The Wick Play

Master a unique and highly effective setup that signals the transfer of control from sellers to buyers in a micro time frame for immediate, multi-week moves

The Wick Play is a unique and highly effective setup that signals the transfer of control from sellers to buyers in a micro time frame. It occurs when a stock creates an upside wick followed by an inside bar with volume dry-up. Though rare, this pattern often leads to immediate, multi-week moves when triggered. Understanding the psychology and execution of the Wick Play can help you capitalize on these high-conviction opportunities.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify the Wick Play and understand its key components

- Recognize the psychological shift between buyers and sellers in this setup

- Develop entry and stop-loss strategies for the Wick Play

- Understand the importance of volume dry-up in confirming the pattern

What Is a Wick Play?

Definition

The Wick Play forms when:

- A stock creates a bar with a prominent upside wick (showing sellers pushed price lower during the session)

- The next bar trades entirely within the wick’s range, forming an inside bar

- Volume typically dries up during the inside bar, signaling reduced selling pressure

Key Components

- Upside Wick: Sellers initially take control, pushing price down from the session’s high

- Inside Bar: The next bar trades fully within the wick, reflecting a stalemate between buyers and sellers

- Volume Dry-Up: Light volume during the inside bar signals a reduction in selling

- Breakout Trigger: The setup triggers when price moves above the wick’s high or the high of the inside bar

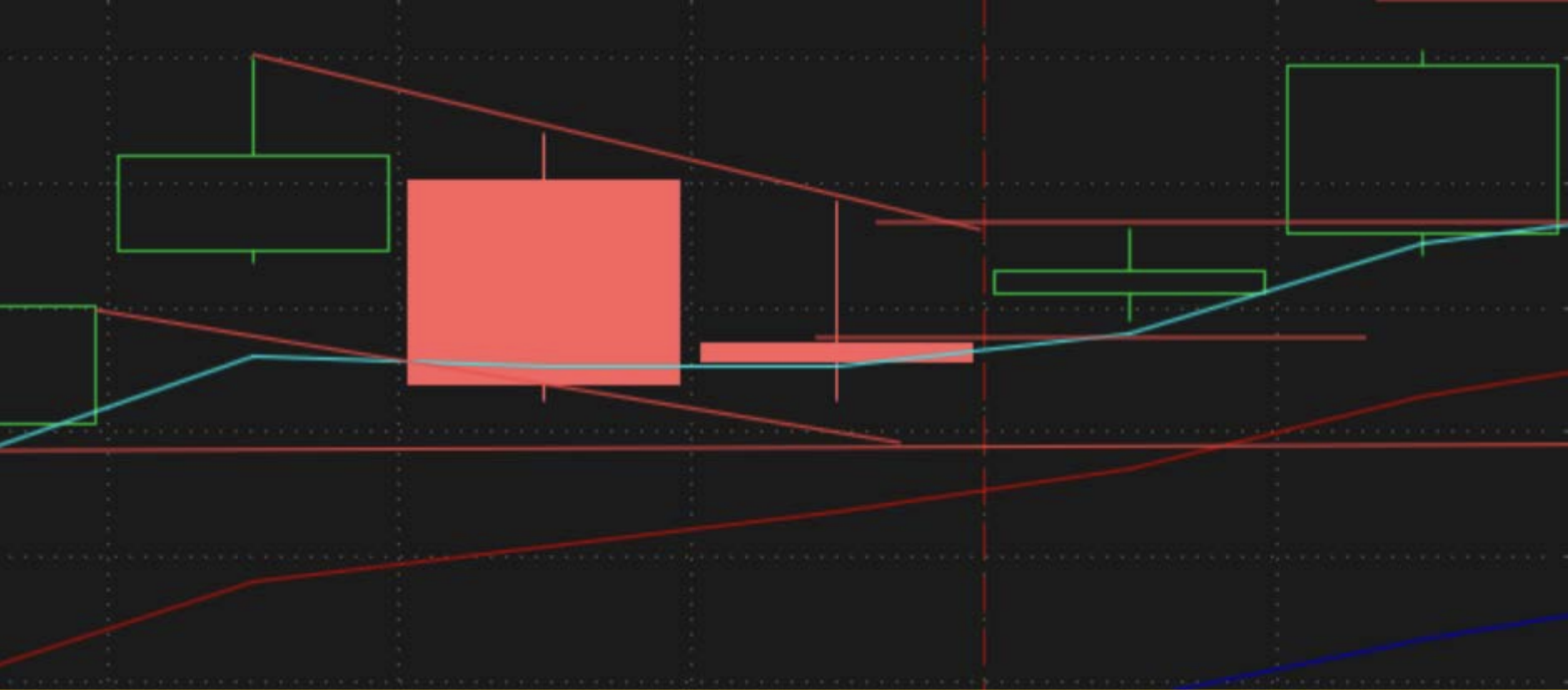

Example: Upstart (UPST)

- The stock formed an upside wick as sellers pushed price lower

- The following inside bar traded within the wick on low volume

- The breakout above the wick high led to a multi-week rally

Understanding the Psychology of the Wick Play

What Does the Wick Represent?

