Chop Before Jackson Hole? – Stocks to Watch

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 20, 2024

Market Action

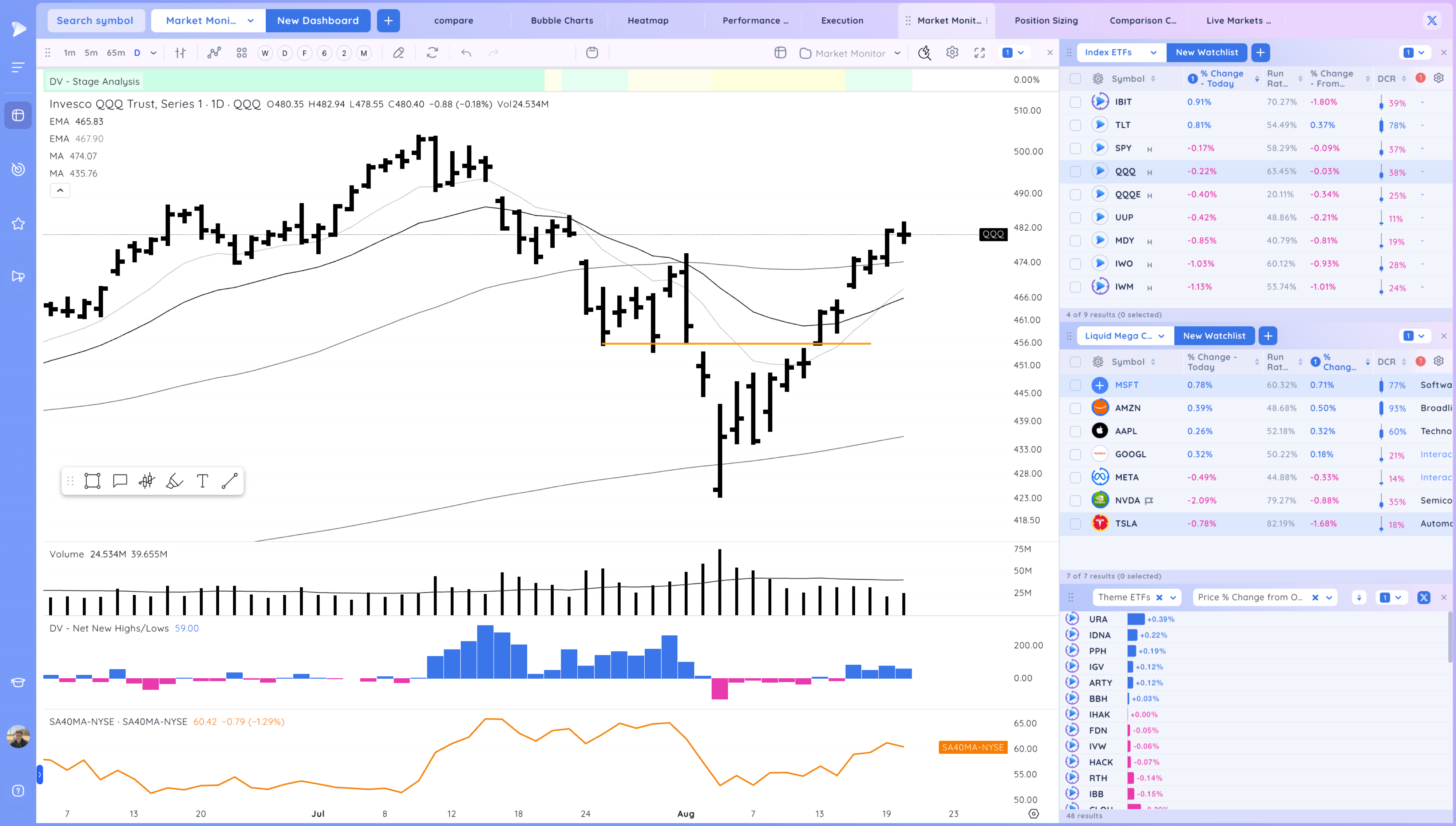

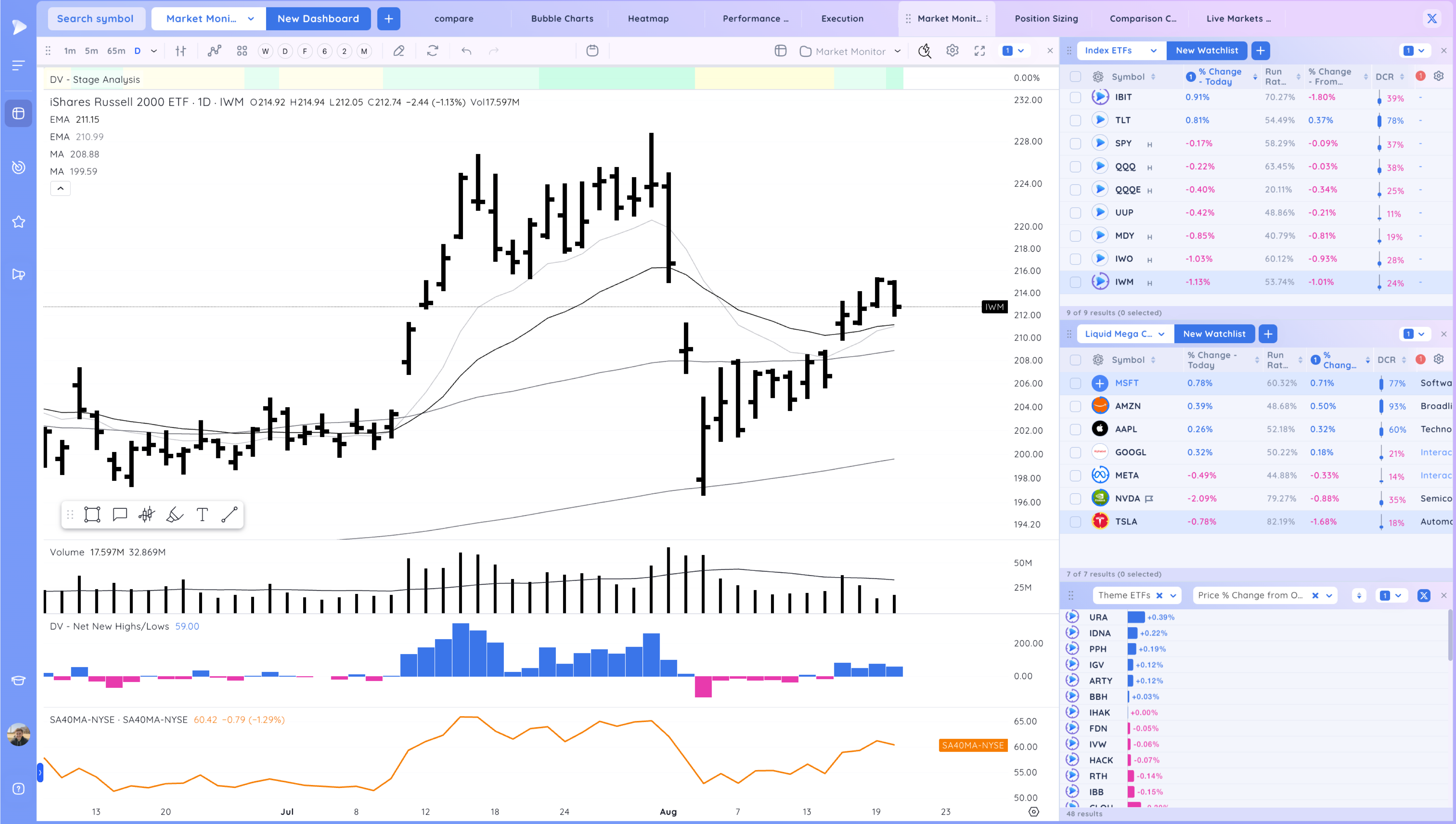

QQQ – A bit of a pause and close off highs but an overall tight day

IWM – weaker, undercutting yesterday’s lows. More reminiscent of stocks on my watchlists

Market Corrections Case Studies

Most of you have probably already read through these but I will include them daily until we resolve the correction

…

Here are the two case studies of 2018 and 2020 that provide examples of what you can expect form a correction just in case you haven’t seen them yet.

