Upside Reversals to End the Week – Santa Rally?

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 20, 2024

Market Action

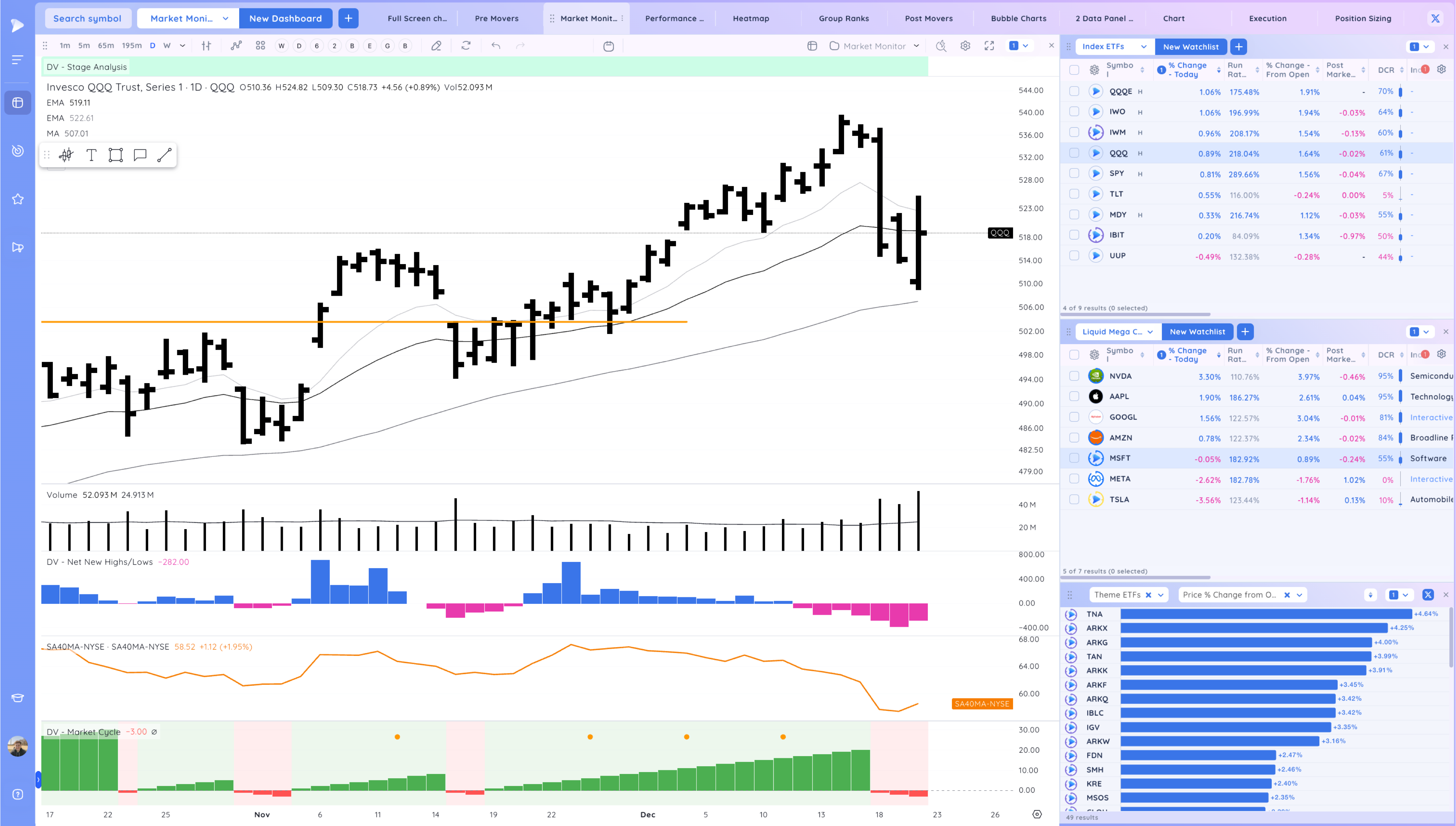

QQQ – gap down then a strong reversal, before a fade into the end of the day. Supportive action but does not negate the sell bar wednesday. We are still below eh 21ema

