Powerful Setup Database

Create a personal library of patterns, precedents, and insights to improve decision-making and build conviction in your trades

A setup database is an invaluable tool for traders, serving as a personal library of patterns, precedents, and insights. It allows you to study historical market movements, winning stocks, and trading setups to improve decision-making and build conviction in your trades. This lesson will guide you through creating, maintaining, and applying a setup database to sharpen your trading skills and enhance your strategy.

Learning Objectives

By the end of this lesson, you will be able to:

- Create a setup database that tracks index trends, winning stocks, and major IPOs

- Analyze historical patterns to recognize market tops, bottoms, and successful setups

- Incorporate insights from historical studies into your current trading decisions

- Build conviction and adaptability using precedents and structured analysis

What Is a Setup Database?

A setup database is a structured record of historical market patterns, trades, and setups. It includes:

- Market Trends: Tops, bottoms, and corrections in major indexes

- Winning Stocks: Charts and setups of past high-performing stocks

- Major IPOs: Multi-year winners and their breakout patterns

Benefits of a Setup Database

- Pattern Recognition: Spot similarities in current and historical price action

- Mental Recall: Build a repository of precedents to guide decisions

- Confidence Building: Reinforce your strategy by analyzing past successes

How to Build a Setup Database

- Step 1: Analyze Market Trends

- Study tops and bottoms in major indexes (e.g., S&P 500, NASDAQ)

