The Integration Challenge

You’ve learned Van Tharp’s mathematical foundation, progressive exposure, market cycle timing, edge-based scaling, and advanced techniques. Now comes the hardest part: combining everything into a coherent system that actually works for your personality, experience level, and trading style.

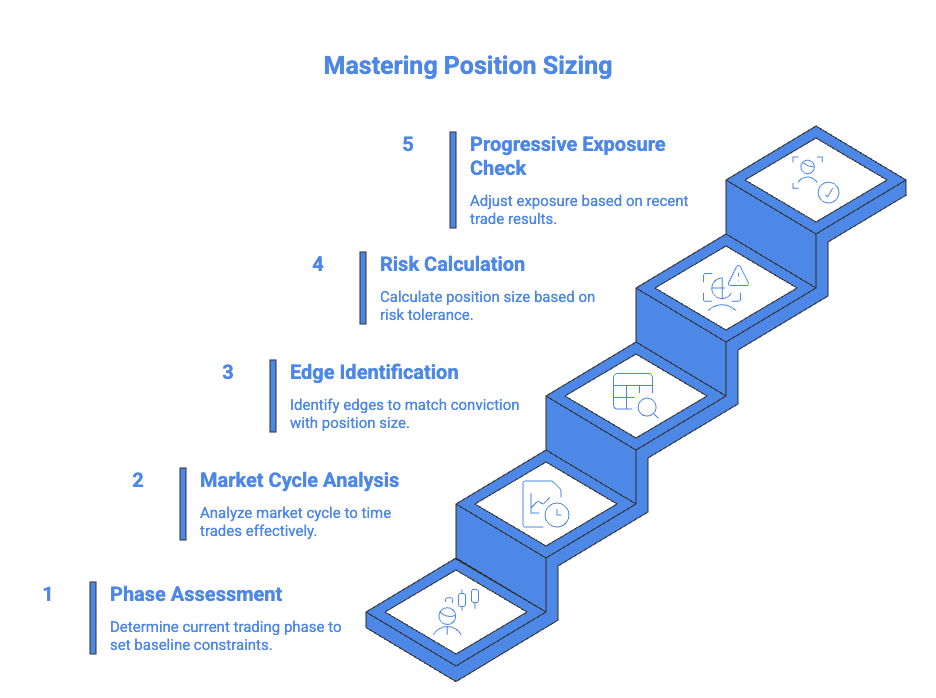

Your Position Sizing Decision Tree

Every trade requires multiple position sizing decisions.

Here’s the complete decision framework professionals use:

Step 1: Phase Assessment (Foundation)

Question: What’s my current trading phase?

- Phase 1: Maximum 8-10% positions, 0.5% account risk

- Phase 2: Maximum 12-15% positions, 1% account risk

- Phase 3+: Up to 20-30% positions, 1.5-2.5% account risk

This determines your baseline constraints for all position sizing decisions.

Step 2: Market Cycle Analysis (Context)

Question: Where are we in the market cycle?

- Early Cycle (Days 1-15): Full position sizes allowed, max aggression period

- Mid Cycle (Days 15-30): Take profits into extensions, be selective with new exposure

- Late Cycle (Days 30+): Reduce all positions by 25-50%

Market timing trumps individual stock analysis. Don’t fight market cycles with oversized positions.

Step 3: Edge Identification (Conviction)

Question: How many edges does this setup have?

- 0 Edges: No trade

- 1 Edge: 75% of base size

- 2 Edges: Full base size

- 3 Edges: 125% of base size

- 4+ Edges: 150% of base size

Your conviction level should match your position size.

Step 4: Risk Calculation (Mathematics)

Question: What’s my logical stop loss distance?

Formula: Position Size = Account Risk ÷ Per-Share Risk

Example: $500 account risk ÷ $2.50 stop distance = 200 shares

Always start with your stop placement, and then work backwards on sizing. You must know how much you’re willing to risk $ wise on every single trade!

Step 5: Progressive Exposure Check (Feedback)

Question: Are my recent trades working?

- Winning Streak: Can size up moderately

- Neutral Results: Standard sizing

- Losing Streak: Reduce all positions by 25-50%, and stop trading after 3-5 losses in a row.