Short Term Expectation based on the close is consolidation or higher. Larger context however still however warrants some caution

Bulls want to see us hold, build, and rally

Bears want to see us follow through lower and take out today’s low

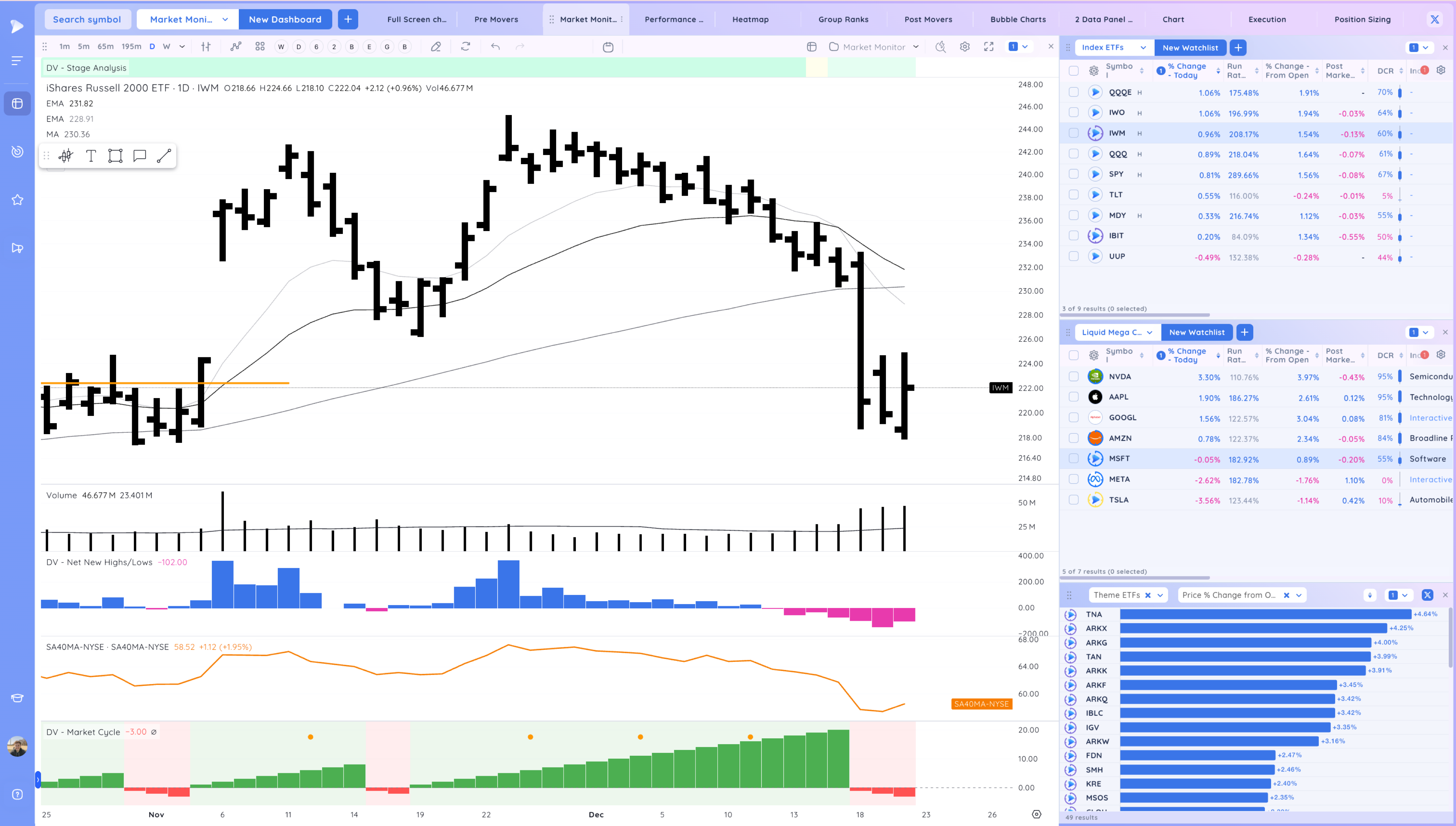

IWM – Still weaker, similar oops reversal action

