Inside Bars

Master the art of identifying volatility contractions and using inside bars as precise entry triggers for high-probability trades

Inside bars are a straightforward yet powerful trading pattern. They represent a contraction in volatility, signaling potential energy for a significant move. By understanding and utilizing inside bars, traders can refine their entries, minimize risk, and increase the probability of success when trading in alignment with broader patterns.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify inside bar patterns and understand their significance

- Use inside bars as triggers for entry in both continuation and breakout setups

- Recognize how volume plays a critical role in validating the pattern

- Manage risk effectively using inside bar setups

What Is an Inside Bar?

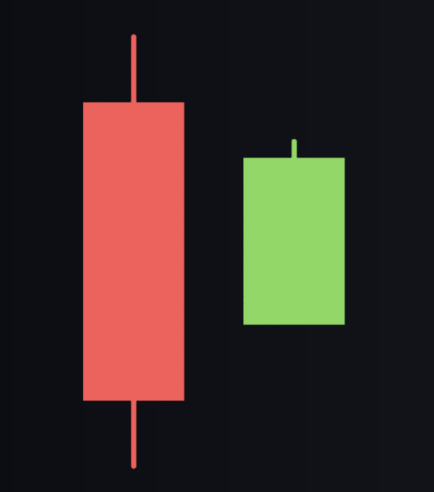

Definition: An inside bar is a price bar where the high and low are entirely within the range of the preceding bar. This indicates a contraction in volatility.

Key Characteristics

- Consolidation Phase: Inside bars typically reflect a pause in market movement as buyers and sellers consolidate positions

- Trigger Points: A move above the high or below the low of the inside bar signals potential breakout or breakdown

- Volume Dry Up: Lighter volume during the inside bar’s formation often precedes significant moves, validating the setup

Using Inside Bars in Trading

Entry Strategies

- Breakout Entry: Enter long when price moves above the high of the inside bar. Enter short (if aligned with the trend) when price moves below the low

- Alignment with Larger Patterns: Inside bars are most effective when nested within broader setups such as bull flags, wedge pops, or EMA crossbacks

Example: AMD Inside Bar Setup

- Setup: AMD forms an inside bar after a wedge pop and pullback into a bull flag

- Volume Dry Up: Noticeable volume reduction on the inside bar signals reduced selling pressure

- Trigger: The breakout above the inside bar’s high initiates a strong upward move

- Follow-Through: Volume increases as the stock continues higher, validating the breakout

Advanced Applications of Inside Bars

Multiple Inside Bars

- Scenario: Occasionally, several consecutive inside bars form, each smaller than the last, indicating extreme tightening

- How to Trade: Use the most recent inside bar’s high or low as the pivot. If triggered, the move will likely clear all prior inside bar levels as well

Combining with Other Patterns

Inside bars often appear as part of:

- Wick Plays

- Bull Flags

- Descending Channels or Wedges

Managing Risk with Inside Bars

Stop Placement

Set stops just below the low of the inside bar for long trades or above the high for short trades. This minimizes risk and ensures that you exit quickly if the trade fails.

Volume as a Validator

- Look for extreme volume dry up during the inside bar formation

- Confirm with a breakout accompanied by an increase in volume, signaling institutional interest

Reflection

Why is volume dry up during an inside bar critical to its reliability as a setup?

Action Items

- Add inside bars to your watchlist criteria for continuation or breakout setups

- Study historical examples to identify where inside bars preceded major moves

Conclusion

Inside bars are a versatile and powerful tool for traders. By signaling contraction in volatility, they provide clear levels for entry and risk management. Combining them with broader patterns and using volume as a validator enhances their reliability and profitability.

Incorporate inside bars into your trading arsenal to refine your entries, reduce risk, and capitalize on high-probability setups.