Post-Earnings Flag Trading

Master the art of trading continuation patterns after earnings gaps, providing better risk management and entry opportunities

The post-earnings flag (or mini base) is a continuation pattern that emerges after a stock gaps up on strong earnings or another catalyst. Unlike buying directly on the initial gap, this pattern allows traders to wait for consolidation and refinement, providing a more manageable risk and higher conviction entry. This session will focus on identifying, entering, and managing post-earnings flags effectively.

Learning Objectives

By the end of this lesson, you will be able to:

- Recognize post-earnings flags and differentiate them from breakaway gaps

- Develop entry and stop-loss strategies for this pattern

- Understand the advantages of buying in pieces to manage risk

- Use short-term moving averages, such as the 5-day and 10-day EMA, to refine entries

What Is a Post-Earnings Flag?

Definition

A post-earnings flag is a short-term consolidation pattern that occurs after a stock gaps up on strong earnings or a catalyst. It typically lasts 1-5 days, allowing the stock to stabilize before continuing its upward move.

Why It Works

- Institutions use this period to absorb shares and build positions

- Consolidation near key moving averages signals strength, reducing the risk of overextension

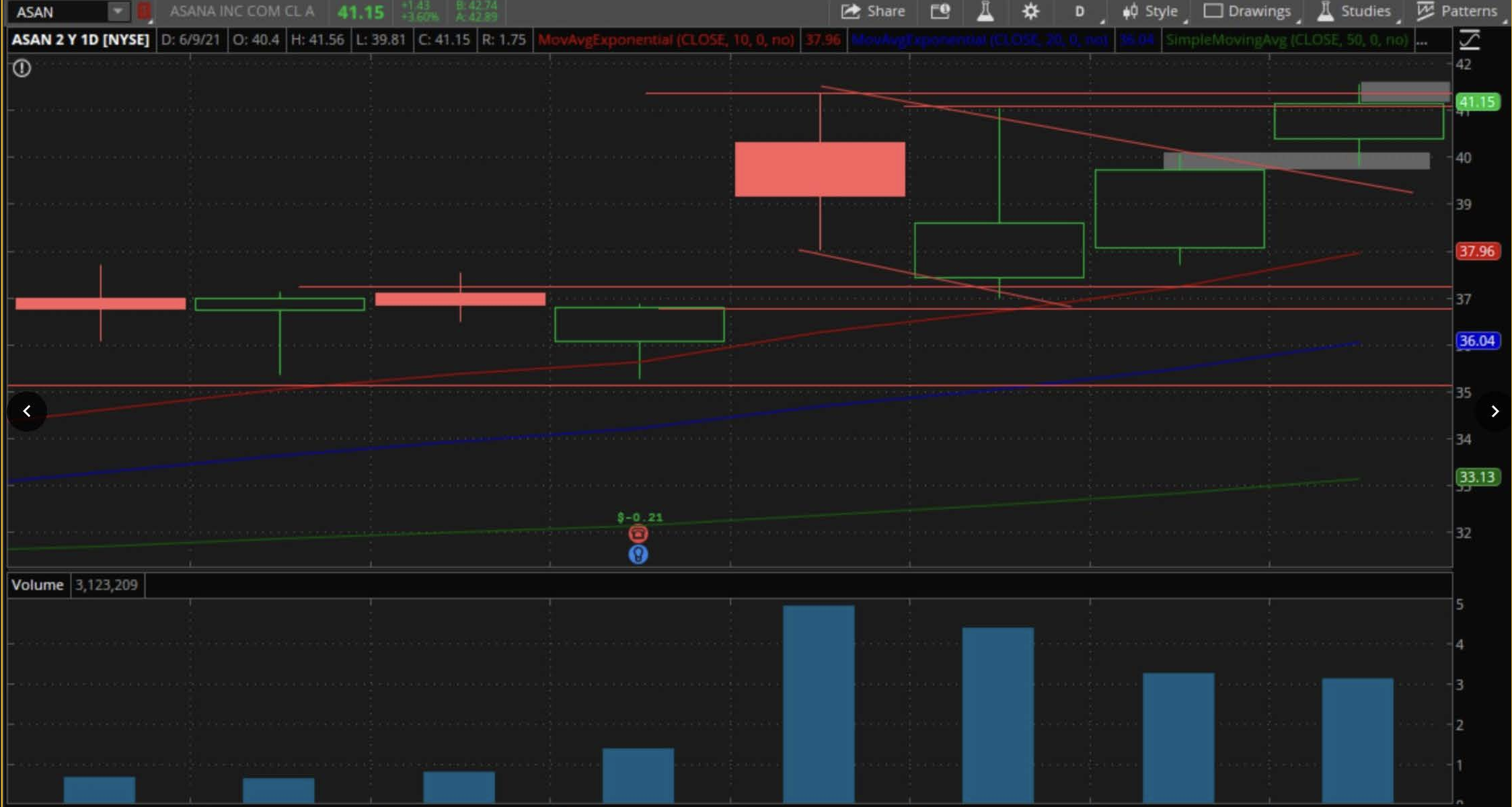

Example: Asana (ASAN)

The stock gapped up on earnings, consolidated near the 10-day EMA for a few days, and then broke out of a small bull flag, continuing its move higher. This pattern provided a secondary entry opportunity with a tighter risk profile.

Key Characteristics of Post-Earnings Flags

- Initial Catalyst: A strong gap-up on earnings or another major event

- Volume Behavior: Heavy volume on the gap day, followed by lighter volume during the consolidation phase

- Proximity to Moving Averages: The flag often forms near the 10-day or 20-day EMA

- Breakout Confirmation: A move above the high of the consolidation pattern on increasing volume confirms the breakout

Entry Strategies for Post-Earnings Flags

Primary Entry Points

- Pullback Entry: Buy during the flag’s pullback into key moving averages (e.g., the 10-day EMA)

- Breakout Entry: Enter as the stock breaks out above the flag’s upper trendline or the high of the initial gap day

- Lower Timeframe Entry: For aggressive traders, monitor intraday charts (e.g., hourly) to anticipate the breakout and manage risk more effectively

