Trading Gappers

Master the art of identifying and trading gap-up stocks for high-momentum opportunities and short-term swing profits

Gaps—sharp, unfilled price increases at market open—can signal high-impact news or unforeseen catalysts that drive strong, often immediate stock price movement. Known as “gappers,” these stocks are valuable opportunities for swing traders, as an unfilled gap can indicate sustained momentum and high demand. In this lesson, we’ll explore how to identify, assess, and trade gappers effectively. You’ll learn key indicators of promising gappers, entry and exit strategies, and how to add gappers to your nightly watch list for ongoing monitoring.

Learning Objectives

By the end of this lesson, you will be able to:

- Recognize different types of gaps and their implications for price momentum

- Identify high-potential gappers using set criteria for price, volume, and gap size

- Understand best practices for entering and exiting trades based on gap behavior

- Integrate gapper stocks into a daily or weekly trading routine for optimal results

What Are Gappers? Types of Price Gaps Explained

A gap occurs when a stock’s price opens significantly higher than the previous close. These gaps can reveal underlying market sentiment or reactions to impactful news. Here are three main types of gaps to recognize:

- Breakaway Gaps

- Often at the start of a new trend, these gaps break out of established trading ranges or bases. This is typically a bullish sign, especially when accompanied by high volume, as it may signal a sustained uptrend.

- Continuation or Runaway Gaps

- These occur within an existing trend, suggesting strong momentum with potential for further movement.

- Exhaustion Gaps

- Usually seen at the end of a trend, they can signify a peak in buying or selling pressure. Unlike breakaway gaps, these may indicate trend reversals or consolidation.

Key Gapper Criteria

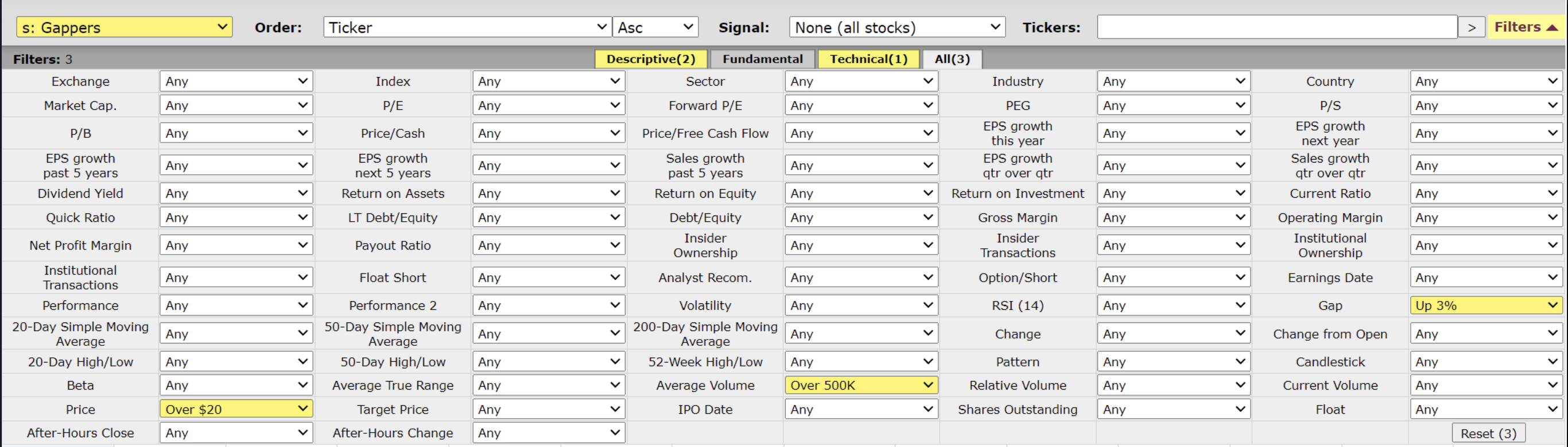

To focus on high-potential gappers, set these filters:

- Price Threshold

- Set a minimum price filter of $20 to avoid low-priced stocks, which may be volatile or lack institutional interest.

- Volume and Relative Volume (RVOL)

- Scan for stocks with a minimum daily trading volume of 500,000 shares, and a relative volume of 3x the average to ensure ample trading activity and liquidity.

- Gap Size

- Look for a minimum gap up of 3%. While larger gaps (e.g., 10–15%) are ideal, setting a minimum of 3% helps you catch subtle yet significant price movements.

Practical Example: Analyzing and Trading a Gapper

Let’s look at how these principles apply with an example of a real-world trade:

Example: Stitch Fix (SFIX)

- Catalyst: The stock gapped up following an earnings announcement that exceeded market expectations

- Volume: Volume surged, signaling heightened market interest and setting up a potential breakout

- Price Action and Entry: After the initial gap, the stock consolidated in a descending channel with reduced volume, creating an ideal entry point after several days. On confirmation of the breakout, a buy was initiated

- Exit Strategy: Following a strong rally, a break below the 10-day EMA was used as an exit, as this often signals a loss in momentum

How to Enter Gapper Trades

- Evaluating the First Day’s Close

- A strong close near the high of the day is favorable, showing buyer support. If the stock fades and closes low, it suggests weaker support and may warrant caution.

- Waiting for Consolidation

- Often, the best entry point appears after a few days of consolidation, forming patterns like bull flags, where volume drops and a breakout is imminent.

- Inside Bar Patterns and Volume Dry-Up

- An “inside bar” pattern—where the price stays within the range of the prior day—and a reduction in volume often indicate a temporary pause before a potential breakout.

Tips for Effective Gapper Trading

Best Practices

- Review Past Price Action: Look at the stock’s recent price history for support or resistance levels. Stocks near new highs are less likely to face resistance, making them more favorable

- Consider Relative Volume and Intraday Behavior: Higher relative volume on the gap day usually signals high interest. For a reliable breakout, make sure the stock doesn’t fade significantly by the close

- Maintain a Watchlist: Track gappers on a watchlist to monitor daily. Gaps may not lead to immediate entries, but with time, they often develop into viable trades

Action Items

- Track for Consistency: Record five stocks from your scan results and observe them over a month. Take notes on their gap behavior and entry/exit opportunities.

Conclusion

The gapper scan is a powerful tool for identifying stocks with high momentum potential, especially when unexpected news or earnings surprise the market. By focusing on stocks with large, unfilled gaps and high volume, you can position yourself to catch short-term swings with strong upside potential. Keep refining your entries and track gapper stocks routinely, and you’ll be well-prepared to capitalize on the next market-moving event.