Tracking 52-Week Highs

Learn to monitor stocks at 52-week highs to identify sector momentum, institutional interest, and discover future trading opportunities through systematic tracking and filtering

In this lesson, we’ll explore the importance of monitoring stocks that reach 52-week highs. Stocks at these levels often indicate sector momentum and institutional interest. However, not all 52-week highs are immediate buy opportunities. By maintaining and reviewing a 52-week high list, you can identify stocks that may present future buying opportunities after they form stable bases or other favorable patterns.

Learning Objectives

By the end of this lesson, you will be able to:

- Understand the significance of stocks reaching 52-week highs in sector analysis

- Set up a process to track stocks at 52-week highs

- Filter 52-week high stocks visually to recognize extended stocks vs. those with fresh buying opportunities

- Integrate 52-week high stocks into your regular review to catch breakout setups early

Why 52-Week Highs Matter

- Indicating Sector Strength and Momentum: Stocks making new 52-week highs often signal momentum within a sector. Tracking these stocks helps you see which sectors are performing best and uncover emerging trends early on.

- Institutional Interest: Stocks at 52-week highs often attract institutional buying, indicating strength and potential for further gains. This activity provides a signal that the stock may continue to perform well in the future.

Example: Sector Momentum

If multiple tech stocks reach new highs simultaneously, it may signal strong sector momentum, making it worth exploring other tech stocks for potential trades.

Building and Maintaining a 52-Week High List

Setting Up Your Tracking System

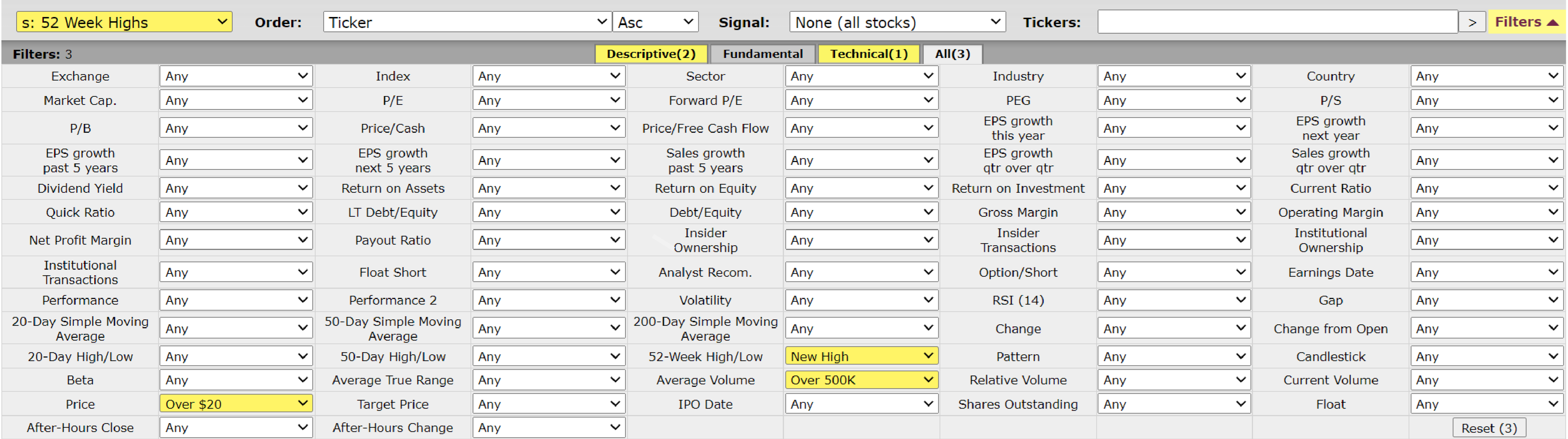

- Setting Up a 52-Week High Scan: Use a stock scanner, like Finviz or MarketSmith, to filter for stocks reaching 52-week highs. This scan provides an ongoing list of top-performing stocks that you can review regularly.

- Creating a Watchlist for Ongoing Review: As stocks hit 52-week highs, add them to a watchlist for easy reference. Keeping an organized list allows you to go back and check these stocks for patterns that signal when they are ready for entry.

Filtering 52-Week Highs for Tradeable Opportunities

Identifying Quality Setups

- Avoiding Overextended Stocks: Not every stock at a 52-week high is immediately buyable. Some may be overextended and in need of a consolidation period. Observing whether a stock’s recent run appears stretched on the chart helps prevent buying at potentially inflated levels.

- Recognizing Fresh Bases and Patterns: When stocks on your 52-week high list start forming tight consolidation patterns or bases, they often present more reliable entry points. A common setup is when a stock makes a high, then consolidates or forms a base for a few weeks before breaking out again.

Key Filtering Criteria

- Look for stocks that have pulled back from their 52-week highs and are forming bases

- Watch for volume patterns that suggest institutional accumulation

- Identify stocks showing relative strength during market pullbacks

- Monitor for tight consolidation patterns like cup-with-handle or high-tight-flag formations

Example: High-Tight-Flag Pattern

If a stock hits a 52-week high and then consolidates tightly for several weeks, it may be setting up for a breakout from a cup-with-handle or high-tight-flag pattern, providing a lower-risk entry.

Integrating 52-Week High Tracking into Your Trading Routine

Daily and Weekly Review Process

Review Schedule

- Daily Scan: Check for new 52-week highs and add quality names to your watchlist

- Weekly Review: Analyze existing watchlist stocks for base formations and potential entry points

- Monthly Analysis: Review sector trends and institutional activity patterns

- Quarterly Assessment: Evaluate the effectiveness of your tracking system and make adjustments

Action Items

- Practice Visual Scanning: Spend time each day visually scanning for relative strength patterns by comparing stocks on your watchlist to the overall index.

- Apply Moving Average Levels: Track moving averages on your watchlist stocks. Notice which ones hold the 10-day, 20-day, or 50-day during a correction.

- Identify High-Strength Stocks During the Next Downturn: When the market pulls back, practice finding stocks that either hold steady or make higher lows.

Conclusion

Mastering the ability to spot relative strength visually is a skill that will greatly improve your stock selection and timing. By observing higher lows, key moving average levels, and tight price action, you can identify strong stocks even when the broader market struggles. Building this skill will make you more adaptable and confident, ready to uncover winning stocks in both bullish and bearish environments.