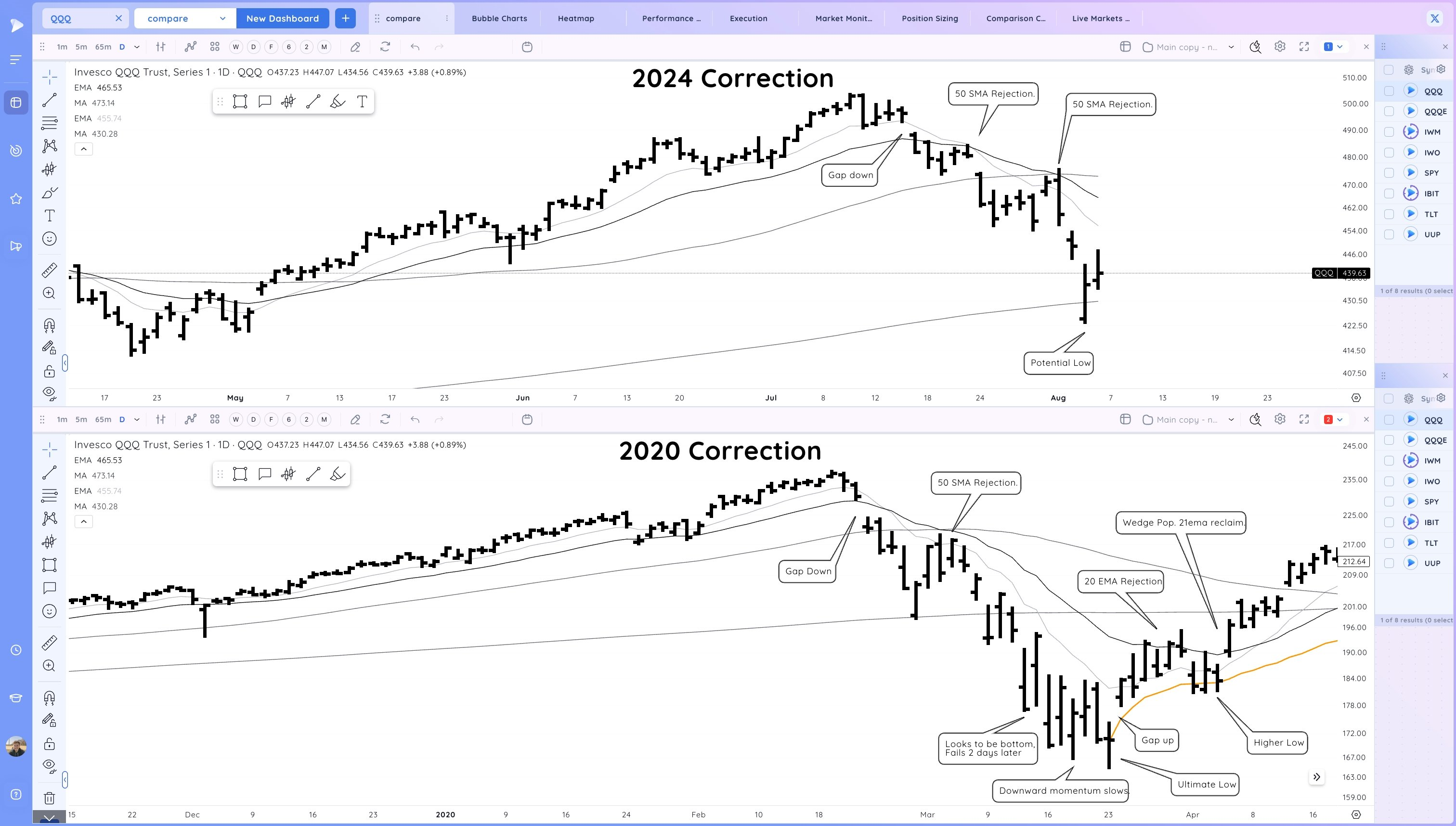

I’ve been taking a look at recent sharp corrections. Here is the 2024 Correction so far compared to the 2020 Correction. Patience (while still prepping for the uptrend) until test/reclaim moving averages from below + form a higher low. If active, tight leashes on trades

QQQ 2024 versus 2020 Case Study – All corrections exhibit similar type action.

