The Double Bottom Base

Master the double bottom base pattern with shakeouts, institutional support signals, and entry strategies for low-risk, high-reward trading opportunities

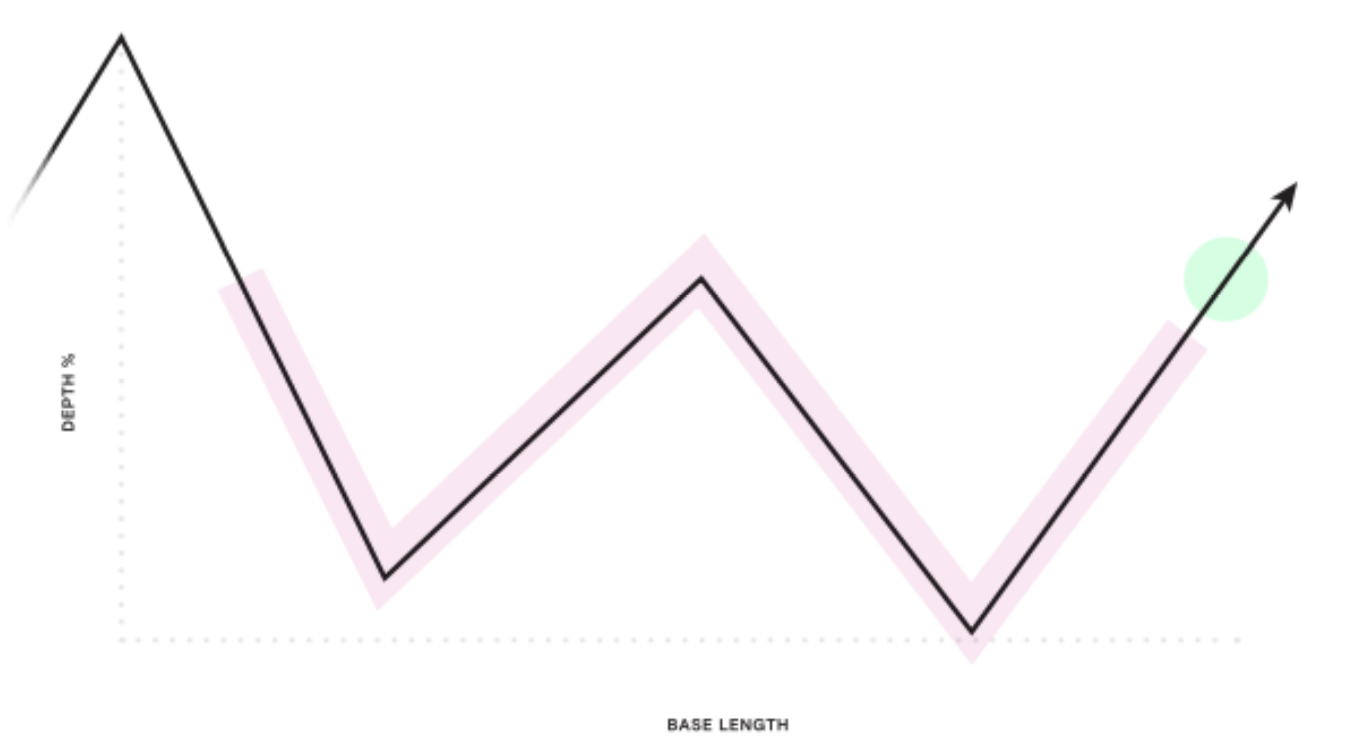

The double bottom base is a powerful continuation pattern marked by a “shakeout” at its low points. This shakeout triggers weak holders to sell, allowing institutional buyers to step in, accumulate shares, and support the stock for its next leg higher. Understanding the structure and entry points of a double bottom base can provide traders with low-risk, high-reward setups.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify a double bottom base and its key components

- Recognize shakeouts as a sign of institutional support

- Use wedge pop and pivotal point strategies to enter double bottom setups early

- Manage trades in volatile setups, including IPOs

What Is a Double Bottom Base?

Definition

A double bottom base is a consolidation pattern characterized by two distinct lows, where the second low undercuts the first. This undercut, or “shakeout,” clears weak holders and sets the stage for a reversal.

Key Characteristics

- Two Lows: The second low slightly undercuts the first

- Shakeout: The undercut triggers stop-losses, creating liquidity for institutional buyers

- Buy Points:

- Early Entry: At the wedge pop or crossback as the price climbs from the second low

- Traditional Buy Point: At the midpoint of the base when price clears resistance

Recognizing Shakeouts as Signs of Institutional Support

Why Shakeouts Matter

Shakeouts flush out weak holders, clearing the way for institutional buyers to step in.

Signs of a Successful Shakeout

- Undercut and Recovery: Price takes out the first low but closes higher, signaling demand

- Volume Spike: Strong volume on recovery days confirms institutional buying

- Follow-Through: Price does not retest the shakeout low after recovery

Example in Roblox

- After undercutting the first low, a bullish engulfing bar on massive volume marked the reversal point

- The pattern showed institutional support, evidenced by follow-through buying and a rapid breakout

Entry Strategies for Double Bottom Bases

Early Entry: Wedge Pop and Crossback

- Look for a wedge pop as price breaks above the descending trendline within the base

- Use crossback setups (reclaiming EMAs) for tight entries before the midpoint breakout

Traditional Buy Point

- Enter when price breaks above the midpoint of the double bottom base

Example in Roblox

- Early Entry: Enter at the wedge pop after the bullish engulfing bar on high volume

- Traditional Entry: Enter as price cleared the midpoint resistance and pivot breakout

Managing Stops and Risk

Stop Placement

- Early Entry Stops: Place stops below the second low of the base

- Traditional Entry Stops: Place stops below the breakout day’s low

Adjusting Stops

- Once the stock moves above the pivot breakout, move stops higher to lock in gains

Example in Roblox

- Early Entry: Place the stop below the bullish engulfing bar

- Pivot Entry: Move the stop below the breakout day’s low to manage risk

- As price moved higher, stops were adjusted to protect gains without cutting off the trade prematurely

Special Considerations for IPOs

IPO Trading Tips

- Before the lockup period (typically six months post-IPO), treat trades as shorter-term swings

- After the lockup period, institutions begin accumulating shares, allowing for longer-term holds

Example in Roblox

- The double bottom base formed before the IPO lockup period

- The trade was treated as a quick swing for a 30% move, given the potential volatility of early-stage IPOs

Reflection

How does the presence of a shakeout in a double bottom base increase its reliability as a setup?

Conclusion

The double bottom base is a versatile pattern that provides both early and traditional entry opportunities. By focusing on shakeouts, volume, and price action, you can identify high-probability setups and manage risk effectively.

Shakeouts and strong volume recovery are key indicators of institutional demand. Combine these insights with tight entries and stop management for optimal results.

Action Items

- Identify double bottom bases on daily or weekly charts. Look for signs of shakeouts and institutional support

- Track setups through their wedge pop and pivot breakouts to refine your entry strategy

- Evaluate the outcome of your trades and make adjustments to your approach