Maximize Your Profits: The Ultimate Guide to Moving Averages

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: July 13, 2024

Have you ever exited a trade too early, either because you thought the top was in or you were afraid of losing open profits, just to watch the name climb higher without you?

We’ve all been there and know how frustrating and costly exiting trades early can be.

But what if you could stay in winning positions longer and capture more profit, simply by using moving averages?

What Are Moving Averages?

Moving averages represent the average closing prices over a specified period and play a key role for day, swing, and position traders. Moving averages can be implemented on any timeframe you choose — daily, weekly, and monthly charts, or even shorter timeframes like the 15, 30, or 65-minute charts.

No matter what timeframe you regularly trade off of, moving averages will help you quickly recognize the direction and strength of the prevailing trend.

Different Types of Moving Averages & Their Importance

Let’s now get a quick refresher on the different types of moving averages, and what scenarios they are most useful in:

Never miss a post.

Sign up to get instant notifications when we publish a new post.

- Simple Moving Averages (SMA)

This type calculates the average price of a security over a specific number of days, assigning equal weight to each price point. It’s straightforward and gives traders a clear view of the price trend over a set period. - Exponential Moving Averages (EMA)

EMAs give more weight to recent prices, making them more responsive to new information. This can be crucial for traders who need to make quick decisions based on the most recent price action.

SMAs & EMAs alike are useful for two main reasons:

1. Trend Identification

As we eluded to above, you can quickly identify the underlying trend of a stock or index by looking at the slope of the SMA or EMA in question. You can also quickly identify how strong the underlying trend is by analyzing the magnitude of the EMA or SMA’s slope.

Here’s an example:

In the above TSLA example, you can easily identify two different periods of price action using moving averages. In the first box, you can see a strong trend simply by looking at the slope of the moving average (blue line). In the second box, you can see the moving average is sideways, telling us that the trend in question is weak. It’s that simple!

Being able to identify the prevailing trend in a matter of moments using MAs helps you discern if the name in question will be one to watch for breakouts, adds on weakness, or a reduction of your position if the name breaks down.

2. Trailing Stop-Loss

MAs are also incredibly useful because they allow for you to use them as a simple trailing stop loss indicator, which is the focus of the application section in today’s lesson. We’ll get into specific rules in a bit, but for now you’re probably wondering why moving averages you should use in the first place.

Let’s answer that now:

Which Moving Averages Should You Use?

While it’d be nice to give you a clear-cut rule set as to which moving averages you should use, it isn’t that simple (nothing is in the market!). But, we’ve come up with a 2-step guide to help you narrow down your choices here.

Step 1: Identify Your Timeframe

Before anything, you have to have a good grasp on what type of timeframe your strategy performs best under. Ideally, the strategy you trade aligns well with your personality & time commitments outside of the market.

- Day Traders: Shorter Moving Averages (4EMA, 10EMA, 20EMA on lower timeframe chart)

- Swing Traders (4EMA, 10EMA, 20EMA, or SMA on intraday / daily / weekly charts)

- Position Traders (10SMA, 20SMA, 50SMA, 200DSMA on daily, weekly or monthly charts)

Step 2: Identify The Stock’s Characteristics

Step 1 is important, but Step 2 is a must. If you’re using a 10SMA to manage a position but the stock in question regularly finds support at the 20EMA, you’ll be shaken out and not make any money using MAs.

It’s a must to identify which moving averages the name you’re looking to build a position in usually respects. This can easily be done by looking to the left (at the stock’s recently traded history!).

