There are so many different ways to go about investing your money in the stock market, whether you have a long-term outlook and want to set yourself up for a smooth retirement or you’re a short-term trader trying to earn income for the here and now.

Of all the options at your disposal, two of the most popular are swing trading vs options trading. They can both be very lucrative, but they’re very different methods. We’ll compare options vs swing trading to show which is best for your goals, risk tolerance, and time commitment.

But if you just want to know the difference between options and swing trading at a glance, swing trading involves capitalizing on minor price fluctuations in a stock’s price over the course of a few days or a week at most.

In contrast, options trading involves financial contracts that give you the right (but not the obligation) to buy or sell a given security at a pre-determined price before a pre-determined date. It’s definitely a bit more complex than swing trading.

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Whichever approach you choose, make sure to set yourself up for success by taking the time to learn from experienced, professional traders. Here at Trader Lion our swing trading course is one of the best resources you can invest in. Learn more today!

What is Swing Trading vs Options Trading?

Both swing trading and options trading involve investing in stocks, but that’s where the similarities end. With swing trading you’re actually investing in the specific stock itself, but with options trading, you’re dealing with contracts associated with the underlying stock.

What is Swing Trading?

Swing trading is a short- to medium-term trading strategy where you hold stocks, ETFs, or other assets for a few days to several weeks at most.

The idea is that stock prices can fluctuate by a few percentage points over the course of a couple days, and though it may not look like much, that movement presents a lucrative opportunity for investors.

The philosophy is to buy low and sell high, or to short high and cover at low if you take the opposite stance on a stock. Either way, you really only care about the technical side of things in analyzing these stocks since you don’t hold a long-term outlook.

Unlike day trading, swing trading exposes the investor to overnight risk. Here are some other key characteristics of swing trading:

- Timeframe: Positions are typically held for days to weeks, making it more flexible than day trading.

- Technical Analysis Focus: Chart patterns, moving averages, RSI, MACD, and volume indicators help you uncover trade opportunities and execute with precision.

- Lower Time Commitment: Since trades last longer, you don’t have to stay glued to your screen monitoring the market like day traders. You could manage the strategy with just 1-2 hours a day. It’s still more involved than long-term buy-and-hold strategies, though.

- Risk Management: Stop-loss orders and risk-reward ratios will need to be put in place for every trade to protect against sudden market reversals.

- Profit Potential: Gains are based on the stock’s price movement. Swing traders aim for consistent, moderate profits rather than big wins.

If you want to generate a regular source of income through your investments and don’t mind a more active trading style, you might be a perfect fit for becoming a swing trader. It’s a fairly simple strategy compared to the other half of the swing trading vs options comparison, too.

What is Options Trading?

Options trading involves buying and selling contracts that give you the right (but not the obligation) to buy or sell an asset at a predetermined price before a specific expiration date. There are quite a few more moving pieces here.

While swing trading focuses solely on price movements of the underlying security, options trading introduces leverage, time decay, and advanced strategies you can use to either enhance profits or hedge risks.

Before we go any further it’s important to distinguish between the two primary types of options contracts: calls and puts. Calls give you the right to buy a stock at a set price, whereas puts give you the right to sell a stock at a set price.

Either way, you’re speculating on how a stock’s price is going to move in the future. If you suspect a stock is going to rise in value over a given period, you might purchase a call option on that stock. If your theory proves true you could buy that stock at a discount and then flip for profit.

On the other hand, you would purchase a put contract if you believe the price is going to plummet. Should things work out how you predicted, you’d be able to sell the stock back at a premium relative to its current market value. Here are some more things to know about options:

- Leverage: You can control a larger position with a smaller capital investment, which amplifies potential returns – but with that comes increased risk.

- Expiration Dates: Every option contract has an expiration date, and timing influences profitability. Unlike swing trading, where you can hold a stock indefinitely, options lose value over time (known as time decay).

- Complex Strategies: Advanced strategies like covered calls, iron condors, and straddles can be implemented to manage risk and maximize returns.