Let your results guide your aggression level.

The Complete Position Sizing Checklist

Before entering any position, run through this systematic checklist:

Pre-Trade Analysis:

□ Phase Verification: Confirmed my current trading phase based on recent performance

□ Market Cycle: Identified current cycle day and appropriate sizing adjustment

□ Edge Count: Systematically counted setup edges (minimum 1 for Phase 2+)

□ Stop Placement: Located logical chart level for stop loss

□ Risk Calculation: Computed exact position size using account risk formula

□ Progressive Exposure: Checked recent trade feedback and adjusted accordingly

□ Correlation Check: Verified position doesn’t create excessive sector/theme concentration

□ Portfolio Heat: Confirmed total portfolio risk remains within limits

Execution Requirements:

□ Entry Price: Waiting for logical breakout trigger, not arbitrary prices

□ Position Size: Buying exactly calculated share count, not round numbers

□ Stop Order: Placed immediately after entry at predetermined level

□ Documentation: Recorded all sizing decisions and reasoning in trading journal

This systematic approach eliminates emotional position sizing decisions.

Common Integration Mistakes

Mistake 1: Technique Overload Trying to use every technique simultaneously. Start simple and add complexity gradually as you prove to yourself that you can trade effectively and profitably.

Mistake 2: Phase Mismatch Phase 1 traders using Phase 3 techniques. Advanced methods require advanced experience and emotional control.

Mistake 3: Selective Application Using the system only when convenient. Position sizing discipline must be applied to every single trade without exceptions.

Mistake 4: Static Thinking Building a system once and never adapting. Markets evolve, and your system must evolve with them.

Mistake 5: No Performance Tracking Not measuring whether your complete system actually improves results. Track performance by component to identify what works.

Building Your Personal Rule Set

Create written rules covering every position sizing scenario:

Market Condition Rules:

- “During market corrections, reduce all position sizes by 40%”

- “No new positions after 35+ day market cycles”

- “Maximum 3% portfolio heat during transitional markets”

Edge-Based Rules:

- “Minimum 2 edges required for any trade”

- “4+ edge setups get maximum allowed position size for my phase”

- “Reduce edge-based scaling by 25% during late market cycles”

Risk Management Rules:

- “Never risk more than 1% account value per trade”

- “Maximum 3 positions in same sector simultaneously”

- “Exit all positions if total drawdown exceeds 8%”

Progressive Exposure Rules:

- “After 3 consecutive losses, reduce position sizes by 50%”

- “Can increase sizes by 25% after 5+ consecutive wins”

- “Return to baseline sizing after any loss following size increase”

Write these down. Emotional decisions in real-time destroy systematic position sizing.

The Psychological Component

Even perfect position sizing systems fail without proper psychology:

Mental Rules for System Adherence:

- “The system is bigger than any individual trade”

- “Emotional decisions override systematic decisions”

- “Consistency beats perfection”

- “Small edges compound over hundreds of trades”

Dealing with System Doubt:

Every trader questions their system during losing streaks. Prepare responses:

- Review historical performance data

- Calculate statistical significance of recent results

- Adjust system based on data, not emotions

- Consider reducing size temporarily, not abandoning system

Building System Confidence:

- Track performance by system component

- Document successful system applications

- Review mistakes as system deviations, not system failures

- Celebrate consistency, not just profits

Key Takeaways

Position sizing systems integrate multiple components: phase assessment, market cycle timing, edge identification, mathematical risk calculation, and progressive exposure feedback. Each component must work together, not independently.

Build complexity gradually, starting with your appropriate phase system. Track performance by component to identify what actually improves results. Write down complete rules to eliminate emotional decision-making.

The path from small account to professional trader requires systematic position sizing applied consistently over years, not months. Master each phase completely before advancing to the next level.

Next Action: Choose your appropriate phase system and write down complete rules covering every scenario. Begin applying the complete system to every trade for the next 30 days. Track results by component and identify which elements consistently add value to your trading performance.

Your position sizing system determines your trading career trajectory more than any other factor. Build it systematically, apply it consistently, and refine it based on data rather than emotions.