The $1 Million Mistake

Picture this… You’re a swing trader with a $50,000 account. Over six months, you nail three perfect trades:

- NVIDIA at $180 before it runs to $360,

- SMCI at $45 before it hits $90,

- and TSLA at $160 before it reaches $240.

Each trade doubled your money. You should be destroying the market that year, right?

But you’re not. In fact, you barely broke even.

Why?

Because you only put 2% of your account into each trade while keeping the other 94% in cash, waiting for the “perfect setup.”

Meanwhile, your friend who caught the same three moves but sized at 15% per position turned his $50,000 into $110,000.

It may sound crazy, but it happens all of the time, all over the world. The best traders take the same trades as you, with the exact timing, and somehow blow your performance out of the water.

Fortunately for you, we’re going to solve that problem completely throughout the rest of this position sizing mini-course.

Remember: it doesn’t matter how good you are at finding winning stocks if you don’t know how to size them correctly.

The Position Sizing Problem

Let’s be direct about this — most traders fail not because they can’t spot good setups, but because they either:

- Risk too little on their best ideas (paralyzed by fear)

- Risk too much too early in their journey (destroyed by greed)

- Size the same regardless of market conditions (ignoring feedback)

- Size the same irrespective of how good the setup is (ignoring your edge)

Before we get into actionable strategies, I want to use 3 of the greatest traders of all time to paint a position sizing picture for you:

Lessons from the Legends

Nicolas Darvas: The Dancing Millionaire

Nicolas Darvas wasn’t a professional trader – he was a ballroom dancer who turned $36,000 into $2 million in 18 months during the late 1950s. Here’s what made him different:

He started small and scaled up progressively. Darvas would buy a small position when a stock broke above his “box.” If it continued working, he’d add to the position. If it failed, his loss was minimal because he tested the waters first.

His approach:

- Initial position: Conservative size to test the idea

- Stock works → Add more

- Stock fails → Small loss, move on

- Never bet big until the market proved him right

Jesse Livermore: The Boy Plunger’s Fatal Flaw

Jesse Livermore made and lost multiple fortunes. His trading rules were brilliant, but he had one fatal flaw that ultimately destroyed him: position sizing.

Livermore’s pyramiding strategy was legendary — he’d start with a small position and add more as the stock moved in his favor (the same as Darvas). But here’s what killed him: he had no limit to how big his positions could get.

A 1934 New York Times article about his bankruptcy revealed the problem:

Livermore would leverage up so heavily that even minor reversals wiped him out. He understood trend following but never mastered risk management.

The lesson: Being right about direction means nothing if your position size can destroy you when you’re wrong.

William O’Neil: The CANSLIM Master

William O’Neil turned $5,000 into $200,000 with three back-to-back trades in the 1960s. His secret wasn’t just finding great stocks — it was position sizing discipline.

O’Neil’s approach:

- Never risk more than 7-8% on any single trade (strict stop losses)

- Cut losses immediately – no exceptions, no hope, no prayers

- Concentrated portfolio – he’d rather own 4-5 great positions than 20 mediocre ones

- Size based on conviction – his best ideas got his largest positions

The key takeaway for you: O’Neil treated position sizing as seriously as stock selection.

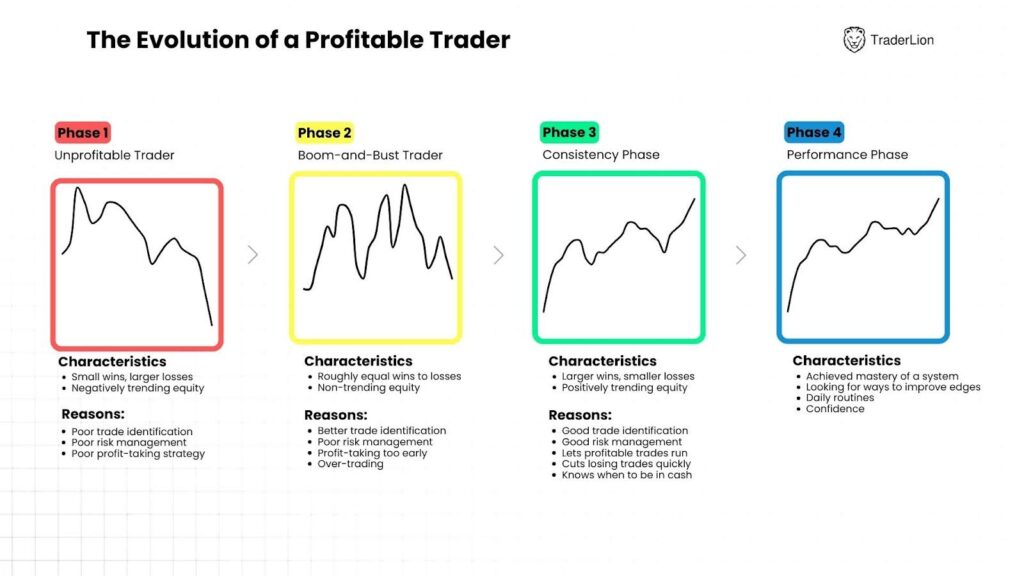

The Evolution Of A Profitable Trader – What Stage Are You?

This is critical – most traders destroy their accounts because they try to position size like professionals before they’ve earned the right.