Stop-Loss Placement

- Place the initial stop just below the low of the flag or the nearest moving average (e.g., the 10-day EMA)

- As the stock moves higher, tighten the stop to protect gains

Managing the Trade: Scaling and Risk Management

Buying in Pieces

Divide your position into multiple entries:

- Initial position during the pullback

- Add to the position on the breakout

- Final addition as the stock clears the pivot high from the gap day

Risk Management

- Start small: Begin with a smaller position during the pullback, as the stock could dip slightly further

- Add size: Increase your position as the stock confirms strength by breaking out of the flag

- Adjust stops: Raise your stop as the stock moves in your favor to lock in gains while managing downside risk

Example in Action: Asana Trade Management

For Asana, you could:

- Buy a small position as it pulls back into the 10-day EMA

- Add more as it breaks out of the flag

- Top off your position as it clears the gap day high, raising your stop after each addition

Refining Entries with Moving Averages

10-Day EMA

This is the primary moving average for identifying support during the pullback phase. Stocks often pause here before continuing higher.

5-Day Moving Average

- Can be used to track the stock’s short-term character

- Provides early signals of support, but trades off the 5-day MA may require more patience before the stock resumes its move

Reflection

Why might buying a post-earnings flag offer a better risk-reward profile compared to buying the initial gap?

Conclusion

Post-earnings flags provide traders with an excellent opportunity to enter high-momentum stocks with reduced risk. By waiting for the stock to consolidate near key moving averages, you can refine your entry, manage your position more effectively, and capture significant upside potential.

Patience is key. Let the stock stabilize after the gap, and use the consolidation phase to build your position and manage risk. Combining this with careful observation of volume and moving averages can lead to high-probability trades.

Action Items

- Analyze three IPO stocks that have passed their six-month lockup period. Look for earnings gaps and post-earnings flags

- Track these stocks for the next 1-2 weeks to validate the patterns and test your entry and risk management strategies

- Refine your trading plan to incorporate multiple entry points and stop-loss adjustments for post-earnings flags