What do you think all of the periods you’ve outperformed the market have in common?

We’ll guess:

- The general markets were “uptrending”*

- Growth stock groups were hot

- And a couple of other factors…

And then we also want you to think about the periods in which you underperformed the markets — what did those times have in common?

- The environment was likely choppy

- You probably overtraded/oversized without focusing on conditions

In this course, we’re going to solve the “market” issue for you — identifying when the market’s hot, when it isn’t, and how you can build your own system to call on every single day you go and place a trade.

Why Most Traders Lose Money by Ignoring Cycles

After mentoring thousands of traders, our team has noticed one thing:

Most traders approach the trading day the same way, every single session. There’s no concept of “market cycle” — they don’t understand that the market is only hot a couple of times a year, and that you can build a system to catch those periods consistently.

They use the same position sizes, the same level of aggression, and the same strategies whether the market is hot, choppy, or not healthy at all for their system.

How Understanding Cycles Can Transform Your Trading

Simply put, when you understand market cycles, you gain a massive edge.

You know when to:

- Be aggressive and trade with size, expecting outsized returns

- Reduce size, sell into strength, and look for base hits to make progress

- Step out of the market completely — looking to save mental and physical capital while the market bases/corrects

Overall, a great market cycle system helps you stop fighting the market and start working with it.

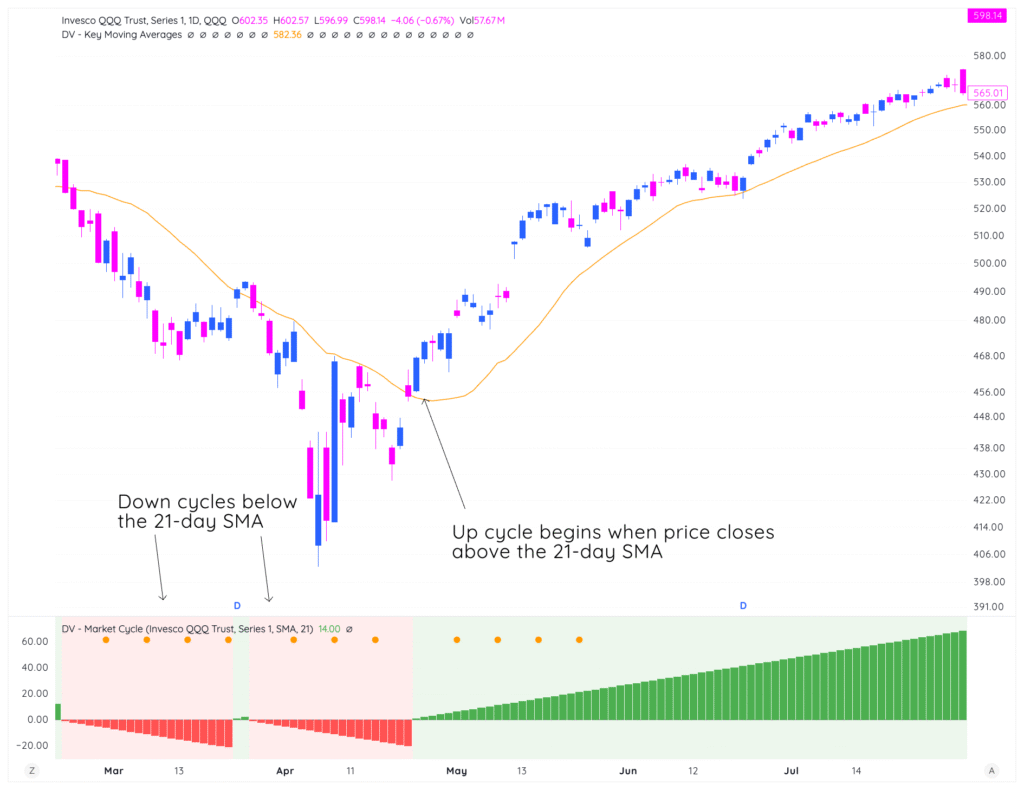

Our Framework: The 21-Day SMA System

Throughout this course, we’ll use one simple, reliable method to identify market cycles: the 21-day Simple Moving Average (SMA) on either SPY or the QQQ.

