4 Charts to Watch Tomorrow

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: August 1, 2024

Written by: Ameet Rai

Never miss a post from Rai!

Sign up to get instant notifications when I publish a new post.

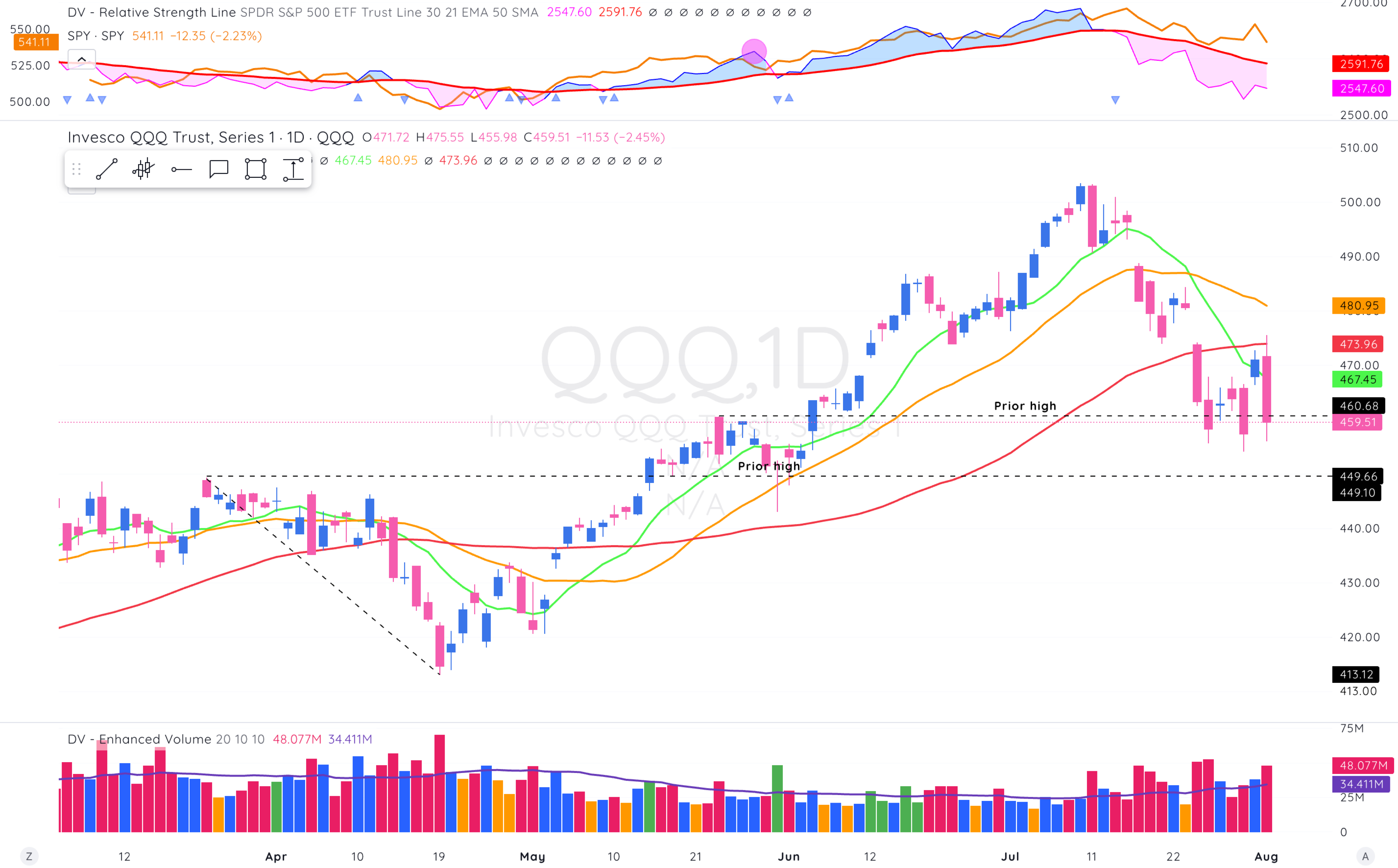

QQQ — As I stated in the last post, not much has changed on the Qs. I have pasted the same comment below. Develop discipline and patience in your rules it’s the only way to profit consistently from the markets.

The Qs remain below the 50-day SMA. Nothing good happens below the 50-day, so continued patience is required to wait for the right pitch to hit a home run on. If you are lacking patience, the market will likely teach you in its own ways (experience over time) on why it’s best to stay on the sidelines as volatility increases.

