Downside Reversals After the Fed Announces Rate Cuts

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 18, 2024

Market Action

QQQ – Was a sell the news event today after the announcement of a 50 bps rate cut. The QQQ closed at lows just above the moving averages.

Short Term Expectation is lower.

Bulls would want to see a strong reversal off the MAs to end the week or a gap up expectation breaker and strong close to the week.

Bears want to see continuation lower closing below all the MAs or a gap up and negative close.

Basically how we close this week will be important information, It will show how the largest institutions have factored in the new news about the macro environment and altered how risk averse they should be.

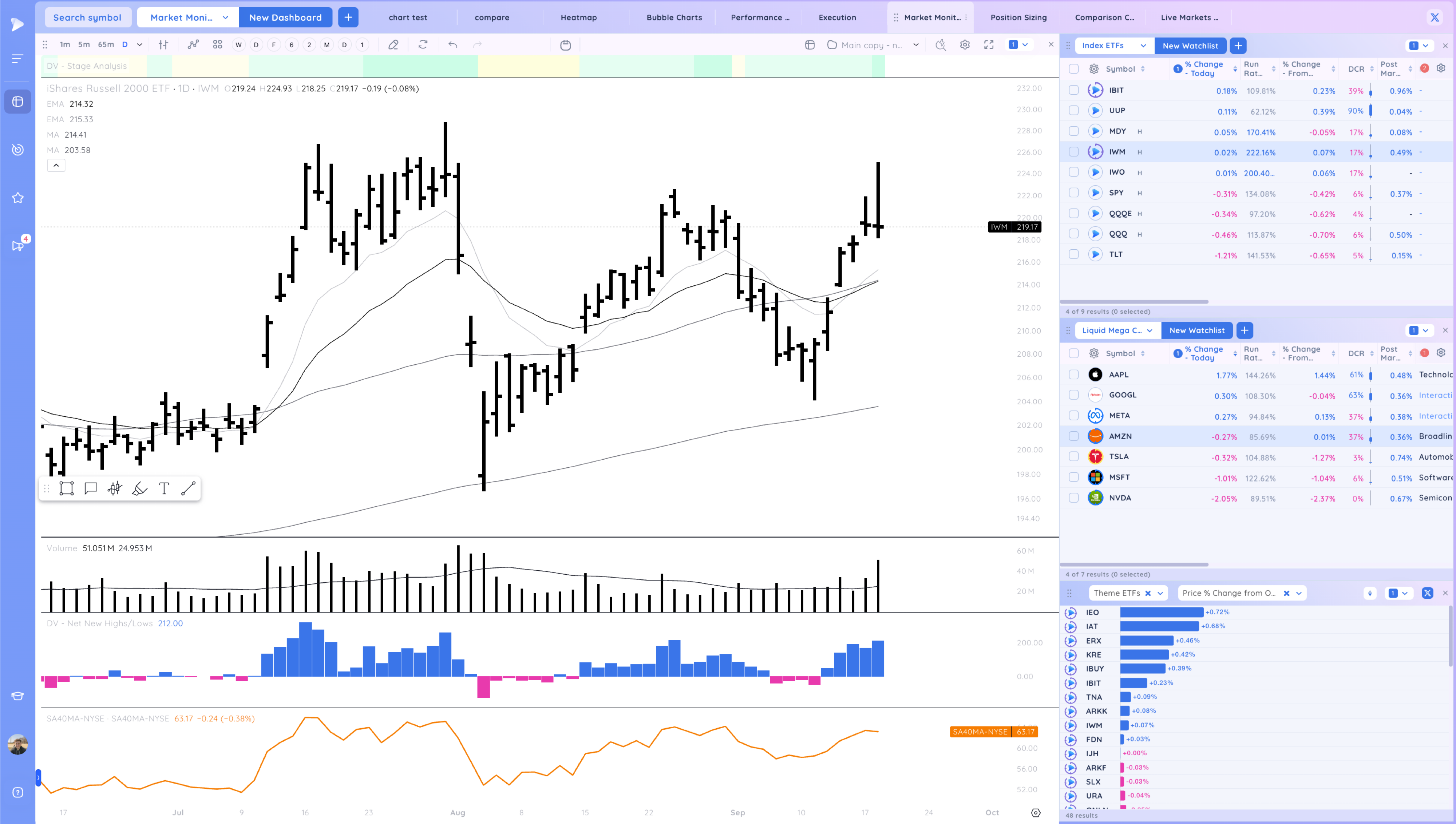

IWM – The Russell was stronger during the day but faded hard. A mirror image bar to yesterday except larger range

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Trends (4/4 Up)

