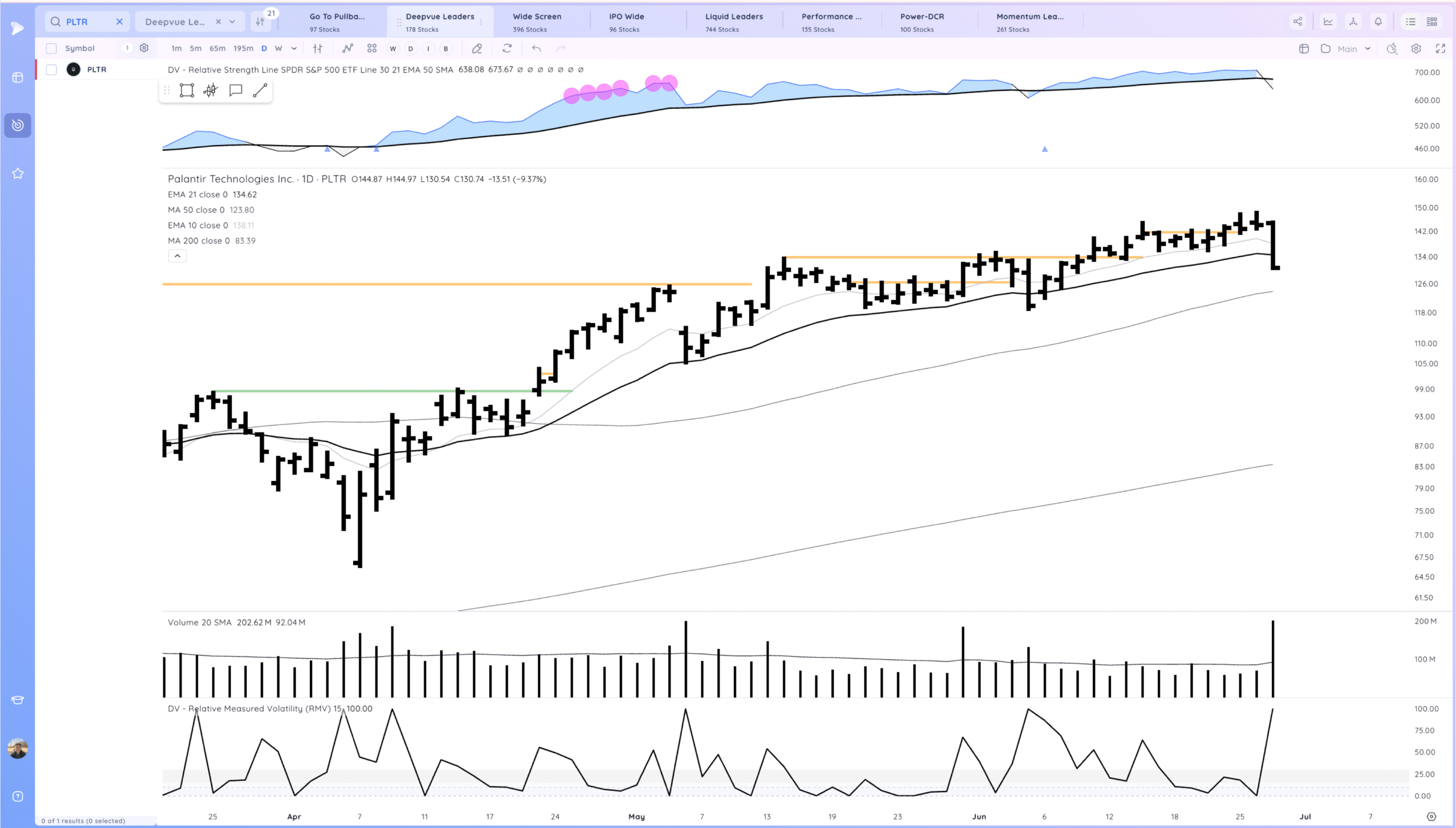

PLTR certainly a negative bar, needs to stick a strong day early next week

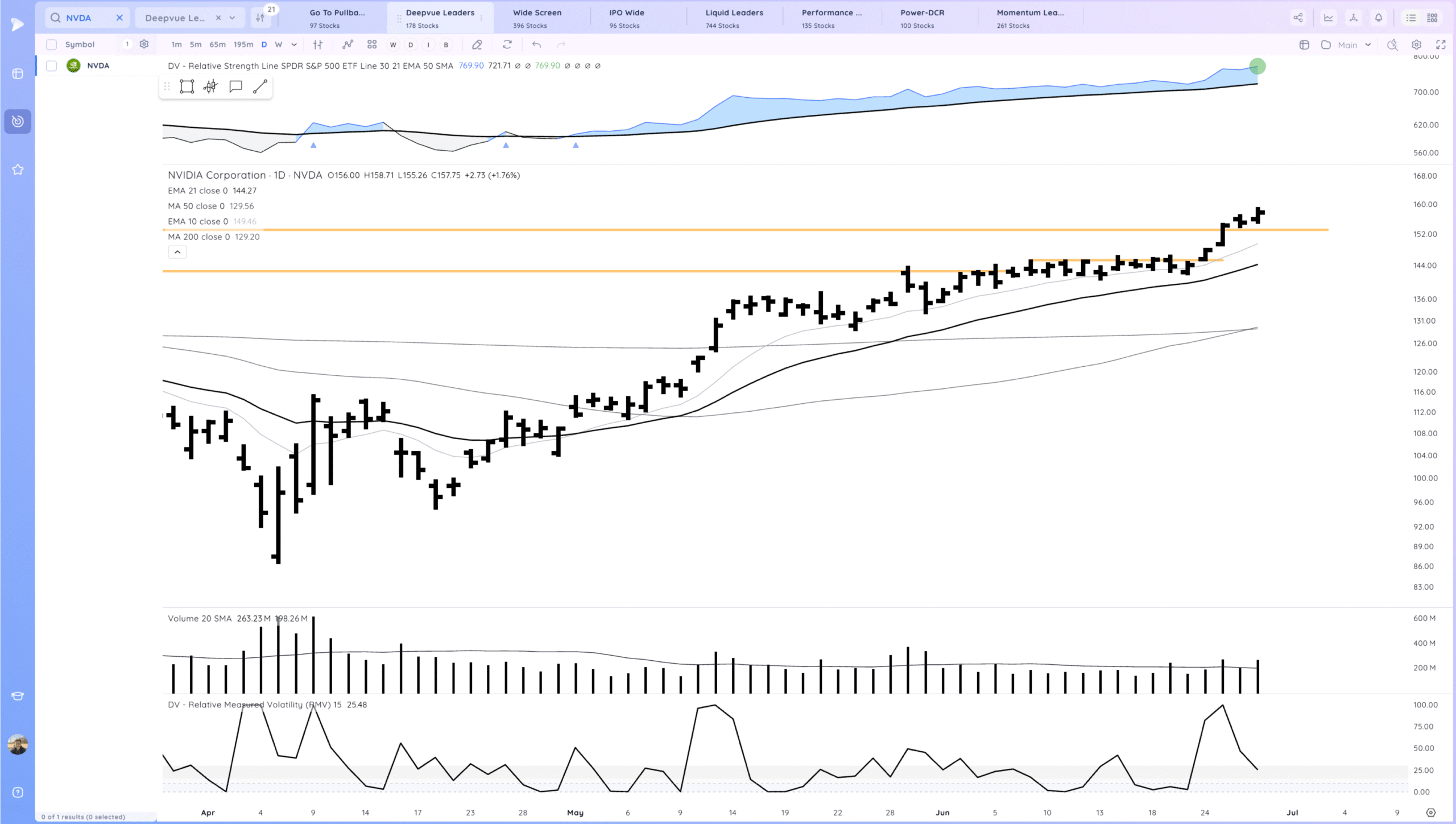

NVDA continuation higher

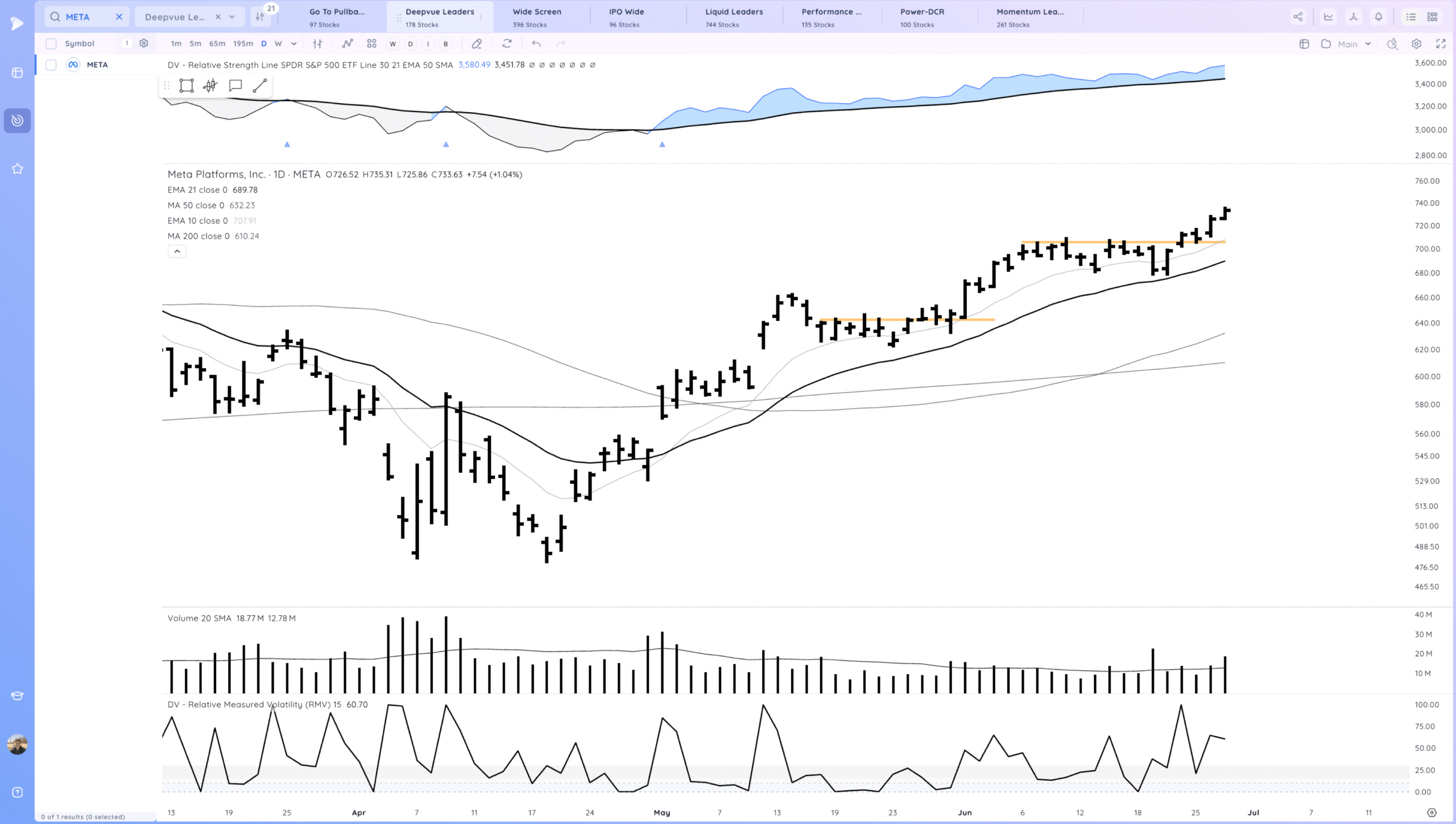

