NVDA Gaps Down After Earnings – What Does this Mean for the Market

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 28, 2024

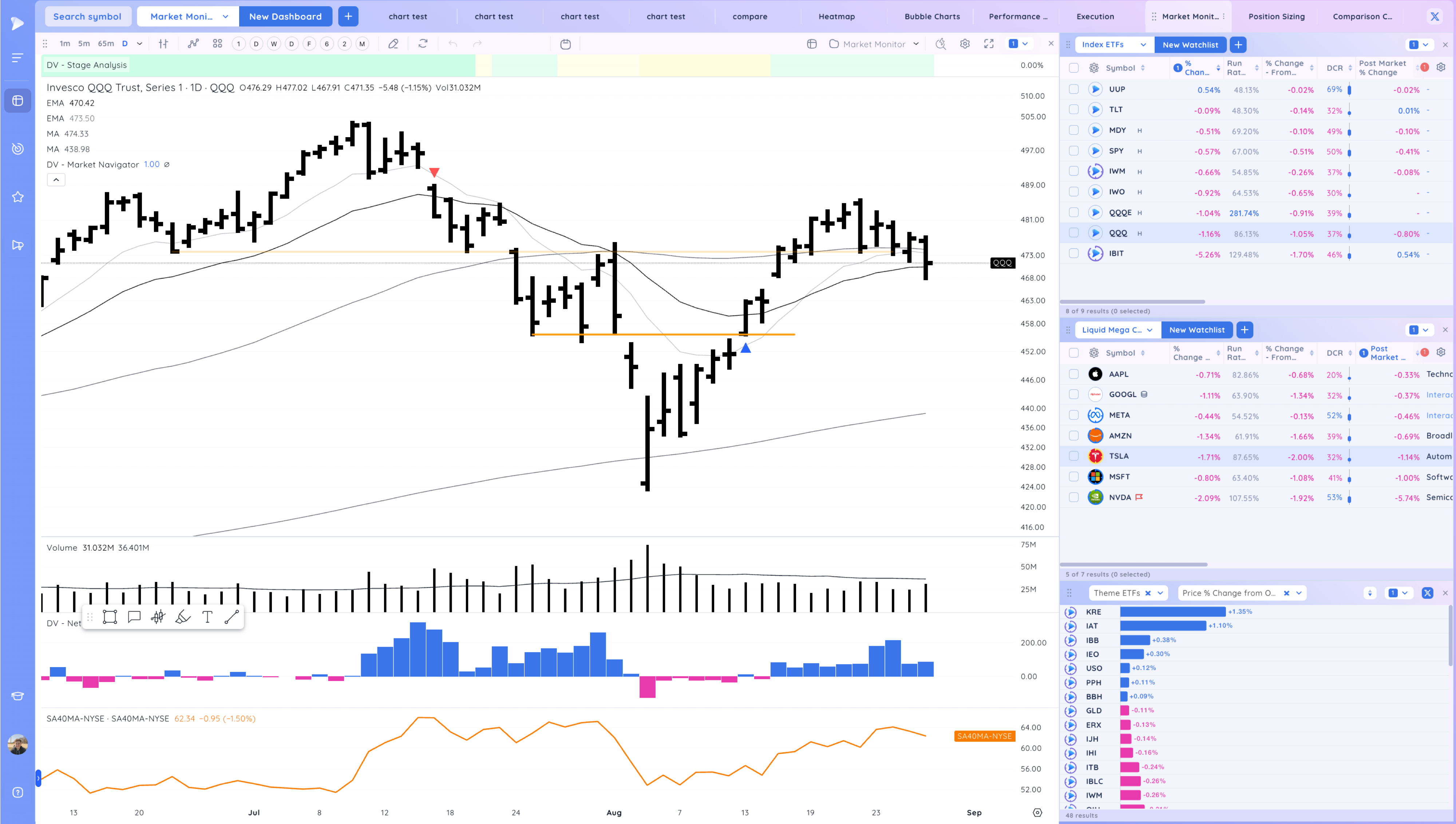

Market Action

QQQ – back under the 50 day and set to gap down tomorrow currently after NVDA EPS. Back below the 50 day

Honestly I prefer this scenario, we will see on the open what the demand is. Have a list of stocks in position if you are one to play oops reversals but also have an open mind for a trend down day.

