Oliver Kell’s EMA Crossback Uncovers Low-Risk Entries

Published: May 22, 2025

What is the EMA crossback strategy?

The EMA Crossback is a technical trading setup and a key part of Oliver Kell’s Cycle of Price Action. It offers a clean, low-risk entry point after a strong rally off of the lows, when a stock pulls back to the 10-day or 20-day exponential moving average (EMA) for the first time.

This setup typically signals that the stock has found a bottom and is beginning a new uptrend. The pullback into the EMAs provides a chance to enter early in the trend, before the next surge in momentum, and with clear risk control.

You can think of the EMAs like a rising floor beneath the stock’s price. When the price revisits them for the first time after a breakout, it often bounces off support, giving you the perfect moment to step in while risk is still low and upside potential is high.

How buying the first pullback after a Wedge Pop reduces risk

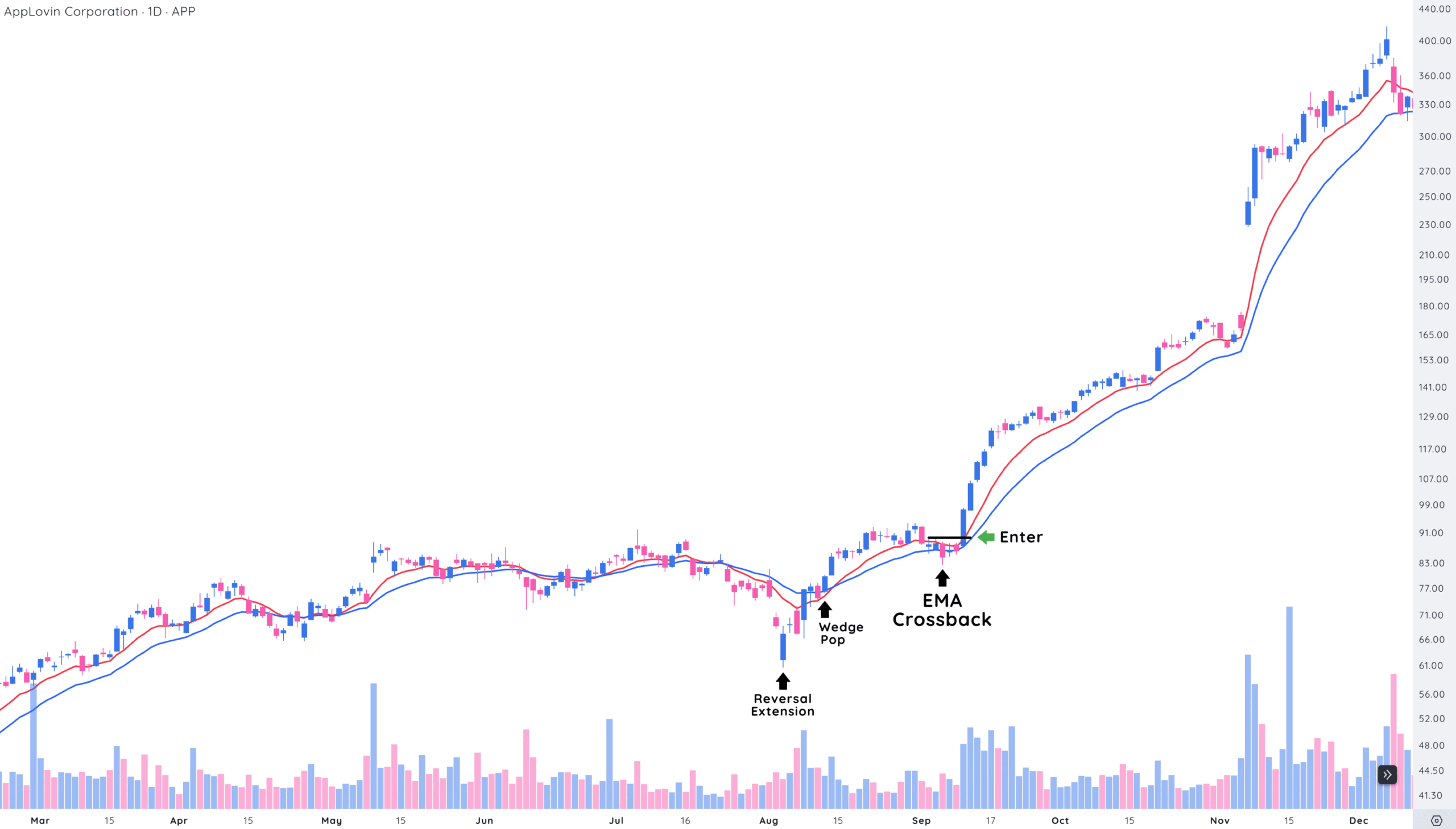

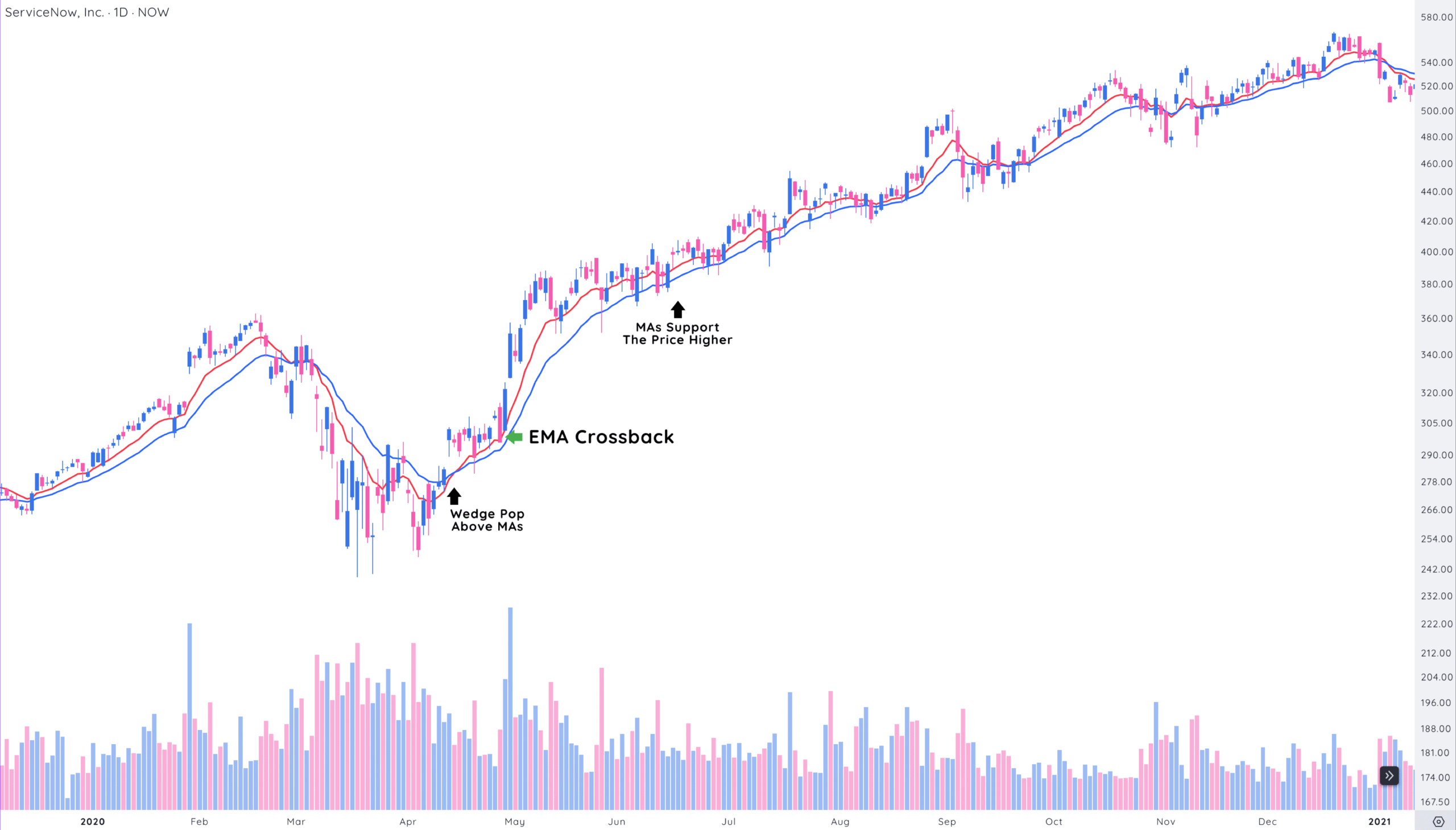

