10 Lessons I Learned While Working With William O’Neil

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

Published: September 11, 2025

Ross Haber, co-founder of TraderLion, brings a wealth of knowledge from his time as a portfolio manager under William O’Neil, the legendary founder of CANSLIM®. In this article, Ross shares the invaluable wisdom and strategies he learned from his time with William O’Neil that shaped his successful trading career.

Never miss a new post from Ross Haber!

Stay in the loop by subscribing to the email list.

1. The importance of trading psychology and emotional/physical well-being

Trading psychology and physical/emotional well-being are probably one of the least discussed, yet most important aspects of becoming a successful trader.

However, the large majority of traders spend little time if any focusing on this aspect of their trading and instead, dedicate their time to methodology, technique, and “special indicators.”

Start by taking good care of your physical and emotional health. This means getting enough sleep, eating well, exercising, etc.

Next, pick up a couple of books and study trading psychology. Two excellent books on this subject are, “Trading in the Zone,” by Mark Douglas and “The Psychology of Trading,” by Brett Steenbarger.

2. The importance of sound rules to avoid emotional decision-making

Having a sound set of rules that are proven to work is essential to success in the stock market. Why is this so important? Two words. Human nature.

Without a sound set of rules to follow, especially during times of extreme volatility, the emotions of fear and greed will take over and greatly affect your decision-making.

3. Risk control (position sizing)

What most traders don’t realize is that a thorough understanding of how to manage risk is even more important than picking the right stock.

The best stock pickers on the planet have a win rate of about 60-65% and anyone who tells you differently is lying.

The fact is, when risk control and proper position sizing are employed, you can be right on your stock selection just 1/3 of the time and still make a fortune in the stock market.

4. Cash is a position

Jesse Livermore said, “There is the plain fool, who does the wrong thing at all times everywhere, but there is the Wall Street fool, who thinks he must trade all the time. No man can always have adequate reasons for buying or selling stocks daily- or sufficient knowledge to make his play an intelligent play.”

Unfortunately, 99% of the professional money managers out there do not understand this whatsoever. Yes, including the ones with MBAs from Harvard, CFA’s, etc.

For example, going to cash early in the year during the 2008 financial crisis and sitting tight until confirmation of an uptrend once again played out worked out extremely well.

Imagine taking your money from a fund manager that went to cash during that time and giving it to one of the many who wound up down 70% or so, as many fund managers did that year.

To them, paying a management fee for a fund manager to sit in cash makes no sense. They’d much rather give it to someone else who is “working.”

5. Post analysis of past trades and creating new rules. There is no one right way, just what’s right for you

The ultimate goal for every trader and investor should be to take a proven methodology and ultimately make it their own.

One of the best ways to do this is to consistently go through your prior trades, figure out what your mistakes were, and then create a rule, or rules to avoid making the same mistake again. After doing this for a while, you will eventually wind up with a personalized version of your chosen methodology.

No two traders view things the same way, even if they are following the same exact methodology. This is why WON finds value in having a group of portfolio managers managing his money, even though they are using the same set of rules and working off the same list of stocks.

6. Never doubt a follow-through day

It’s very easy to let your emotions get the best of you and not get invested when the market follows through, for one reason or another. This is most often a result of fear or an incorrect opinion. Hence, see Lesson #2.

Never forget, the market doesn’t care what you think, or how you feel. Doubting a valid follow-through day and not getting invested in time can be an extremely costly mistake. That is why we have sound rules and risk control in place.

7. No ego

A big ego is the biggest problem, especially if you trade for a living. Arrogant traders with huge egos all eventually implode.

WON was not shy about making this very clear. Not to mention, I have seen countless fund managers with enormous egos draw down 80-90% and go out of business. Unfortunately, this is rather common.

