Stop-Loss Placement and Risk Management

Master the essential skill of stop-loss placement to protect your capital, maximize profits, and maintain discipline in your trading strategy

Stop-loss placement is an essential part of any trading strategy, especially when trading breakouts or pullback setups. It not only defines your maximum risk but also helps you stay disciplined and avoid emotional decision-making. This lesson explores where to place your initial stop, how to adjust it as your trade progresses, and when to exit a position that’s stagnating. By mastering these techniques, you’ll improve your ability to manage risk while maximizing your trading potential.

Learning Objectives

By the end of this lesson, you will be able to:

- Determine where to place an initial stop-loss when trading breakouts or pullbacks

- Adjust stop-loss levels as the trade progresses to protect profits without limiting potential gains

- Recognize when to exit positions based on time stops or lack of movement

- Decide when to use hard stops, mental stops, or alerts depending on your strategy and preferences

Initial Stop-Loss Placement: The Basics

Why Is the Initial Stop-Loss Important?

When you enter a position, your initial stop-loss defines the maximum amount of capital you’re willing to risk. If the trade doesn’t work as planned, the initial stop ensures you exit before suffering large losses.

Key Principle: Protect Your Reason for Entry

One of the core ideas when setting a stop-loss is tied to the reason for entering the trade. For example:

- If you’re buying a breakout, the breakout itself is the reason you’re in the trade. If the breakout fails, your reason for buying is invalid, and you should exit.