META some follow through up

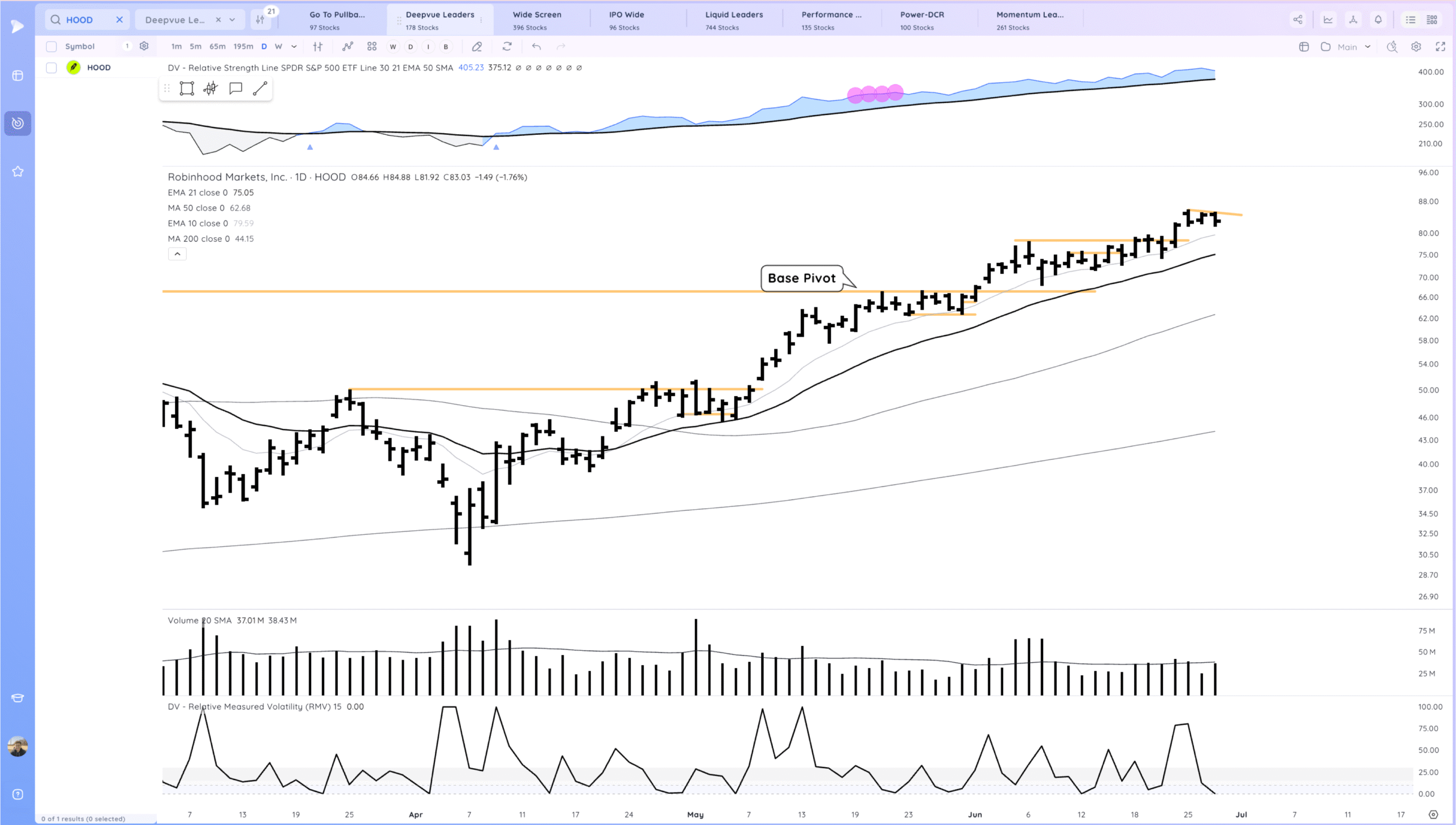

HOOD tightening in a short flag at highs

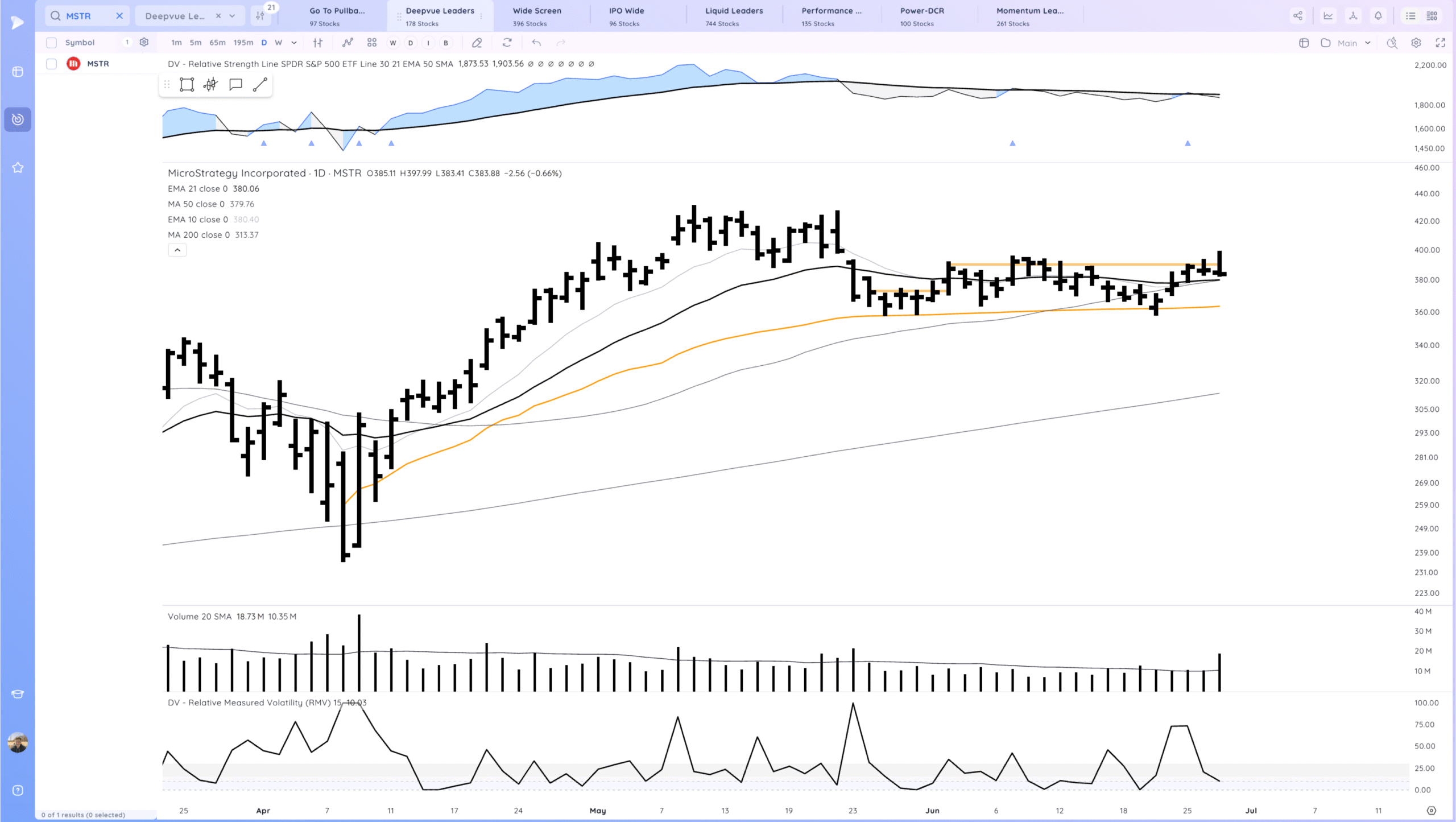

MSTR fade but watching for a re-breakout

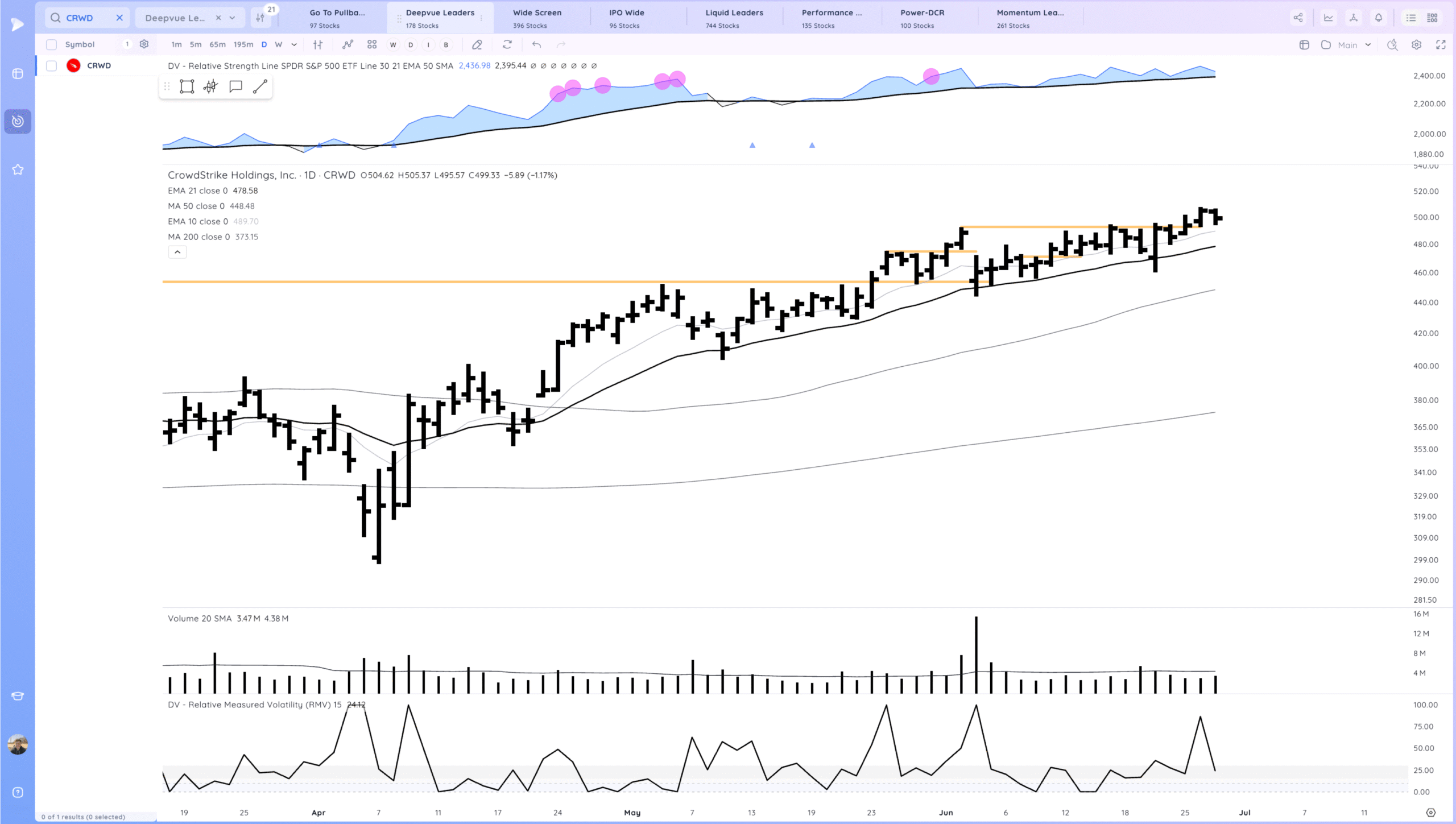

