Wedging Higher? What’s Next for the Market

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 12, 2024

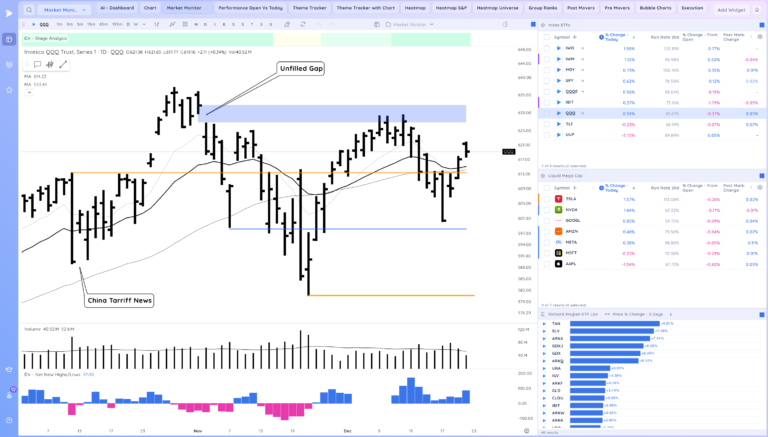

Market Action

QQQ – We have progressed strongly since the large gap down and 200 sma test. However the last 2 days have not been able to make much progress and we remain below a declining 21ema

We are stalling a bit at the prior gap down area and are wedging higher. Be ready for anything and caution is warranted until we get back above the moving averages

IWM – Weaker look, still in this range.

