The more you trade in accordance to the Market Cycle System, the more you’ll be on the right side of the market.

And since 3 out of 4 stocks follow the market’s general trend, you’ll likely make a significant amount of progress only trading long when we’re in an up cycle, and staying cash when we’re in a down cycle. You now know how to spot this and hopefully have started analyzing market cycles on your own charts.

But, here’s one of the issues that comes along with every single system in the markets (because nothing is perfect):

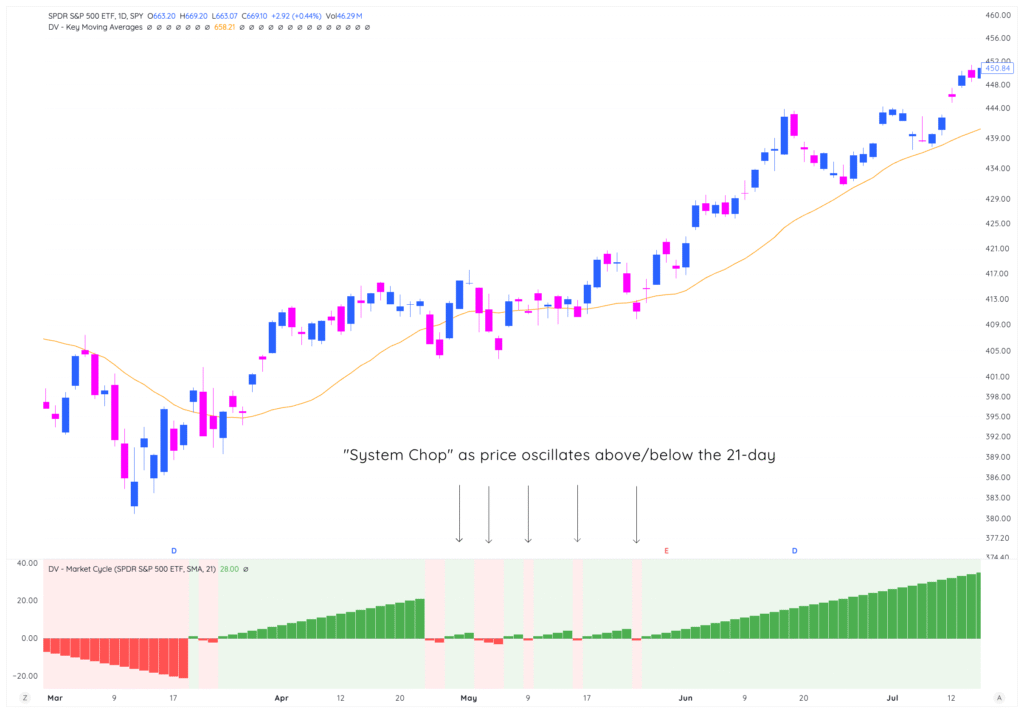

The Problem: False Signals and Whipsaws

You’ve seen this already in some of the examples we’ve given you, but there are periods in which the market will oscillate between an up and down cycle for a couple of sessions at a time. This creates system chop, which can lead to frustration when trying to get positioned.

Here’s what this looks like on the charts:

This kind of noise around the moving average is normal, but it can be costly if you’re making position changes on every signal. You end up:

- Buying high and selling low on whipsaws

- Missing the real moves while getting caught in the noise

- Losing confidence in your system

One of the best ways to reduce this “noise” is to compare the 21-day SMA vs the 21-day EMA.

SMA vs EMA: Which Gives Cleaner Cycle Reads?

Simple Moving Average (21-day SMA):

- Takes the average of the last 21 closing prices

- All days weighted equally

- More stable, less reactive to single-day moves

- Better for identifying sustained trends

Exponential Moving Average (21-day EMA):

- Gives more weight to recent prices

- Reacts faster to price changes

- More sensitive to recent action

- Can give earlier signals but also more false signals

For cycle counting, we prefer the 21-day SMA because:

- We want to identify sustained moves, not react to every wiggle

- The slightly slower response helps filter out noise

- Institutions often use SMAs for their decision-making

- It matches the timeframe of most intermediate cycles (3-6 weeks)

