Strong end to the Week. Nasdaq at a Key Level

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 13, 2024

Market Action

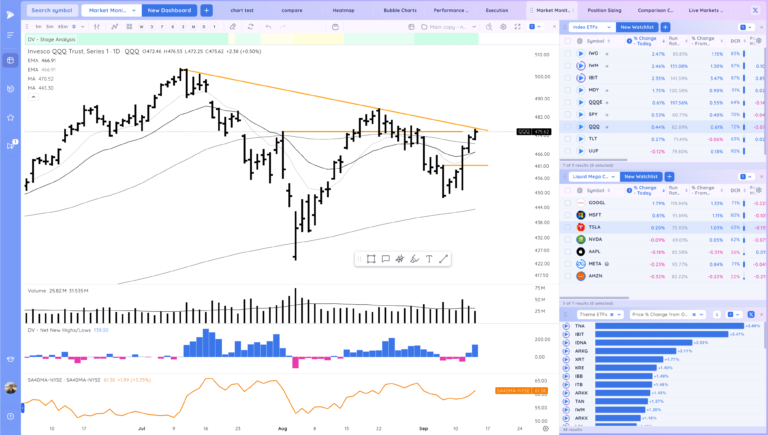

QQQ – slight follow through up. At a key level

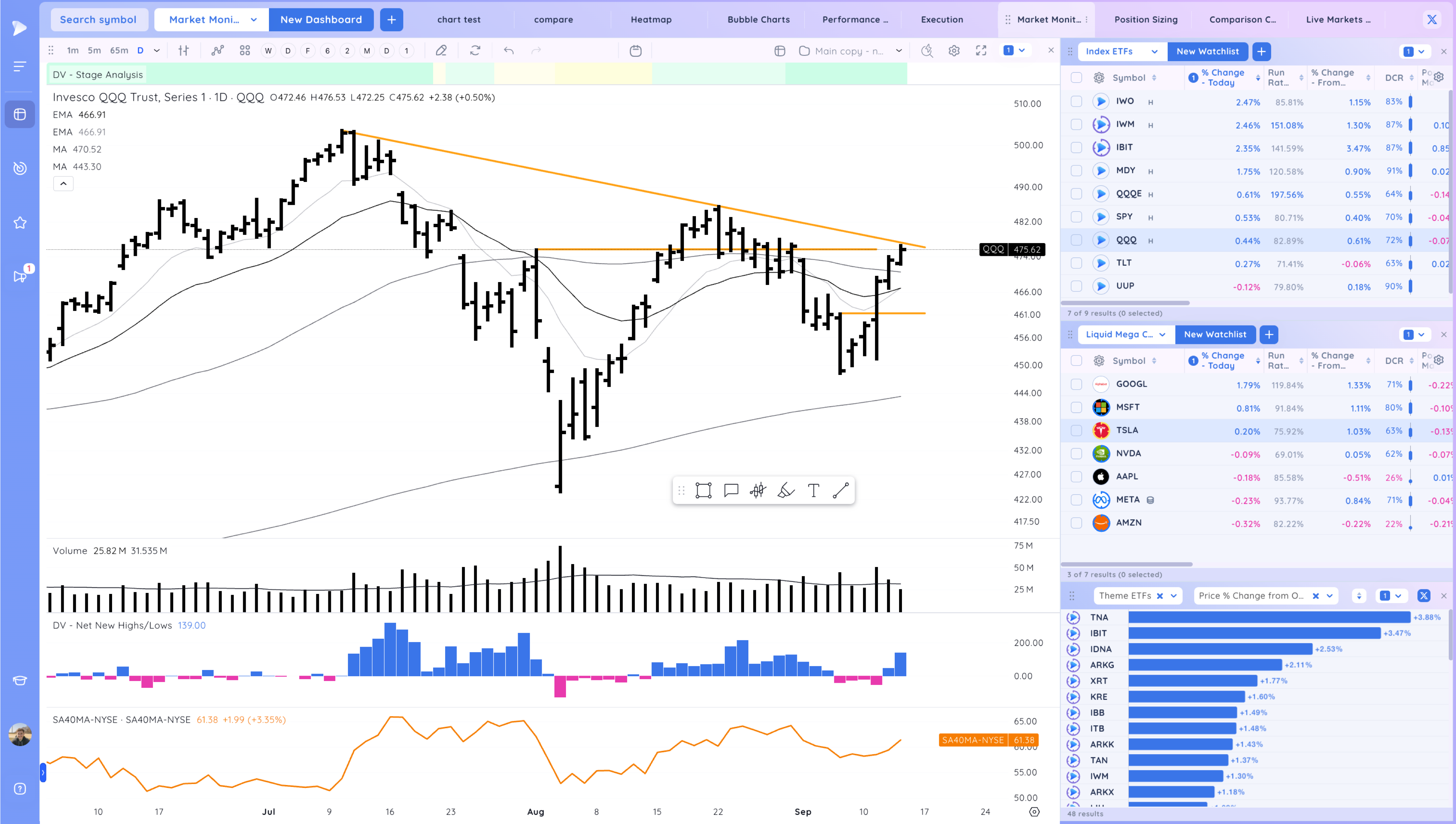

IWM – Stronger with the gap and go. A bit short term stretched

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Trends (4/4 Up)

Shortest – 10 Day EMA – Above Rising

Short-term – 21 ema – Above Rising

Intermediate term – 50 sma – Above Declining

Longterm – 200 sma – Up – Above Rising

Powered by Deepvue

The following report is brought to you by Deepvue. We have a special offer of 2 Months for $39

