The TML Talk | December 11, 2024

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

December 11, 2024

2 min read

Summary of Key Points from the Webinar

Market Overview:

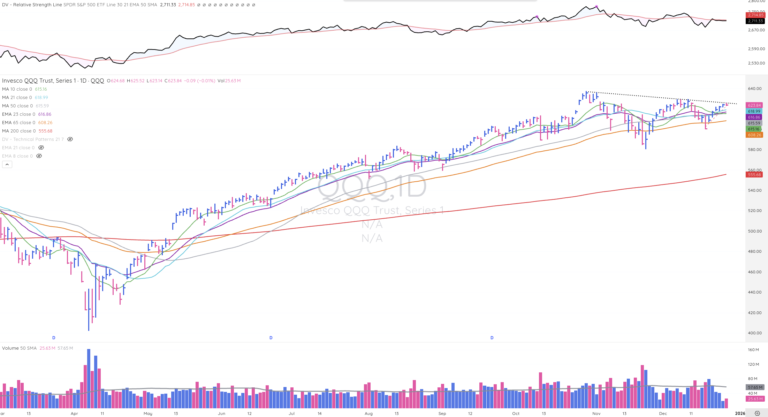

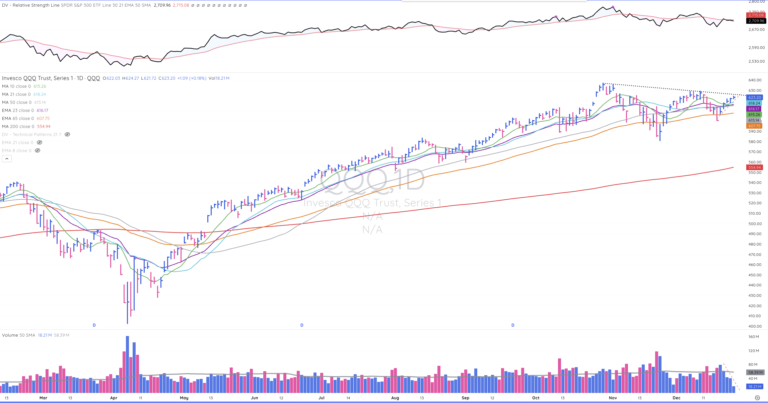

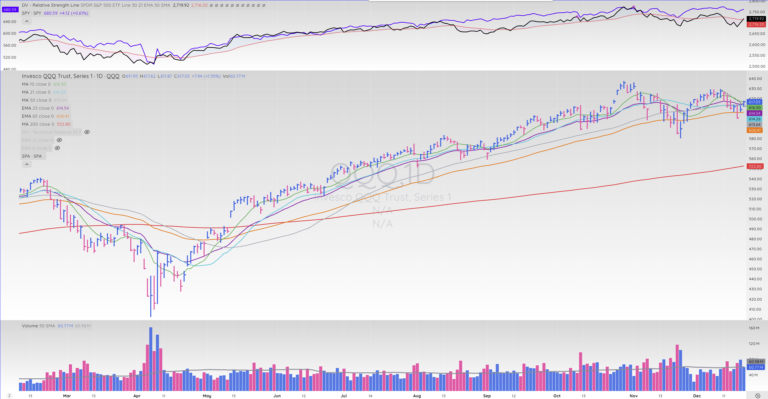

- The NASDAQ reached new all-time highs, with notable contributions from Tesla (TSLA) and Google (GOOG), which also achieved record highs.

- Rotation among sectors such as energy, retail, and technology was highlighted, indicating a broad-based rally.

- The importance of qualitative insights and focusing on leadership stocks in the market’s uptrend was emphasized.

Key Learnings and Strategies:

- Timeframe Importance: Utilize multiple timeframes (daily, weekly, monthly) to identify long-term pivot points and avoid misjudging stocks as overextended.

- Adding on Strength: Buy into strength near significant breakout points while being cautious of potential pullbacks.

- Sector Leadership: Focus on top-performing sectors and industry groups, as nearly half of a stock’s movement is influenced by its sector and industry.

Observations on Market Leaders:

- Tesla (TSLA): Highlighted its breakout through the $445.50 all-time high pivot, suggesting the potential for further upside.

- Google (GOOG): Benefiting from its quantum computing story, making it a preferred play in the theme.

- Broadcom (AVGO): Setting up constructively across timeframes with strong volume, though earnings were flagged as a key near-term event.

- NVIDIA (NVDA): Consolidating, with potential support at the 65-day EMA.

Stock Mentions and Commentary

Stocks with Positive Sentiment:

- Tesla (TSLA): Strong breakout from a major pivot point.

- Broadcom (AVGO): Constructive technicals across all timeframes; a potential earnings catalyst.

- Zillow (Z): Tight flag pattern with potential breakout near $84.

Stocks with Mixed or Neutral Sentiment:

- NVIDIA (NVDA): Holding support but still requiring further consolidation.

- MongoDB (MDB): Lacking tight technical action and trailing its peers.

Emerging Opportunities:

- Retail Stocks: Strong action across leaders such as Costco, BJ’s, and WWW.

- Nuclear Power Plays (e.g., NN, OKLO): Speculative, with tight patterns near key moving averages.

Actionable Takeaways:

- Manage Risk with Defined Stops: Always define stops before entering trades, especially when buying on weakness.

- Focus on Leadership: Leaders like Tesla, Palantir (PLTR), and Reddit (RBLX) provide opportunities to buy high and sell higher.

- Use Longer Timeframes: Incorporate weekly and monthly charts to align with key pivot points and avoid missing significant setups.

- Stay Disciplined: Rotate into themes showing clear strength, such as AI, quantum computing, and semiconductors.