Steps to Setting an Initial Stop-Loss

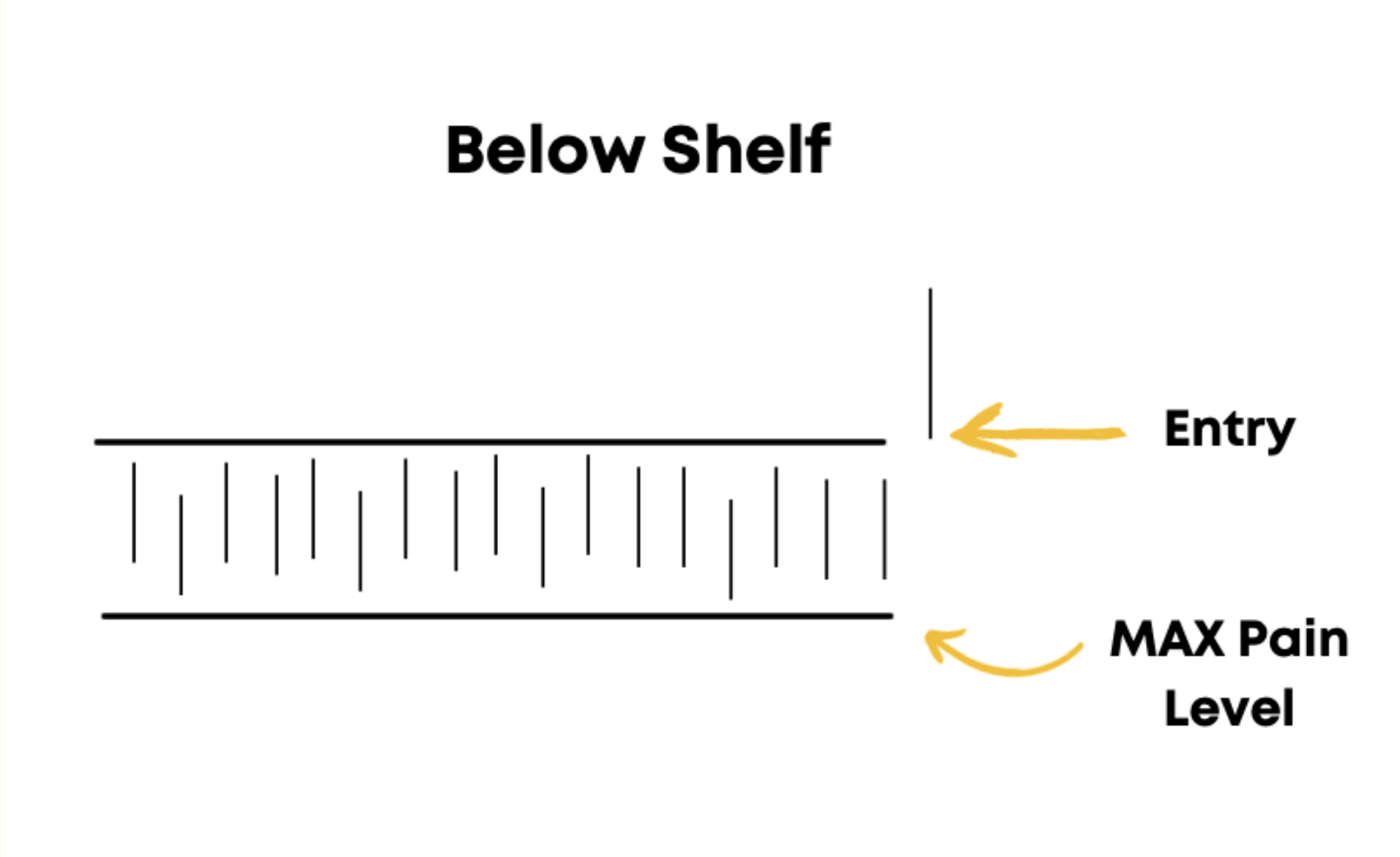

Max Pain Stop

- Definition: This is the level at which you absolutely must exit the trade, no questions asked.

- Where to Place It: Below a key support level, such as the low of the consolidation or “shelf” preceding the breakout.

- Purpose: This ensures that if the trade completely breaks down, you limit your losses and free up capital for better opportunities.

Example: If a stock breaks out of a $50 consolidation and trades up to $53, your initial stop-loss might be placed just below $49—the low of the consolidation range.