Shortest – 10 Day EMA – Above Rising

Short-term – 21 ema – Above Rising

Intermediate term – 50 sma – Above Declining

Longterm – 200 sma – Up – Above Rising

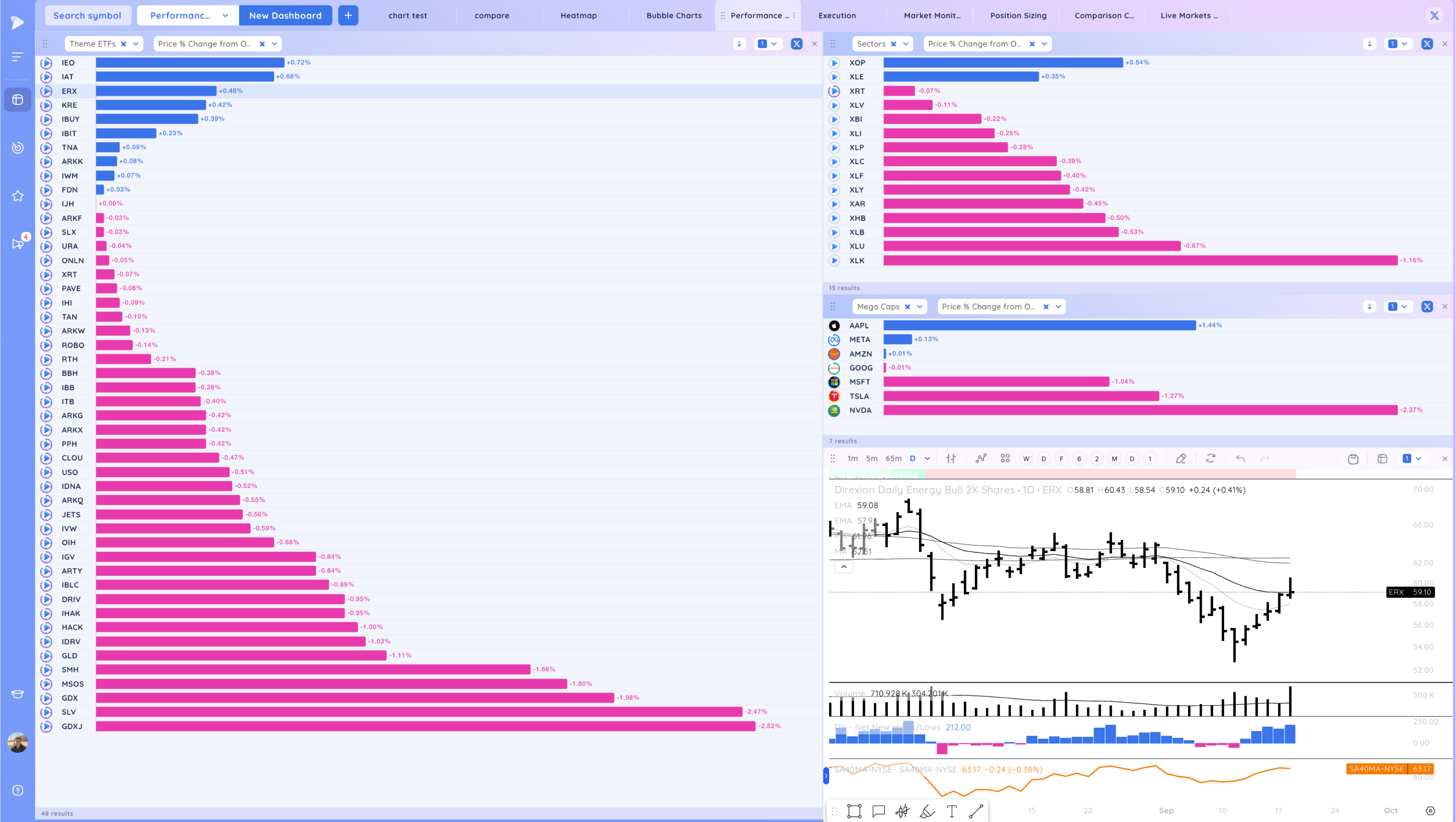

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Heatmap from Deepvue

Energy names showing some strength, most themes down from the open

Key Stocks in Deepvue

NVDA was looking strong with an upside reversal but closed at lows undercutting the recent range

AAPL much stronger with better DCR pushing to fill the gap from the gap down

TSLA another downside reversal at the pivot

CAVA still holding the 10ema

CART expansion up and base breakout. Better low risk buys were lower

DUOL similar. Expansion and testing highs

RDDT strong RS continuing higher

FSLR fade

LNTH good strength as the base develops

CRS good intraday move from inside day near the pivot, but faded

APLD strong intraday move but fade off highs

AFRM tightening up right side of the base

IOT still forming a range

QFIN downside reversal but still in the range

LTH still near highs

Market Thoughts

How we close the week will be key. NVDA and semis took a hit but nothing broken just yet.

Day by Day – Managing risk along the way