IWM – pulling into the 10ema

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Trends (2/4 Up)

Shortest – 10 Day EMA – Up – Below declining

Short-term – 21 ema – Up – Above Rising

Intermediate term – 50 sma – Below declining

Longterm – 200 sma – Up – Above Rising

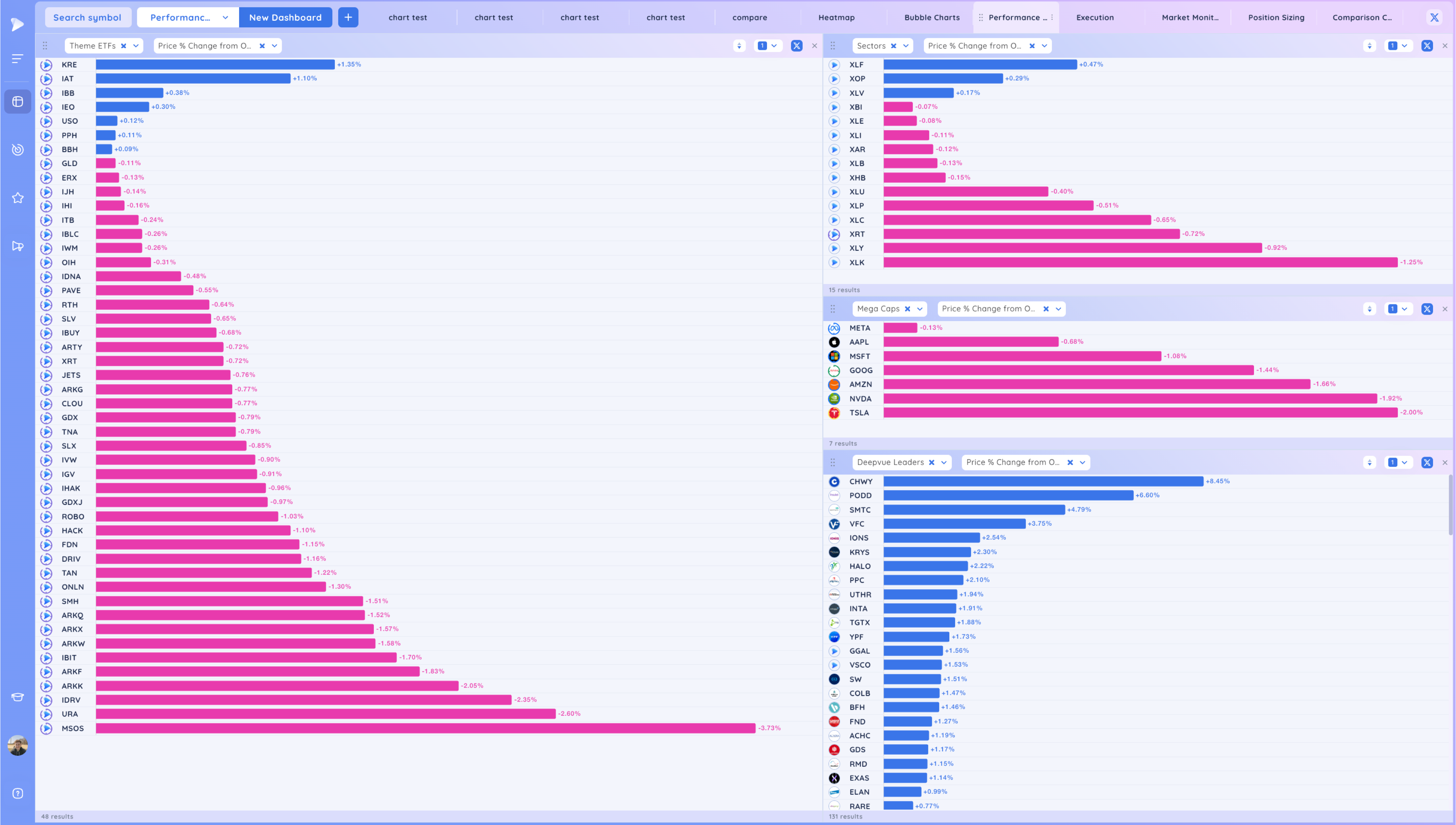

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Key Stocks in Deepvue

NVDA strong report with beats and triple digits but gapping down post market. Growth is slowing (tough comparisons to prior 400% growth lol)

Currently set to open below the 50 day MA tomorrow and below the handle it has been forming.