CRWD tight inside day

Key Moves

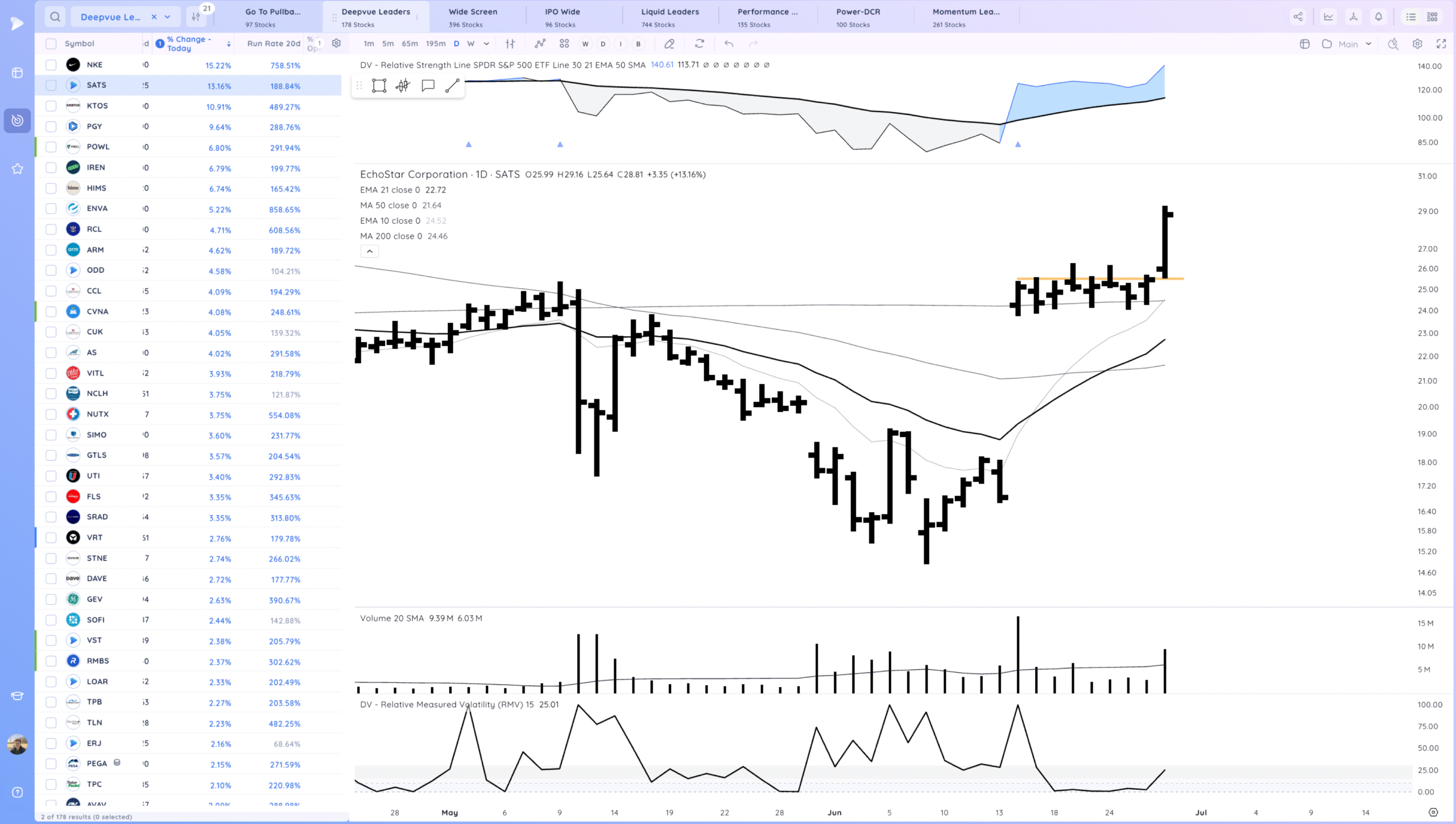

SATS from the focus list, strong push from the consolidation. fast mover

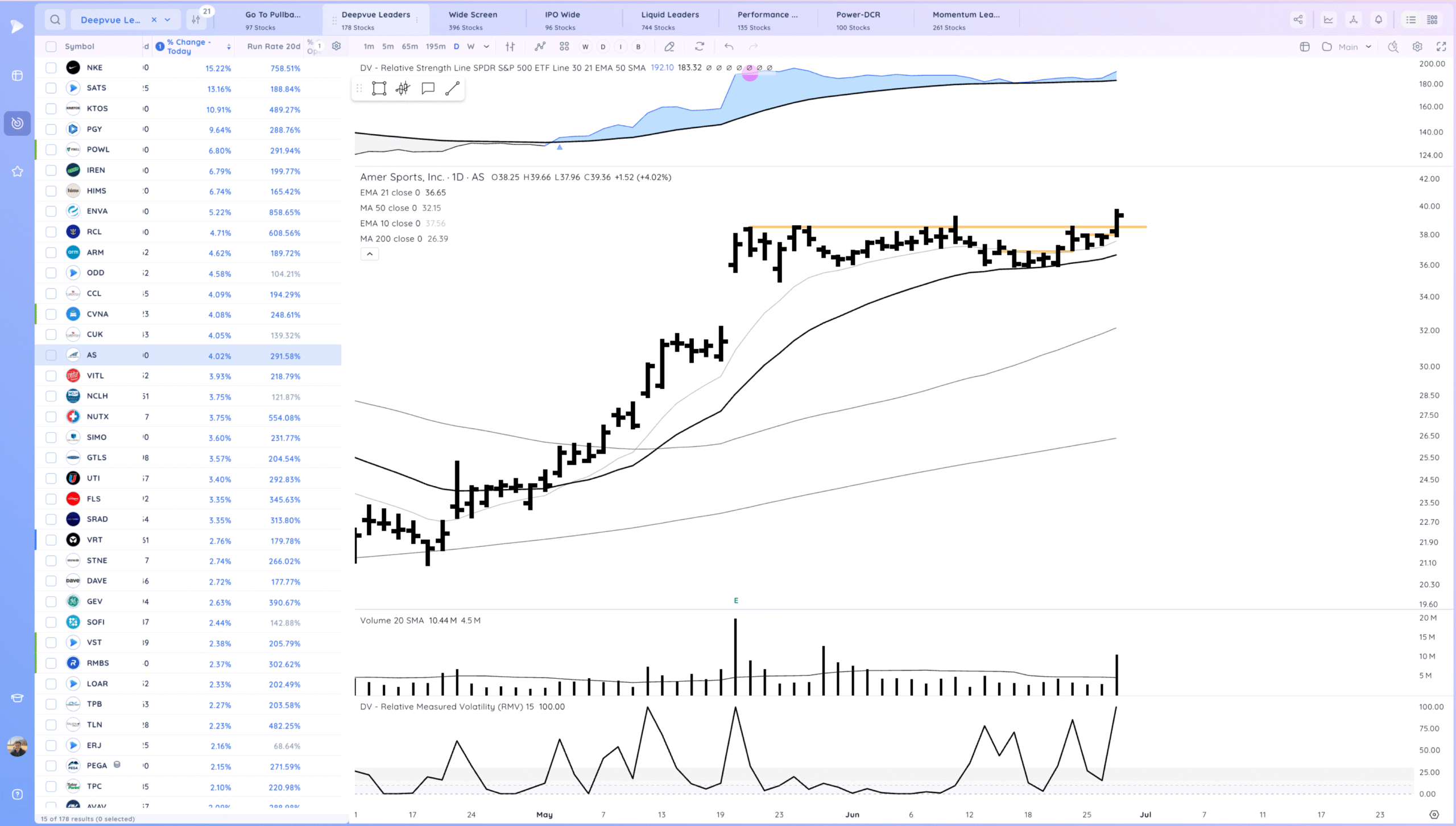

