Base N’ Break (Downside)

Learn to identify and trade the continuation pattern that confirms downtrend persistence and helps protect capital during market declines

The Base n’ Break to the Downside is a crucial pattern in the Cycle of Price Action that confirms the continuation of a downtrend. After an initial selloff, the stock briefly consolidates below declining moving averages before breaking to new lows. This pattern helps traders recognize where they are in the downtrend and provides opportunities to assess market conditions and manage risk. In this lesson, you’ll learn how to identify and trade the Base n’ Break to the downside, and understand its significance within a larger market context.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify the Base n’ Break to the downside as a continuation of the downtrend

- Recognize key price action and volatility shifts leading to Base n’ Break patterns

- Use the Base n’ Break to determine where you are in the overall price cycle

- Stay patient in downtrends by waiting for volatility contraction and screening for relative strength

- Apply the Base n’ Break strategy to both individual stocks and broader market indices to stay on the right side of the trend

What is the Base n’ Break (Downside)?

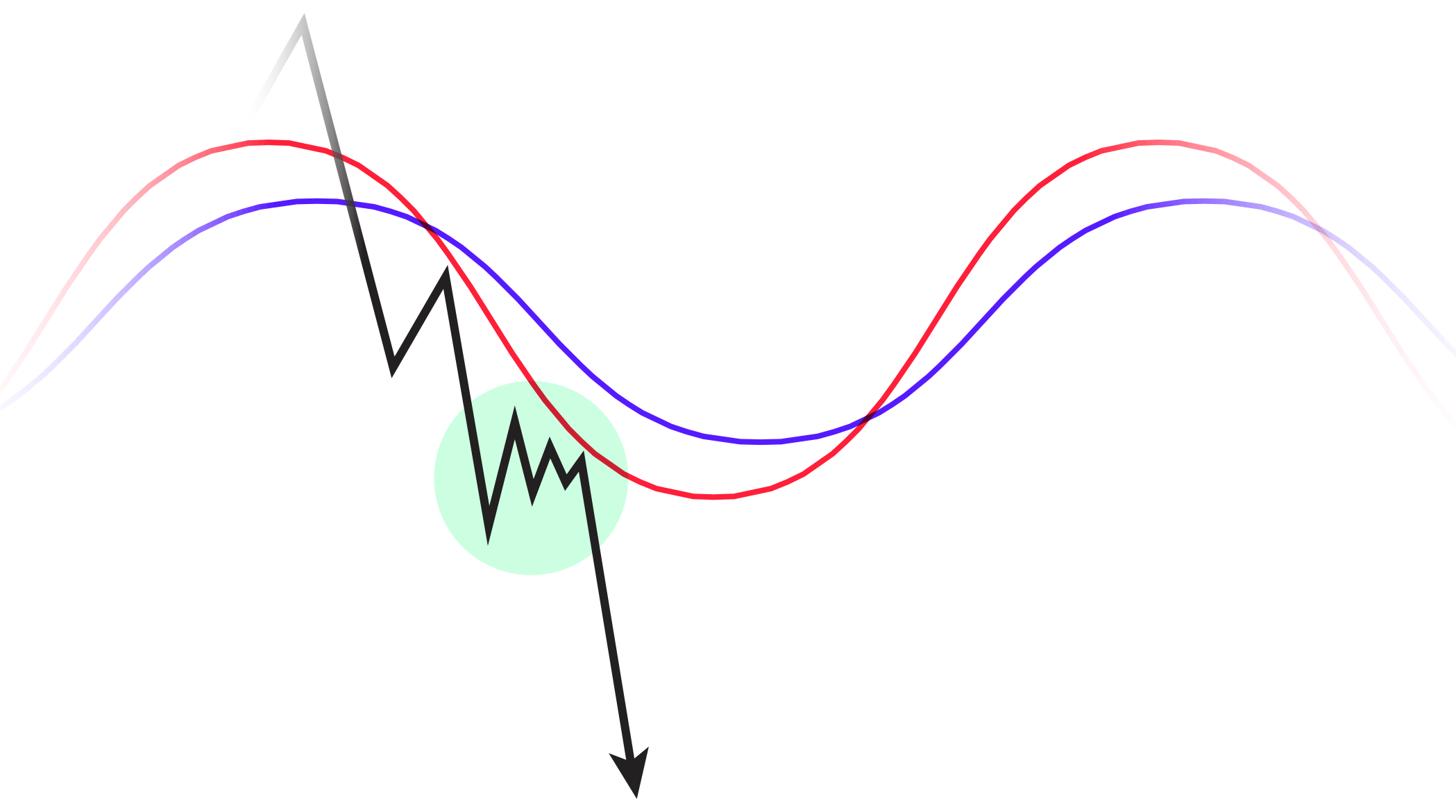

The Base n’ Break to the Downside occurs during a confirmed downtrend when a stock consolidates below declining moving averages before breaking to new lows. As the price finds resistance at the 10- and 20-day EMAs, it forms a tight consolidation range, often followed by another sharp decline.

