How to Use the S.N.I.P.E. Framework to Improve Your Trading Edge

Published: June 24, 2025

The S.N.I.P.E. framework is a simple yet effective tool that helps you focus your trading process. If you’ve ever struggled with too many ideas, inconsistent execution, or missed opportunities, this framework can help. Whether you’re new to the markets or already have some experience, mastering S.N.I.P.E. will give you an edge in planning and managing trades. Let’s break it down and see how you can use it to improve your results right away.

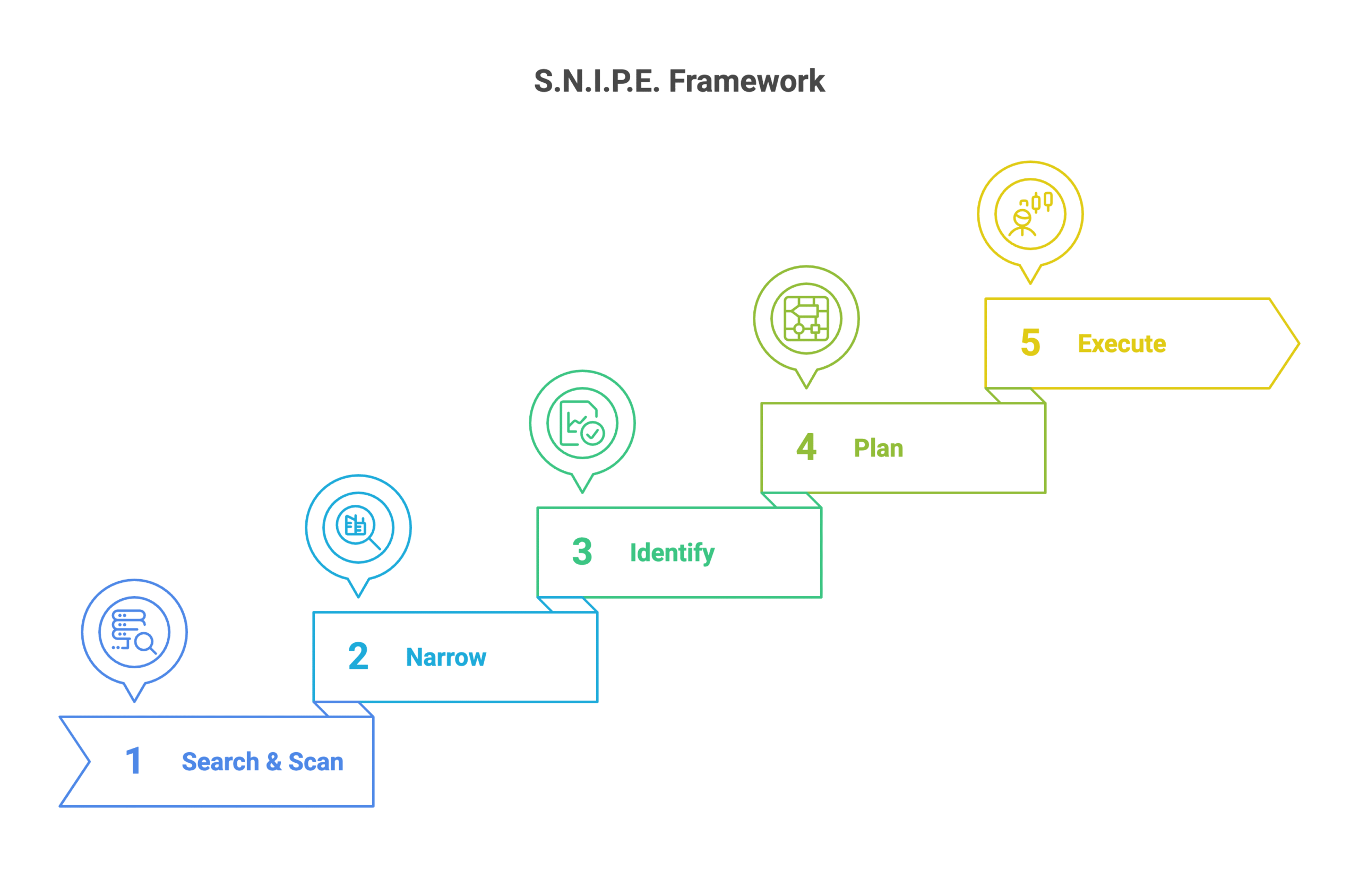

What Is the S.N.I.P.E. Framework?