- Day 1 (Wick Formation): Sellers dominate, creating a visible wick as they push price lower

- Day 2 (Inside Bar): Buyers step in and support the stock, resulting in an inside bar and reduced selling pressure

Why the Wick Play Works

- The upside wick creates a clear battleground

- The inside bar reflects a stalemate, as selling subsides and buying interest increases

- Breaking the wick high signals that buyers have overwhelmed sellers, leading to a sharp upward move

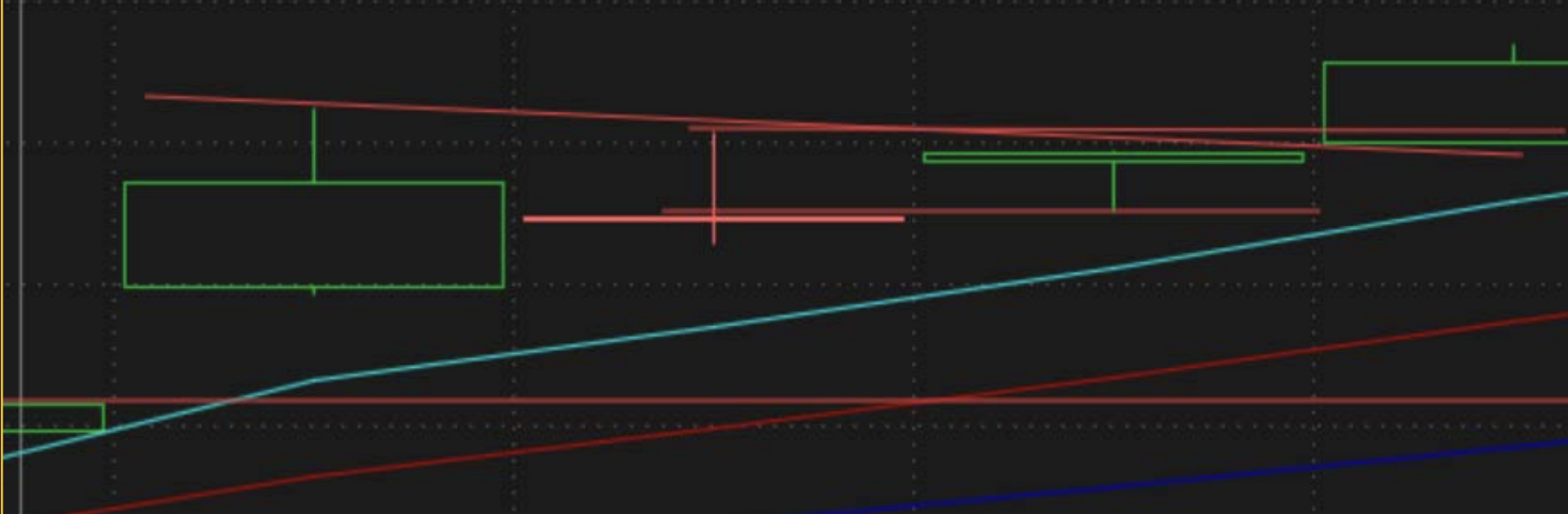

Example: Nvidia (NVDA)

After a prior move higher, Nvidia formed a Wick Play within a short-term flag. Breaking the wick high led to a strong continuation rally.

How to Trade the Wick Play

Entry Points

- Aggressive Entry: Enter as the stock breaks above the inside bar high (often provides a tighter stop)

- Conservative Entry: Wait for price to break above the wick high for confirmation

Stop-Loss Placement

- Place your stop below the low of the inside bar to manage risk tightly

- For more room, use the low of the wick as your stop level

Position Management

- Scale into the trade as price moves higher

- Use trailing stops to lock in gains if the move extends over multiple days or weeks

