Daily Trading Routine

Master the essential daily habits that separate successful traders from the crowd through a structured approach to pre-market preparation, real-time execution, and post-market analysis

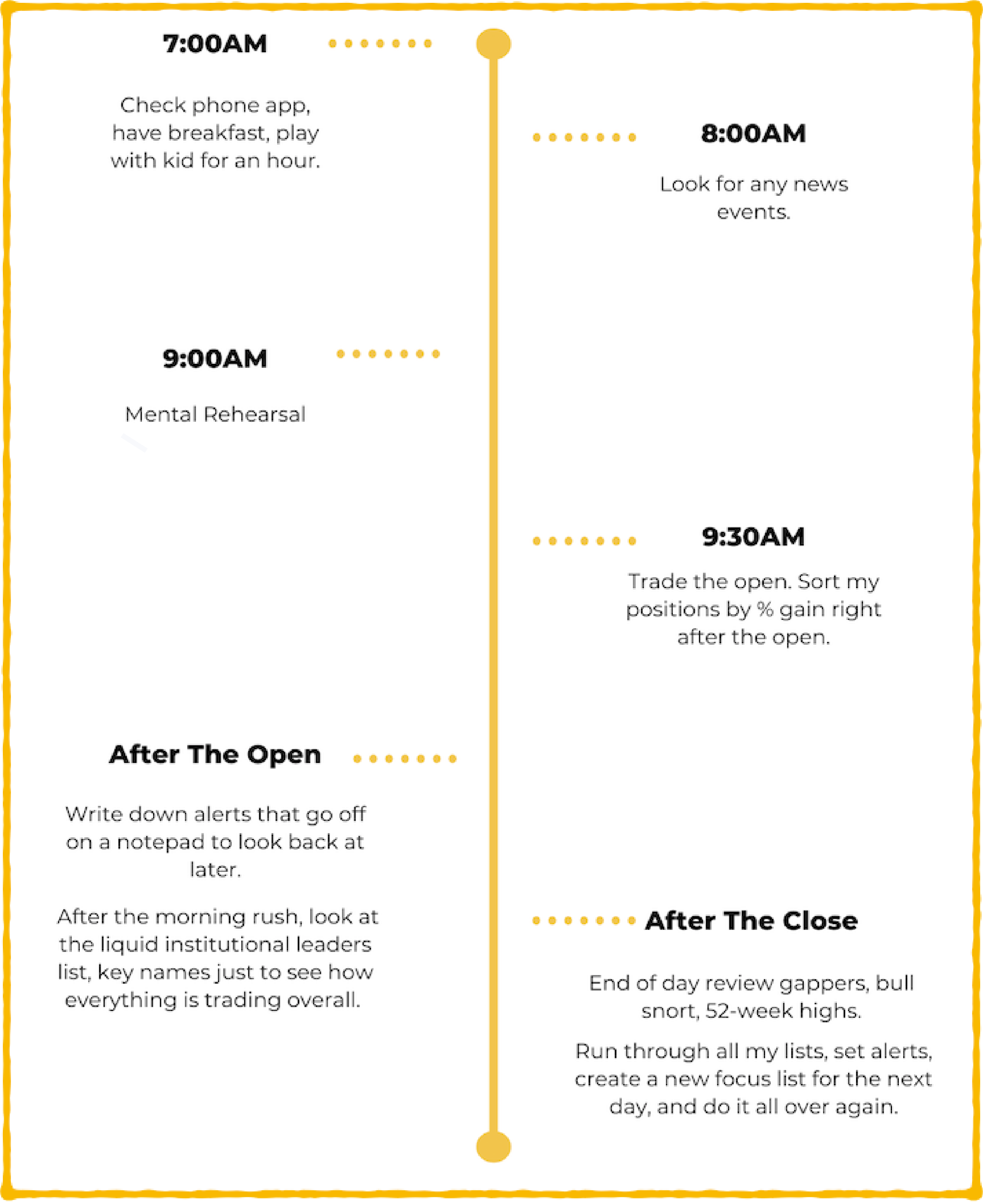

A consistent, structured routine is one of the key components for trading success. In this lesson, we’ll walk through a sample daily routine that incorporates essential pre-market, intra-day, and post-market practices. You’ll gain insights on preparing mentally before the market opens, managing your trades throughout the day, and using a post-market review to improve your strategy for the following day.

