The Master Class in Real-Time

As we covered in the last lesson — 3 out of 4 stocks follow the market’s direction. So to raise your chances of profitability and superperformance, you need to make sure you’re trading with the market, not against it.

Today’s lesson will show you how a multi-time US Investing Champion does exactly that.

We’re going to break down exactly how Mark Minervini scaled into the first correction post-COVID recovery, in September of 2020, and then his most recent progressive exposure masterclass in January of 2025. Incredibly valuable, and we hope you can pair the lessons you’ve learned in this course with what you’re going to master today.

Case Study #1: The 2020 COVID Bottom

Let’s start with the COVID Correction:

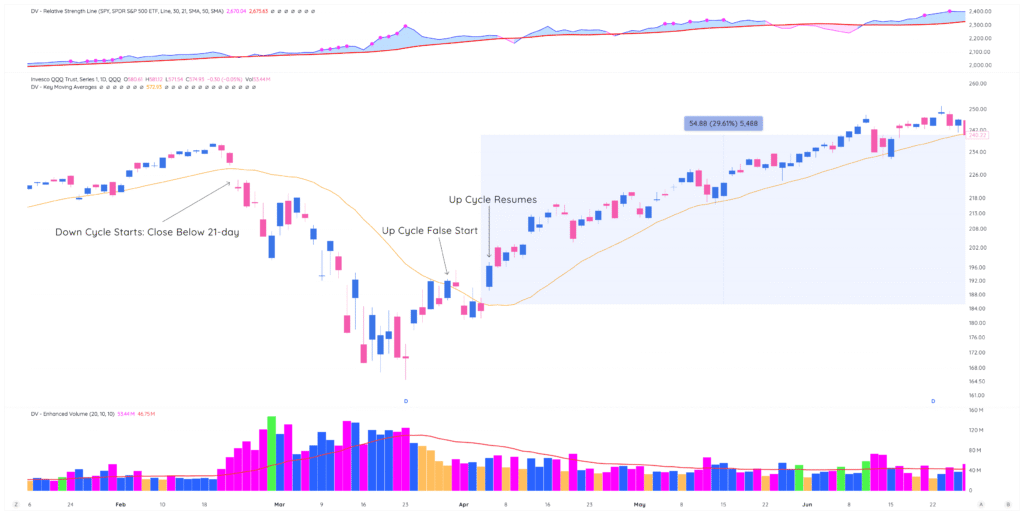

The market sold off 30% in only 3 weeks, and then snapped back with a 30% gain after reclaiming the 21-day SMA. In the image above, we’ve shown you where the down cycle began, a false start up cycle, and then the true up cycle signal that worked (a close above the 21-day SMA).

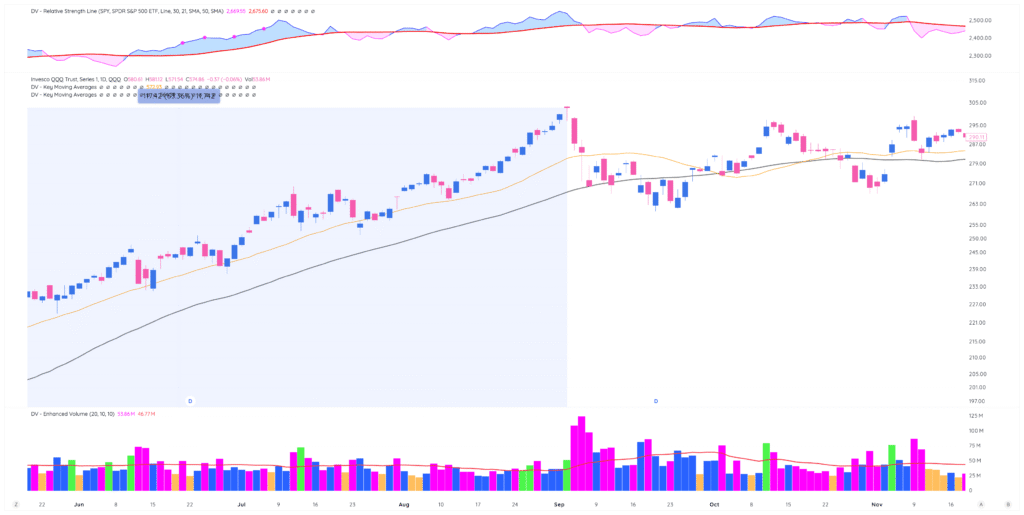

Fast forward a couple of months later, and the market had rallied 60% after reclaiming the 21-day, never closing below it for more than 1 day at a time the entire time.