Market Corrections Case Studies

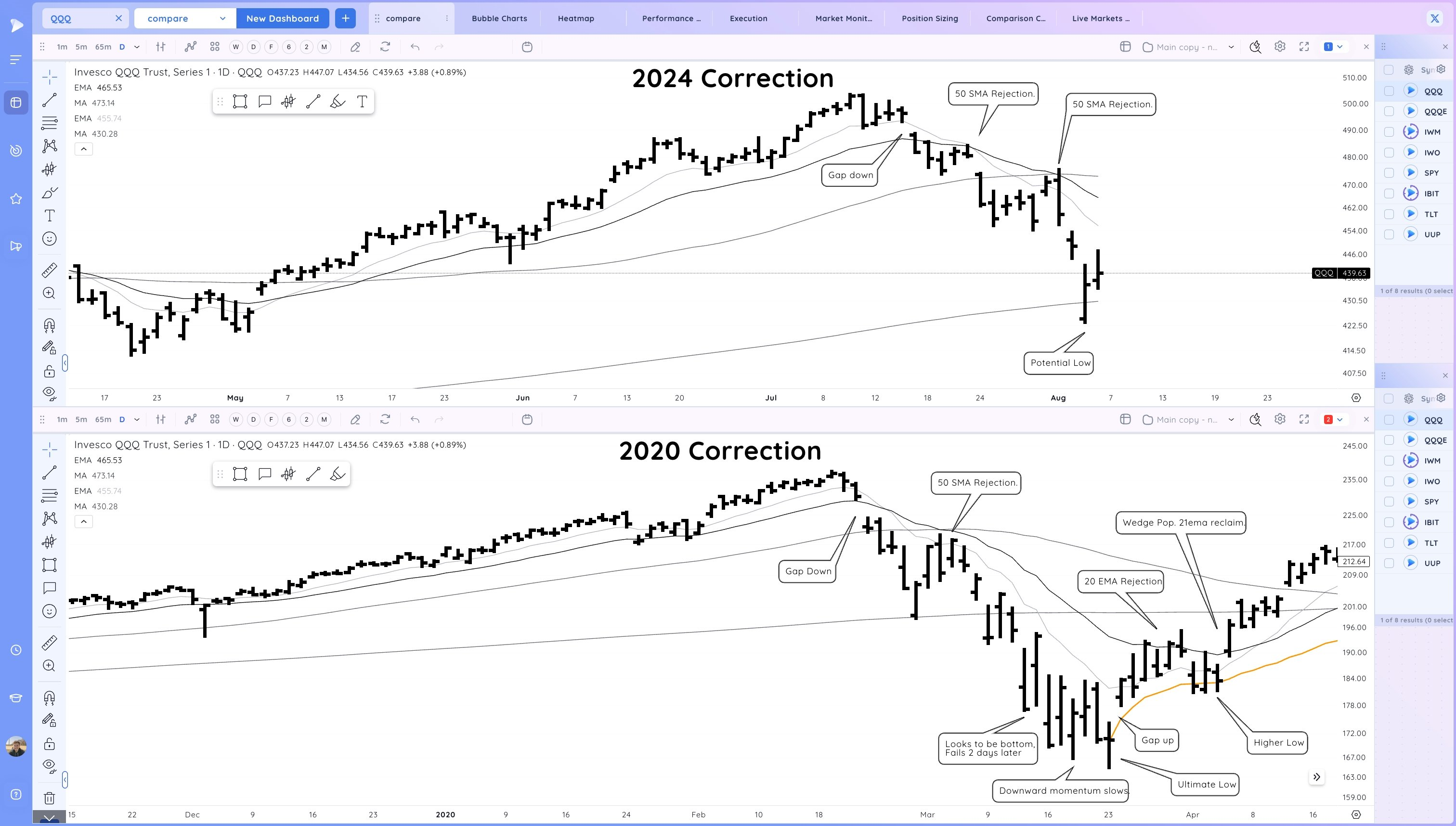

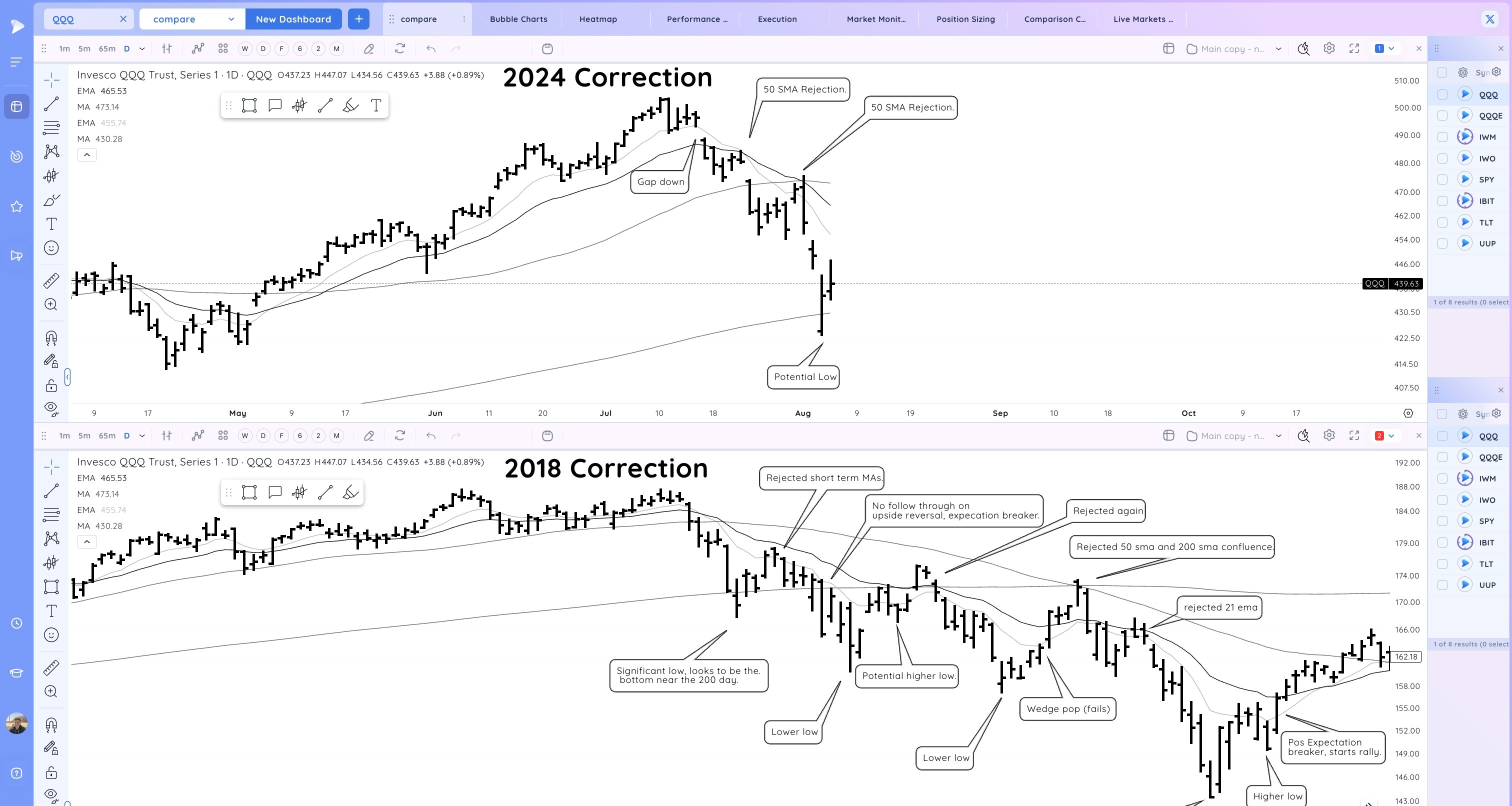

Here are the two case studies of 2018 and 2020 that provide examples of what you can expect form a correction just in case you haven’t seen them yet.

