Bull Pennants

Master short-term continuation patterns that signal periods of contraction and consolidation before a continuation of the prior uptrend

Bull pennants are another highly effective continuation pattern, similar to bull flags but with a distinct formation. These short-term patterns signal periods of contraction and consolidation before a continuation of the prior uptrend. In this session, you’ll learn to identify and trade bull pennants while managing risk effectively.

Learning Objectives

By the end of this lesson, you will be able to:

- Understand the structure and characteristics of bull pennants

- Differentiate between bull pennants and bull flags

- Identify entry points and manage stop-losses for pennant patterns

- Utilize pennants as a secondary entry strategy after missing the initial breakout

Understanding Bull Pennants

Definition

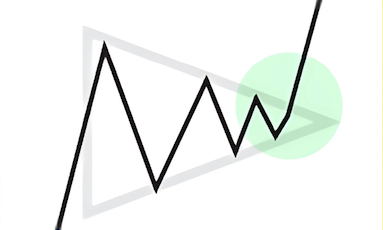

A bull pennant is a short-term continuation pattern marked by lower highs and higher lows, creating a triangular shape. It signifies a contraction in volatility after a strong upward move, often followed by a breakout in the same direction.

Key Characteristics

- Lower Highs and Higher Lows: Forming a symmetrical triangle or “pennant”

- Volume Behavior: High volume on the initial move, followed by decreasing volume as the pattern develops. Volume should increase on the breakout

- Short Duration: Typically lasts 5-7 days

Difference Between Bull Flags and Bull Pennants

- Bull Flags: Have a parallel channel with lower highs and lower lows

- Bull Pennants: Feature converging trendlines with both lower highs and higher lows

Real-World Example: Teladoc

Setup

The Teladoc example demonstrates a breakout from a larger base, followed by the formation of a bull pennant.

Key Observations

- Change in Character: After a large base with shakeouts on the lows, the stock breaks out, signaling a shift in sentiment

- Formation of the Pennant:

- The pennant forms right near the 10-day moving average

- Volume declines during the pennant formation, indicating reduced selling pressure

- Breakout: On increased volume, the stock breaks out of the pennant, offering a secondary entry point

Entering a Bull Pennant Trade

Primary Entry Point

- Enter as the price breaks above the pennant’s upper trendline, ideally on higher-than-average volume

Alternative Entry Point

- For aggressive traders, consider entering near the lower trendline during the consolidation phase if the stock shows strong support near the 10-day EMA

Stop-Loss Placement

- Below the lower trendline of the pennant

- Alternatively, just below the 10-day EMA if the pennant forms near this moving average

Managing Risk and Re-Entry Opportunities

Risk Management

- Set tight stops below the pennant to limit losses if the breakout fails

- If stopped out, watch for a potential reset or a new consolidation pattern to re-enter the trade

Secondary Entries

Bull pennants are ideal for traders who missed the initial breakout. After the larger breakout (e.g., from a base or wedge pop), the pennant provides a chance to enter during the consolidation phase before the stock continues its upward move.

Example in Practice

In the Teladoc example, traders who missed the initial breakout had an opportunity to enter on the bull pennant breakout. This approach still allowed for capturing significant upside while managing risk near the 10-day EMA.

Reflection

What key differences between bull flags and bull pennants make each pattern unique for trade setups?

Conclusion

Bull pennants are versatile short-term continuation patterns that provide high-probability entry points after an initial breakout. Whether you use them as a primary strategy or a secondary entry after missing the breakout, understanding and applying this pattern can significantly enhance your trading performance.

Action Items

- Analyze two stocks that have recently broken out of long-term bases. Look for bull pennant formations near the 10-day EMA and evaluate potential entries

- Track the performance of these stocks after the breakout to validate the strength of the pattern

- Create a trading plan that includes primary and secondary entries for patterns like bull pennants