Candlestick Patterns as Market Clues

Learn to interpret candlestick patterns as supplemental clues for market psychology, trend analysis, and informed trading decisions

Candlestick patterns provide powerful insights into market psychology, helping traders understand the battle between buyers and sellers. While not a standalone trading strategy, they serve as a supplemental tool for confirming or questioning trends. The key is to interpret these patterns within the context of the stock’s overall price cycle, volume behavior, and position relative to moving averages.

This lesson will teach you how to use candlestick patterns as clues to assess market behavior, identify potential reversals, and make more informed trading decisions.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify key candlestick patterns and their psychological significance

- Assess the importance of volume in confirming candlestick patterns

- Evaluate candlestick patterns in the context of the broader trend and price cycle

- Recognize the importance of consecutive patterns in signaling trend weakness

Using Candlestick Patterns as Clues for Trend Analysis

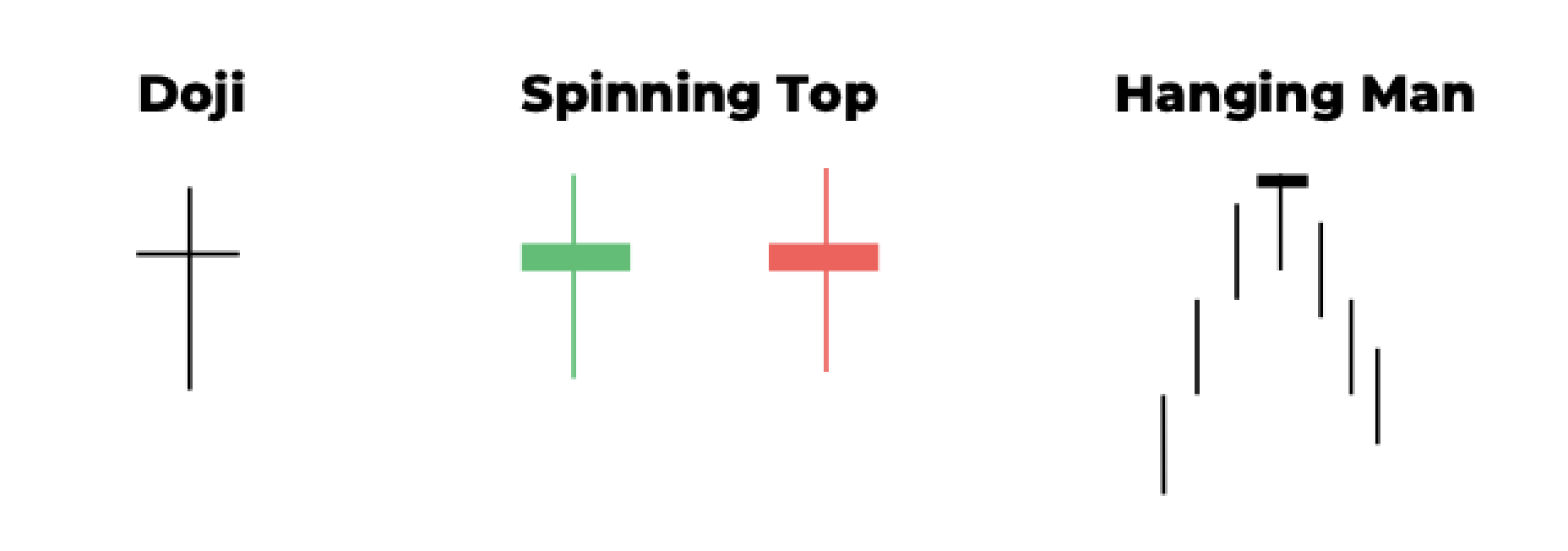

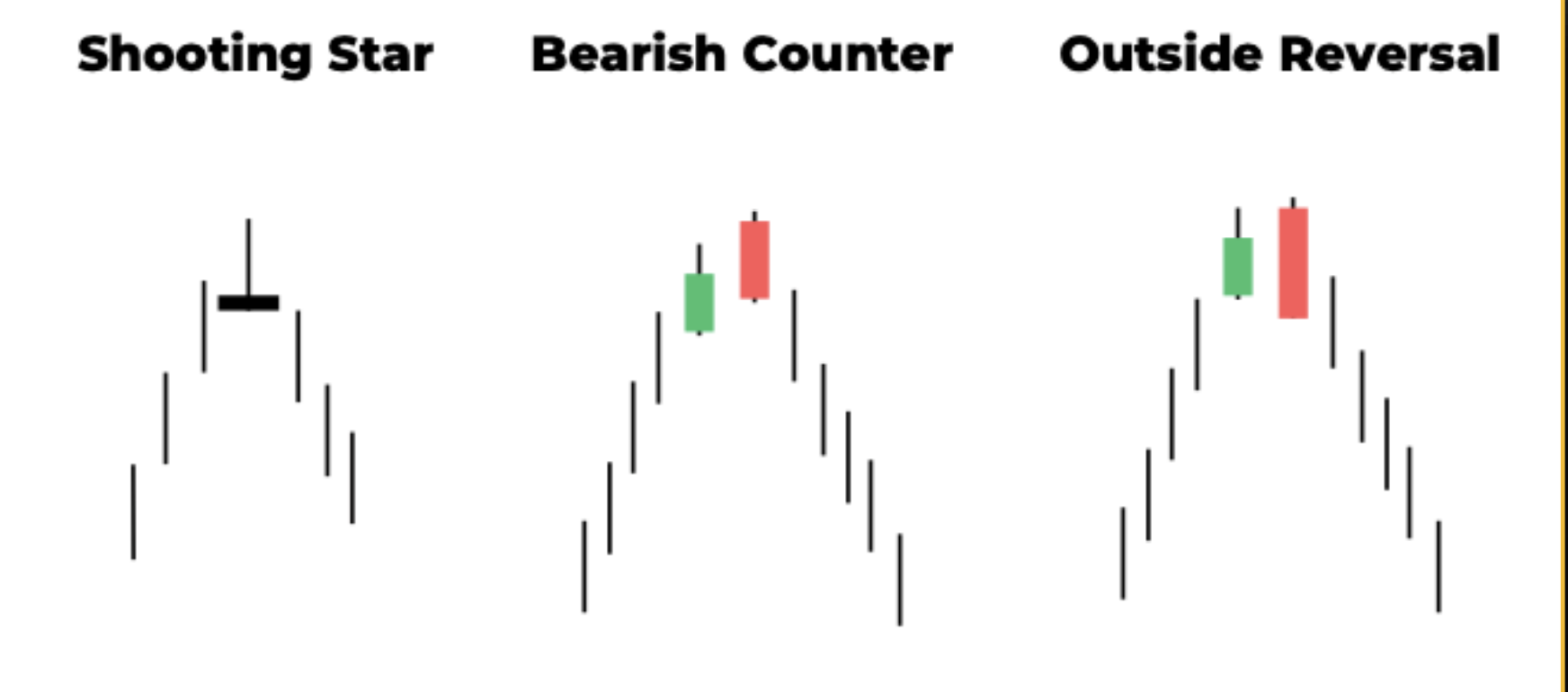

Candlestick patterns provide powerful insights into market psychology and are a valuable supplement to other technical tools. The visuals below will help you understand key patterns like Doji, Hanging Man, Shooting Star, and more.

Indecision Candles

Indecision candles signal a temporary balance between buyers and sellers. These patterns are especially significant when they occur at key points in the trend, such as near resistance or after significant price extensions.

- Doji: Indicates indecision; neither buyers nor sellers dominate