Phase 1 Traders (Years 1-3):

- Downward-trending equity curve

- Don’t know their stats (win rate, avg gain/loss)

- Maximum position size: 8-10%

- Focus: Learning, not earning

Phase 2 Traders (Years 4-7):

- Boom-bust cycles – make money then give it back

- Know the basics but lack consistency

- Maximum position size: 12-15%

- Focus: Building consistent processes

Phase 3 & 4 Traders (8+ years):

- Consistent profitability over multiple market cycles

- Know their numbers by heart

- Can size 20-30%+ positions safely

- Focus: Optimizing and scaling

Remember this:

Dan Zanger has 35+ years of experience. Mark Minervini has 25+ years. Ross Haber has 20+ years. They’ve EARNED the right to size large positions through decades of experience.

You haven’t. Not yet…

The Psychology Behind Position Sizing Failures

Here’s why most traders sabotage themselves:

- The Ego Problem: Nobody wants to start with “meaningless” 5% positions. Your ego wants to make “real money” right away.

- The FOMO Problem: You see others bragging about 30% position sizes and think you need to match them.

- The Hope Problem: You convince yourself that this time is different, this setup is “guaranteed.”

- The Impatience Problem: Proper position sizing feels slow when you want to get rich quickly.

All of these feelings are normal. All of them will destroy your account if you act on them.

The Path Forward

What you’ll realize by the end of this course is that position sizing isn’t about memorizing formulas. It’s much more than that. To position size like the pros, you have to build the discipline to:

- Honestly assess your current skill level (no ego allowed)

- Start with position sizes appropriate for your stage (even if they feel “small”)

- Track every single trade to know your real statistics

- Scale up only after proving consistency over multiple market cycles

Remember: The goal isn’t to get rich quickly. The goal is to stay in the game long enough to compound your edge over years, not months.

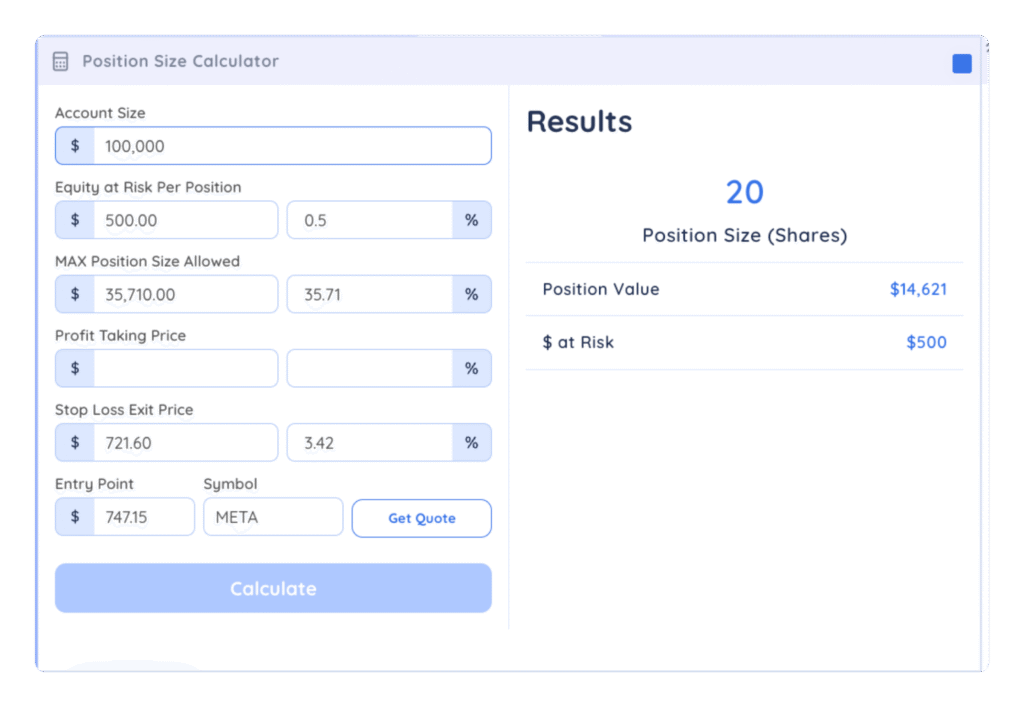

The Deepvue Position Sizing Calculator

Before we go any further, let’s quickly highlight a helpful tool that we’ll be referencing throughout the rest of this mini-course:

Deepvue’s Position Sizing Calculator.

Key inputs:

- Account Size

- Equity At Risk Per Position

- MAX Position Size Allowed

- Your Preferred Profit Taking Price

- Stop Loss / Exit Price

- Your Entry & Symbol

Then you can press “get quote” to update the current price, and the calculator will spit out how many shares you should buy based on the inputs.

What’s Coming Next

In Lesson 2, we’ll dive into the numbers that matter — calculating your batting average, average gain/loss, and the 0.5%–2.5% total account risk rule that keeps professional traders from blowing up.

You’ll learn exactly how to set up your tracking systems and why these statistics are more important than any stock picking method you’ll ever learn.

Key Takeaways

- Position sizing determines your results more than stock picking ability

- The legends all had different approaches but shared strict risk management

- Your position sizing must match your experience level

- Psychology, not mathematics, is the biggest enemy

- Most traders size too large too early and blow up their accounts

Next Action: Before moving to Lesson 2, complete the Stage Assessment worksheet to determine your current trader stage honestly. No ego, no exceptions – your account balance depends on getting this right.