Set up for Rally? Tightening Ranges

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

April 12, 2025

Market Action

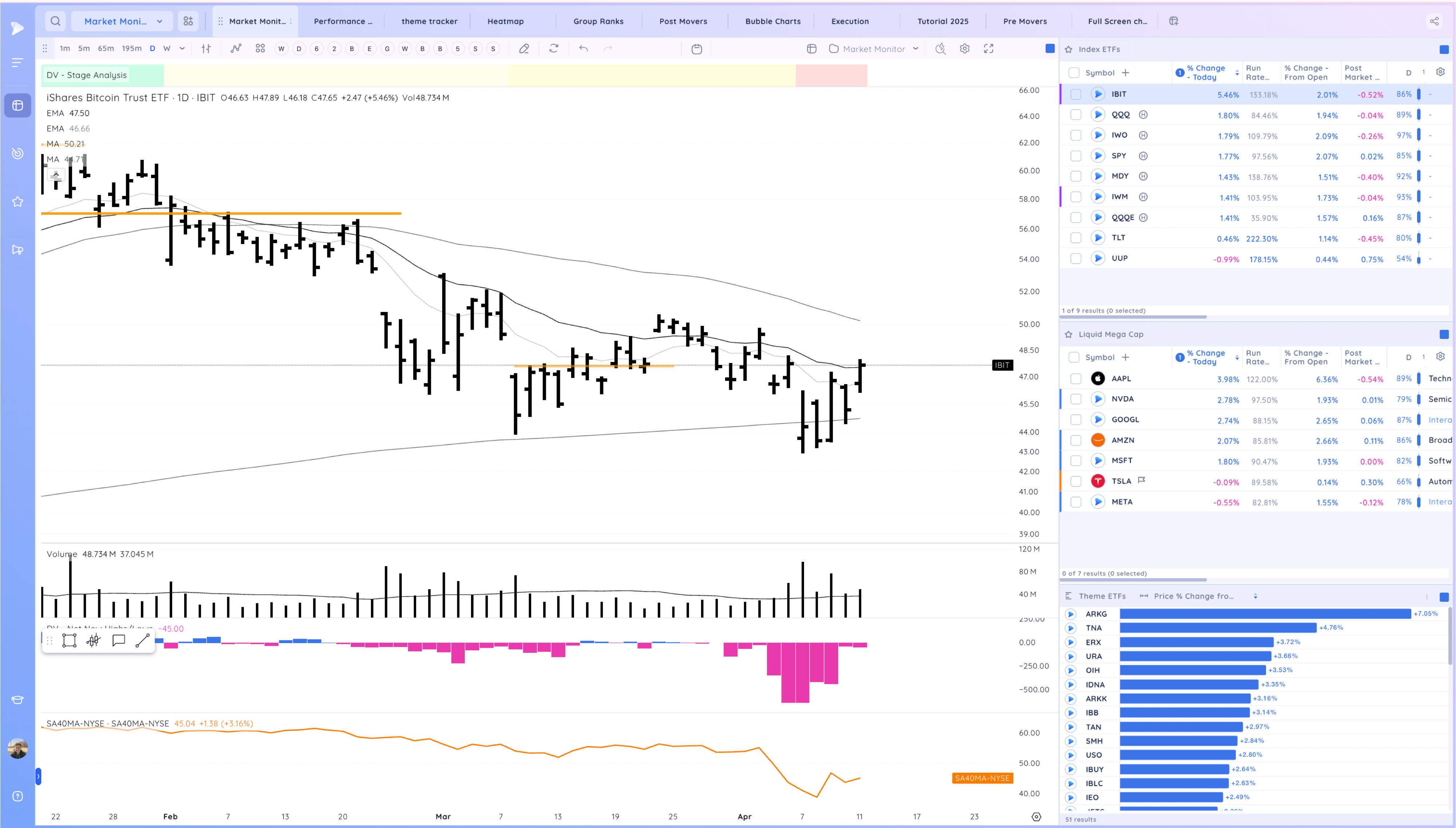

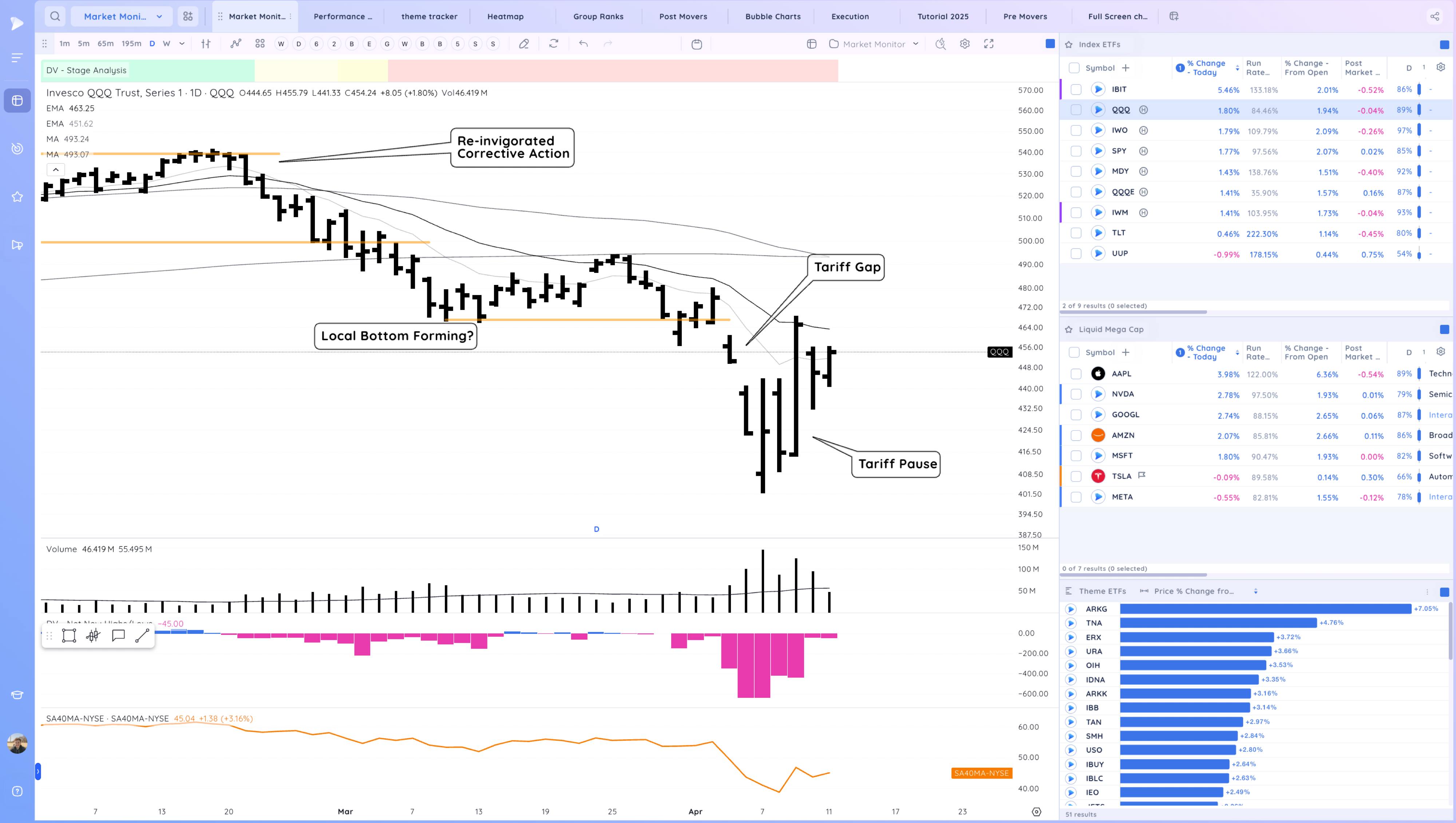

QQQ – Constructive action to end the week with a tightening day closing near highs. The market is contracting an expecting an expansion higher or lower from here.

We remain below the 21ema and 200sma for now. Good to see ranges tightening a bit.