Bulls want to build here or rally strongly

Bears want to see us break lower belwo this range

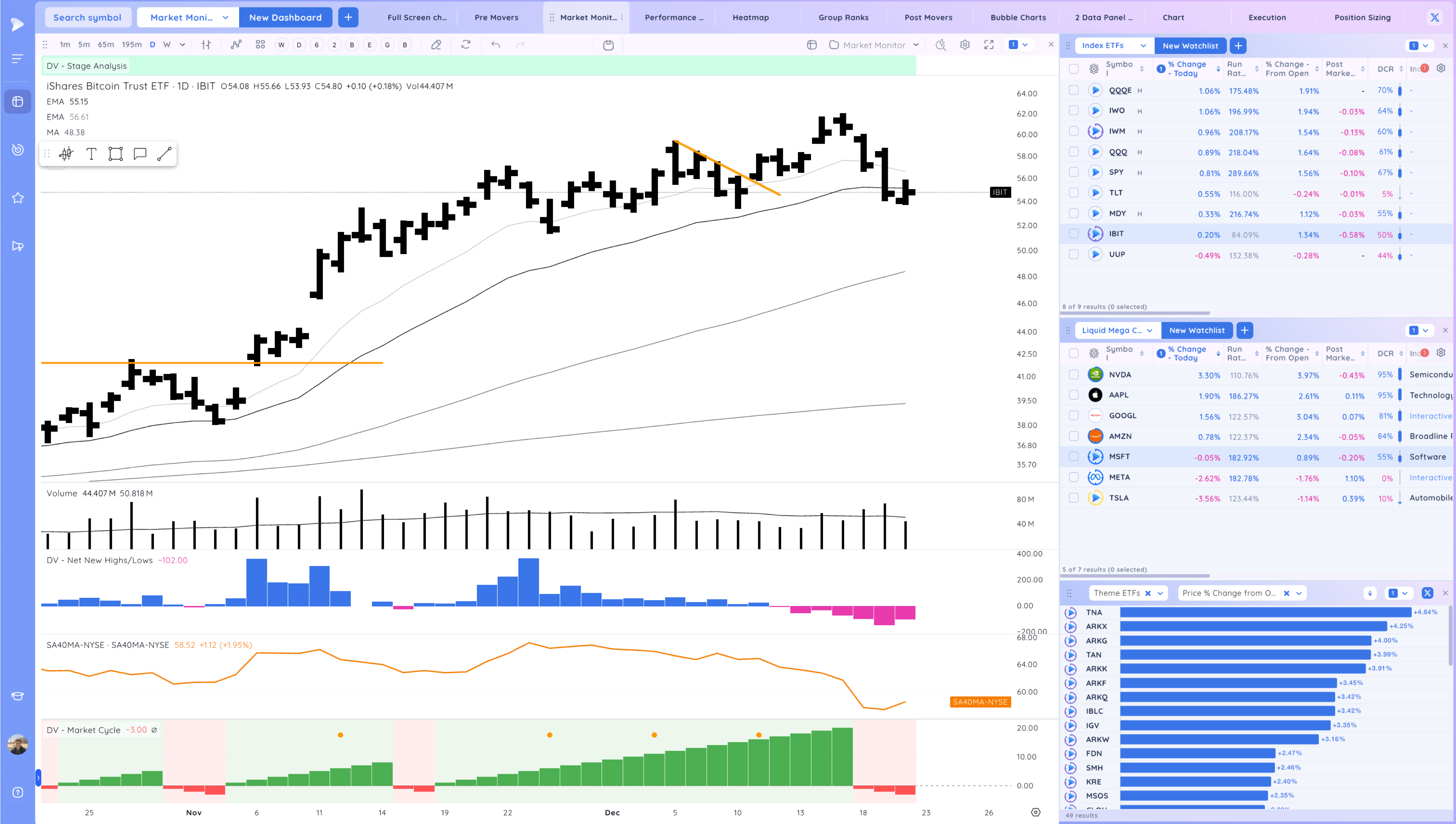

IBIT- weaker bounce attempt, right at the 21ema

Bulls want to see us build sideways and rally

Bears want to see us follow through lower

Trends (2/4 Up)