NVDA Weekly, this is the fourth major base of this move. 1st and 2nd bases are considered early stage

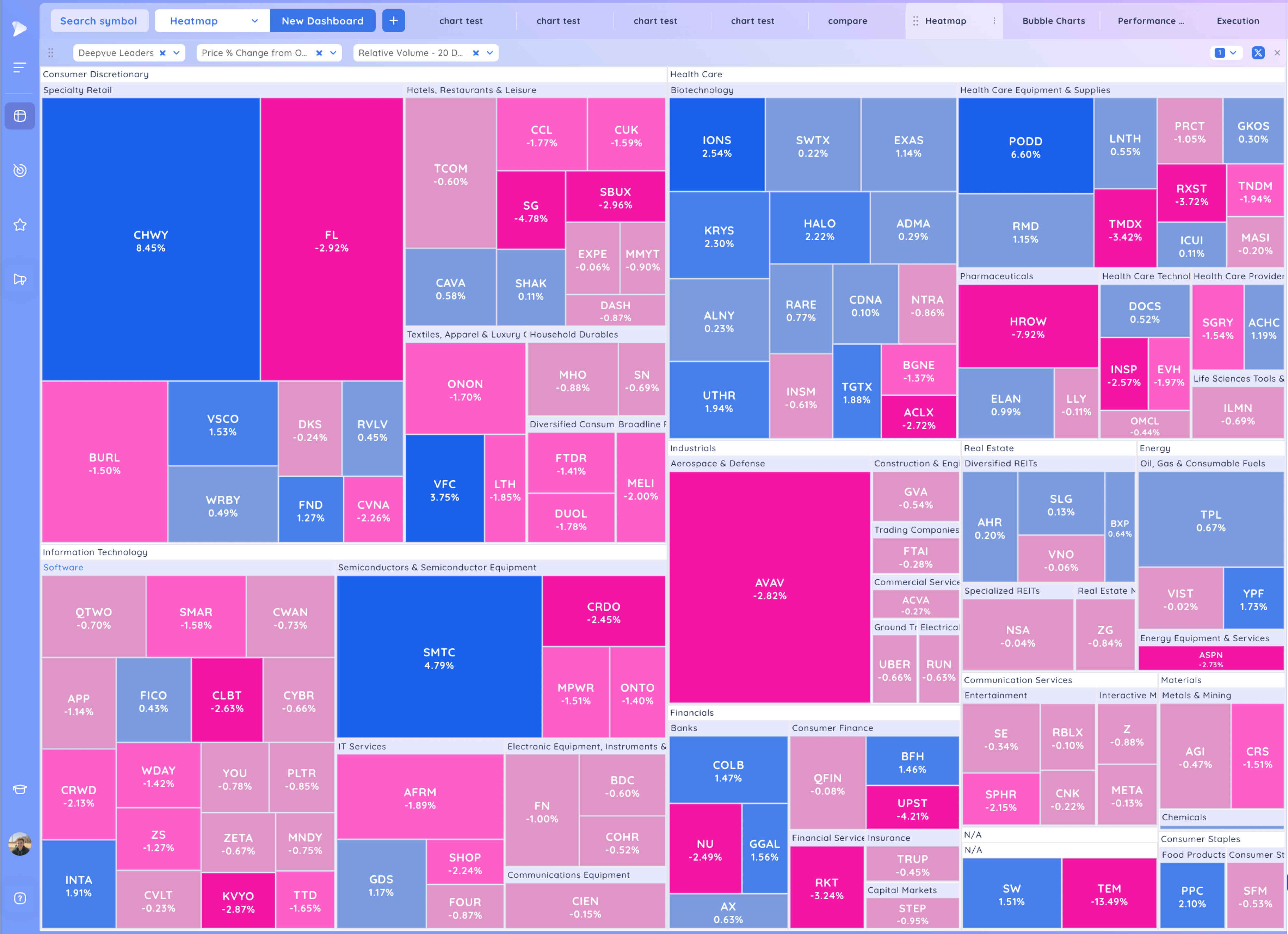

CAVA inside day. Could not yet push the gap

SG continuation down after neg expectation breaker and HVC failure

DOCS still near 36

CYBR wider range day, see if it can hold this handle

PRCT still building a flag

FOUR flagging, needs to resolve that fade bar

LLY high flag but fade signs

KVYO resolving down from double inside

META pulling back to the 21ema

Market Thoughts

NVDA is the leader of the market. We’ll have to see how it and the market responds to the gap down. Be prepared for any scenario.

Day by Day – Managing risk along the way