Key Characteristics

- Consolidation Below Moving Averages: After an initial selloff, the price briefly consolidates but is unable to break above the declining moving averages

- Break to New Lows: The stock breaks down through the consolidation, signaling the continuation of the downtrend

Example: RCL 2023

In 2023, RCL experienced a Base n’ Break to the downside, with the price consolidating below the 10- and 20-day EMAs before continuing to new lows.

Recognizing the Base n’ Break to the Downside

Key Signals Leading to a Base n’ Break

- Wedge Drop Confirmation: The Wedge Drop signals the end of the uptrend and the start of the downtrend

- Resistance at Moving Averages: As the stock rallies into declining moving averages, it finds resistance and forms a tight range

- Breakdown Through the Pivot: The stock then breaks below the consolidation range, continuing the downtrend

Example: DECK 2021-2022

In 2021, DECK experienced multiple Base n’ Breaks after a Wedge Drop, with the stock repeatedly finding resistance at the moving averages before continuing to new lows.

Waiting for Volatility Contraction

Downtrends are typically more volatile than uptrends due to fear-based selling. In a strong bear market, it’s common for the stock to experience sharp selloffs followed by brief consolidations. However, it’s essential to wait for volatility to contract before taking action, as this can provide a clearer and safer trading environment.

- Higher Volatility in Downtrends: Expect sharp selloffs followed by brief consolidation periods, but be patient until volatility decreases

Trading the Base n’ Break to the Downside

Patience is Key

During a downtrend, it’s essential to remain patient and avoid entering trades too early. Wait for the Base n’ Break to fully form, and ensure that volatility has contracted before making any moves. This helps avoid getting caught in a bear market rally or premature reversal attempts.

Steps to Trading the Base n’ Break (Downside)

- Wait for the Consolidation: Once the stock has declined, wait for it to consolidate below the moving averages. This forms a tight price range, similar to the Base n’ Break during uptrends

- Identify the Pivot: As the price consolidates, a pivot forms, signaling a potential breakdown point. Look for weakness that drags the price through the pivot

- Enter the Short: Once the price breaks through the pivot and shows further selling pressure, enter a short position with a stop placed just above the moving averages

- Set Tight Stops: Protect yourself against sudden bear market rallies by placing a stop above the pivot or the highest point of the consolidation range

Example: MSFT 2022

In 2022, MSFT experienced significant volatility after its Wedge Drop. Multiple Base n’ Breaks to the downside confirmed the continuation of its downtrend, providing shorting opportunities.

Risk Management in Downtrends

Downtrends are fast-moving, so controlling risk is critical. Use tight stops and limit shorting to confirmed downtrends. Avoid shorting in strong bull markets or when volatility remains high.

Applying the Base n’ Break to Indices and Market Conditions

Leading Stocks vs. Market Indices

Leading stocks often begin their Cycle of Price ahead of the overall market. In the same way that leading stocks make new highs before the broader market, they can also show signs of weakness before the indices. Pay attention to leading stocks forming Base n’ Break patterns, as this often signals broader market weakness.

- Market Dictates Aggression: When the index is in a downtrend and leading stocks are breaking down, it’s time to be defensive and focus on relative strength. If no stocks are setting up, remain patient and wait for the broader market to stabilize

Using Base n’ Breaks as a Market Indicator

When major indices like the S&P 500 or NASDAQ form Base n’ Breaks to the downside, it signals further market weakness. If stocks are not setting up for breakouts, and the market is in a confirmed downtrend, it’s better to remain in cash or look for shorting opportunities.

Example: ANF 2023

In 2023, the ANF stock showed early signs of a bottom forming while the broader index continued to decline. By waiting for a clear signal, traders avoided getting caught in further selloffs.

Example: TMDX 2023

After chopping near its highs in early 2023, TMDX dropped sharply following a gap down and Wedge Drop. Each rally into the moving averages formed a Base n’ Break, signaling further downside before it reversed.

Reflection

How will you apply the Base n’ Break to the downside to your trading strategy? What steps can you take to improve your patience and timing in volatile markets?

Conclusion

The Base n’ Break to the Downside confirms the continuation of a downtrend by signaling further weakness after a consolidation below the moving averages. By recognizing this pattern, staying patient, and waiting for volatility contraction, you can avoid costly mistakes in bear markets and position yourself for better opportunities when the trend reverses. During these phases, it’s important to focus on preserving capital and screening for stocks that exhibit relative strength as the broader market searches for support.