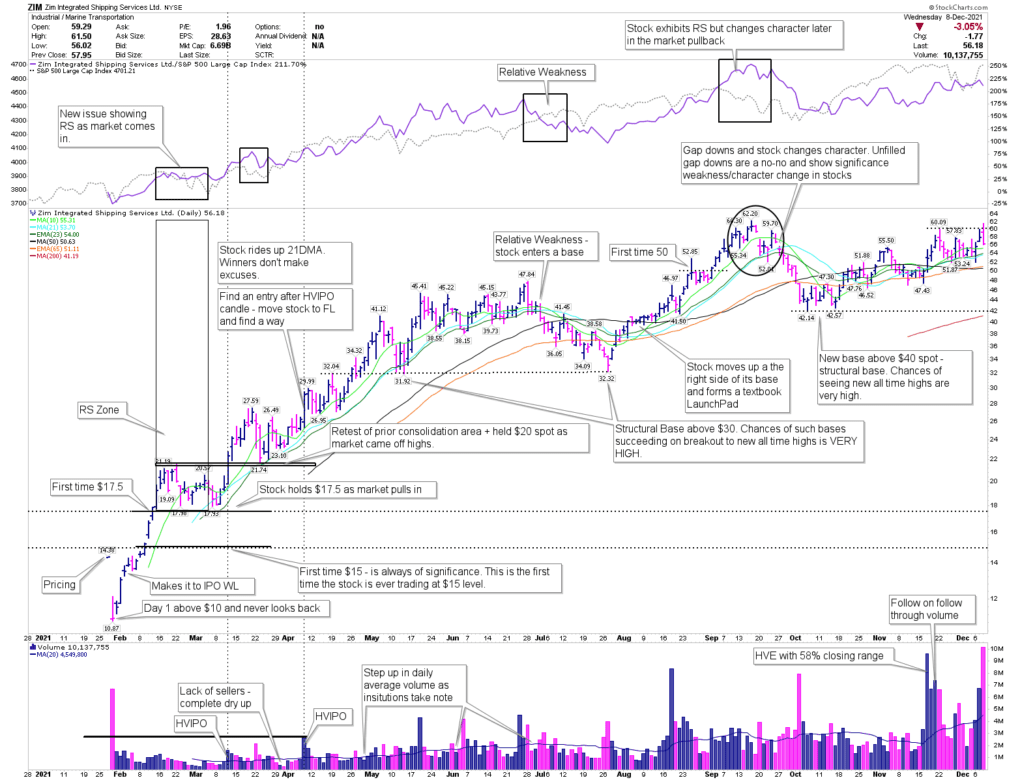

ZIM MarkUp – 2021 Winners

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: December 8, 2021

1 minute

Chart

Click on the chart below to expand.

Never miss a post from Rai!

Sign up to get instant notifications when I publish a new post.

Price and Volume Characteristics

Process

- IPO Week (first 5 sessions up) stock would make #TLIPOWL

- Can be on #TLGappersWL on HVIPO candles in March and April 2021.

- RS Zones on market pullbacks, the stock would make RS Lists.