Let’s now see where Mark was executing after the market sees a big volume sell off:

About a week after the market sold off, Mark started his buying:

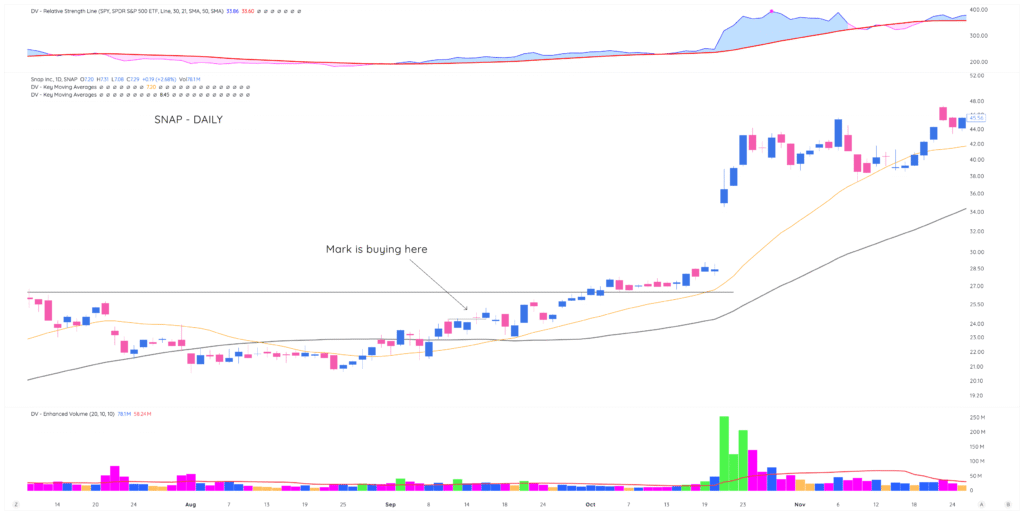

- First, SNAP on 9/15/2020

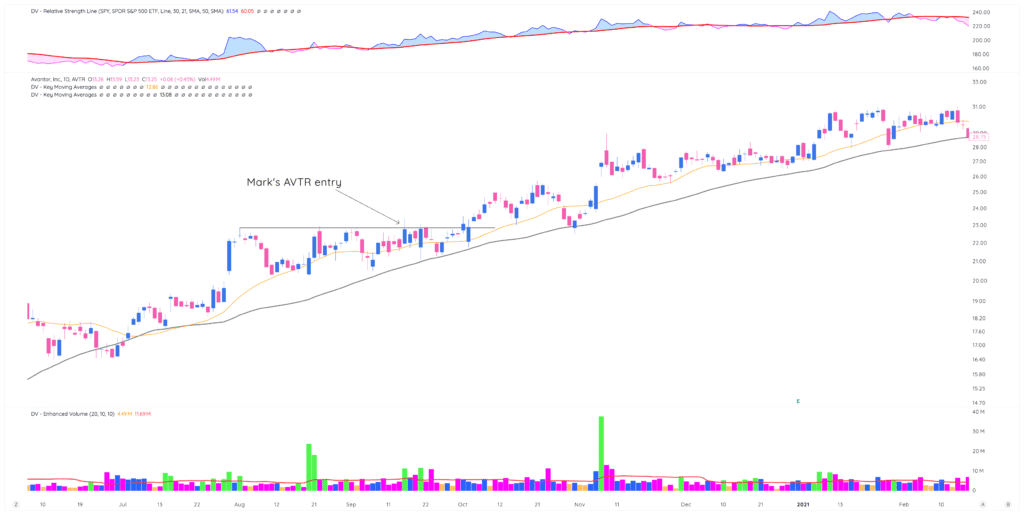

- Second, AVTR on 9/16/2020

- Then WMT on 9/18/2020

- Then PINS on 9/22/2020

Note how he started off slow — only buying one name at a time, waiting for it to work before putting on more exposure.