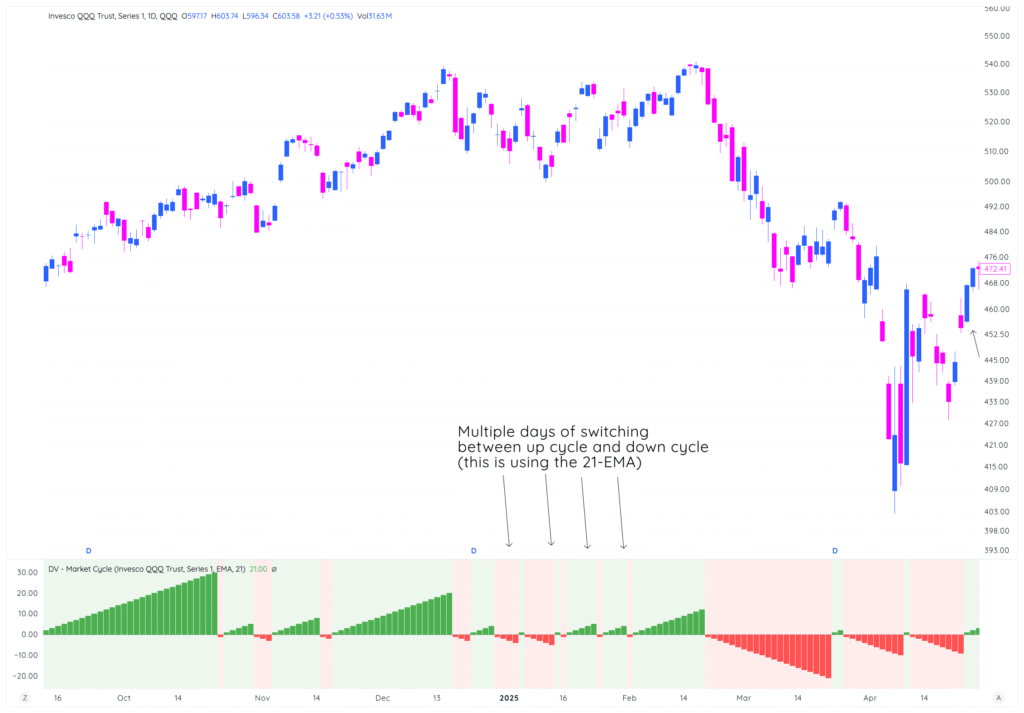

Visual Examples of System Chop Using EMA vs SMA

Here’s QQQ at the start of 2025, using the 21-EMA as our cycle indicator:

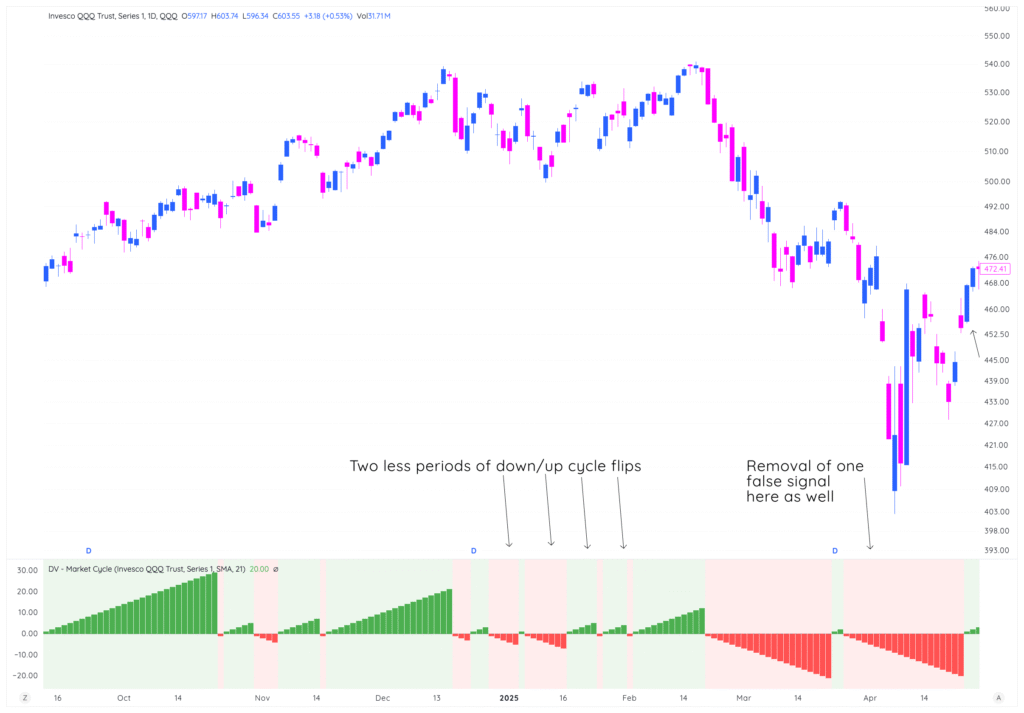

Now compare that with the 21-day SMA:

Slightly smoother trends in each direction – have removed two different periods of system chop just within this 4 month period.

Fine-Tuning Your Personal Market Cycle System for Reliability

Your task from this lesson is simple — don’t just take our word for it.

You’re going to have to get your elbows dirty, but here’s what you need to do:

- Apply the Market Cycles indicator to your Deepvue workspace

- Change the input to SMA vs EMA for your specific ticker (SPY, QQQ, IWM, whatever you feel most comfortable aligning your system with)

And simply go through how many signals from up to down and down to up cycles there are. If there are more signals that are just “noise” using SMAs, then consider switching to EMAs. If opposite, consider using SMAs more than EMAs.