AS breakout, watching for follow through

Setups and Watchlist

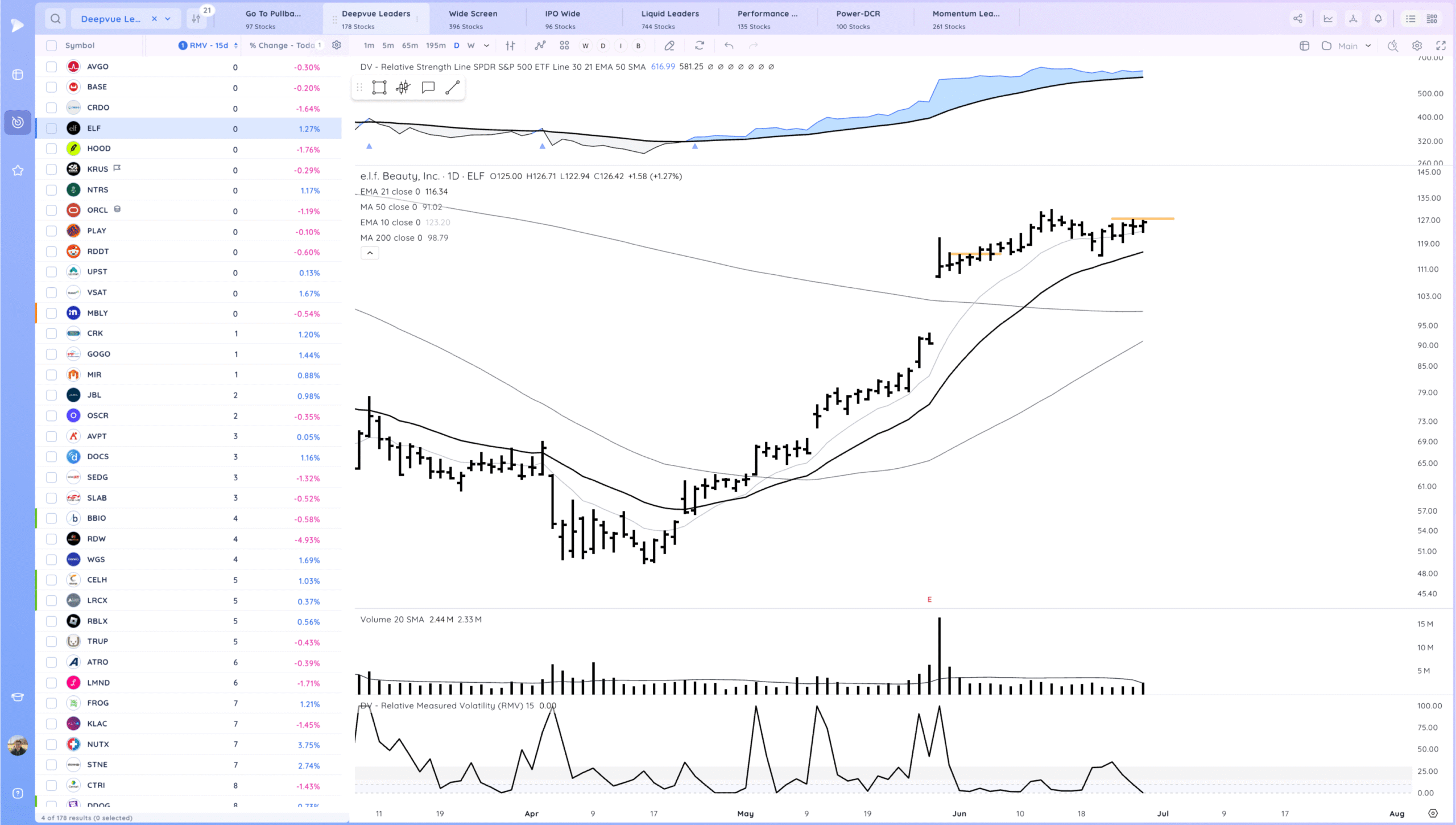

ELF watching for a range breakout

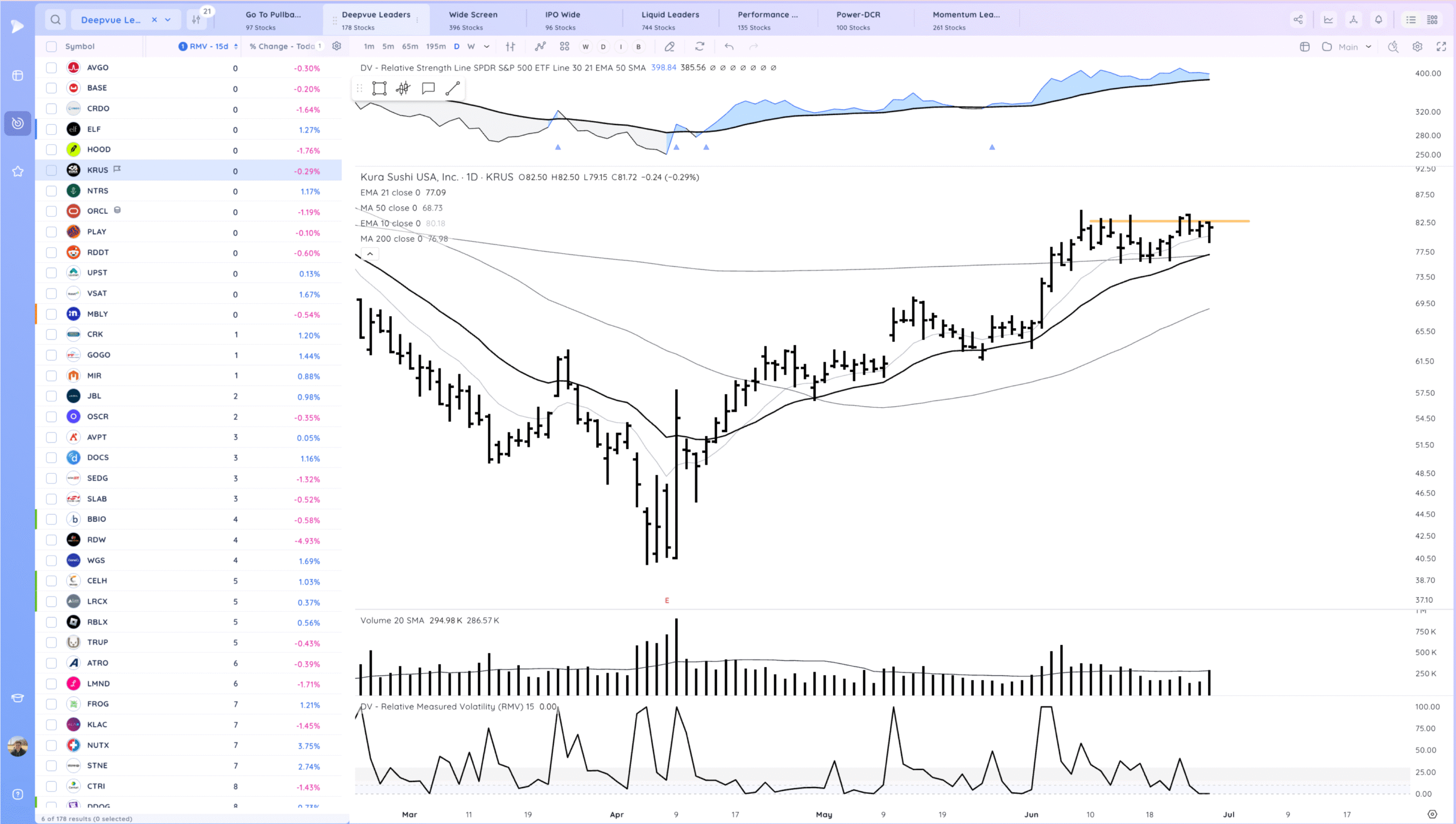

KRUS Sushi. Watching for a consolidation breakout.