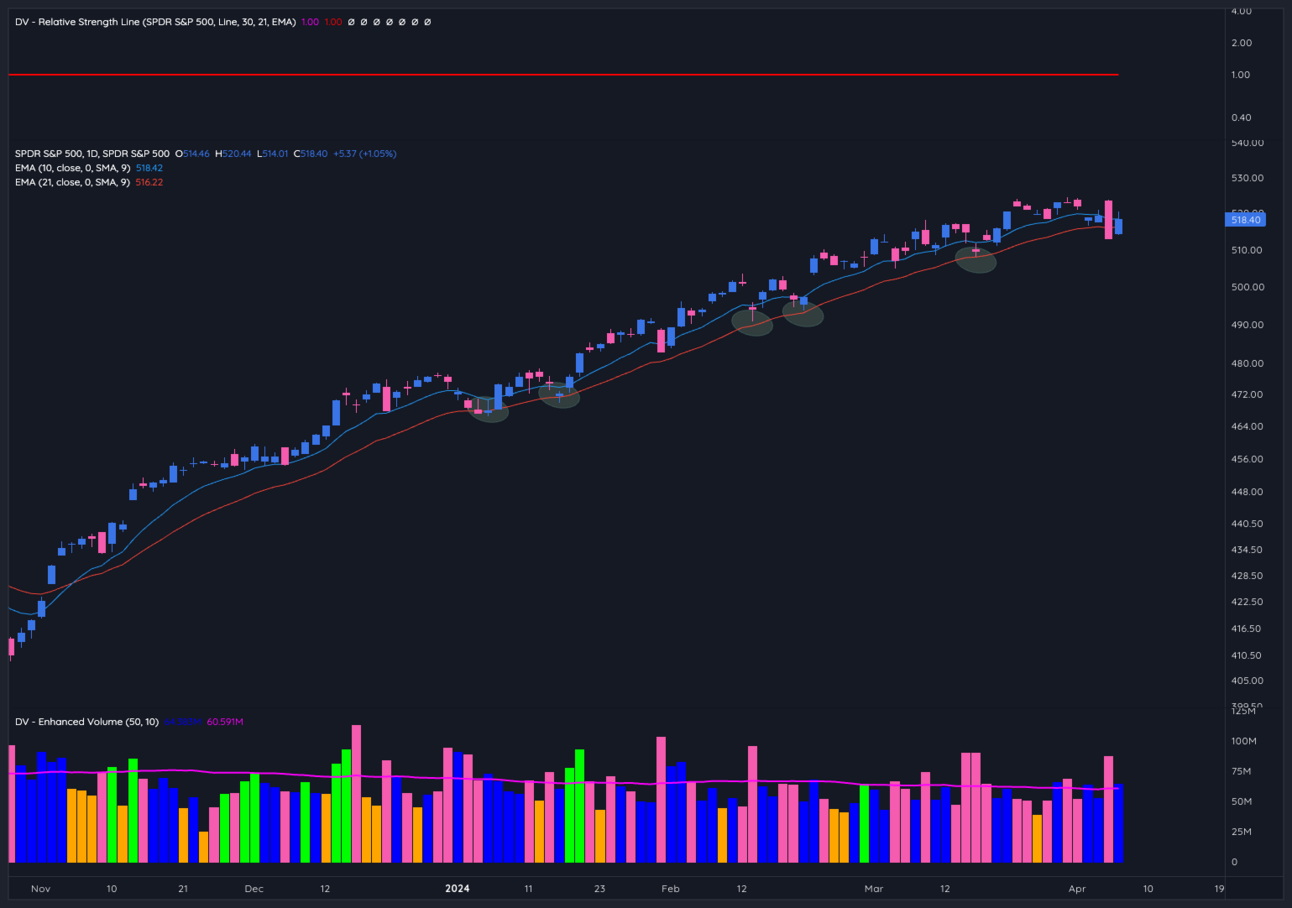

As you can see in the $SPY example below, the 10EMA (blue line) acted as support early in the run from November until the start of the new year. But as time went on, the 21EMA (red line) has been reliable support, with mutliple shake outs now occurring as price undercuts the 10EMA regularly.

BONUS Step 3: Oliver Kell’s Moving Average Template

If you still don’t know which moving averages you should use, we’ll give you the MA template that US Investing Champion Oliver Kell implements on a daily basis over at the Swing Report.