We’ve had additional “negative news’ regard tariffs and retaliations by China and the market had held up well, we may now be looking past that.

The short term expectation based on today’s close is sideways or higher Continuing to expect volatility and news catalysts.

Bulls want to see us push higher and reclaim the 21ema

Bears want to see more uncertainty about the tariffs/trade war and for us to break lower from this 2 day range.

Daily Chart of the QQQ.

IWM – Similar 2 day range within the Wednesday bar

IBIT- Stronger, reclaiming the 21ema

Trends (1/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above Rising

Short-term – 21 ema – Below declining

Intermediate term – 50 sma – Below declining

Longterm – 200 sma – Up – Below Increasing

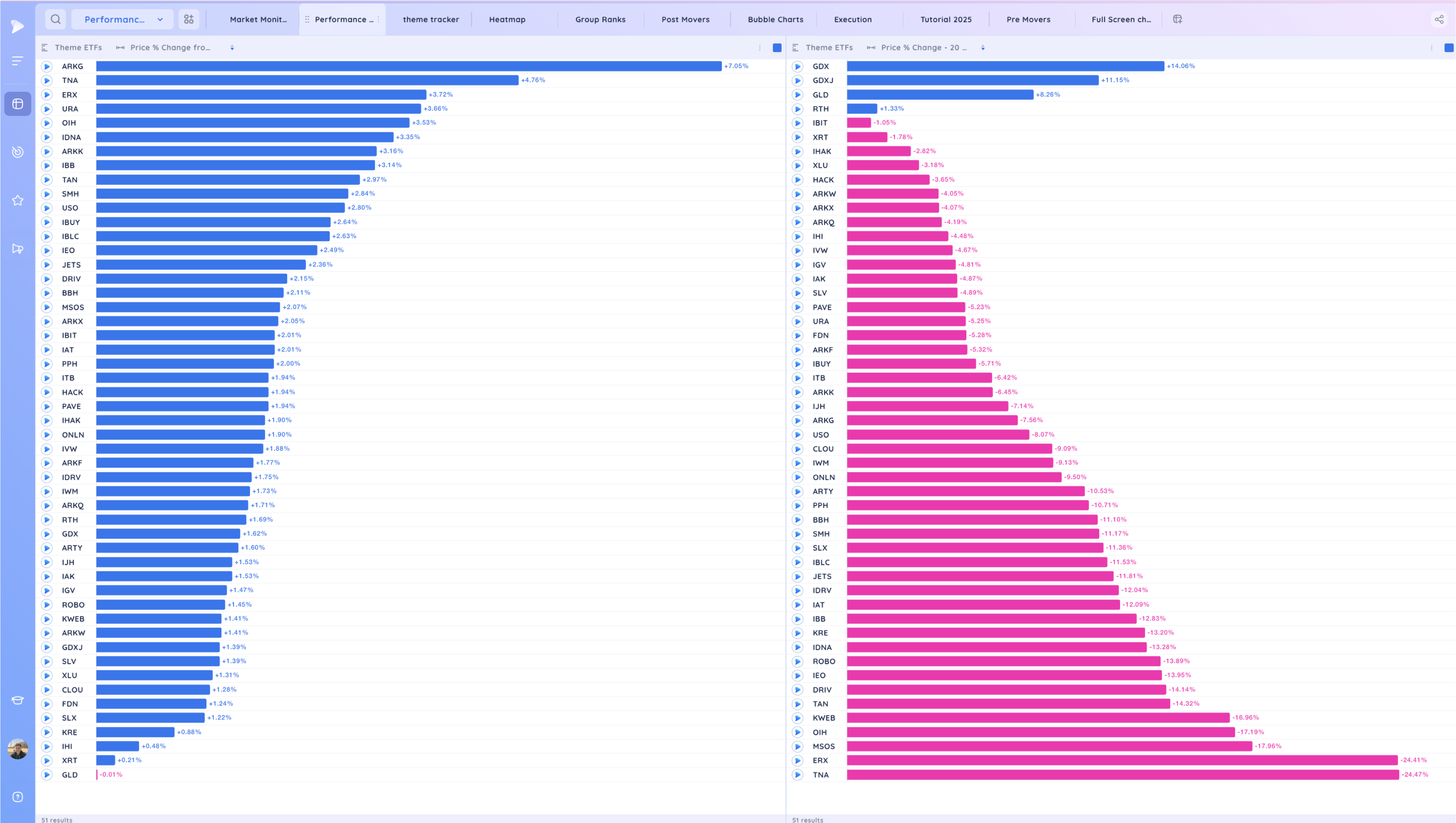

Groups/Sectors

Performance Today from open on the Left, Performance over the past 20 days on the right.