Here’s his SNAP entry:

His AVTR entry:

His WMT entry:

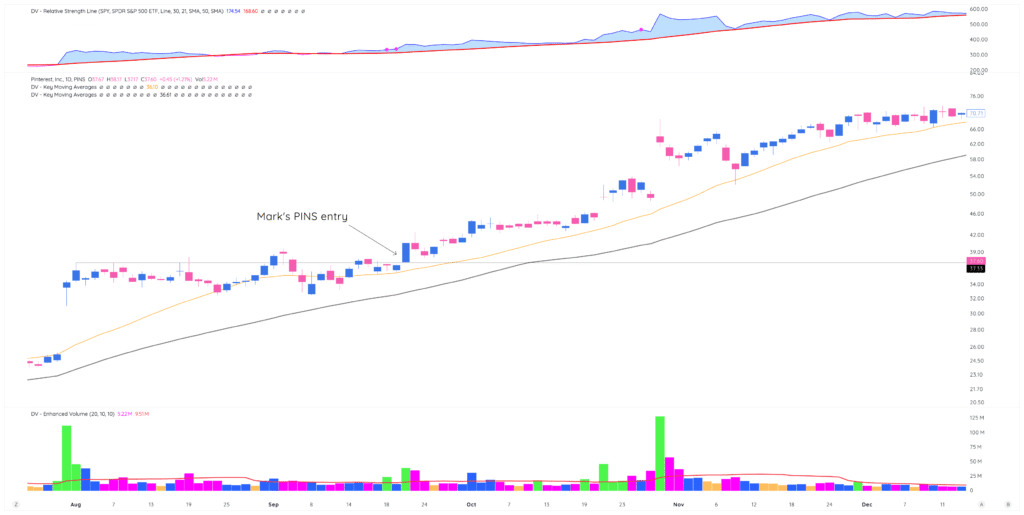

Mark’s PINS entry:

Then, once his positions started working in his favor, he got aggressive.

He added:

- AMD, LEN, MTH, SAIL on 9/30/2020

- CRWD on 10/01/2020

- DNLI on 10/02

- GLOB, MRVL, RGEN on 10/05/2020

- AMZN, BABA, BILL, EPAM QCOM in the days following

What you should notice here is clear:

You start with a couple of single positions, and then when they work, get aggressively quickly. This is right in line with what we talked about during the previous lesson on market cycles and getting positioned early in trends to capture the most amount of upside.

We highly recommend you go chart out the tickers he bought, on those days, to see the edges at play and how you could have position sized in leading names out of the first correction since the COVID bottom.

Case Study #2: The 2025 Market Re-Entry

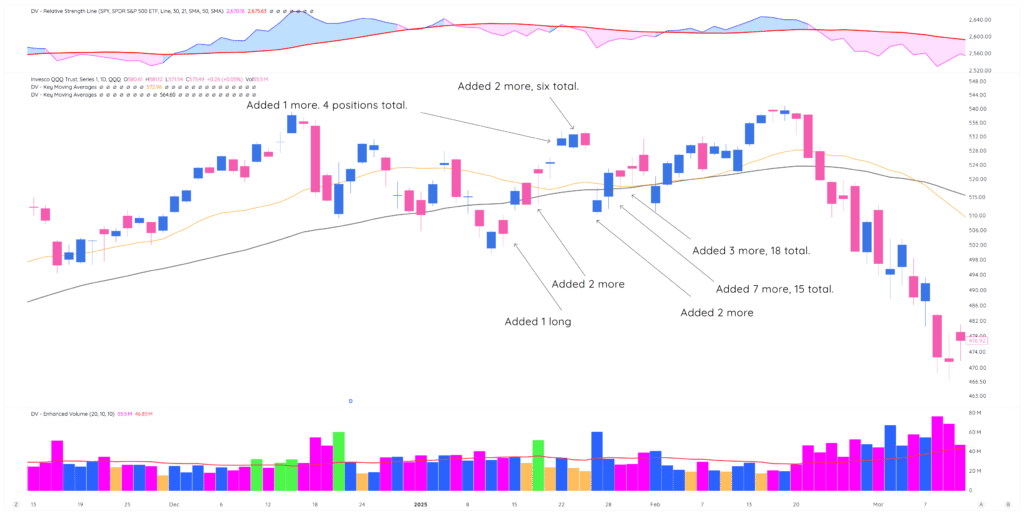

Fast forward to January 2025. Minervini had been short SPY, but the market started showing signs of bottoming. Time to flip from defense to offense, but how do you do that without getting your head ripped off?