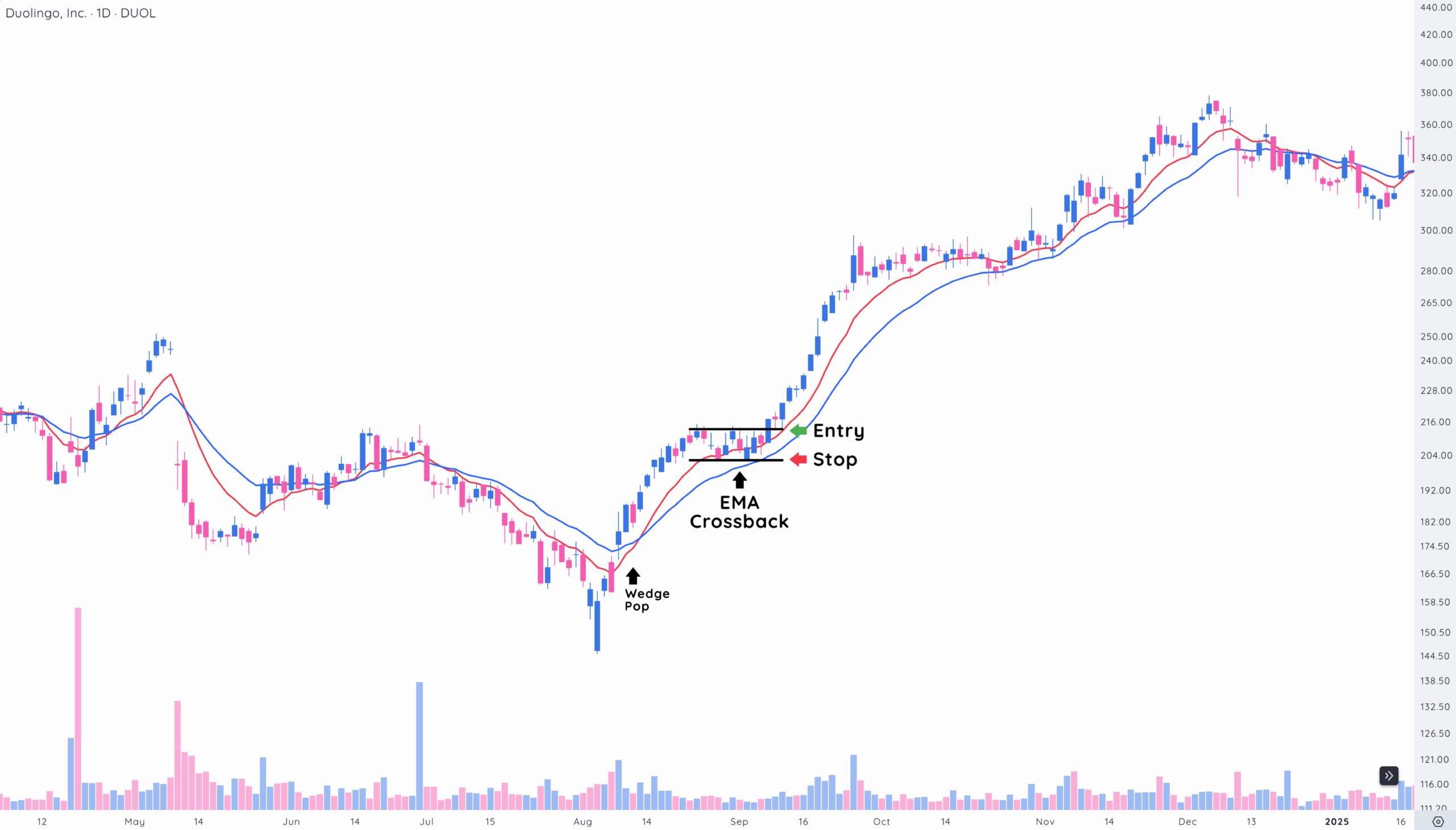

A Wedge Pop occurs when the price reclaims both the 10-day and 20-day EMAs after a sharp drop, signaling a shift into a new uptrend. This confirmation gives you early insight that momentum is changing direction and buyers are stepping back in.

Never miss a post.

Sign up to get instant notifications when we publish a new post.

After a strong move up off of the lows, most stocks don’t just keep rising – they pause and consolidate the recent gains. This sideways, or slightly downward movement, creates a pivot point that creates a tradeable range.

When the stock respects the moving averages, meaning it bounces off them rather than falling through, it’s usually a sign that buyers are still in control as they support the price higher. This moment becomes your window to enter a trade before momentum picks up again.

Buying at this EMA Crossback point gives you a low-risk entry, since you’re close to support and can use a tighter stop-loss. You’re not chasing a breakout, you’re entering before momentum picks up again, which can lead to better trades with higher reward potential.

How moving averages confirm price support

A key part of the EMA Crossback strategy is recognizing when moving averages act as support. In strong uptrends, the 10-day and 20-day EMAs often behave like a rising floor, giving you visual confirmation that the stock is being supported by demand.

- Break above the EMAs: The stock moves above the 10 and 20 EMAs with strong volume, signaling the start of a potential uptrend.

- Pull back to the EMAs: After the breakout, the price pulls back or drifts sideways toward the EMAs, setting up the Crossback.

- Retest the highs: The stock bounces off the EMAs and retests its recent high to confirm if the breakout has real strength.

- EMAs start rising: As the stock holds support, the EMAs begin to slope upward, showing growing buying interest.

The cleaner and shallower the pullback, the better – A slow drift into the EMAs is ideal. It shows the stock isn’t in a rush to sell off and that buyers are likely waiting to add more shares.

