Identifying and Tracking Doublers

Learn to identify stocks that have doubled in value and show potential to double again through effective scanning and chart analysis techniques

In this lesson, we’ll focus on identifying and tracking “doublers”—stocks that have doubled in value and show potential to double again. Doublers often gain momentum from institutional interest and positive sentiment, and understanding how to identify them early can give you a significant edge. This lesson explains how to set up scans for doublers, how to filter them effectively, and what chart patterns to look for to assess whether a stock still has room to grow.

Learning Objectives

By the end of this lesson, you will be able to:

- Set up and refine scans to find stocks that have doubled within a specified timeframe

- Use price and chart filters to identify doublers with strong potential for further gains

- Visually assess charts to determine if a doubler is in an early or late stage of its trend

- Apply these principles to spot high-potential stocks in real time

Understanding the “Doubler” Strategy

- What is a Doubler? A doubler is any stock that has increased 100% or more within a certain period. These stocks have proven upward momentum, and in many cases, they continue to attract strong buying interest and rise even further.

- Why Focus on Doublers? Stocks that double are often experiencing rapid growth due to high demand, significant news, or institutional buying. Identifying them early allows you to capitalize on future gains, as doublers often have the potential to double again.

- When to Run Doublers Scans Start running doublers scans a few months into the year, as stocks with strong year-to-date (YTD) growth begin to emerge. Alternatively, you could base scans around market lows or correction points to capture stocks rebounding significantly from recent lows.

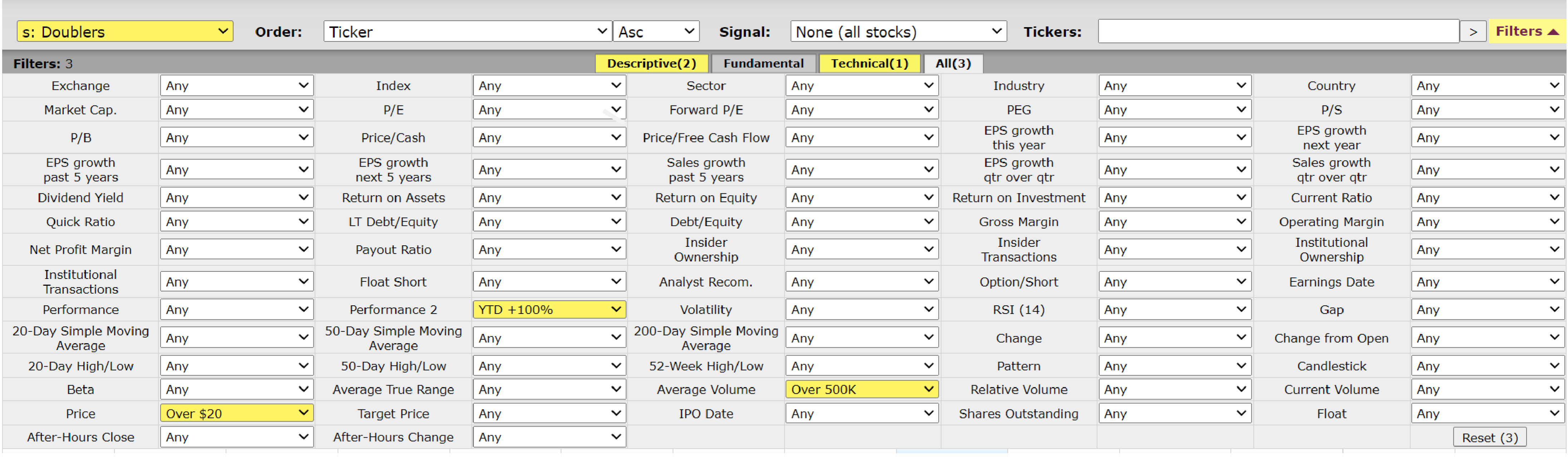

Setting Up a Doubler Scan

- Basic Doublers Scan Criteria:

- Price: Minimum $20, though sometimes a lower price, like $15, may capture smaller stocks early in their growth.

- YTD Performance: Over 100% growth. This simple filter isolates stocks with clear upward momentum.

- Alternative Method: Off Correction Lows Some traders use correction lows instead of YTD performance as a starting point. For instance, if the market experiences a 10% pullback, scanning for stocks with strong rebounds from these lows can uncover stocks likely to double as the market recovers.

- Example Scanning Tools:

- Finviz and MarketSmith: Both tools allow you to set custom filters, including percentage growth, price minimums, and other key metrics.

Using Visual Analysis to Filter Doublers

- Why Visual Filtering Matters Scans give you a list of potential candidates, but filtering by visual assessment is essential. By reviewing each stock’s chart, you can determine its stage in the trend, which helps you assess whether it has more room to grow.

- What to Look For in the Chart:

- Time of the Doubling: Rapid doublings over short periods (like weeks) often indicate intense buying interest, while slower doublings over months may suggest steadier, long-term growth.

- Higher Timeframes: Review weekly or monthly charts to see if a stock has recently broken out or is in an extended uptrend, as these may signal different stages in the trend.

Chart Patterns and Timing in Doublers

- Recognizing Early vs. Late-Stage Doublers

- Early-Stage Doublers: Stocks that have just doubled but are showing tight price action or are near a breakout pattern, such as a high-tight flag, may still have considerable upside potential.

- Late-Stage Doublers: If a stock has multiple weekly extensions or shows signs of an overextended rally, it may be reaching the end of its trend.

- Visual Cues for Timing Patterns like high-tight flags (where a stock moves up 100% or more and consolidates tightly) or “base-on-base” formations indicate the stock is potentially building for another leg up.

- Example Patterns:

- High-Tight Flag: A sharp upward move followed by a period of tight consolidation.

- Cup with Handle: A classic base formation often seen before another price rally.

Action Items

- Set Up and Run Doublers Scans: Choose a stock scanning tool and set criteria for stocks that have doubled YTD or from a recent correction low.

- Review and Filter Results: Visually assess each chart to gauge whether each stock has room for further growth, paying attention to higher timeframes.

Conclusion

Doublers present exciting opportunities, especially when identified early in their trend. By combining scanning techniques with visual chart analysis, you can refine your ability to spot high-potential stocks with momentum. With practice, you’ll develop a trained eye for finding these winners, positioning yourself to capture the next doubling stocks on their way up.