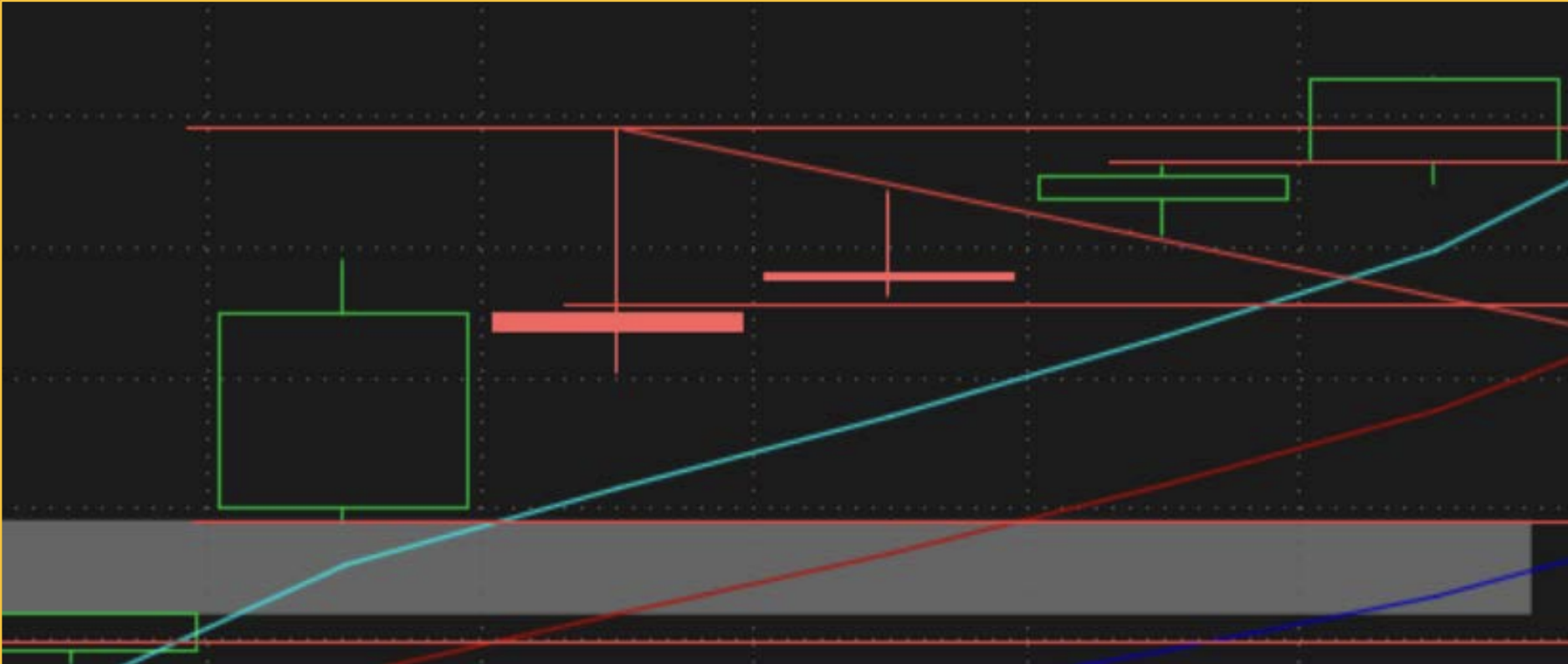

Example: Tesla (TSLA)

- Entered at the inside bar breakout with initial stops below the inside bar low

- Added to the position after confirmation of the wick high breakout

- Trailed stops to lock in gains during the subsequent rally

Key Considerations for the Wick Play

Volume Dry-Up

The inside bar should form on reduced volume, confirming that selling pressure has subsided.

Context Matters

While the Wick Play can stand alone as a short-term setup, its effectiveness increases when it aligns with larger patterns (e.g., flags or bases).

Avoid Extreme Volatility

Wicks with overly large ranges can introduce excessive risk. Look for setups with tighter wicks and low volatility.

Bearish Wick Plays

The pattern also works in reverse for bearish setups. A downside wick followed by an inside bar can signal a breakdown if price breaches the wick low.

Reflection

What role does volume dry-up play in confirming the Wick Play pattern?

Action Items

- Find and study Wick Plays in stocks with recent high volatility. Look for tight inside bars with volume dry-up

- Track the performance of these setups to refine your entry and management strategies

- Experiment with different stop-loss placements to optimize risk management

Conclusion

The Wick Play is a rare but highly rewarding setup that provides clear, actionable signals when executed correctly. By focusing on volume dry-up, tight ranges, and strategic entries, you can effectively capture explosive moves with minimal risk.

The Wick Play compresses market psychology into a micro timeframe, providing a unique edge when executed with precision. Master this pattern to add a powerful tool to your trading arsenal.