You’ve learned the complete Market Cycle System.

You know how to identify cycles using the 21-day SMA. You understand the four phases and what to do in each. You know when to enter, when to exit, and how to size positions through the cycle. You’ve seen 12 years of data and historical examples proving the system works.

Now what?

The Complete System Recap

Here’s everything you need in one place:

Identifying Cycles:

- SPX/QQQ closes above 21-day SMA = up cycle begins

- SPX/QQQ closes below 21-day SMA = down cycle begins

- Use SMA (not EMA) for cleaner signals

Four Cycle Phases:

- Days 1-3: Early cycle, start with 50% exposure

- Days 4-7: Stress test, add or reduce based on action

- Days 8-15: Sweet spot, full exposure and active management

- Days 15+: Late cycle, start taking profits and reducing

Entry Strategy:

- Enter early (Days 1-3) with manageable position sizes

- Add after stress tests if stocks hold key levels

- Focus on 3-4 best ideas initially

Exit Strategy:

- Take partial profits on 15-20% moves

- Exit when stocks break key moving averages

- Reduce aggressively after Day 20 or in bear markets

- Cut losses quickly when setups fail

Position Sizing:

- Start: 50% invested across 3-4 positions

- Build: 80-100% after successful stress test

- Peak: Full exposure Days 8-15

- Reduce: 40-60% Days 15+

Cycle Duration:

- Average: 21 days

- Bull markets: 30+ days

- Bear markets: 13-15 days

Common Mistakes to Avoid

Going all-in on Day 1 You’ll get crushed on false starts. Always start with 50% exposure and let the cycle prove itself.

Not adapting to market character Bull markets need patience. Bear markets need aggression on the sell side. Don’t use the same approach in every environment.

Ignoring individual stock signals Even in strong up cycles, some stocks will fail. Cut them when they break technical levels. Don’t marry positions.

Fighting the cycle When the market breaks below the 21-day SMA, the up cycle is over. Don’t hope it comes back. Accept it and adjust.

Overcomplicating the system The 21-day SMA and cycle phases are enough. Don’t add 10 more indicators trying to “improve” it.

Your Next Steps

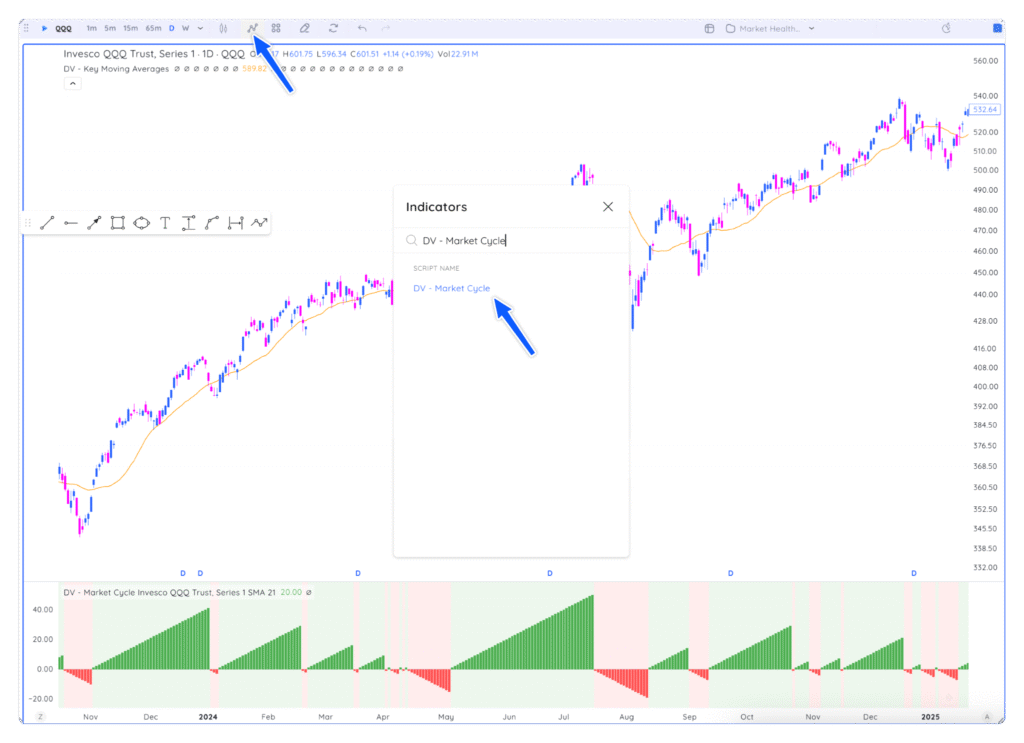

1. Apply the indicator in Deepvue Search “DV – Market Cycle” in your indicators library. Add it to your charts. Set it to your preferred ticker (SPY, QQQ, IWM).

2. Start tracking the current cycle Note what day we’re on. What phase are we in? What should your exposure be based on this?

3. Build your watchlists Once you’ve determined where we currently are, it’s time to start checking if your planned actions align with what the market’s doing. If so, great work. If not, always ensure your actions align with what you’ve learned over the past 7 lessons!

4. Journal your cycles Track each cycle: when it started, when it ended, how long it lasted, how you traded it, what you learned.

5. Start with small size Even if you’re experienced, use smaller position sizes for the first 3-5 cycles while you build confidence in the system.

Final Thoughts

The Market Cycle System is simple. It’s not easy, but it’s simple.

Most traders fail because they’re looking for complexity. They think the secret is some complicated indicator combination or pattern that nobody else knows about.

The secret is this: align yourself with the market’s trend and adapt as conditions change.

When the market is above its 21-day SMA, be long with appropriate position sizing for the cycle phase. When it’s below, be defensive or out completely. When cycles start getting shorter, be more cautious. When they’re running long in a bull market, be patient.

That’s it.

The system won’t be perfect. You’ll have losing trades. Some cycles will fail on Day 3. Some will run 50 days when you took profits at 20. That’s fine. Over time, the probabilities work in your favor.

Consistency beats complexity. Trade the system the same way every time. Let the market tell you what to do through the cycle signals. Keep learning and adapting based on what you see.

You now have a framework that works across all market environments. Use it.

Good luck.