- 10EMA

- 20EMA

- 50SMA

- 200SMA

These should be more than enough to get you on your way as you navigate the right MAs to use for you and your system.

Let’s now get to the actionable piece of today’s lesson:

3 Distinct Sell Rules Using Moving Averages

We’re going to break this section into 3 separate pieces, first focusing on offensive sell rules using MAs, then defensive sell rules, and then finally adding to current positions if price holds the MA in question.

Offensive Sell Rules: Extension from Moving Averages

When your position is significantly extended from a key moving average, it might be time to consider taking some profits off the table. This ‘extension’ indicates that the stock may be overbought in the short term and that a pullback/consolidation period may be in store.

For example, if a stock is stretched 10-25% (or more) above its 10EMA or 20EMA, it could be a signal to sell a portion of your position. This allows you to lock in gains and hold for any pullback that may be on the horizon.

Here’s an example with $SMCI from 2024:

If long from the breakout, you easily could have used this area (or any similar extensions prior) as a point to sell into strength. Since that period we can see price has not gone much higher…

Common question:

Is there an exact percentage I should be looking for to sell portions of my position into strength at?

The answer is no, there is not an exact percentage that will be the same on every single stock. Just as we spoke about in rule 2 above, each stock trades on its own merit. Extensions in some names will be higher than others, it simply depends on the historical price action of the stock in question.

Defensive Sell Rules: Breaking of Moving Averages

While offensive extension sell rules look to capture gains and take advantage of strength in your current positions, you can also use moving averages to keep you in names when the action is good and get out when action is poor (protecting from further downside but giving the opportunity to stay in the position if price resumes higher).

Here’s a good guide to implement if you’re a swing trader:

- Sell a portion of your position on a break below the 10EMA (if price has respected this area in the past)

- Sell the final portion of your position on a break below the 20EMA (if price has respected this area in the past)

This allows you to still capture upside movements if price is to break the 10EMA but stays above the 20EMA, and if it breaks below both you know the short and medium trend has weakened significantly.

BONUS RULE:

To navigate the volatility and avoid premature exits, consider the rule of two closes below the moving average before executing a sell.

This means if the stock closes below a significant moving average (like the 10, 20EMA or 50SMA) for two consecutive sessions, it may be time to defensively exit the position to protect your gains and limit losses. If it only closes below that level for a single session, you can continue to hold and see if it bounces back the following day.

The example above is the daily chart of AMD from 2018. Price gapped above the 10EMA in late July and would then undercut this level intraday the third week of August. Using a close below (or two closes below) the moving average rule keeps you for an extra 50% gain.

Adding To Positions: When to Increase Your Position After Price Holds MAs

Now that we’ve talked about offensive and defensive sell rules using MAs, we can now quickly cover the topic of adding back to your position if price holds above the MA in question.

Here’s what you should be on the lookout for:

- A low volume retrace to the MA in question

- 2-3 days of consolidation near or at the MA

- Price compression (hint: look for an inside day!)

A mistake we see a lot of traders make is blindly buying more shares just because a stock retraces to a moving average.

This makes managing risk difficult as you don’t have a clear level to play against nor do you know if the trend will resume upwards yet. We want to be adding after price tells us there is more buying pressure, not before.

Here’s a good example, using NFLX from 2018:

As you can see, implementing each of the different sell rules using MAs we’ve learned today can be a powerful strategy when implemented correctly!

Putting it all Together

Boom! We’ve covered a lot today. Here are the actionable takeaways you’ve now mastered:

- Moving averages can be useful indicators to identify the direction & strength of the prevailing trend

- Moving averages can be used as key indicators for offensive & defensive sell rules

- Moving averages can also be used as critical levels to add shares against

By now you can clearly see how profitable it can be to implement moving averages into your overall day, swing, or position trading strategy.