Learning Objectives

By the end of this lesson, you will be able to:

- Establish a comprehensive daily trading routine that balances analysis with action

- Prepare a list of stocks for focused monitoring and set alerts for key price levels

- Develop a post-market review process to improve your trading performance

Pre-Market Preparation

Your trading day starts well before the market opens. An effective pre-market routine helps you mentally prepare and identify potential trade targets.

- Checking Overnight Activity: The instructor starts his day by briefly reviewing his portfolio using a mobile app, assessing any major overnight changes before settling into his desk.

- News Review: Trading rooms or online communities can be valuable for filtering actionable news. It’s helpful to have a network or tool that filters essential news from routine updates, as reacting to every bit of information can lead to overtrading.

- Mental Rehearsal: Around 9:00 AM, before the market opens, a mental checklist or rehearsal of planned actions is beneficial. This includes deciding which stocks might require immediate action and reiterating the trading plan to minimize emotional responses. If a specific stock demands early action, it’s noted as part of this pre-market focus.

Trading the Market Open

The first 30 minutes of the market open are often the most volatile. This trader uses a balanced approach to handle both high-potential trades and downside risks.

- Strategic Approach to Open Volatility: To avoid overtrading, the instructor often refrains from trading immediately at the open unless a specific stock has a catalyst, like an earnings report or strong price action indicators from the previous day.

- Using Alerts and Pre-Set Plans: Sorting stocks by their percentage change and focusing on those with losses (“red names”) right at the open allows for quick action on high-priority positions. This process emphasizes managing downside risks first, ensuring any “fires” are contained before shifting to other trades.

Midday Monitoring and Adjustments

After the initial open, a stable routine of monitoring lists, managing alerts, and observing market trends can enhance focus.

- List Management: Throughout the day, this trader manages multiple lists, including:

- Liquid Leaders: Stocks with high liquidity and institutional interest.

- Daily Focus List: Key stocks with potential based on technical setups and previous analysis.

- Alert System: Having thousands of alerts set for various price levels ensures that no significant price action is missed, even on stocks that are not currently being watched. Writing down triggered alerts for later analysis also adds a layer of reflection and insight into market strength or weakness.

Post-Market Routine and Review

The post-market period is valuable for reviewing the day’s performance and preparing for the next.

- End-of-Day List Review: After the market closes, the trader reviews specific lists, such as “Gappers,” “Bull Snort,” and “52-Week Highs.” This process, done each evening, mirrors the Sunday night preparation routine and ensures that no stock with high potential for the coming days is overlooked.

- Alert Reflection and Adjustment: Analyzing how stocks performed after alerts were triggered provides insight into the market’s behavior. For instance, if multiple alerts triggered for breakouts that failed, this may indicate a weak market environment.

- Late Night Wrap-Up: Final preparations for the next day often occur in the evening, once personal responsibilities are managed. This extra time allows for refining trading strategies and addressing any unfinished analysis from earlier in the day.

Action Items

- Create Your Morning Routine: Write down three essential actions you want to complete every morning before trading. This might include news review, setting alerts, or a mental rehearsal of your plan for the day.

- Set Alerts for Two Stocks: Choose two stocks and set alerts at significant price levels. Throughout the week, note any trends or market signals these alerts provide.

- Post-Market Reflection: At the end of each trading day, review any triggered alerts. Reflect on how the stocks performed and what market insights they provided. Note these in a journal for pattern recognition over time.

Conclusion

A structured routine can help you trade with greater confidence, reduce impulsive decisions, and better understand the daily rhythms of the market. By consistently evaluating your stocks, setting alerts, and refining your process, you can make more informed decisions that align with your trading strategy.