It’s the best platform for swing and growth stock traders

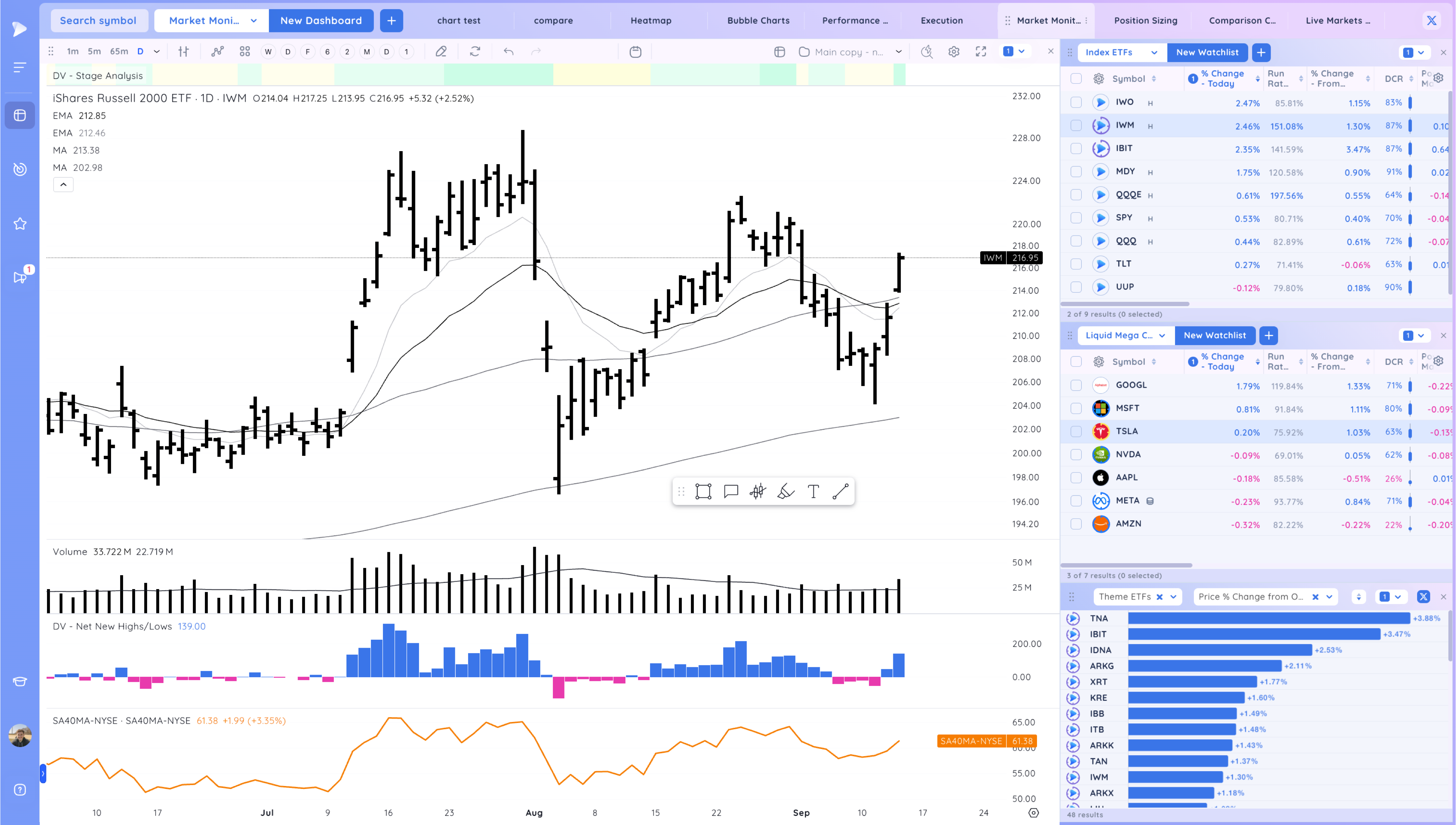

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

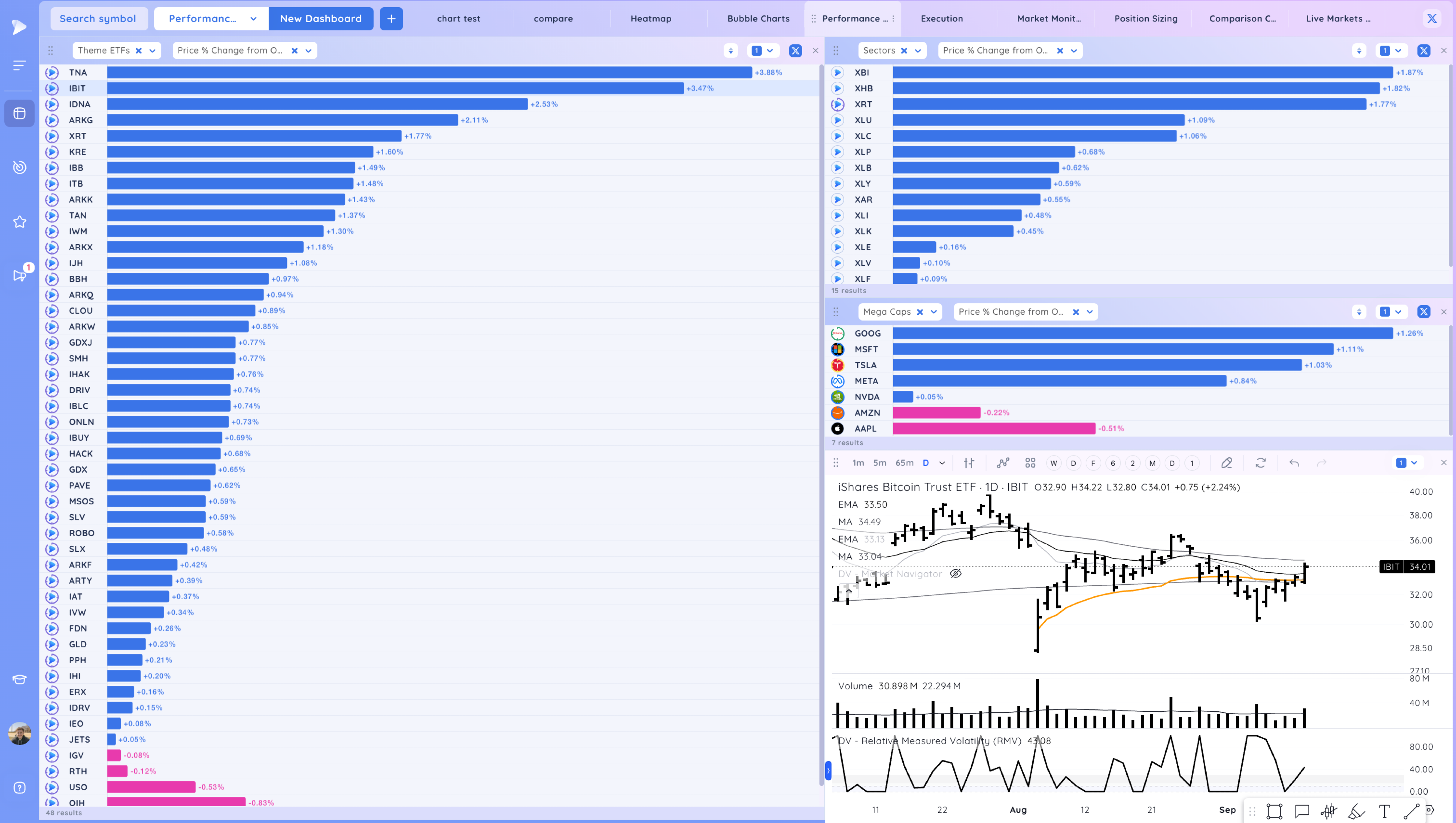

Key Stocks in Deepvue

NVDA tight day above the moving averages

RDFN expansion up. Z also moved

BNTX highest volume in over a year. NVAX also moving