Performance Charts from Deepvue

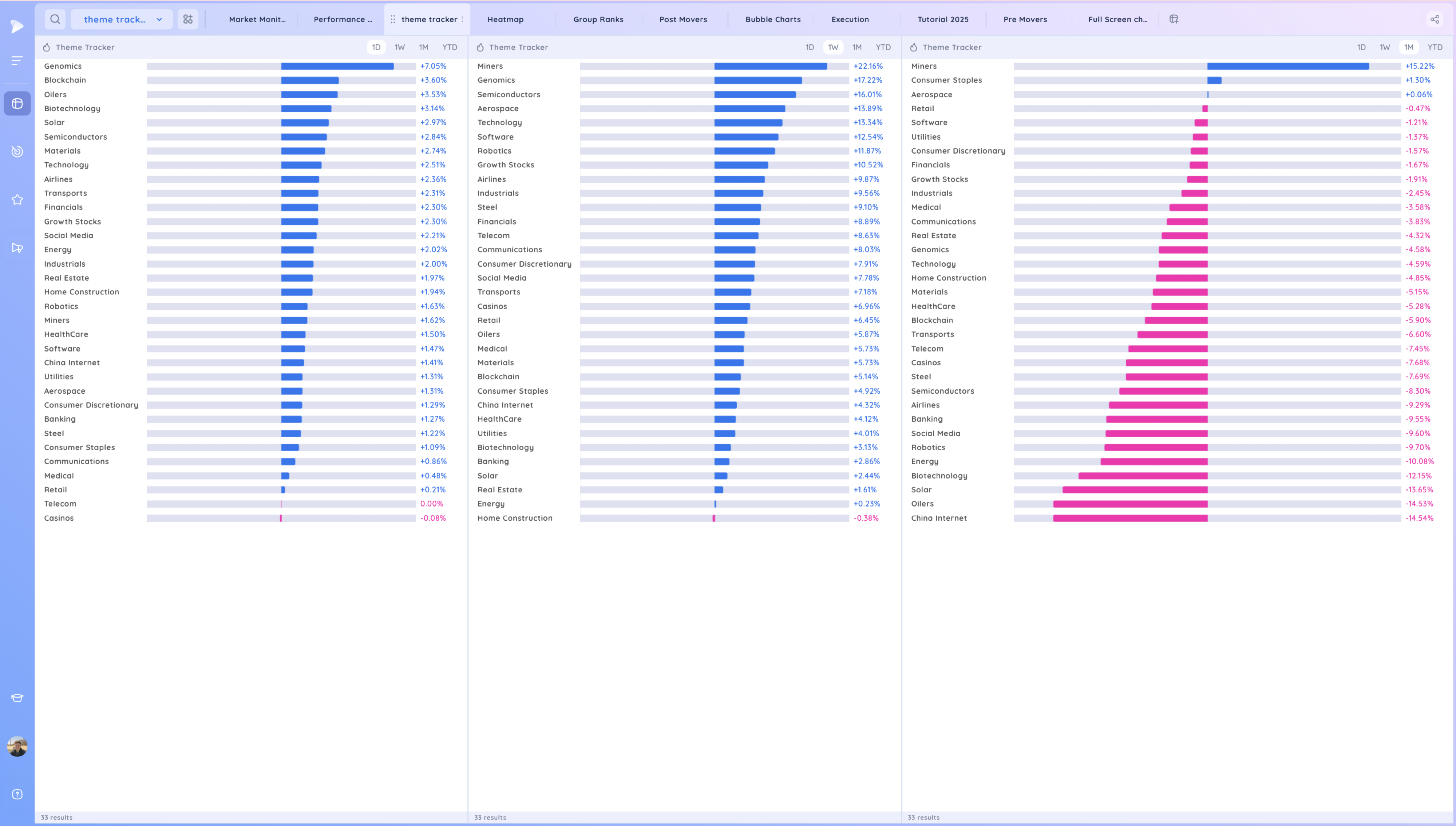

Prebuilt Deepvue Theme Tracker

Deepvue Leaders Heatmap

S&P 500.