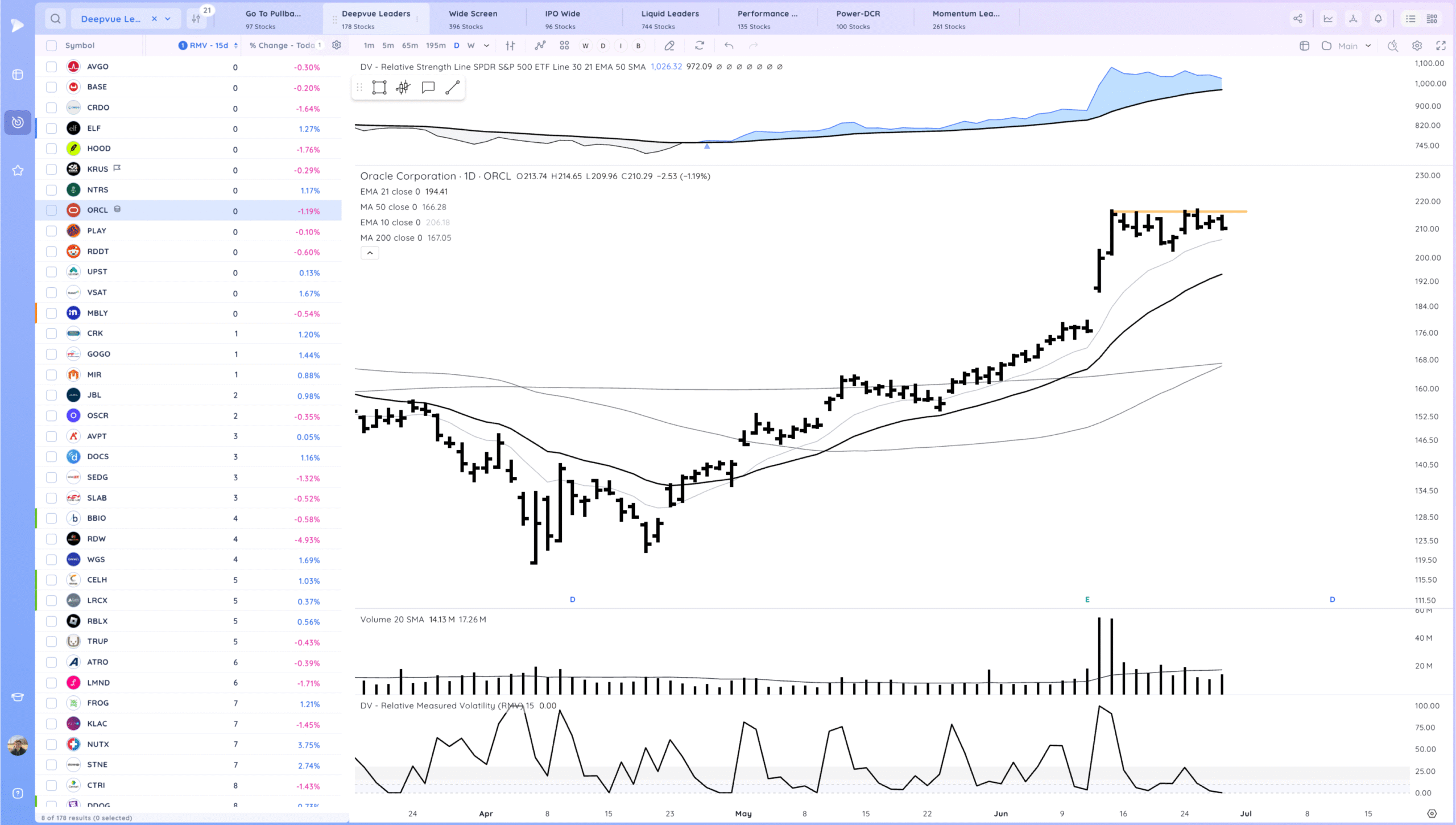

ORCL watching for a consolidation breakout

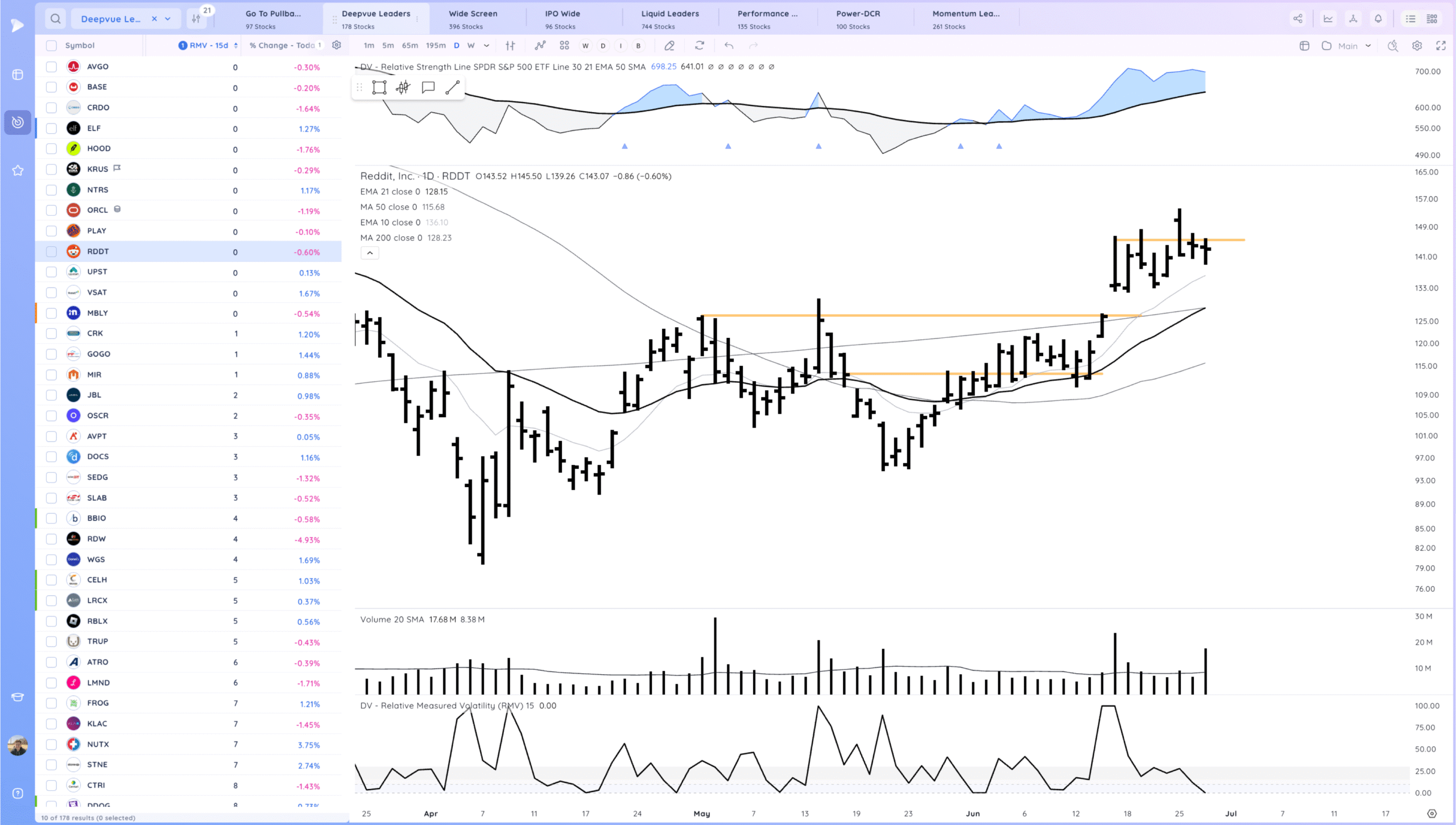

RDDT little whippy but subtle tightening, watching for a range breakout

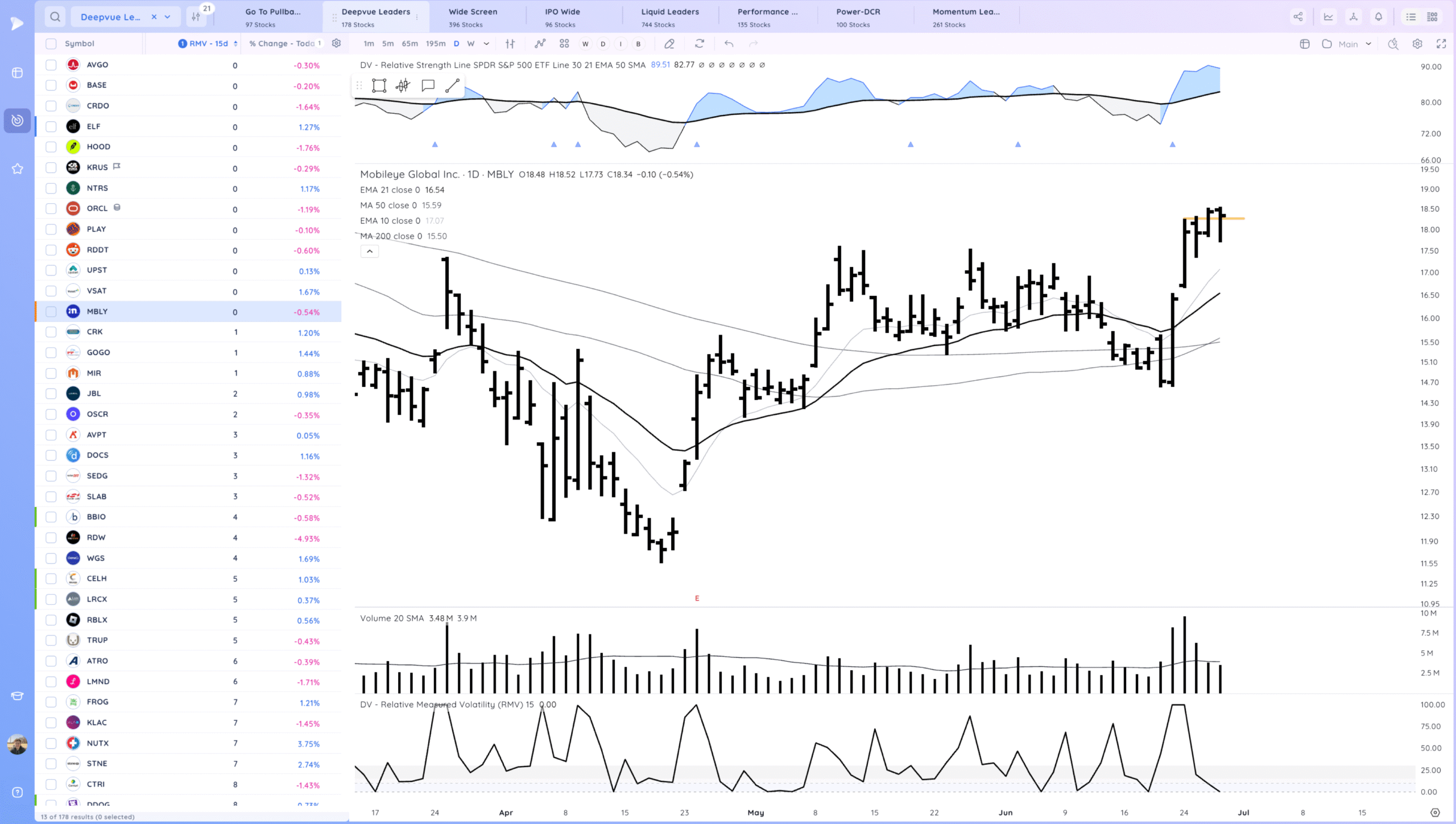

MBLY tightening but would prefer one more pullback day before expansion. Self driving theme