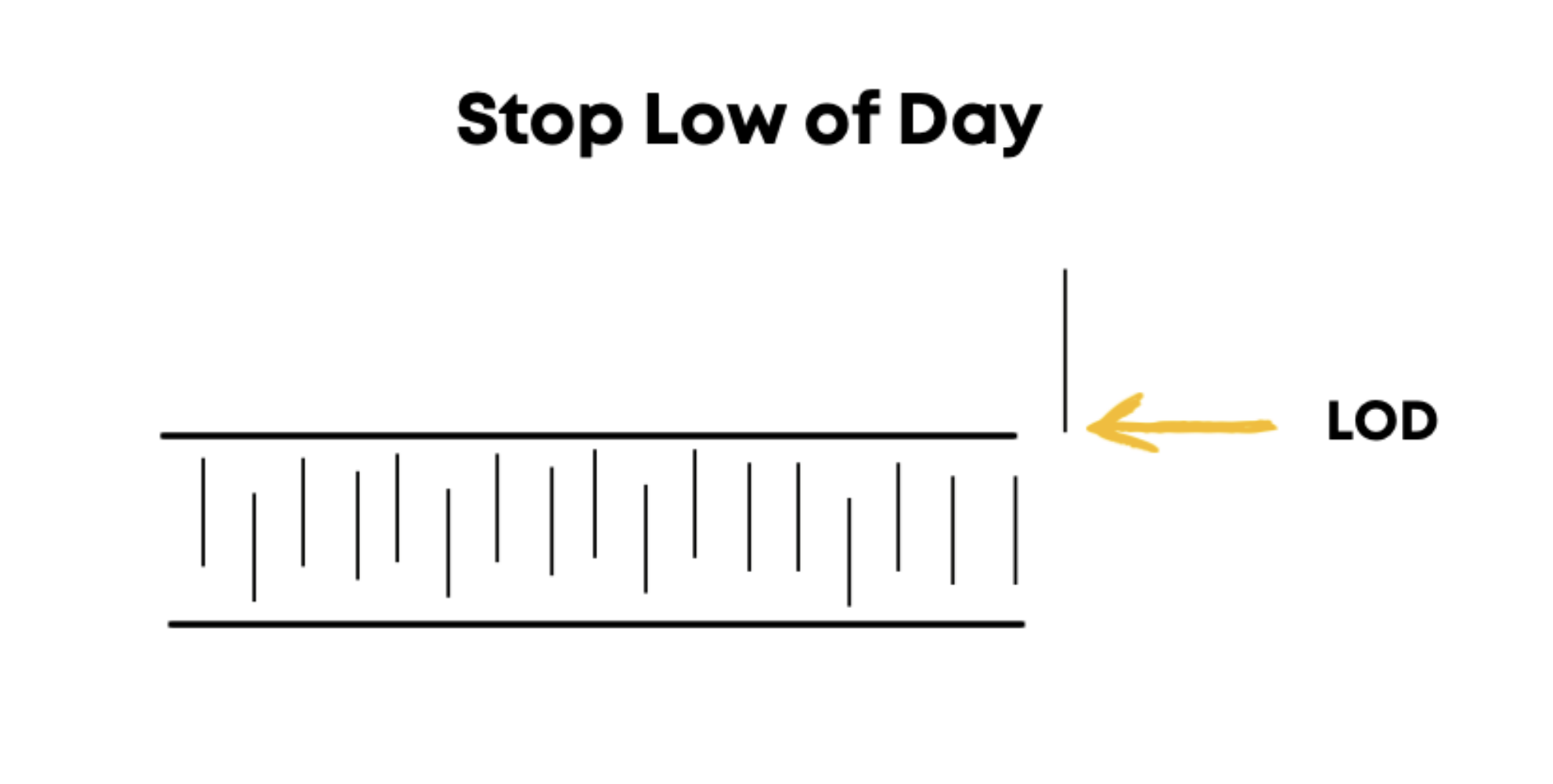

Breakout Day Low Stop

- Definition: Once the breakout is confirmed, move your stop to the low of the breakout day.

- Why It’s Important: By doing this, you reduce your risk and ensure that you’re only holding the trade if the breakout remains intact.

- Example: If the breakout occurred on a day with a low of $51 and the stock moves higher, shift your stop to $51 after confirmation.