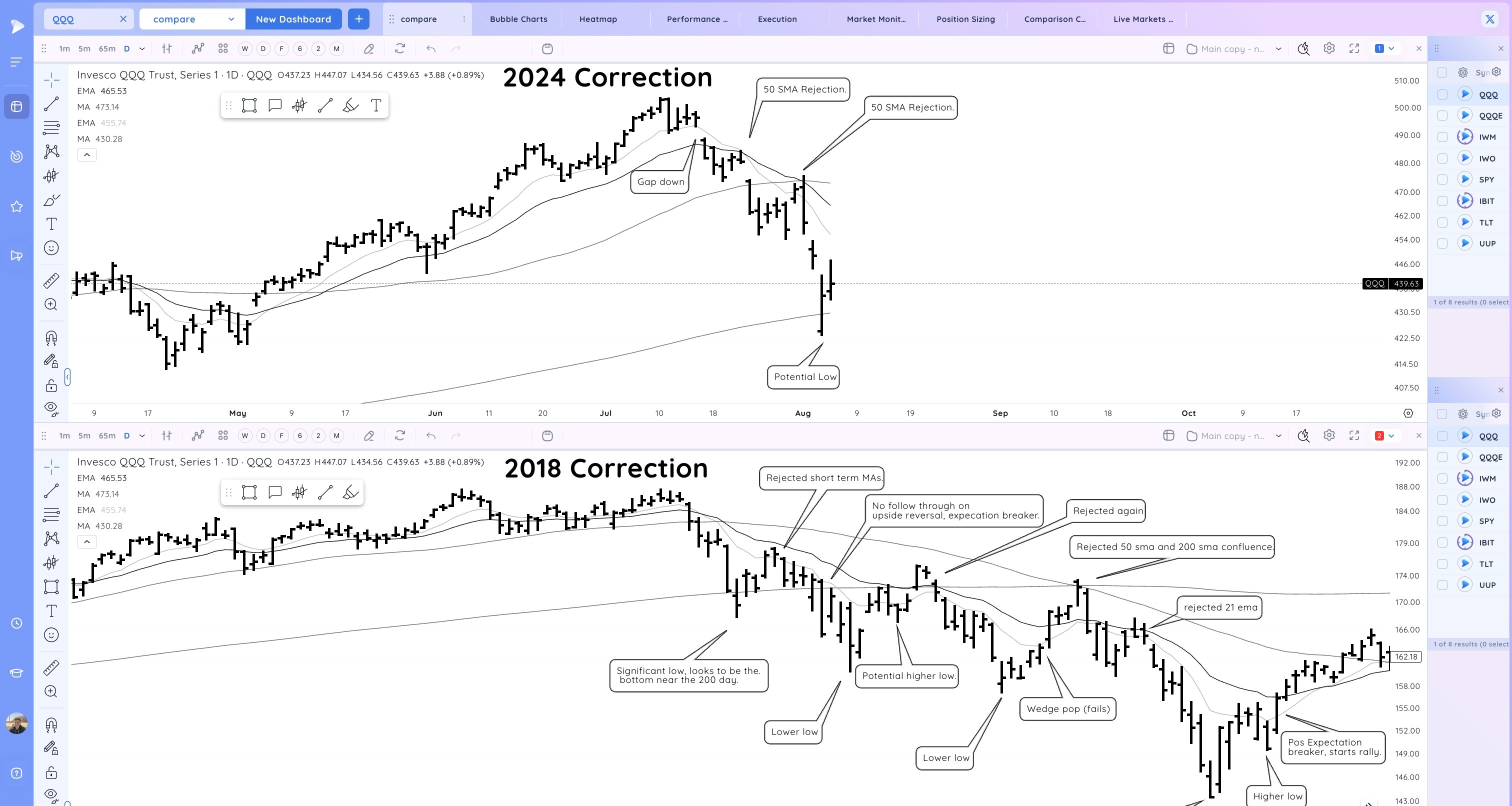

Here is the current 2024 Correction versus the 2018 Correction. Notice in that one there were similar points where it looked to be over, only for the rally to fail at key MAs. We’ll see how this current one ultimately resolves. The low could be in, one day at a time.

QQQ 2024 versus 2018 Case Study – Patience is required during corrections, taking it day by until the market proves itself.

Also key is how potential leaders are acting. As the correction ends they will be all setting up and breaking out through pivots.

Look for group action, big gap ups, volume surges, Higher lows as the market makes lower ones, reclaims of moving averages

Avoiding the chop and frustration is key during corrections. Experienced traders can look to pick spots, daytrade or see if levels holds during the day to hold through the close but less is more until the wind is back at our back.

With all that said you should be getting excited. We’ve had some great opportunities in 2023 and 2024 and this correction is setting up another one. The longer this goes on and the deeper the correction, the greater the potential for another uptrend that could change your year and life. You just have to do your homework and be ready mentally when that happens.

Trends (4/4 Up)

Shortest – 10 Day EMA – Up – Above Rising

Short-term – 21 ema – Up – Above Rising

Intermediate term – 50 sma – Up – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Key Stocks in Deepvue

NVDA inside day, on a pullback the 50day would be a great level to watch

LLY reconfirmation, continued RS

SBUX flagging after the gap, volume declining

ZIM inside day, close just above the HVC. Intraday Structure at 22.60, AVWAP from gap up at 22.80

APP tried to push from the stubby flag but not the best close

AXON flagging on declining volume

META flagging sideways, strongest of the megas

KVYO downside reversal but still in the range at the key level. Would love a gap down and then oops reversal

EXAS still tight against the 200. One day this will breakout or fail haha

IBIT Gap up but fell back into the range. One to keep watching as it is still tight below the 21ema

SG follow through down and no support at the HVC, needs to reset or snapback

ONON back to the pivot

Market Thoughts

Finally got some chop and downside reversal type action, no crazy selling to indicate this is more than just some normal action after a strong run up.

News event happening friday, we may see some chop into that and then high volatility.

Day by Day – Managing risk along the way