Here’s how it works:

- When SPX closes above its 21-day SMA, we consider it an “up cycle”

- When SPX closes below its 21-day SMA, we consider it a “down cycle”

- We count the days in each cycle to understand where we are in the pattern

Why the 21-day SMA?

It’s sensitive enough to catch meaningful moves but smooth enough to avoid getting whipsawed by daily noise. It’s also widely watched by institutions, which means it tends to act as real support and resistance.

More Real Examples

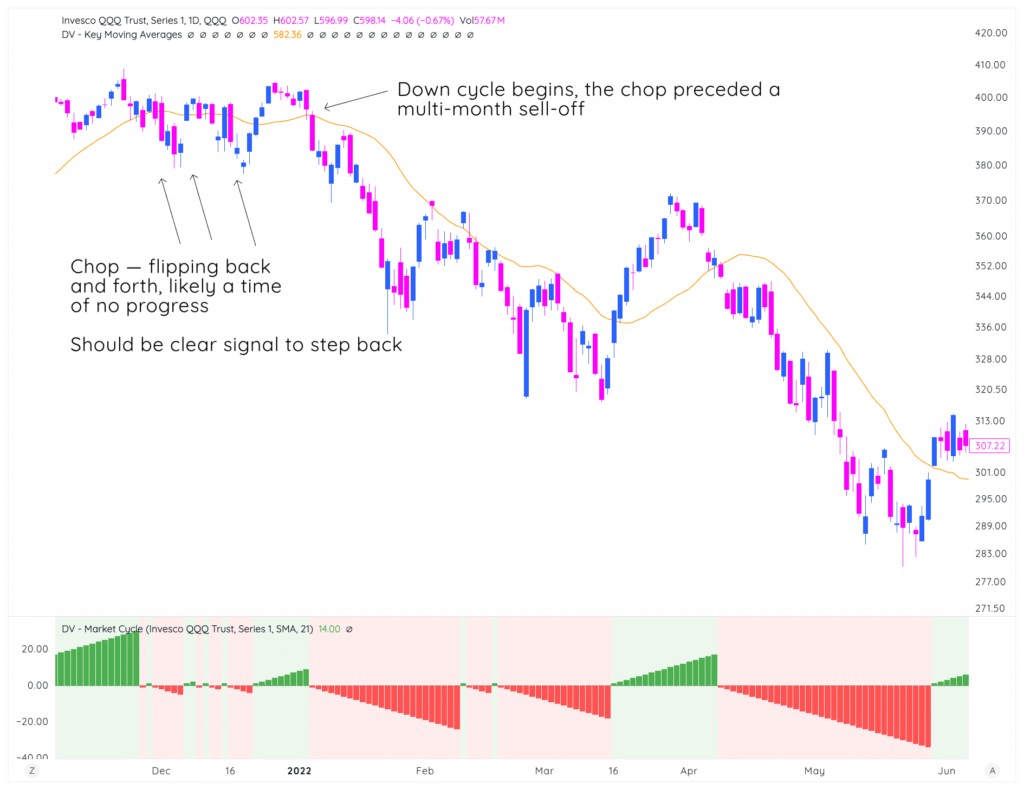

Here’s our first example — the end of 2021 into the start of 2022.

You can see that there was about a month of chop, easily seen with the cycle flopping between up and down in December.

This chop preceded a multi-month sell off, which was a nice win for our market cycle system.