- Higher Learning Curve: Given all the moving pieces in a single options trade you need to understand pricing models, volatility, and market conditions for consistent profits.

Options trading is ideal for anyone trying to make the most of limited capital or hedge against other positions you already hold. Just know that it can take a while to get to the point where you feel confident trading options.

Swing Trading vs Options Trading: Which Investment Strategy is Right For You?

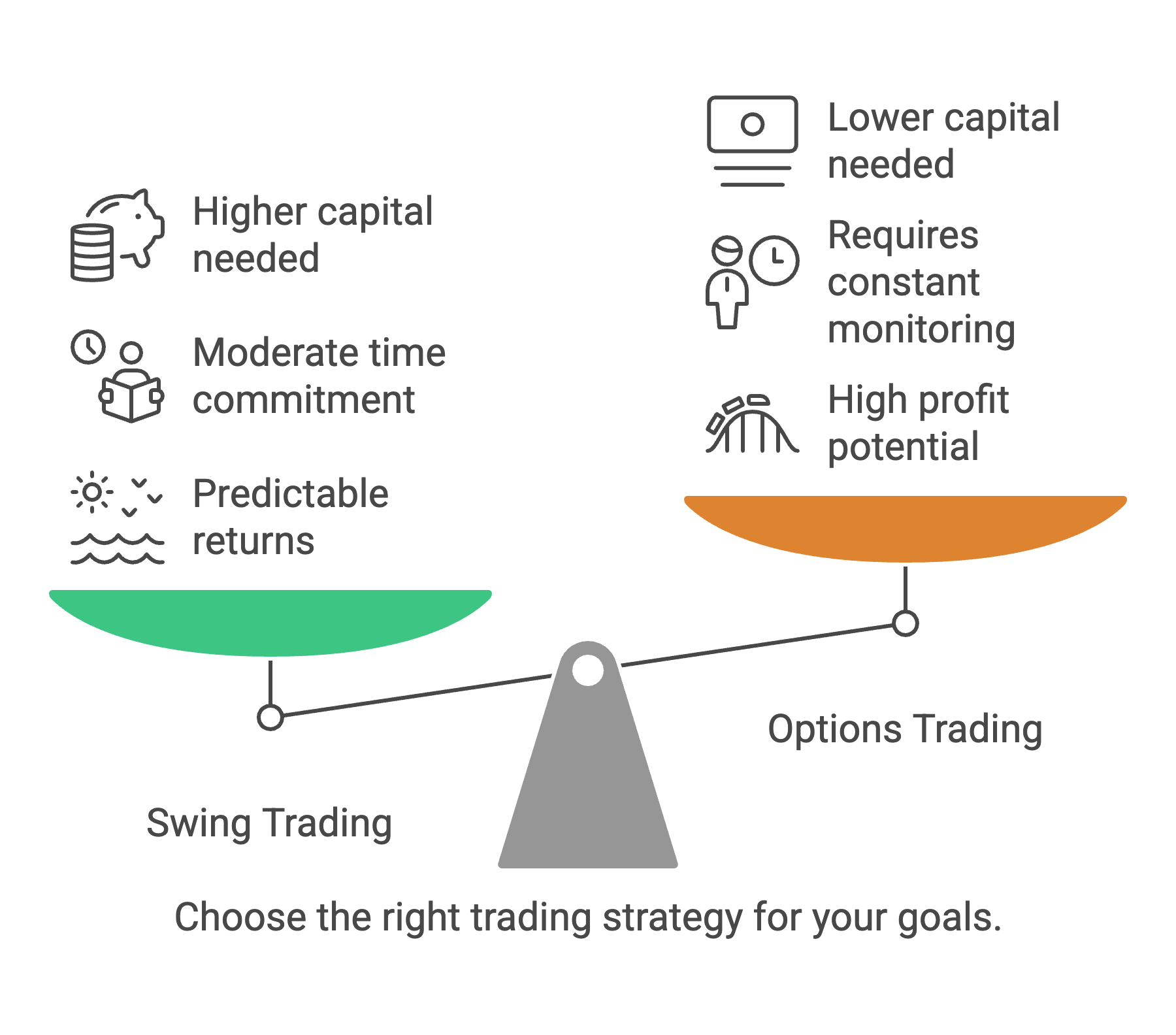

Choosing between options vs swing trading comes down to a few key considerations.