Step-by-step guide to trading the EMA crossback

The EMA Crossback gives you a clean entry point with low risk and high potential. To make the most of it, you need to combine timing, price action, and trend confirmation.

Here’s exactly how to do it:

1. Identify the leading stocks

Start by spotting stocks that are breaking above their moving averages while the broader market (like the S&P 500 or NASDAQ) is still pulling back or trending lower. These are the early movers showing relative strength – a key signal that institutions may be accumulating them.

2. Wait for the pullback

After a sharp rally off the lows, be patient. The stock will often consolidate or drift back down toward the 10-day or 20-day EMA. This is the sweet spot.

You want the price to return to a rising moving average where support is likely to show up. Let the stock come to you, don’t chase the first spike.

3. Look for signs of strength

Once the price taps the EMAs, let it prove it wants to go higher. Watch for:

- Tight price bars (low volatility)

- Volume increasing on up days (accumulation)

- Bullish candlestick patterns (like hammers or engulfing patterns)

This is your confirmation that buyers are stepping in.

4. Set your stop-loss

Risk management is key. Place your stop-loss just below the most recent swing low or consolidation base. This protects your capital if the setup breaks down and the stock loses support.

5. Enter the trade

Start building your position as the stock holds above the EMAs and begins to move higher. Ideally, you want to enter as the price breaks out above the recent consolidation range.

You don’t need to go all-in right away. You can scale in with strength and add on confirmation.

💡 Pro Tip: Always zoom out to the weekly timeframe. You want to see that the bigger trend is intact. If the broader setup is bullish, the EMA Crossback becomes even more powerful.

How the EMA crossback keeps you in trades longer

One of the biggest challenges in trading is knowing when to hold and when to sell. The EMA Crossback helps solve that problem by giving you a smart, low-risk entry early in the stock’s price cycle, before the big moves happen.

When you buy at the EMA Crossback, you’re not chasing the stock at its highs. Instead, you’re entering at a point where the price is pulling back into support, giving your trade room to grow. That makes it easier to stay in the trade and ride the trend.

- Let the trend work for you: As long as the 10 and 20-day EMAs are rising and the price stays above them, the trend is likely still intact. Let the stock move up naturally – don’t rush to cash out early.

- Use a trailing stop: Start with your stop-loss just below the pivot or support zone. As the stock climbs, move your stop up gradually, by following the moving averages to avoid getting shaken out too soon.

- Trim, don’t dump: If the price gets extended, meaning it’s far above the EMAs, you can trim part of your position to reduce exposure and lock in gains. But hold the rest in case the trend continues.

- Watch for re-entry signals: Look for continuation patterns like flags, pennants, or mini pullbacks. These give you a chance to add back shares or enter a new trade with the trend still in your favor.

When you enter a trade early in the Cycle of Price Action, you’re giving yourself the best shot at capturing a larger portion of the move. When your timing is right, it becomes much easier to stay in the trade longer and let your winners run.

How to use the EMA crossback on indices and top stocks

The EMA Crossback isn’t just useful for individual stock setups. It also works incredibly well when applied to broader market indices.

When a major index pulls back into its 10-day or 20-day EMAs, it can signal a potential turning point for the overall market. These are the moments where institutional buyers often step in, and that’s when strong individual stocks tend to shine.

Think of the index as a marathon pack and leading stocks as the front-runners. When the pace slows (market pulls back), the strongest runners don’t fall back – they surge ahead.

Watching those front-runners break away early gives you a clue that momentum is returning. Soon, the rest of the pack follows their lead.

Here’s what to watch for:

- Index pullback into support at the EMAs: This often signals that a broad bounce may be coming.

- Leading stocks break out early: Stocks showing relative strength will start pushing higher even before the index recovers fully.

- Synchronized moves confirm trend: As both the index and the leaders begin to rise, confidence in the trend grows.

When the index is pulling back into support, focus on the leading stocks that aren’t breaking down. If they’re consolidating tightly, holding near highs, or even moving up while the market is flat, they’re likely true leaders.

Final thoughts on using the EMA crossback strategy

The EMA Crossback is one of the easiest and most reliable ways to buy a strong stock without chasing.

You’re waiting for a clean setup:

- A strong move up

- A pullback to support

- A bounce off the 10-day or 20-day EMA

That’s your moment to act.

Instead of buying extended when everyone else is chasing, you’re buying when the stock is pulling back and showing signs of accumulation. This gives you a better entry, tighter risk, and a shot at riding the next leg higher.

It keeps things simple and clear. You know where your support is, where to place your stop, and what you’re looking for in price action.

So if you miss the breakout, don’t worry. Let the stock come back to you.

Wait for the EMA Crossback. That’s your window to get in with confidence.