Heatmap from Deepvue

Group Ranks: 1 Day, 1 Week, 1 Month, 3 Month from left to right. This is a preset for Deepvue Members

Leaders and Key Moves

Important Note: Many of these “leaders” are leading to the downside. Still they provide a good gauge of market environment. As new leaders reveal themselves I will curate this list.

NVDA Constructive action near the 21ema and above the level, watching for reconfirmation or a failure below the thursday low

TSLA Watching for a pop through the 21ema

META Weaker, below the moving averages

PLTR Really good action with a tight range at the 21ema, watching for expansion up from the inside day. Focus of mine

If this fails it would be useful information as well.

MSTR Push from the inside day, reclaiming the 21ema. We’ll see if this can being a new uptrend

Stocks Showing RS

Even through the market is in a correction, it’s best practice to continue to monitor for persistent RS and developing themes. Tracking names every day will point you to the leaders early as the market is entering it’s last stage of the correction.

However just because a stock is showing RS one day does not mean it is buyable, and RS matters most in the later third of a correction.

AGX Push from the inside day

AU very strong but also stretched here, expecting a pull in soon

LOAR recent Aero IPO, very strong but watching for higher low/10ema pullback

CELH acting well, inside, watching for reconfirmation up

CVNA set up a tight range, great stock for swing traders

GRPN popped through the range

TTAN push through the pivot, an IPO to watch closely

TMDX strong move from the consolidation day, watching for a higher low

ASAN watching for a breakout through the 200sma, off the bottom type play. This is a fast mover

CAVA acting well after undercutting a prior base low. Watching for reconfirmation higher and getting back above the 50day. A newer IPO to watch

HOOD strong, actionable friday. Can watch for the next higher low potentially against the 50sma

CRWV ipo to watch, could really move if AI names come back in favor.

EAT tight 2 day range

RBRK watching for follow through up from the reversal and then reclaim of the level