I’ve been taking a look at recent sharp corrections. Here is the 2024 Correction so far compared to the 2020 Correction. Patience (while still prepping for the uptrend) until test/reclaim moving averages from below + form a higher low. If active, tight leashes on trades

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

QQQ 2024 versus 2020 Case Study – All corrections exhibit similar type action.

Here is the current 2024 Correction versus the 2018 Correction. Notice in that one there were similar points where it looked to be over, only for the rally to fail at key MAs. We’ll see how this current one ultimately resolves. The low could be in, one day at a time.

QQQ 2024 versus 2018 Case Study – Patience is required during corrections, taking it day by until the market proves itself.

Also key is how potential leaders are acting. As the correction ends they will be all setting up and breaking out through pivots.

Look for group action, big gap ups, volume surges, Higher lows as the market makes lower ones, reclaims of moving averages

Avoiding the chop and frustration is key during corrections. Experienced traders can look to pick spots, daytrade or see if levels holds during the day to hold through the close but less is more until the wind is back at our back.

With all that said you should be getting excited. We’ve had some great opportunities in 2023 and 2024 and this correction is setting up another one. The longer this goes on and the deeper the correction, the greater the potential for another uptrend that could change your year and life. You just have to do your homework and be ready mentally when that happens.

Trends (1/4 Up)