- During chop, we should be sizing down or out completely

- Then clearly out or short during a bear market / down cycle

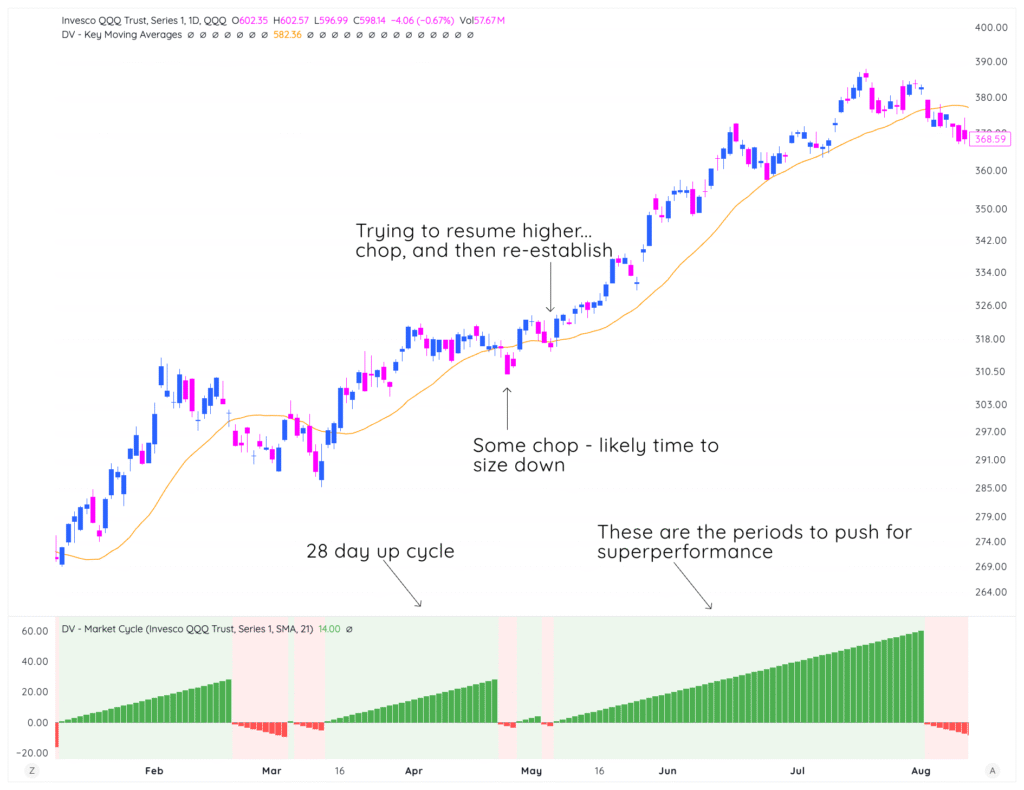

Let’s check out another period from 2023:

2023 was clearly a great year for our market cycle — 3 periods of 25+ day up cycles within the first 8 months.

These are the periods to push for superperformance (when the stock action matches the market action, more on this next).

The Main Takeaway From Today

Trading the same way every single day, all year round is one of the easiest ways to blow your account. You’ll never make it as a trader doing that.

Instead, you need to ebb and flow with the market — pushing it when times are good and stepping back when they aren’t.

The Market Cycle System (using the 21-day SMA) is our most simplest method to achieve just that… superperformance on a yearly basis, making sure you’re always aligned with the market’s prevailing trend.

One Caveat To The Market Cycle System & Looking Forward To Lesson 1

Before we move on to the next lesson, there’s one more thing to cover:

Even if the Market Cycle system is “up”, that’s not a full-on green light to trade aggressively, not respect proper risk management practices, or buy everything in sight.

An up cycle means you can put on long exposure, only where your stocks warrant. The same for a down cycle — you should only be shorting if stocks are giving shortable setups.

Lesson 1’s Main Idea

In the next lesson, we’re going to show you the next step of the Market Cycle System — it isn’t enough to simply identify when we’re in an up cycle, down cycle, or chop.

By studying the patterns, you’ll be able to identify:

- When to put exposure on early in the cycle

- When to expect “stress tests” – healthy pullbacks in uptrends

- When to take profits and size down later in trends

- And when to re-up all over again

See you there!