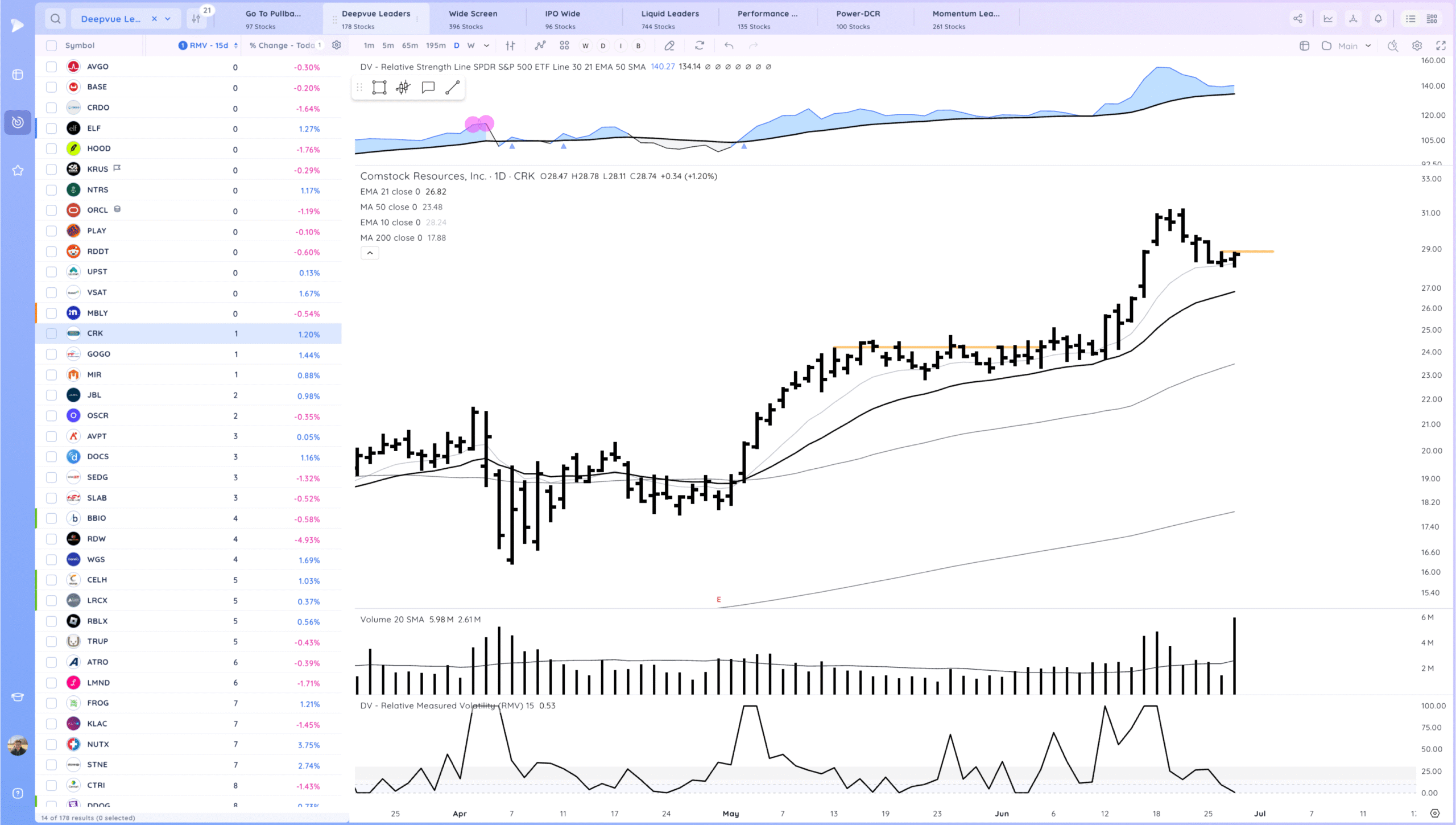

CRK watching for a 10ema range breakout

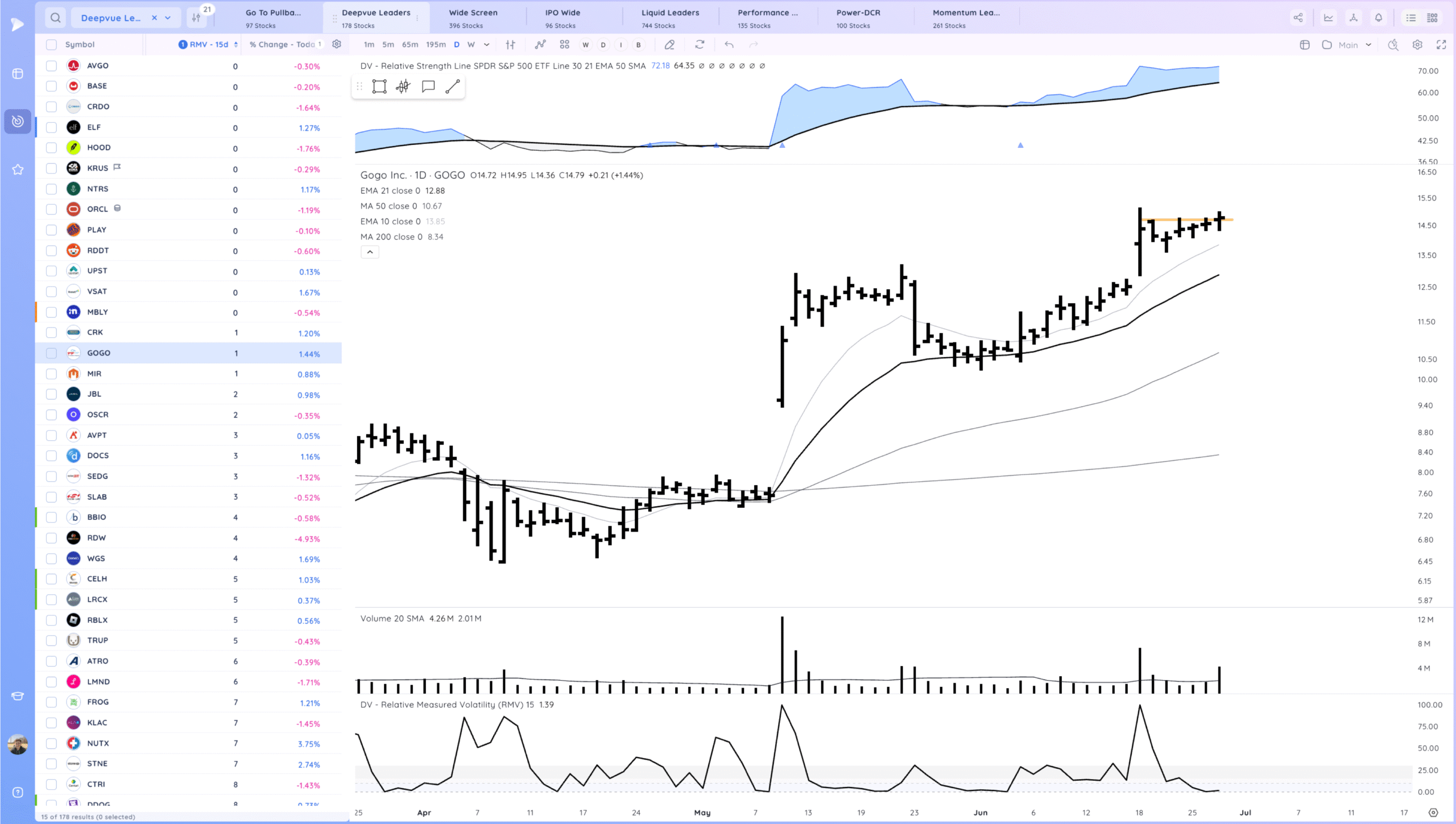

GOGO watching for a range breakout

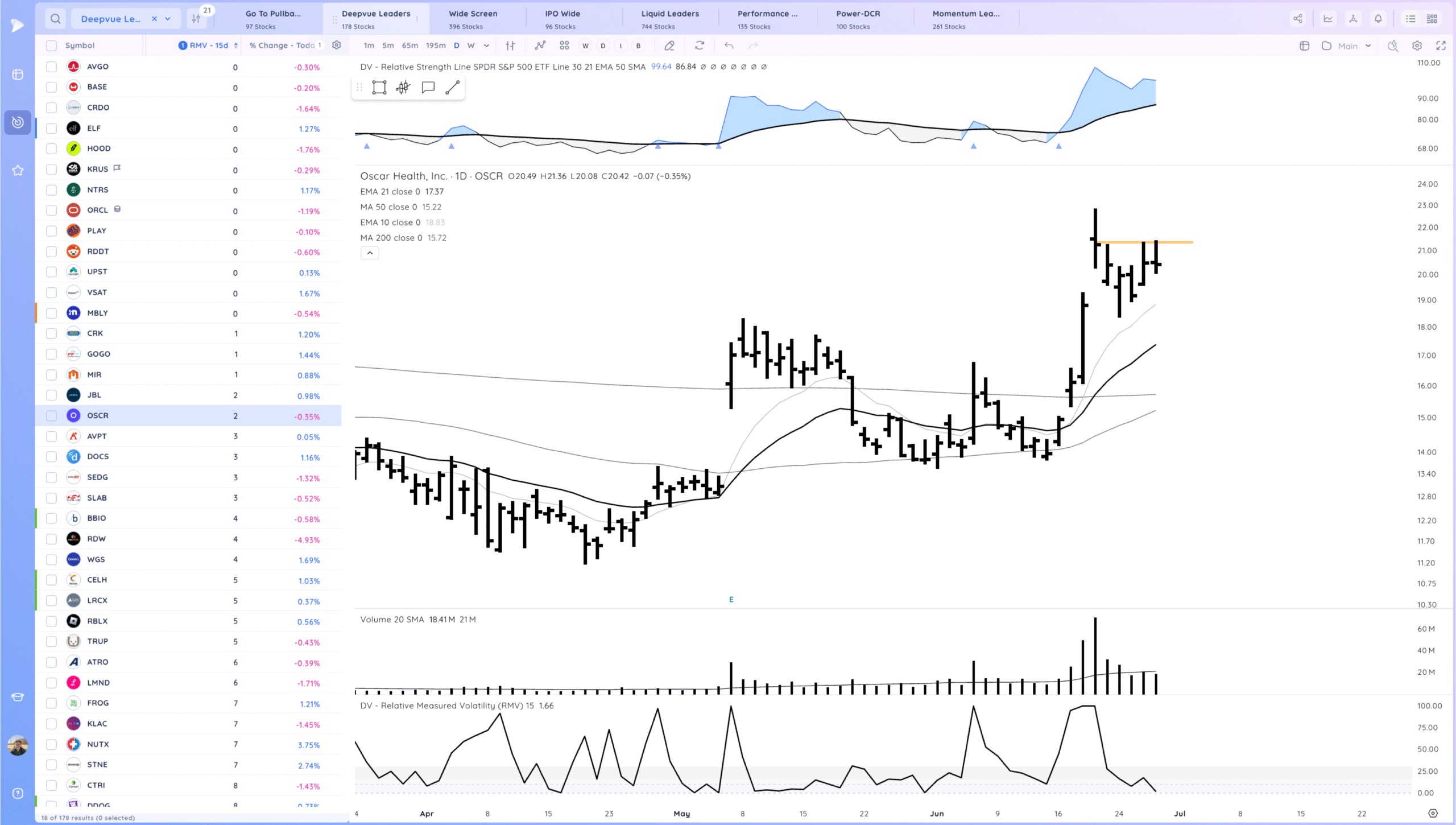

OSCR watching for a range breakout. would prefer a bit more tightness

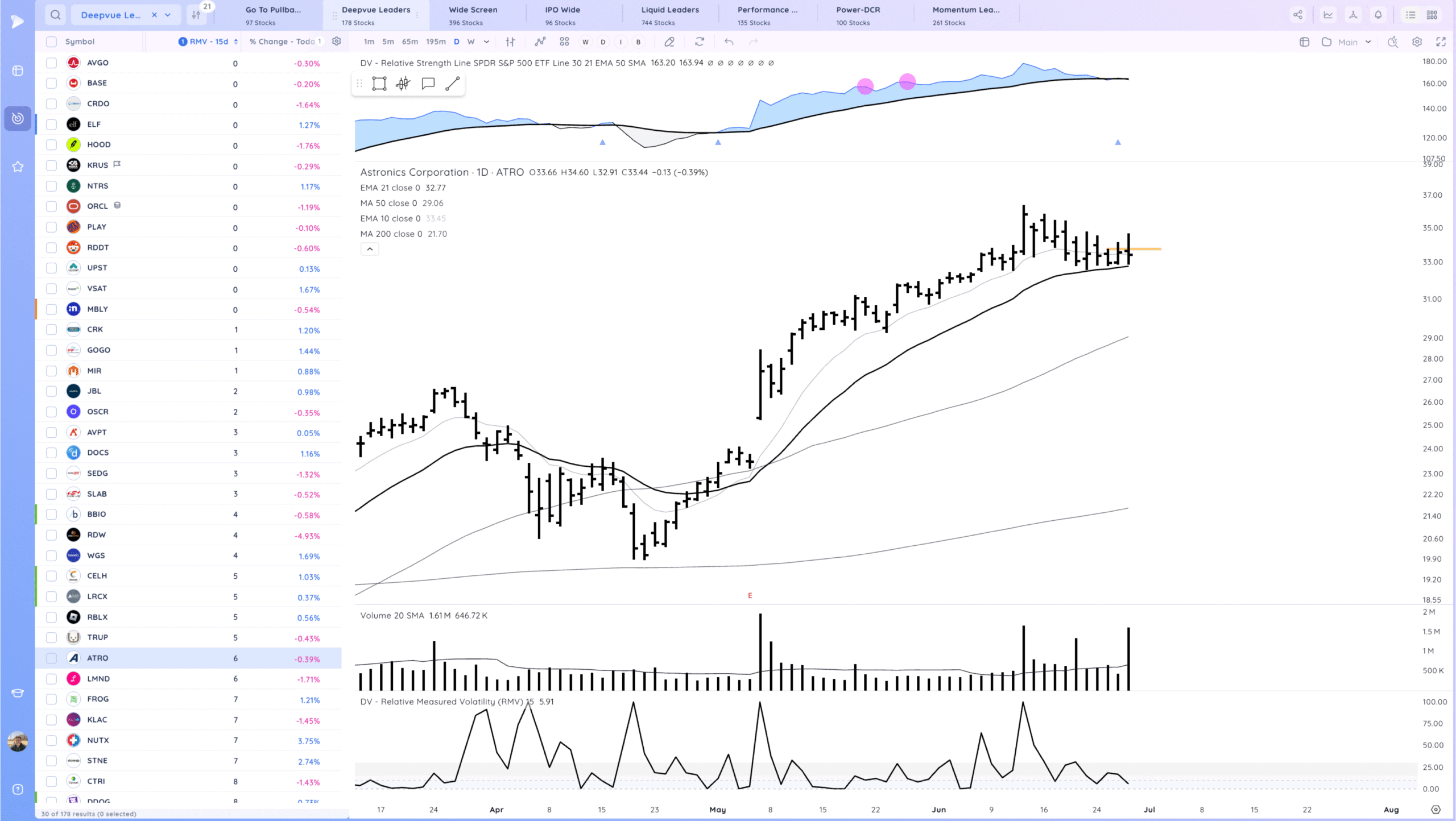