- Compare duration and magnitude of past corrections

- Note differences in behavior between tech-heavy NASDAQ and diversified S&P

Example

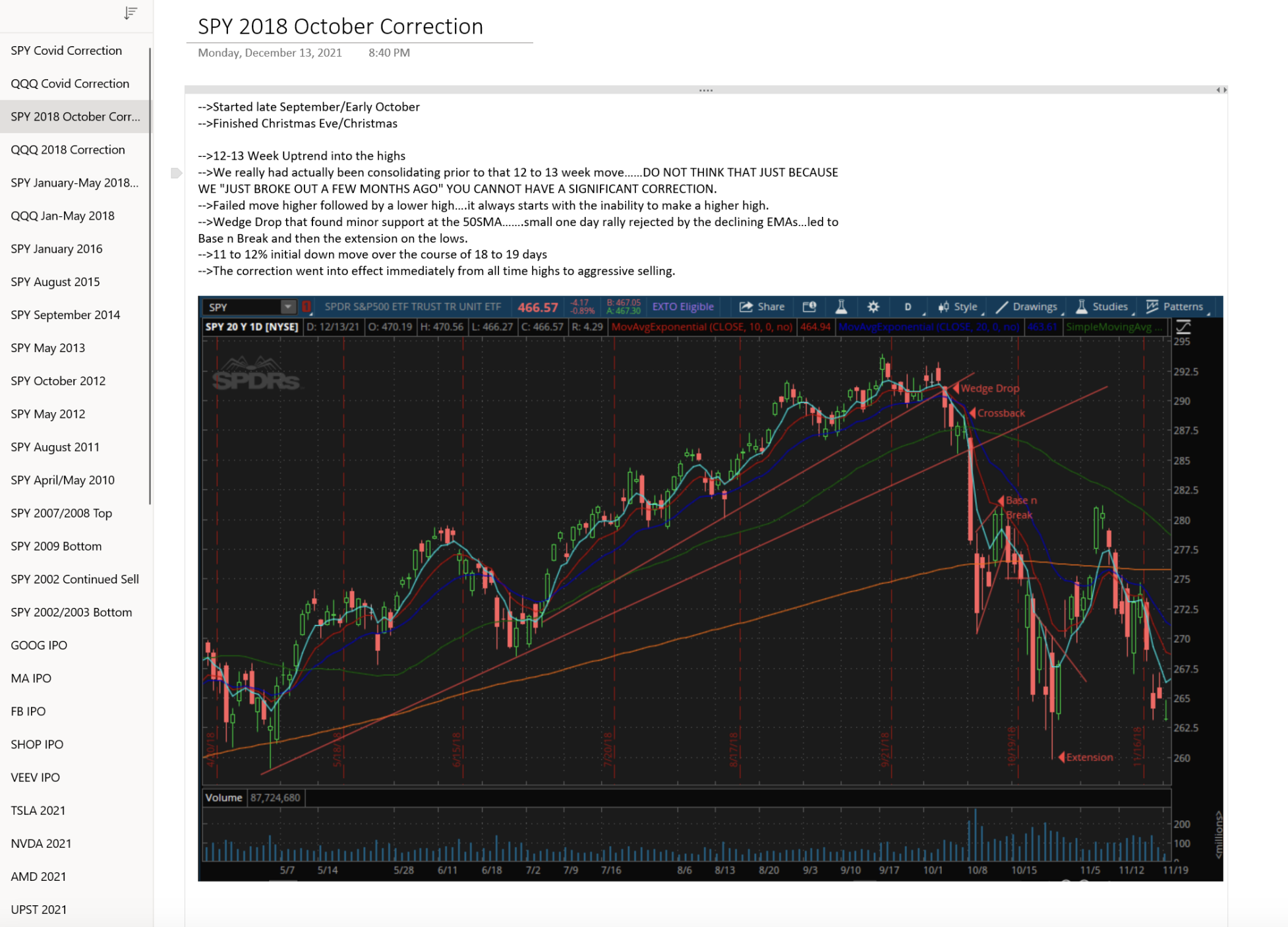

- 2018 Correction: 12–13 week uptrend into highs, followed by a sharp 11% drop in 18 days

- Insight: Corrections can happen quickly after extended moves, even after breaking out of a base

- Step 2: Track Winning Stocks

- Focus on stocks that meet your trading criteria, even if you didn’t trade them

- Capture weekly and daily charts with marked buy and sell zones

- Include fundamentals like earnings and sales growth for deeper insights

Example

- Facebook (2012 IPO): 14 months after IPO, a 25% earnings gap triggered a sustained uptrend

- Step 3: Study Major IPOs

- Review IPOs with multi-year runs like Google, MasterCard, or Shopify

- Identify common triggers (e.g., earnings gaps, post-lockup breakouts)

- Note how long it took for sustained moves post-IPO (often after the 6-month lockup period)

Example

- Facebook showed higher lows and a massive earnings gap, signaling the start of its uptrend

- Step 4: Document Recurring Setups

- Save examples of your go-to setups (e.g., wedge pops, bull flags)

- Annotate charts with entry, stop-loss, and exit points

- Update the database regularly with new examples and outcomes

Using the Setup Database in Real-Time

- Apply Precedents

- Use historical patterns as a guide but stay adaptable

- Example: Tesla’s current consolidation may resemble its February 2020 high

- Adapt to Market Conditions

- Recognize when a precedent might not play out (e.g., UPST failing to form a higher low at the 200-day moving average)

- Adjust your strategy based on the setup’s actual behavior

- Review and Reflect

- After a trade, compare your decisions with database examples

- Identify where your execution aligned with or deviated from successful patterns

Examples and Case Studies

Example 1: Market Tops and Bottoms

- Correction Case Study: October 2018 S&P 500 correction

- Uptrend duration: 12 weeks

- Correction: 11% drop in 18 days

- Insight: Duration of uptrends can signal when to watch for exhaustion

Example 2: IPO Analysis

- Facebook (2012 IPO):

- Breakout Trigger: 25% earnings gap after 14 months

- Insight: Major IPOs often consolidate for months before significant moves

Reflection

What historical setups or precedents have influenced your trading decisions recently?

Conclusion

Building and maintaining a setup database is one of the most effective ways to grow as a trader. By studying historical patterns, IPOs, and market trends, you’ll develop sharper insights and a stronger conviction in your trades. Take the time to create your database—it’s an investment in your trading success.

Action Items

- Start Your Database: Add examples of market tops, IPOs, and winning stock setups

- Analyze a Precedent: Compare a current stock or market condition with a historical example

- Refine Your Focus: Identify your most successful setups and prioritize them in your trading plan