- Spinning Top: Similar to a Doji, with slightly more range between open and close prices

- Hanging Man: Occurs after an uptrend, showing profit-taking. May indicate the start of a reversal if followed by bearish action

Reversal Candles

Reversal candles often precede a change in trend, especially when confirmed by volume. These patterns are more significant when they appear in overextended conditions or at key support/resistance levels.

- Shooting Star: Buyers drive prices higher intraday, but sellers regain control, closing near the open

- Bearish Counterattack: Sellers overwhelm buyers, forming a strong downward reversal

- Outside Reversal: A bearish engulfing pattern where the current day’s range exceeds and engulfs the prior day’s range

Reflection

Have you ever overreacted to a single candlestick pattern? How could context and volume analysis have changed your decision-making?

Conclusion

Candlestick patterns offer valuable clues about market sentiment, but their effectiveness lies in the context of the overall trend and volume. By learning to identify and interpret these patterns alongside other technical indicators, you’ll gain deeper insights into potential trend changes and make more informed trading decisions.

Remember, candlesticks rarely tell the full story on their own. Use them as part of a broader toolkit for assessing market behavior and planning your trades.

Action Items

- Familiarize yourself with candlestick patterns by reviewing charts of your recent trades

- Incorporate candlestick analysis into your trading journal, noting patterns and their context

- Practice using volume and trend position to confirm or downplay the significance of candlestick patterns