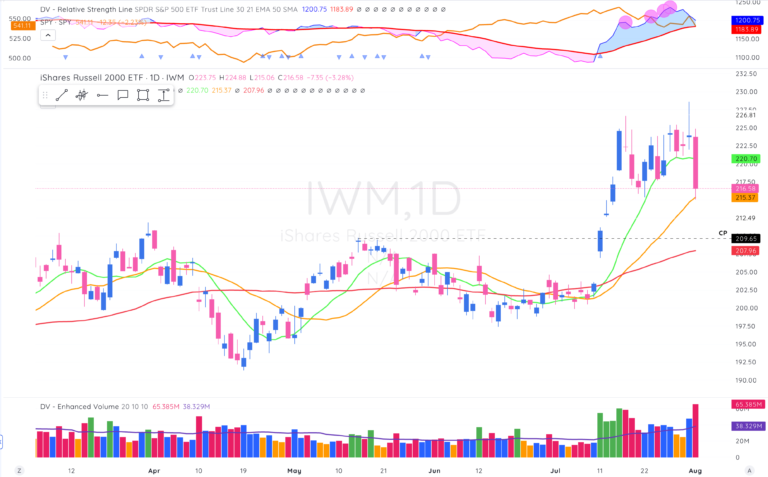

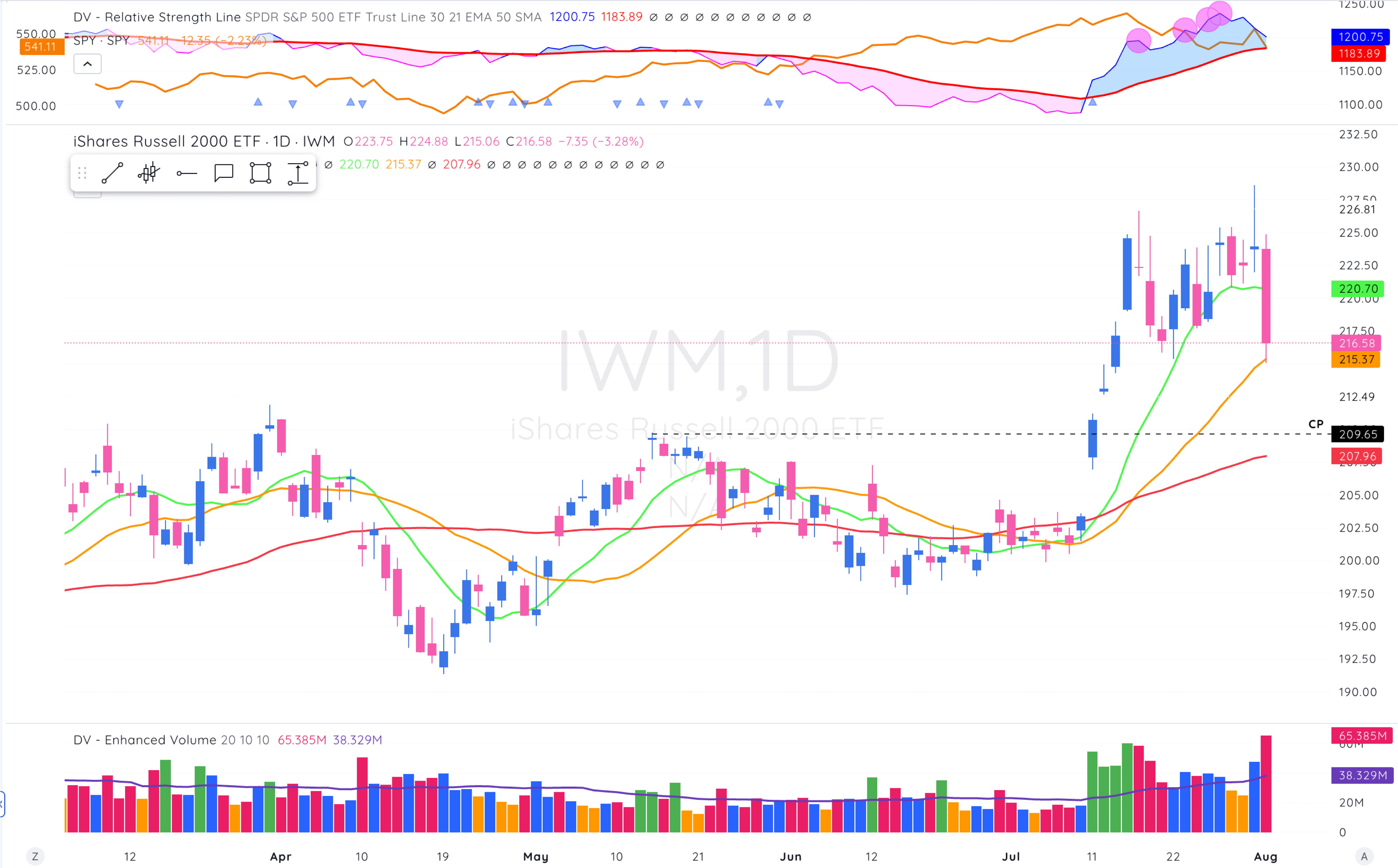

IWM – The Russell breaks below the 10-day in a single bar and straight to the 21-Day SMA. More watch as see mode to see if it remains the leading index with the

62.5% RS Screen – This is the screen I run in corrections; I want to know which stocks are holding up well and showing Relative Strength. This is list is not “actionable” it just gives me a universe of stocks showing Relative Strength 62.5% of the time from a 5 day to 20 Day timespan.

AGNC AMCR ASTS AUR BABA BCS BTE BTG C CFG EOSE ERIC ET FHN GE GERN GOLD HBAN HBI IAG IMNN INFY JPM KDP KGC KMI KO LYG META MO NEE NEM NGD NOK NUZE PCG PFE RF RIVN RUN TEVA TFC TOST ZAPP

PS: I’m excited about the webinar we are doing with Jason Shapiro on August 24, 2024 at 11am EST. Check it out here.