What’s your tolerance for risk, and what are your financial goals?

How much time do you want to spend in front of a screen?

What capital do you have to start with?

Are you a beginner trader looking to start slow or do you want to try something more advanced?

Answering all these questions will lead you to one strategy over the other. We’ll break down all of this and more below as we compare and contrast swing trading vs options.

Risk vs Reward

Taking a look at the risk-to-reward ratio of any given investment opportunity is the first step to figuring out if it resonates with your goals and personality type. You can’t have reward without some semblance of risk – it’s just a matter of figuring out where you fall on that spectrum.

Risk is typically moderate with swing trading because you’re trading stocks, ETFs, or other assets with intrinsic value. Your downside is limited to the amount you invest, but you can mitigate risk even further with stop-loss orders and proper position sizing.

Typical returns for swing trading tend to be on the lower end, between 5-10% per trade is a great aiming point for investors. 12-24% returns over the course of a year would be considered a very high rate of success.

Meanwhile, options trading offers a higher profit potential since you’re working with more leverage. Your risk is limited just to the premium of the contract you’ve purchased, as well, which tends to be fairly low.

Sometimes traders earn over 100% on a single trade! These home runs just don’t really occur with swing trading, and it’s easy to get hooked in by this appeal.

However, options have time decay. If the stock isn’t moving in your favor as time goes on, the contract you’re holding continues to lose its value. Many contracts end up expiring worthless and you’re out the premium paid.

There’s a different type of risk involved with selling options contracts, which is a unique take on this strategy that we haven’t really covered yet. There, your risk could in theory be unlimited. We recommend newcomers stick with buying options contracts at first for this reason.

Ultimately both strategies have their risk profiles and profit potentials, but swing trading is generally seen as a more predictable and repeatable trading strategy.

Time Commitment

The idea of hands-off trading is appealing, but it’s just unrealistic. Any strategy, whether it’s swing trading vs options trading, is going to take up some amount of time through learning, analysis, and execution.

Since trades are held for days or weeks, you don’t need to monitor the market constantly. Most swing traders check their positions once or twice a day, so you can technically hold down a full-time job while earning money on the side with swing trading.

In contrast, options trading requires a bit more vigilance since there is a clock ticking from the moment you purchase the contract. You need to monitor your positions since theta erodes the value of your options daily.

Options prices react more aggressively to market news and volatility as well, so you might find yourself spending hours a day watching charts, adjusting positions, or rolling contracts to manage risk.

Even if you’re trading longer-dated options, you still need to track implied volatility and market sentiment frequently. It’s harder to trade options while managing other responsibilities like a full-time job compared to swing trading.

Capital Requirements

The amount of money you have to jumpstart your investment journey will play a role in whether swing trading vs options trading is right for you. Both require you to have some cash upfront, but the requirements are much lower with options trading.

After all, you’re only paying premium – at least, at first. You can control 100 shares for a fraction of the cost it would take with swing trading. But, leveraging options incorrectly can quickly lead to large losses.

It’s also worth noting that to really capitalize on the appeal of options trading you do need the capital to afford 100 shares of the stock in question before the contract expires.

Say you purchased a call option for 100 shares of stock XYZ, currently trading at $50/share with a strike price of $40/share. Sounds great – you can buy XYZ at a steep discount!

But, you need $4,000 on hand to do so. Otherwise, you’d have no choice but to sell the contract itself to another investor who does have the financial means to exercise the option, albeit still making a profit but likely not capturing as much as you could.