Progressive exposure!

Here’s the PE sequence that shows you exactly how it’s done:

- January 14th – Added 1 long position. Just testing after covering shorts.

- January 16th – Added 2 more. Market rewarding long bias. Three positions total.

- January 22nd – Added 1 more. Market keeps cooperating. Four positions now.

- January 23rd – Added 2 positions. Six total.

- January 24th – Added 3 more. Nine positions. Market extremely cooperative.

- January 27th-28th – Peak aggression mode. Added 9 more positions. 18+ total.

- January 29th – Only added 3 positions. Market showing hesitation, so he adjusted.

Notice something crucial: early positions were partial sizes (quarter and half positions), but he only went to full position sizes during that peak period from January 24th-28th.

What This Actually Teaches Us

Both examples show the same pattern. You start small, let the market tell you if you’re right, then scale accordingly. It’s not rocket science, but it requires discipline most traders don’t have.

Here’s how this applies based on your trading phase:

Phase 1 traders: Your version might be going from 1 small position to maybe 3 positions over a couple of days. You haven’t earned the right to size yet based on your equity curve.

Phase 2 traders: Be more aggressive – maybe building from 1 position to 5-6 positions over a week, scaling position sizes as confidence builds. To ensure you don’t go back into the “boom-and-bust” equity curve visual, ensure you’re taking partial profits at logical points.

Phase 3+ traders: Start approaching Minervini’s level of aggression, but only after proving you can handle the psychological pressure of rapid scaling once you see progress.

The Position Sizing Progression

Here’s how Minervini actually scales position sizes:

- Pilot buys – Quarter-sized positions. If you normally risk 12%, your pilot might be 3%

- Half positions – 6% in our example. Market’s cooperating, but not going full yet

- Three-quarter positions – 9%. Market momentum building, confidence growing

- Full positions – That 12%. Only during peak market cooperation

- Overweight positions – 15%+. Rare and only for Phase 3+ traders during exceptional conditions

The beauty of this approach is that the market tells you what to do next. Your recent positions working? Add more. Recent positions getting stopped out? Scale back or stop entirely.

The Psychology Behind It

What Minervini demonstrates isn’t just position sizing – it’s emotional discipline. He waits for proper conditions (patience), follows a systematic process (discipline), adjusts based on market feedback (flexibility), and starts small to manage risk (humility).

Most traders do the opposite. They have no patience, no system, ignore market feedback, and let ego drive their position sizing. That’s why most traders blow up and Minervini has been consistently profitable for decades.

The progressive exposure approach keeps you in the game during all market conditions. You’re not sitting in cash missing moves, and you’re not betting huge when the market’s against you. You’re constantly adjusting based on what’s actually happening.

What’s Coming Next

The next lesson takes everything we’ve learned over the last 7 lessons and adds an extra layer to them. We’ll be covering:

- How To Pyramid Into Winners

- Where To Sell Into Strength

- Managing Position Sizing & Correlation Risk

- Portfolio Heat Management

- Position Sizing During Earnings Season

Tons of applicable information depending on where you are in your position sizing journey!

Key Takeaways From Today’s Lesson

Progressive exposure isn’t random position sizing – it’s a systematic response to market conditions. You start with pilot positions and build based on what actually happens, not what you hope will happen. Peak aggression only comes during peak market cooperation.

Most importantly, your results guide the entire process. The market tells you what to do next if you’re disciplined enough to listen.

Next Action: Look at your recent trades and current market conditions. Where should you be in the progressive exposure cycle right now? Start your next position at the right size for your phase and let the market guide what comes next.