8. Properly interpreting the health and breadth of the market’s leadership

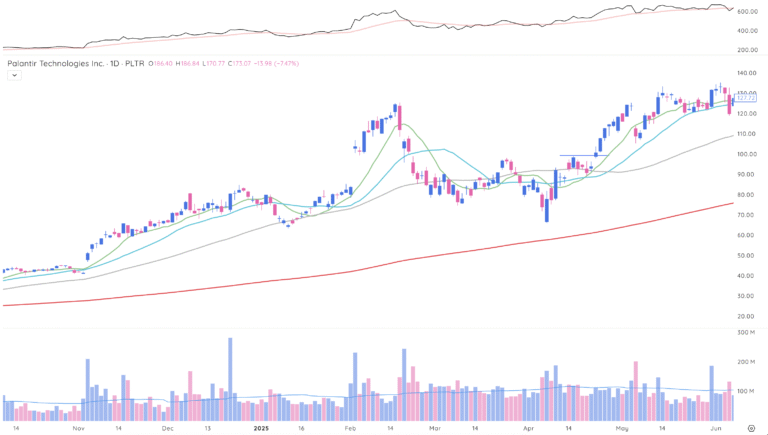

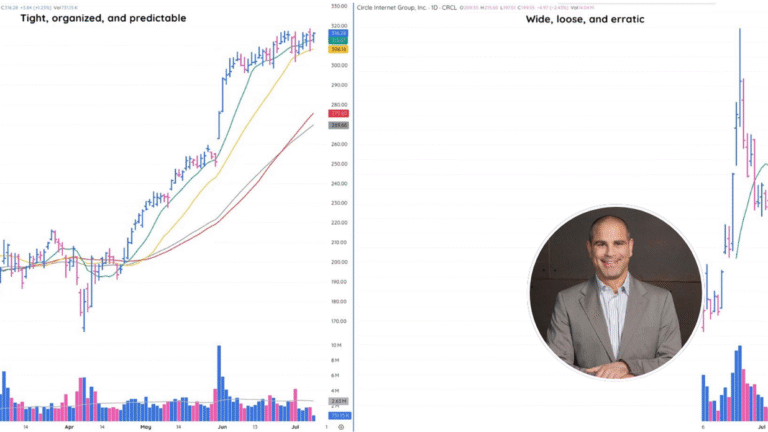

There is no better way to gauge the market’s health than by the price/volume action of the market’s leading growth stocks.

There are tons of great indicators out there for gauging the market’s health, but at the end of the day, they are all derivatives of price and volume. So, understanding how to interpret price/volume action is an extremely important skill to develop.

9. Always listen to yourself and avoid taking advice/tips from others

Develop the conviction to listen to yourself and never anyone else.

WON could give a room full of traders 50 winning trades in a row and the large majority will ultimately lose money.

Even if the CEO of a company has given you inside information that you know is 100% true, you still don’t know how the market will react. There are fund managers sitting in prison right now for trading on inside information and losing money for exactly this reason.

10. Always stay positive no matter what!

The ability to remain positive when things aren’t working as planned makes the difference between winning and losing.

Missing trades and losing money is all part of the game. How you handle it is key. Once you allow your psyche to turn negative, you might as well take the day off, because nothing good happens from negativity.

On the other hand, the next time a trade goes sour, you miss a breakout, or etc., if you stay calm, cool, and positive, remember that there is always opportunity ahead, and remain focused on what’s in front of you the likelihood of a positive result goes through the roof.

Continue Your Trading Education

Understanding the relative strength line is just one piece of the puzzle when it comes to finding

true market leaders.

Successful trading requires a deep understanding of technical analysis, market psychology, and

proven strategies that work

across different market conditions.

If you’re serious about taking your trading to the next level and want to learn from seasoned professionals like Ross Haber who’ve

consistently found market leaders using these exact techniques, you’ll want to check out our weekly market analysis.

TML Talk provides in-depth market commentary, real-time stock analysis, and actionable insights that help you identify

the strongest stocks before they make their big moves. You’ll get the same analysis and thought process that has helped

us spot winners like ELF and TSLA early in their runs.