We’ve done the study ourselves, which is why we use SMA especially on QQQ/SPY.

You can also mess around with the moving average length — 20 days, 23 days, etc.

The whole point is you should be building your own Market Cycle System, based on the education we’ve given you so far in the course!

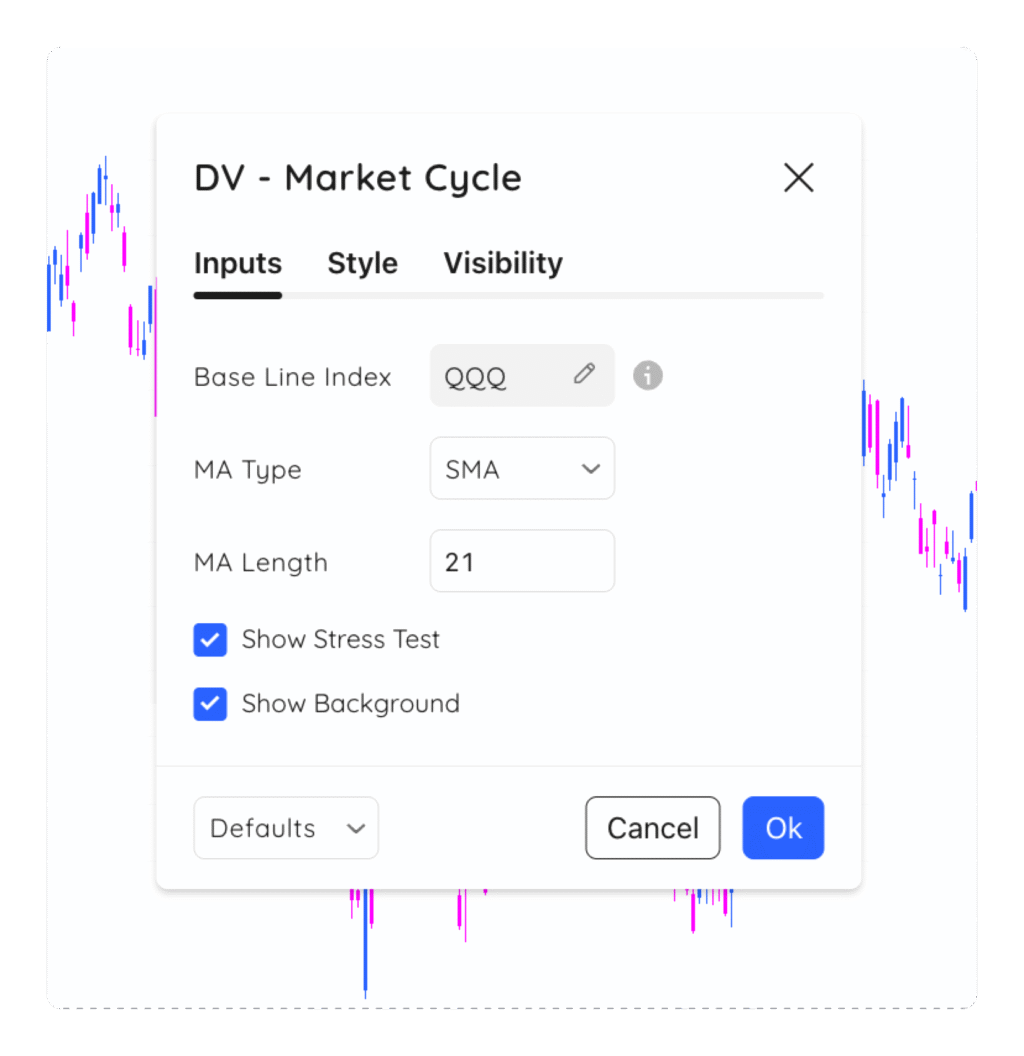

Using Deepvue to Track The Market Cycle System

We covered this yesterday, but here’s a little more granular look at the inputs you have control over on the Market Cycle indicator:

You have the flexibility to control:

- Your baseline Index (QQQ, SPY, IWM, whatever ticker you want)

- Your MA type (SMA vs. EMA)

- Your MA Length

And you can even plot Stress Tests with an orange dot on the indicator itself.

All of these inputs will help you craft the perfect Market Cycle System for you and your trading.

So here are the key takeaways from today’s lesson

- Not every cross of the 21-day SMA is a tradeable signal

- EMA vs. SMA highly depends on your style, timeframe, and what index you choose as the baseline

- Figuring out which is right for you is highly personal and requires work on your end

- Use the Deepvue indicator to make your analysis more simple as you find the perfect inputs for you and your personality

System chop is a part of trading — the goal is to reduce it as much as possible by analyzing what works best for you.

Looking Forward

Now that you have a clean system for identifying cycle changes, the next lesson covers the most important part: how to actually enter/exit positions using the Market Cycle system.

You’ll learn why going big early often beats building positions slowly, and how to let your stocks tell you whether you’re aligned with the cycle or not.