ATRO watching for a range re-breakout

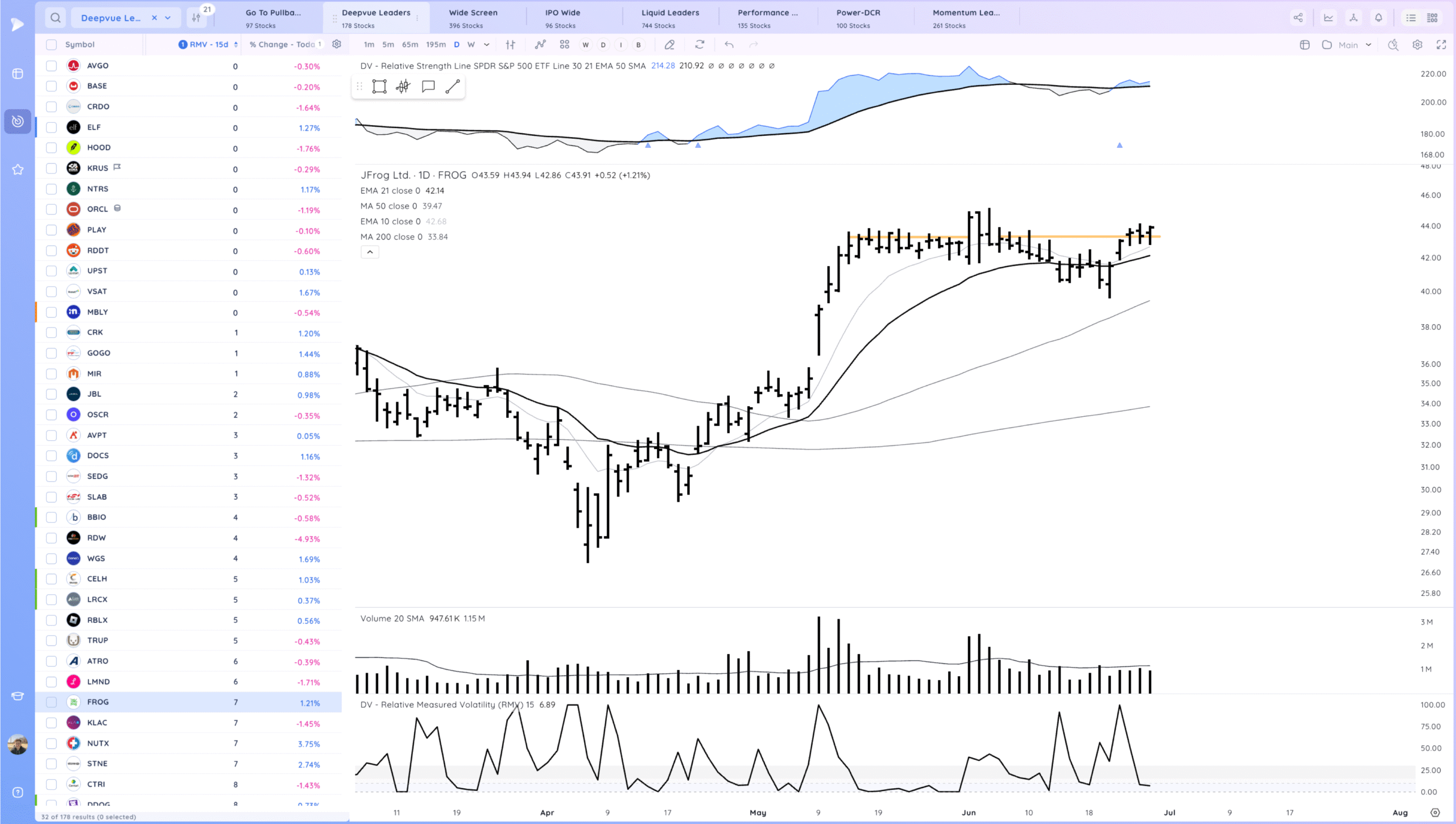

FROG watching for a range breakout through recent highs

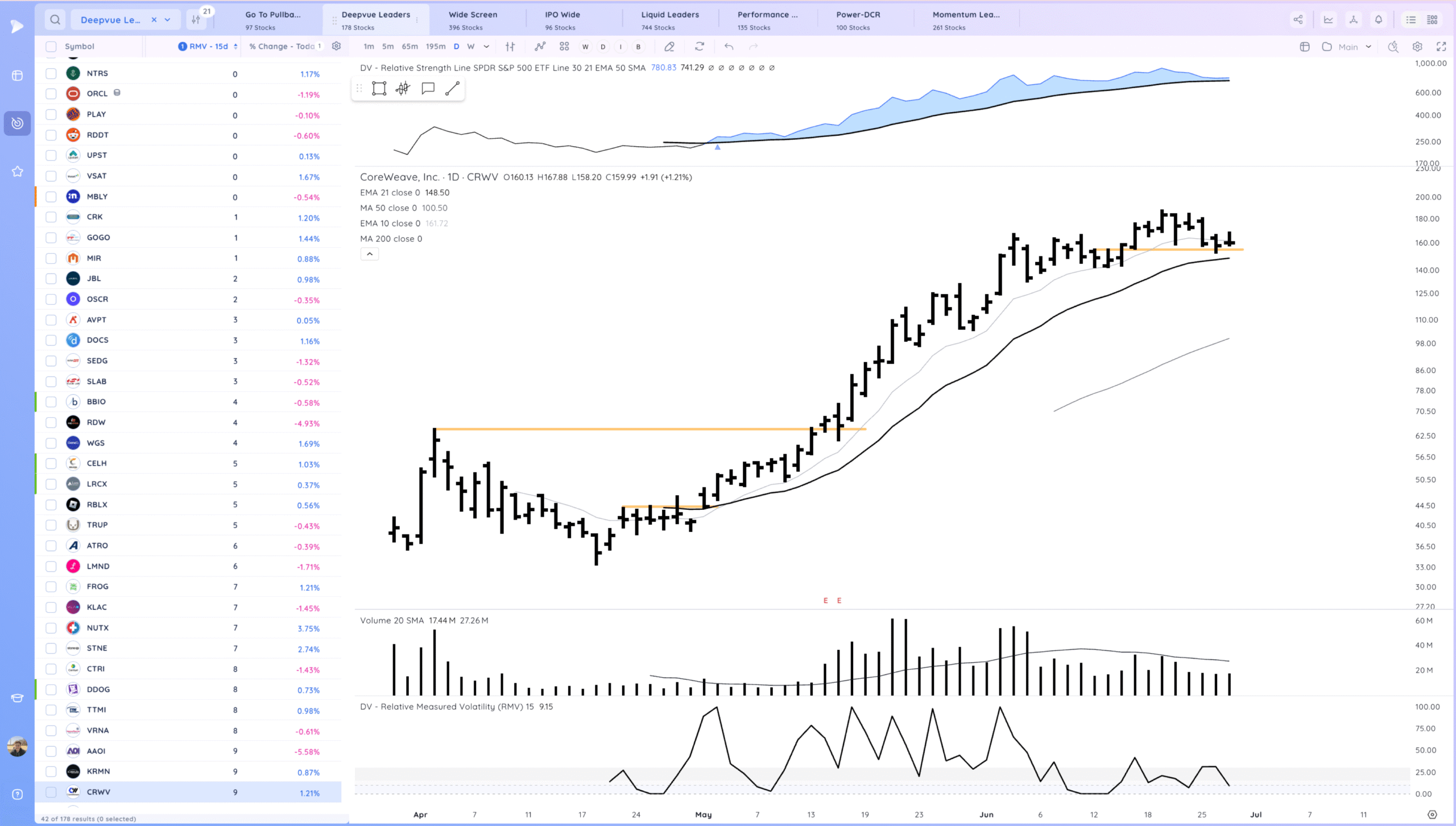

CRWV tightening a bit to end the week as it pulls back to the prior range breakout. Watching for a reversal up. If it breaks the 21ema the setup is void