Market Conditions

The current market conditions will impact whether options vs swing trading is a better fit. Swing trading works well in all options, be it a bull market or bear market. You can find a stock that’s exhibiting some level of volatility to capitalize on short-term price movements.

The same can be said of options trading, though, since you can take a bullish outlook on a stock and purchase call contracts or a bearish outlook by purchasing put contracts.

You can even sell your own contracts if the market is relatively flat and stocks aren’t really moving in either direction, earning income through premium alone. This is to say that options might be a bit more versatile in different market conditions.

Skill Level & Learning Curve

There’s a dramatic difference between swing trading vs options in looking at which is more complex. The learning curve with options trading is far steeper since there are so many moving parts: expiration dates, strike prices, and greeks (delta, theta, gamma, etc.).

Even just getting a solid grasp of the differences between calls and puts can be tough for beginners, let alone understanding how implied volatility and time decay affect options pricing.

On the other hand, swing trading is fairly straightforward. Swing trading patterns, trends, and indicators like moving averages and RSI can help identify opportunities. Decisions are made from more of a place of fact and data than educated guesses like in options trading.

While both strategies involve some level of education and practice, swing traders can hit the ground running much faster (and with more confidence) than options traders, all else equal.

So, Is Swing Trading or Options Trading Better?

Hopefully you have a solid grasp of the difference between options and swing trading and more importantly, which is right for you.

It’s not really a matter of one being “better” than the other. It’s just about choosing the right strategy for your financial situation, goals, risk tolerance, and time commitment. Here’s a brief summary of the key takeaways:

- Swing trading provides steady, consistent profits without the added complexity of options contracts.

- Options trading can offer higher percentage returns but comes with greater risk and a steeper learning curve.

All that being said, if you want to earn regular income without spending too much time in front of your screen learning, analyzing, or executing, consider swing trading. But does it ever make sense to combine these for the best of both worlds?

Can Swing Trading and Options Trading Work Hand-in-Hand?

Whether it’s hedging a swing trade through options or actually swing trading options contracts, there are a few different ways these two approaches can complement each other.

Using Options to Hedge Swing Trades

Say you’re holding a stock in a swing trade and want to protect your position against unexpected price drops. You can buy a put option. This is kinda like purchasing insurance for your position.

The put option gains value if the stock price declines, offsetting some or all of the losses on the original trade. This strategy lets you stay in trades longer while limiting downside risk.

Generating Income Through Options While Swing Trading

Another way you can earn more income while holding a position as a swing trader is selling covered calls. This lets you collect premium income while still benefiting from some potential upside movement.

If the stock remains below the strike price, you keep both the premium and the shares. If it rises above the strike price, you’ll be forced to close out your position but will still benefit from the price increase from the entry price up to the strike price.

Another method is selling cash-secured puts to enter trades at a lower price. This approach allows you to collect a premium upfront while waiting for a stock to reach an ideal entry point. If the stock doesn’t drop to the strike price, you still keep the premium.

Using Options to Confirm Trade Setups

Even if you don’t want to dabble in options and choose to stick with swing trading only, you can at least use options activity to confirm your trading plan.

Unusual options flow, such as high-volume call buying or put selling, is indicative of institutional positioning. This essentially helps you gauge market sentiment before entering a trade.

Say a stock is approaching a key technical level and there is significant call option activity. This could signal strong buying interest, reinforcing the potential for an upward breakout. On the other hand, heavy put buying or call selling might suggest downside pressure.

Bringing Our Options vs Swing Trading Comparison to a Close

Both swing trading and options trading have their place in the grand scheme of things. One isn’t inherently better than the other – but the vast majority of investors will be better suited to the simplicity and predictability of swing trading.

Our blog has more resources on topics like the Mark Minervini strategy, Stan Weinstein stage analysis, and more. But whether you’re looking for a swing trading or stage analysis course, empower yourself at Trader Lion and gain an edge in any market conditions.

This is where traders come to learn and grow, so get started for free today and tap into your full potential as an investor. Join thousands of traders who trust Trader Lion today!