IBIT and Bitcoin names moving. Reclaim 21ema

CAVA pull back to the range high. One to watch next week

APP continued expansion from tight area

DOCS continuation

INTA compressing near 10ema

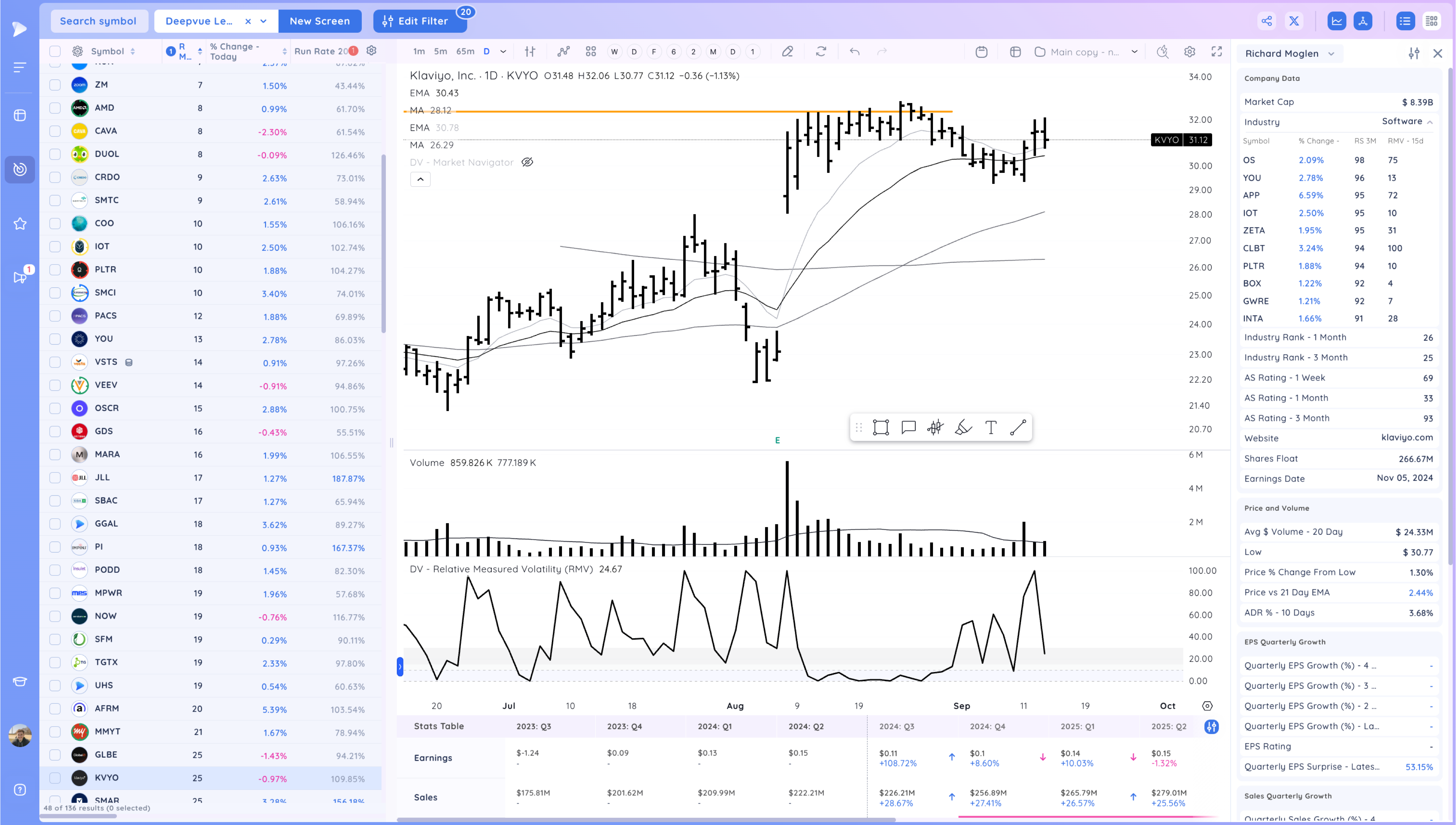

KVYO forming a base below the key level

ONON tight day

CART through the pivot

FTNT 21ema pullback

APLD very volatile name,

TSLA grinding higher, below key level and gap

RDDT off the 21ema. One to watch next week

Market Thoughts

Good end to the week. Many names have already pushed for 2-4 days. Not seeing quite as many immediately ready names

Day by Day – Managing risk along the way