Shortest – 10 Day EMA – Down – Below Declining

Short-term – 21 ema – Down – Below Declining

Intermediate term – 50 sma – Down – Below Declining

Longterm – 200 sma – Up – Above Rising

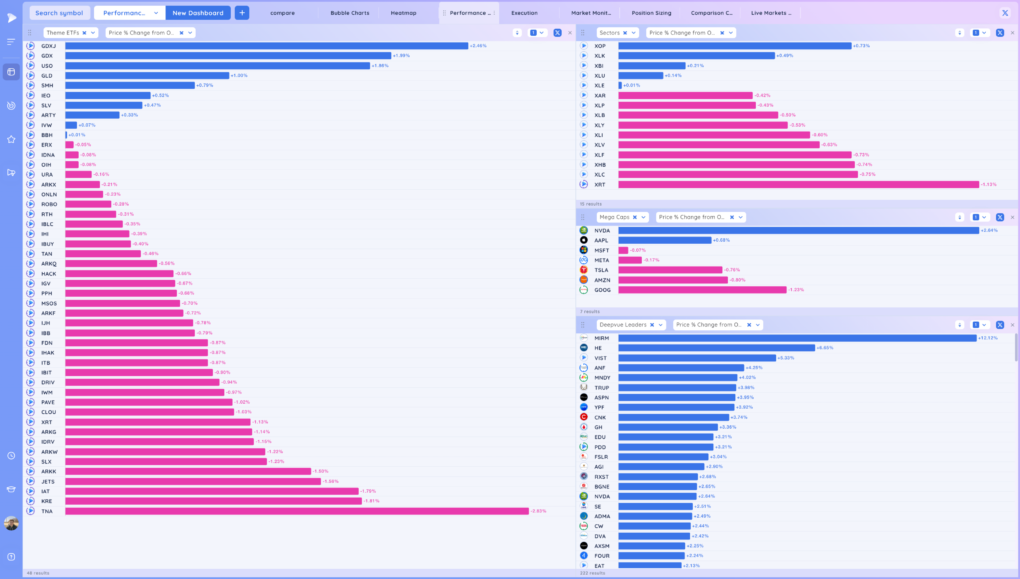

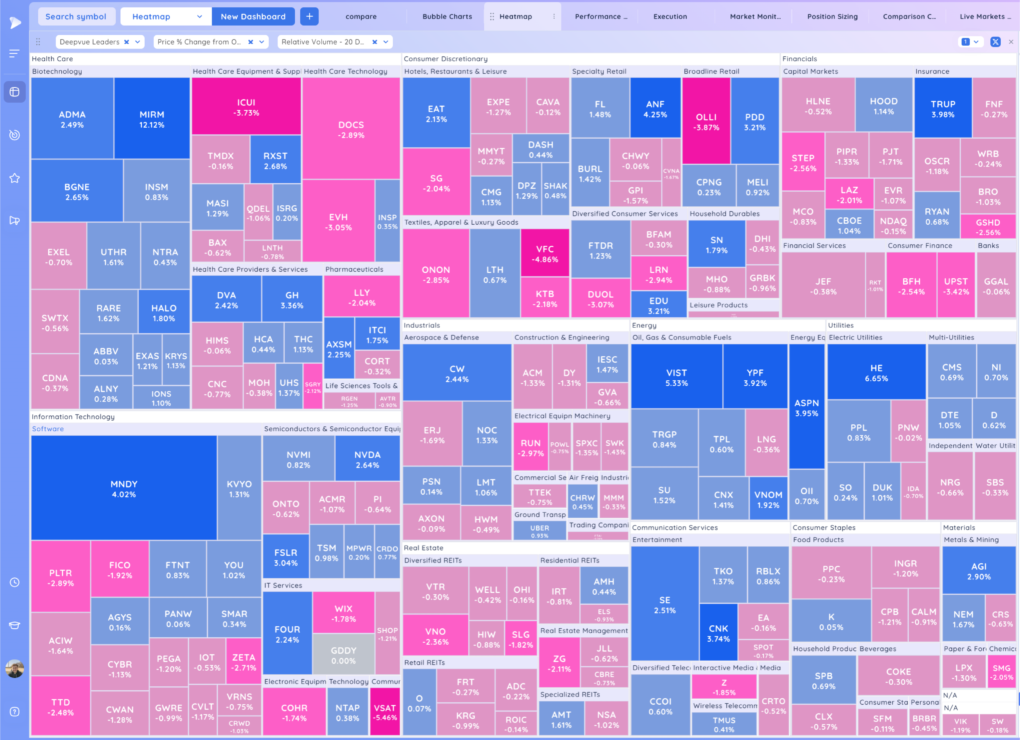

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

Miners the strongest from the open. Semis showing a bit too. Energy, Reits

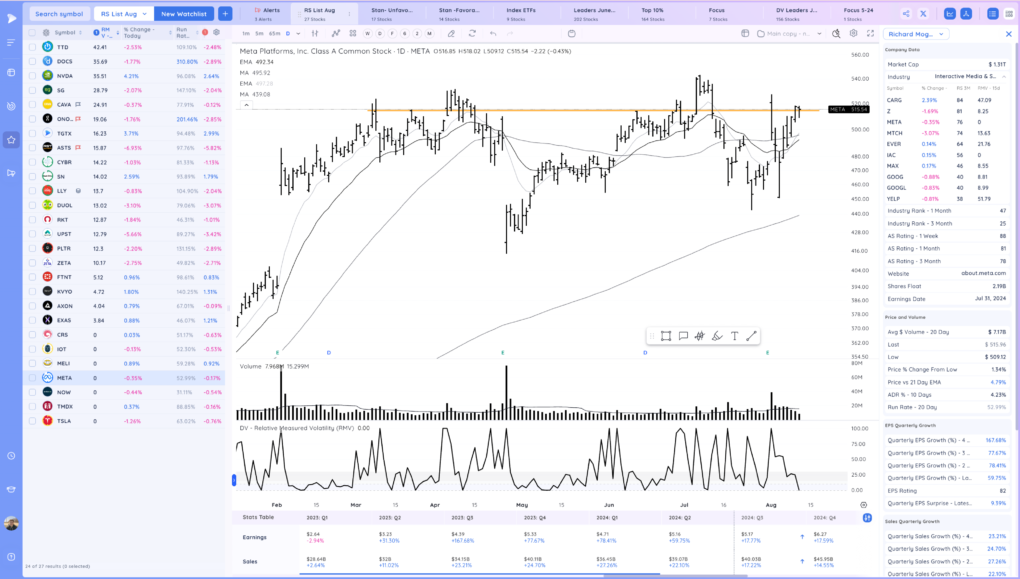

Key Stocks in Deepvue

NVDA strong action, but ran into the 21ema

SG not the strongest day, looking for it to flag out. HVC is a key level

PLTR downside reversal

AXON many recent gap ups and strong moves have similar type bars

EXAS tightening, biotech has been strong

DASH Moving up the right side. Strong estimates

MNDY Earnings gap

CPNG holding tight so far after the power move up

CAVA Tight day

TSLA still forming a tight range here below the 200 sma, can it pop through? Or break lower?

IOT tight action near the key level

META near the base 90% line tight day

Market Thoughts

We’ve had a strong move up since the large gap down and are now running into the declining MAs. Now we have to see if we can solidly form a higher low and pop through or if there is more downside

Keep an eye on stocks that are showing RS and group rotation each day. That will provide some useful tells outside of analyzing the indexes.

Day by Day