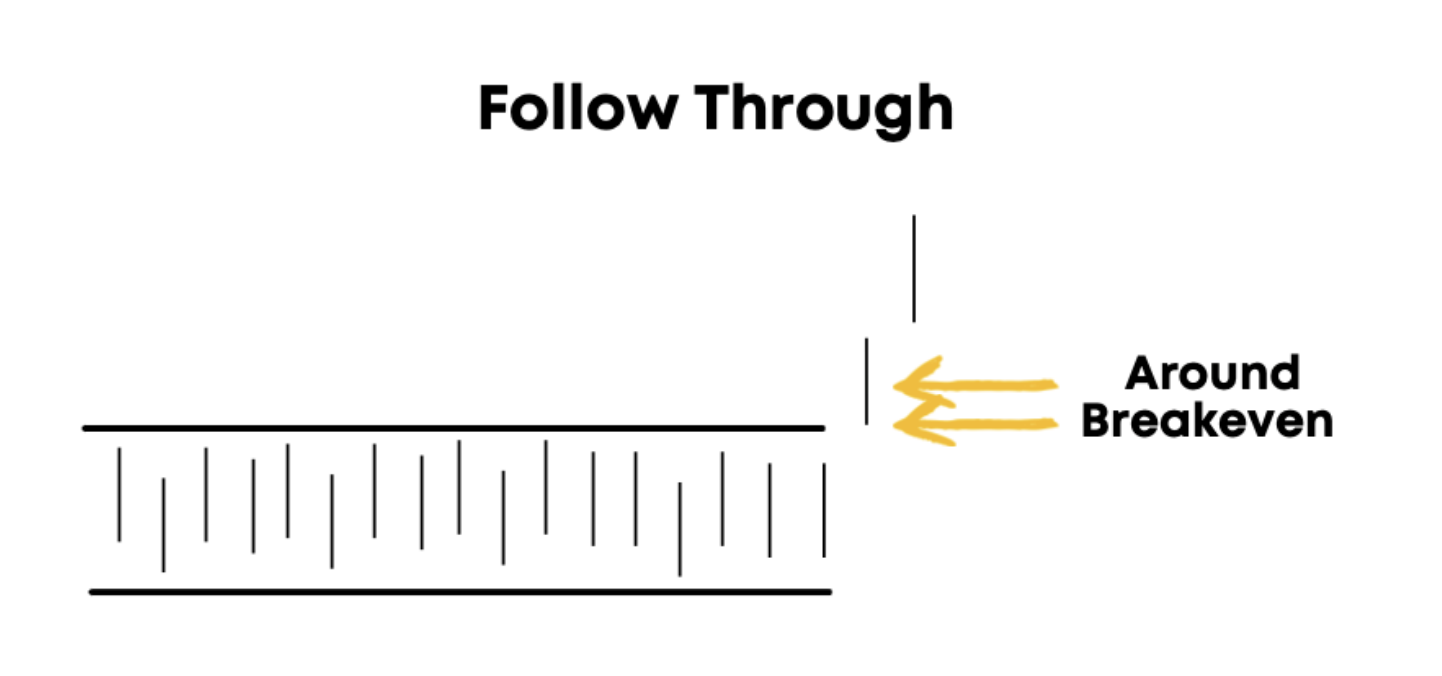

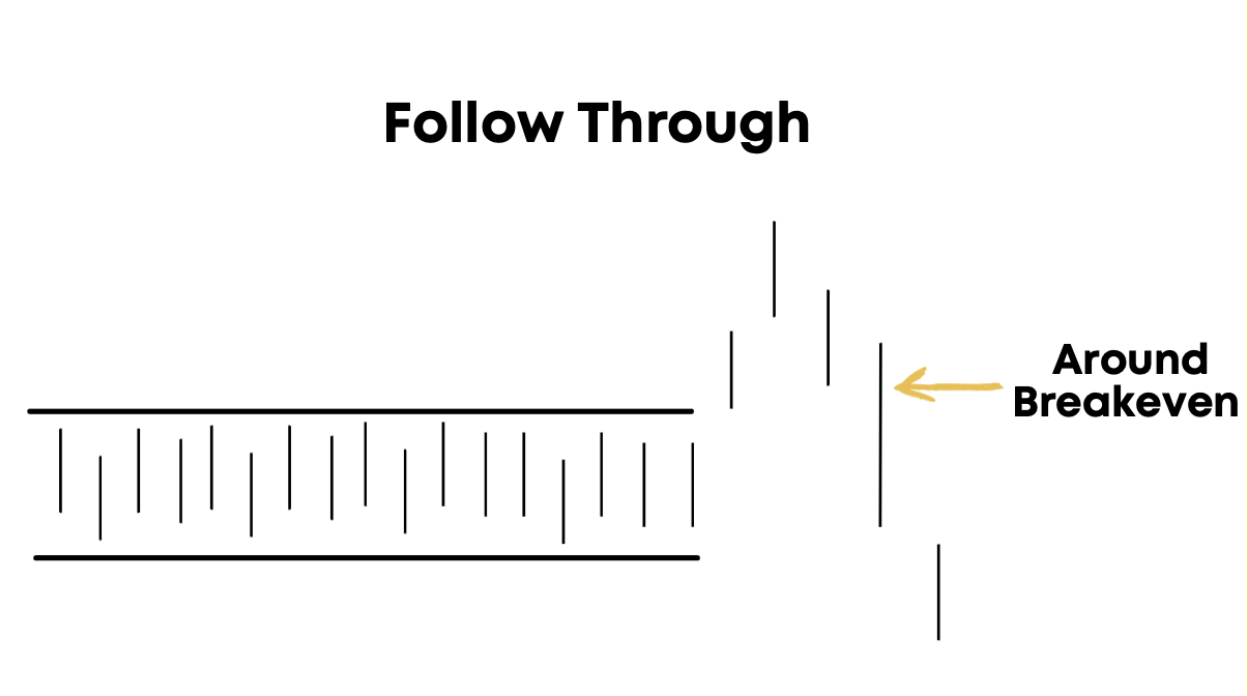

Break-Even Stop

- Definition: Once the trade moves in your favor, aim to move your stop-loss to around your entry price (or slightly above).