S.N.I.P.E. stands for:

- Search and Scan

- Narrow

- Identify

- Plan

- Execute

Each part plays a role in building a disciplined, repeatable trading routine.

Step 1: Search and Scan

In this first step, you’re casting a wide net. You want to surface stocks or setups that fit your general criteria.

Typical filters at this stage might include:

- Liquidity: Stocks with average daily volume above 1-2 million shares

- Dollar Volume: $10M+ per day

- Recent Earnings: Strong quarter-over-quarter growth

- Relative Strength: Top 20 % in their sector or market

- Market Trends: Align with the current stage of the cycle

If you use screening software like Deepvue, this process becomes much faster.

Step 2: Narrow

Now it’s time to get selective. This is where you cut your broad list down to a shortlist of top candidates.

Focus on:

- Strong setups forming

- Leading stocks in leading sectors

- Clear edges present (we’ll cover examples next)

- Themes supported by institutional flows

If a stock doesn’t fit your style or current market phase, drop it.

Step 3: Identify

At this point, you’re drilling down into each candidate. You want to see if it truly offers a good risk/reward opportunity.

Use this checklist:

- Technical setup: Is the chart clean and tradable?

- Volume analysis: Is institutional accumulation present?

- Price behavior: Are tight ranges and constructive action visible?

- Edges present: Does it have one or more of your proven edges?

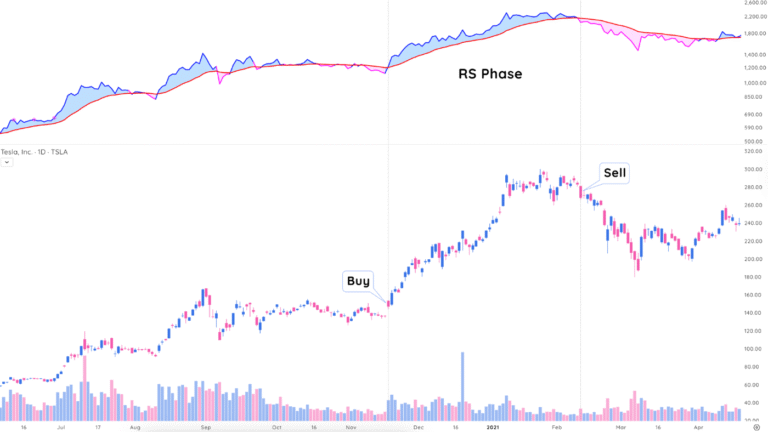

Examples of strong edges include:

- High Volume Edge (HV1, HVE): Highest volume in 1 year or ever

- Relative Strength Edge: Outperformance during market pullbacks

- N-Factor Edge: Multiple momentum factors aligning (new highs, earnings, volume, RS)

Step 4: Plan

Don’t trade without a plan. For each stock, map out:

- Entry level

- Stop-loss level (tight but logical)

- Position size (based on conviction and edge strength)

- Targets or trailing stop rules

For sizing, one approach is to scale up based on the number of edges:

| Edges Present | Position Size |

|---|---|

| 1 edge | 10% |

| 2 edges | 12.5% |

| 3 edges | 15% |

| 4 edges | 20% |

This is flexible—adjust based on your style and account size.

Step 5: Execute

Execution is where most traders stumble. To improve:

- Pre-plan the trade so decisions are automatic

- Use limit orders or conditional orders to manage entry

- Respect your stop—no exceptions

- Follow your sell rules

- Journal the trade for later review

Why S.N.I.P.E. Works

The strength of this framework lies in its simplicity:

- It forces you to follow a structured process

- It reduces emotional decisions

- It helps avoid chasing random trades

- It sharpens your focus on high-quality opportunities

Most traders struggle because they skip steps—especially “Narrow” and “Plan.” S.N.I.P.E. keeps you grounded.

Common Mistakes to Avoid

- Skipping the Narrow step

Too many stocks = scattered focus = poor execution. - No clear entry and stop

You need to know exactly where you’ll get in and out. - Sizing too large on weak edges

Save your biggest trades for setups with multiple edges. - Forcing trades in poor market conditions

Be selective. Some market phases are best for sitting out.

Mastering S.N.I.P.E. won’t turn you into a perfect trader, but it will tilt the odds in your favor. More discipline. Better focus. Fewer mistakes. If you apply this framework consistently, you’ll see an improvement in your trading edge—and your results.

For a deeper dive into the S.N.I.P.E. framework and dozens of other proven strategies, check out The Trader’s Handbook. It’s packed with practical tips from some of the most experienced traders in the business—and it’s one of the best resources you can have on your desk.