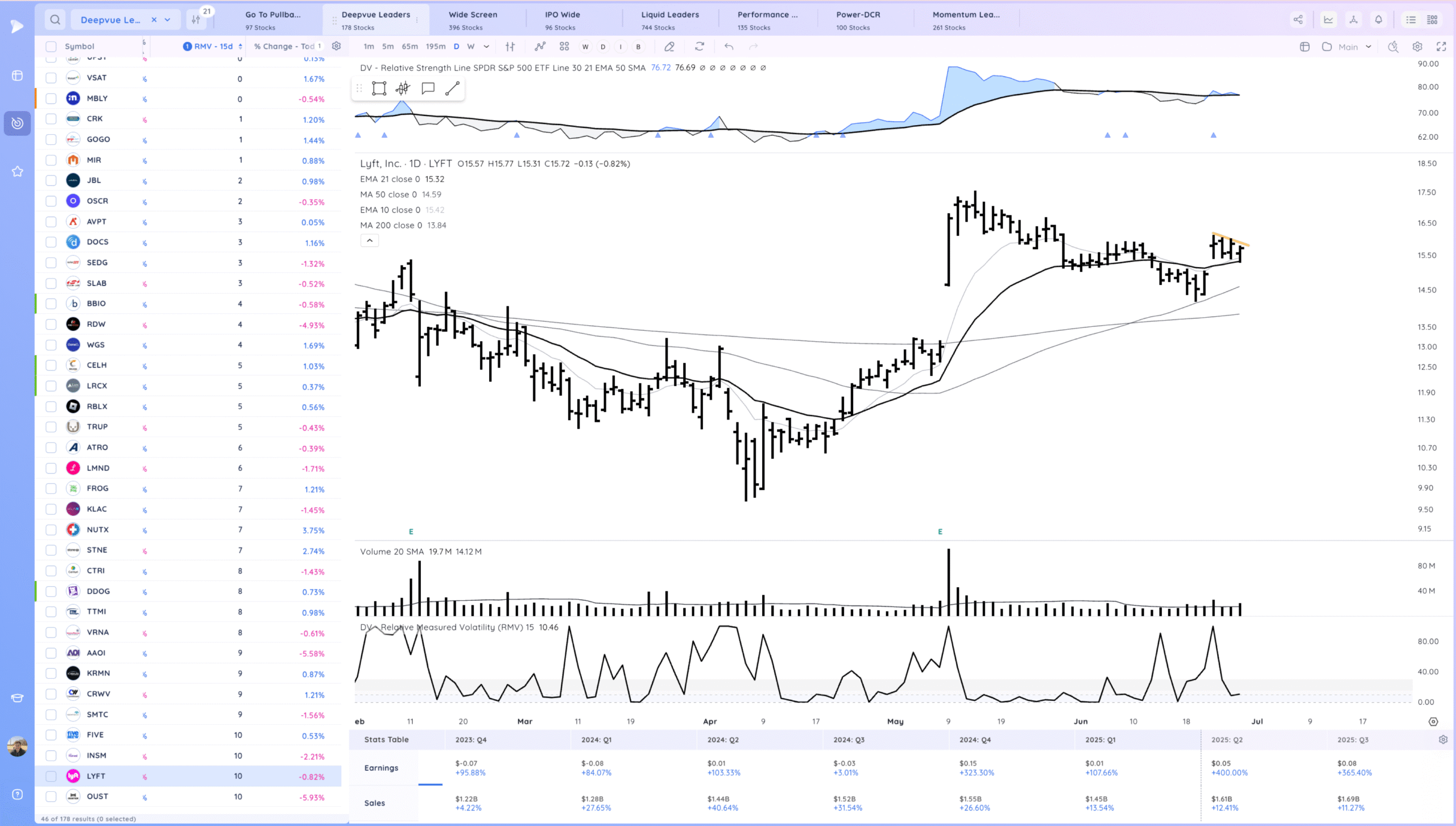

LYFT setting up in a flag. UBER also on watch for a range breakout

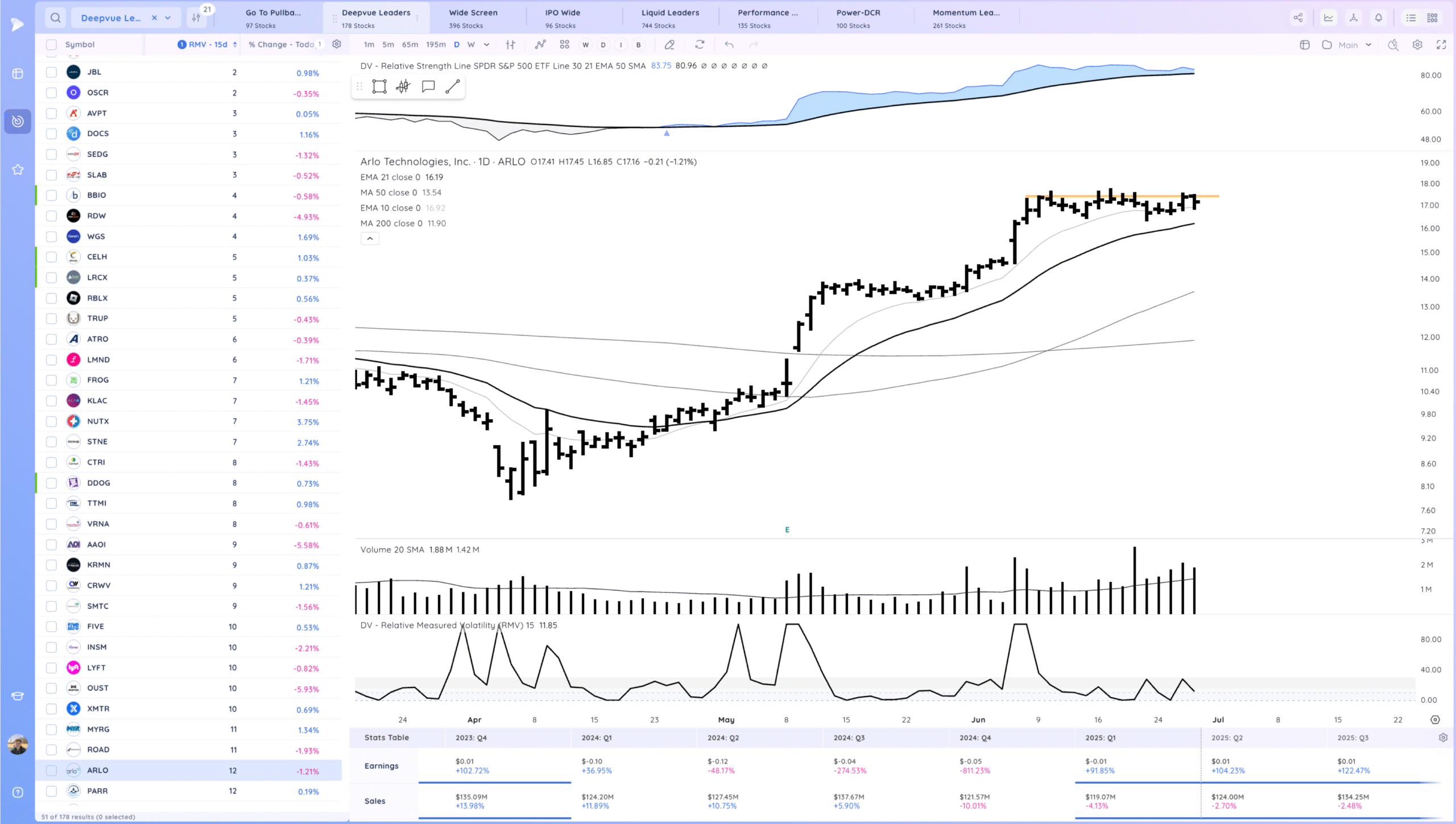

ARLO watching for a consolidation breakout

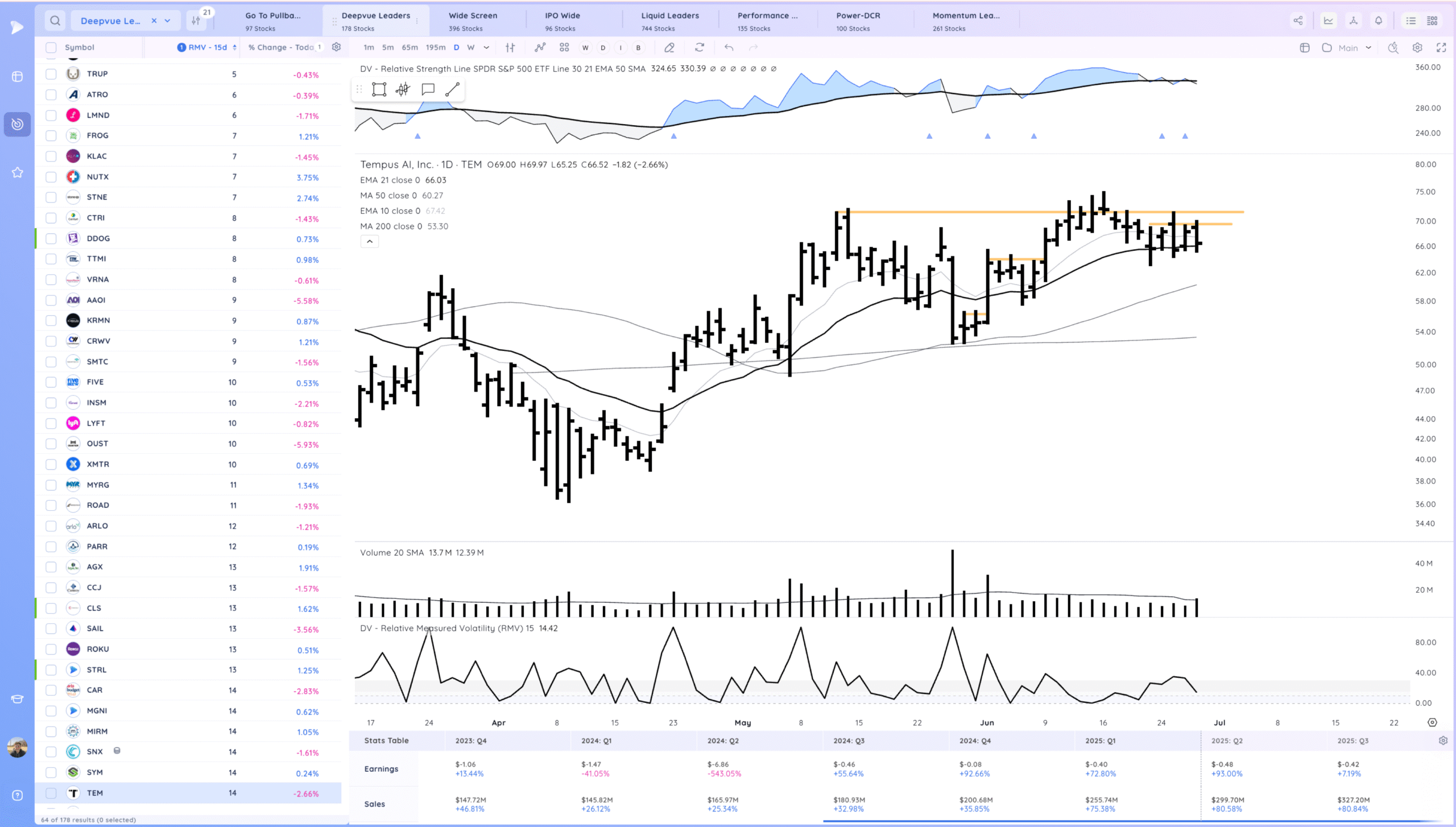

TEM forming a range here. Has frustrated many. Bit wild but watching for tightness and a range breakout

Today’s Watchlist in List form

Key Names

NVDA, TSLA, META, PLTR, MSTR, CRWD UBER HOOD

ELF KRUS ORCL RDDT MBLY CRK GOGO OSCR ATRO FROG CRWV LYFT ARLO TEM

Focus:

MSTR RDDT TEM

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

Decent number of setups this weekend. The Market continues to climb a wall of worry. PLTR on watch as a market gauge.

Mentally aware that we are on the longer end of a market cycle and that we are entering a more seasonally weak/choppy period.

Anything can happen, Day by Day – Managing risk along the way

Continue Reading The Full Trade Lab Report

Get instant access to comprehensive market analysis that cuts through the noise and shows you exactly where the opportunities are