- Goal: Protect your principal investment while still allowing the stock room to move.

- Caution: Don’t move your stop to break-even too quickly. This can “choke” a position that might just need time to develop.

Advanced Stop-Loss Strategies

Pivot Point Management

- What It Is: Adjusting your stop-loss based on how the stock behaves around key pivot levels (like the breakout point or recent highs/lows).

- Why It’s Useful: If a stock retests its breakout level and fails, it may be a sign to exit the trade.

- Example: After a breakout above $50, the stock retests the $50 level but fails to hold it. This could indicate a breakdown, prompting you to exit.

Tight Stops for Momentum Trades

- If you’re a momentum trader, most of your winners should work immediately. Stops in the range of 1-3% are often used to control risk.

- For high-conviction trades or volatile stocks, you may widen stops to 5%, but reduce your position size to maintain proper risk management.

Trade-Offs with Tight Stops

Using tight stops minimizes losses on failed trades but may result in getting stopped out prematurely. Be willing to re-enter if the stock sets up again.

Handling Stagnant Trades: Time Stops

What Is a Time Stop?

A time stop is when you decide to exit a trade if it doesn’t move as expected within a specific timeframe.

- Why Use It? If a stock isn’t moving, your capital may be better utilized elsewhere.

- Example: If a breakout stock consolidates for two weeks without progress while other opportunities emerge, it might make sense to exit.

Guidelines for Time Stops

- Avoid exiting too soon—stocks often need time to build momentum.

- Use discretion. Time stops shouldn’t have rigid rules but should factor in other available opportunities and overall market conditions.

Hard Stops vs. Mental Stops

Hard Stops

- Definition: A pre-set stop-loss order placed directly in your trading platform.

- When to Use:

- If you’re unable to monitor trades regularly.

- For volatile stocks where sudden moves could result in significant losses.

- Pros: Removes emotions from execution.

- Cons: May get triggered by intraday volatility or spreads.

Mental Stops

- Definition: Stops that you track mentally or on paper, rather than placing directly in the market.

- When to Use:

- If you want to avoid being stopped out by market noise.

- For stocks with wide bid-ask spreads.

- Pros: More flexibility, avoids premature exits.

- Cons: Requires discipline to execute consistently.

Personal Execution

Many traders prefer to manually execute stops using market orders, especially for high-conviction trades. While this requires discipline, it allows for real-time decision-making based on current market conditions.

Common Pitfalls to Avoid

- Moving Stops Downward

- Resist the temptation to lower your stop-loss below your initial level. This often leads to larger losses and undermines your strategy.

- Setting Stops Too Tight

- While tight stops can minimize losses, they can also result in being stopped out unnecessarily. Adjust stops to suit the volatility of the stock.

- Ignoring Stagnation

- If a stock isn’t moving and there are better opportunities available, don’t be afraid to exit and reallocate your capital.

Reflection

Think about a trade where you exited too early or held too long. How could better stop-loss management have improved your outcome?

Conclusion

Stop-loss placement is the foundation of effective risk management and is critical to long-term trading success. By defining your max pain stop, adjusting to breakout lows, and moving to break-even as trades progress, you can protect your capital while allowing winners to run. Whether you use hard stops, mental stops, or time stops, the key is staying disciplined and consistent with your approach.

As you refine these strategies, remember that trading is a game of probabilities. A few paper cuts from tight stops are a small price to pay for avoiding large losses and staying in the game for the next big opportunity.

Action Items

- Review your current trades and ensure all have clearly defined stop-loss levels.

- Use your trade journal to evaluate how well your stops are performing over time.

- Practice setting both time stops and price-based stops to identify what works best for your style.