Shortest – 10 Day EMA – Down Below Declining

Short-term – 21 ema – Down Below Declining

Intermediate term – 50 sma -Up Above Rising

Longterm – 200 sma – Up – Above Rising

Deepvue Special Offer – Try 2 Months for only $39

Try out the best platform for CANSLIM Swing and Position Traders – Top Trader Screens, Unique Indicators – Streamlined Routines

Groups/Sectors

Performance Today on the Left, Performance over the past 20 days on the right.

Performance Charts from Deepvue

Deepvue Leaders Heatmap

S&P 500

Group Ranks: 1 Day, 1 Week, 1 Month, 3 Month from left to right. This is now a preset for Deepvue Members

Post Market Movers. Not much of note

Key Stocks and Moves in Deepvue

NVDA positive outside day below the MAs, watching for follow through up next week

TSLA faded end of day, right at the ATH. Watching for respect and a push off that level next week

META follow through down after bounce attempt

AMZN decent close

GOOG nice oops reversal – this is when we open below the prior day low and push up through it

ALAB showing great RS, break from this flag. RMV5 tight signal yesterday

RDDT good action holding the 21ema

MSTR great action today, watching for follow through. Today low risk setup at the 50 day, oops reversal

PLTR strong oops reversal turned outside day. Great close

GEV strong action still in this tight base, looks amazing on a weekly

Stocks Setting Up / RS

Focusing more on watching the leaders and watching for relative strength versus looking for just setups

What we are looking for is sustained RS throughout the market pullback

CRDO building a nice range here, pivot just below the earning gap close

SMTC big of a fade but setting up a range at the 21ema post gap

NVCR inside day

AVGO fade but forming a range here, watching for a u turn higher

RBRK flag into the HVC

GOOG watching for follow through

GME would love it to get a bit tighter with an inside day, but setting up a pivot here

RBLX pushed today watching for follow through

ASAN tight day, watching for a push higher

INTA good action, watching for follow through. Another oops reversal example actionable through the prior day low

HIMS swing trade setup and volatile name, that green line is the prior ATH. Inside day watching for a push higher

DUOL great action off 50day area, watching for follow through

SQ oops reversal at the prior base pivot, watching for follow through higher

VST watching for follow through higher

BE watching for follow through higher

AFRM watching for follow through higher

APP watching for follow through higher

AVPT watching for follow through higher

KD watching for follow through higher

GEO tight inside day at the pivot

COIN at the 50 day, watching for follow through higher

BILL watching for follow through up

NNE volatile day, setting up a spot, very spec name

TSLA watching for a push off the prior ATH

RKLB actionable today, forming up a range above the prior ATH

LMND setting up a range just below the 21ema

Themes and Leaders

Key Themes: Software, AI

These names have the top RS, growth stories

TSLA PLTR RDDT ALAB APP DOCS GEV

Focusing on stocks holding above or near the 10emas, then 21emas, recent pivots, and earnings gaps.

Will be sorting by weekly closing range tomorrow to see stocks holding up.

Quick tip!

Sort the DV leaders screen or larger watchlist by Weekly Closing Range, % Vs 21ema, or RS 1 week to quickly find top RS names

Market Thoughts & Focus

Really like todays action, not only because it was largely positive, but because it creates a clear line in the sand. For the indexes and leaders, a break of today’s low suggests more weakness, larger pullback, and more time needed. If we hold and build though, that low can be used to manage risk against

Leaders acted well today, ALAB RDDT in particular which held up the best.

A lot of names set up in ranges near or just below the 21ema which the potential to follow through up early next week. however, if these ranges resolve down, or pushes fail, again that suggests more time is needed.

Lots of oops reversals to study above, that can be a great entry tactic in a leader during a short pullback. Often risk can be managed under 2%.

Anything can happen, Day by Day – Managing risk along the way