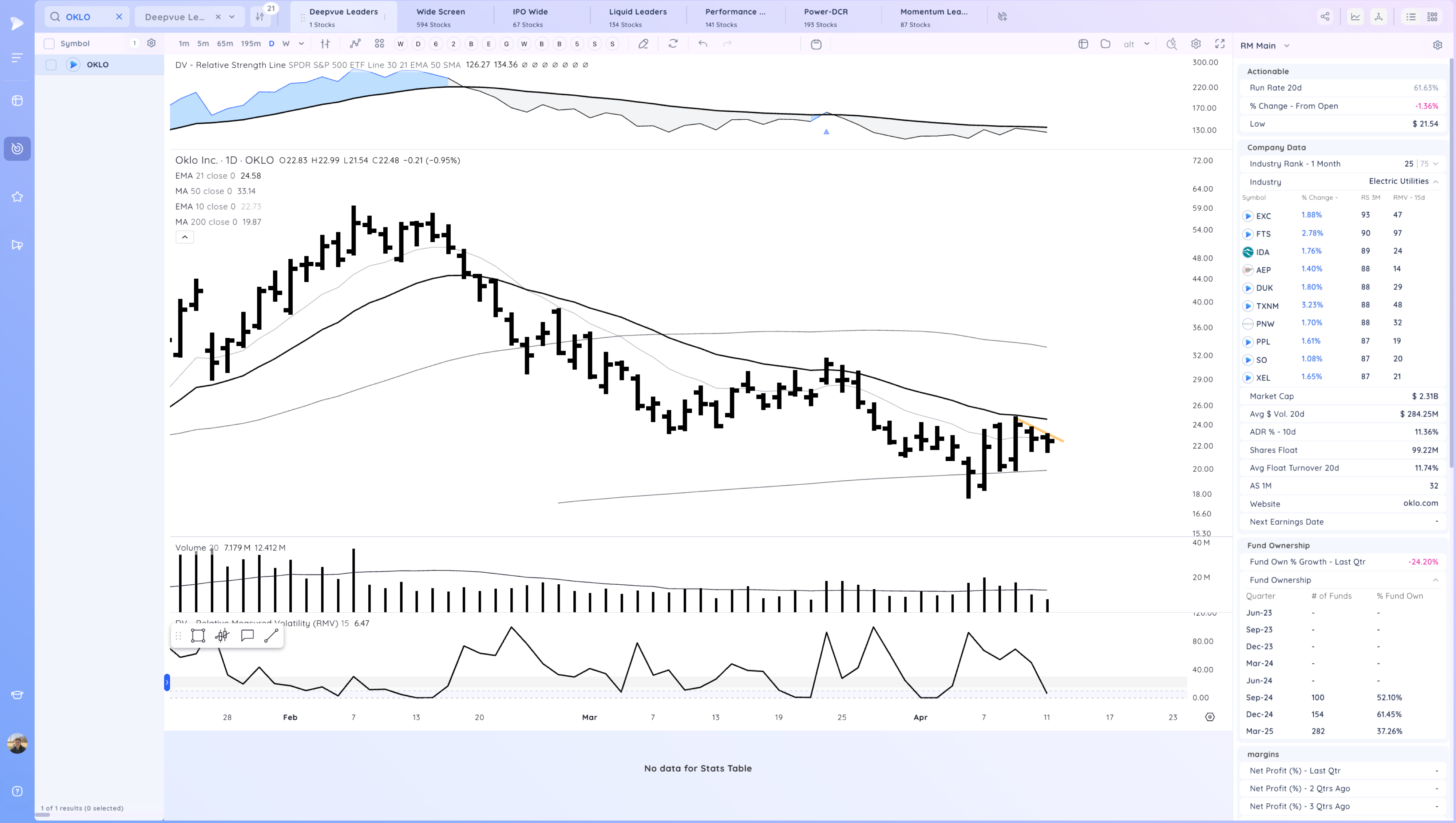

GEV watching for a push from this range and the 50sma. NNE OKLO also look interesting

CRWD a focus along with PLTR. Watching for a pop through the 50sma. Cyber group acting well

FTNT watching for push off the 21ema from this range

ZS similar 2 bar range

OKTA watching for a push from this range through the 21ema

CYBR move from the inside day friday, watching for a push though this level and then the 50sma

TTWO got the pop, watching now for a higher low or pause before the consolidation pivot

UBER watching for a a break from this right range

WGS good action, watching for a push from this range

OKLO swing trade type play, watching for a flag breakout. NNE SMR very similar

RKLB nice action, watching for a push higher

Today’s Watchlist in List form

Potential Leaders + Mega Caps ( Most leading to the downside for now)

NVDA, TSLA, META, PLTR, MSTR

Stock on Watch

AGX, AU, LOAR, CELH, CVNA, GRPN, TTAN, TMDX, ASAN, CAVA, HOOD, CRWV, EAT, RBRK, GEV, NNE, OKLO, CRWD, PLTR, FTNT, ZS, OKTA, CYBR, TTWO, UBER, WGS, SMR, RKLB

Focus

PLTR CRWD

Themes and Leaders

Strongest Themes: TBD – Cyber interesting in growth space

Market Thoughts & Focus

Encouraged by going through several hundred charts this weekend as bases continue to form and ranges tighten after the big bar Wednesday. How these ranges resolve will be a big tell, if we can push higher constructive, but if we break and close below them then the market is likely not ready.

Wednesday’s low is also another clear line in the sand we we remain vulnerable to news headlines related to tariffs.

The market is still below the 200 day and 50 sma so we are certainly not out of the woods yet.

Anything can happen, Day by Day – Managing risk along the way