The Base n’ Break

Learn to identify consolidation patterns in uptrending stocks and capitalize on low-risk entry opportunities as stocks resume their advance

Building a reliable trading system is essential for any successful stock trader. This lesson focuses on key strategies for selecting the right stocks, timing your trades, and understanding the natural cycle of price action in the market. By the end of this lesson, you’ll know how to identify high-potential stocks, leverage technical analysis for optimal trade timing, and apply the price cycle to maximize your profits while minimizing losses.

Learning Objectives

By the end of this lesson, you will be able to:

- Identify strong growth stocks using earnings and sales data

- Analyze stock price and volume to inform your trading decisions

- Recognize key phases in the stock price cycle for better entry and exit points

- Apply moving averages and multiple time frames for trend confirmation

- Manage risk by using position sizing and logical stop-loss strategies

What is the Base n’ Break?

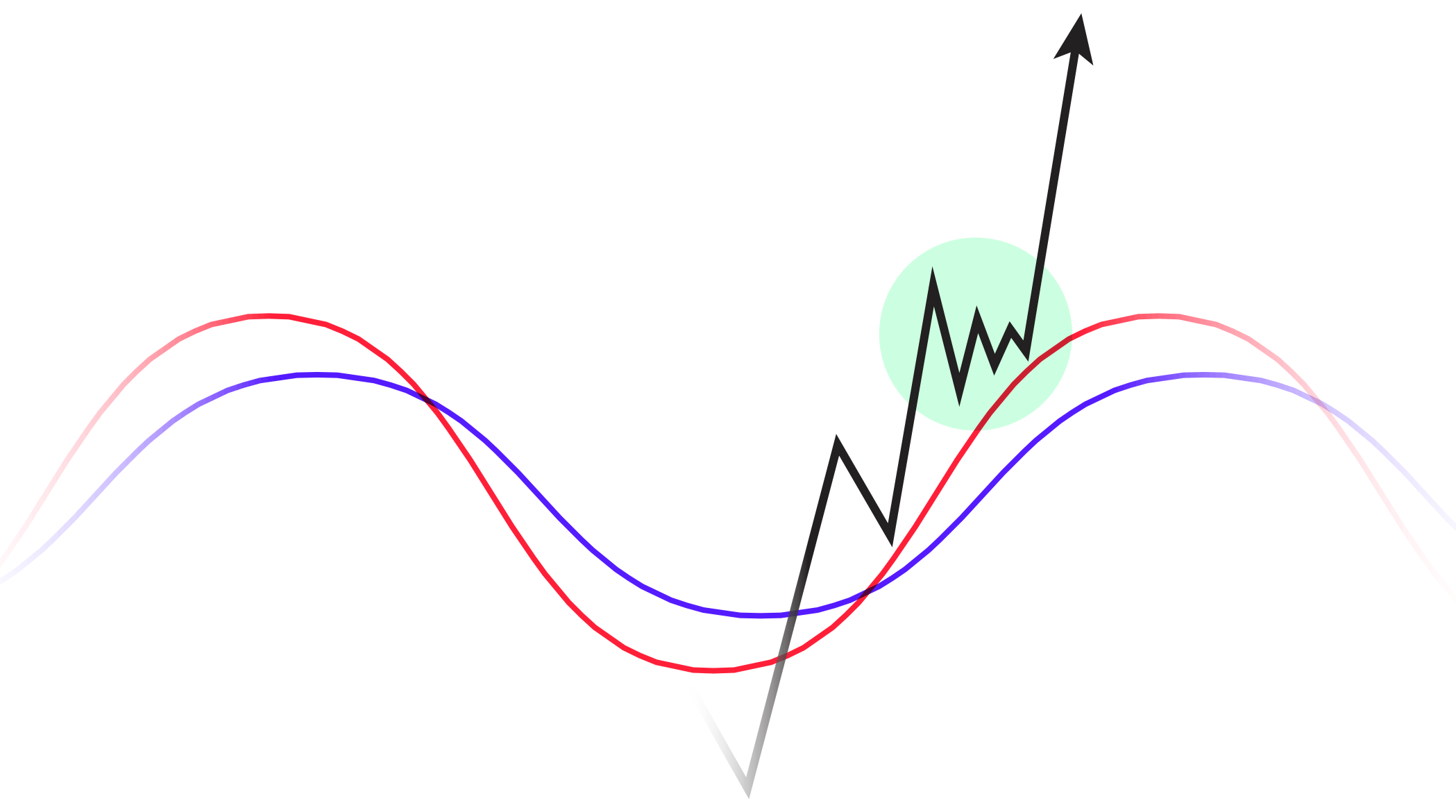

Defining the Base n’ Break

The Base n’ Break is a consolidation pattern that occurs during an uptrend, when a stock pulls back into its moving averages (usually the 10- and 20-day EMAs) after a previous advance. This consolidation typically forms a tight trading range, creating a pivot point that offers a low-risk entry for traders.

Key Characteristics

- Short-term consolidation: The Base n’ Break usually forms over 1-3 weeks as the stock digests its gains

- Price Support: The price will pull back into the rising moving averages and consolidate before breaking higher again

Key Elements of the Base n’ Break

- Formation of a Pivot: As the price consolidates, a pivot point forms, offering a tradable range

- Retest of Moving Averages: The stock often retests the 10- and 20-day EMAs during the consolidation

- New Highs: Once the pivot is broken, the stock will resume its uptrend and advance to new highs

Example: NIO 2020

In 2020, NIO demonstrated several Base n’ Breaks, each time consolidating near its moving averages before breaking to new highs, allowing traders to add to positions during the uptrend.

Trading the Base n’ Break

Identifying the Buy Area

When trading the Base n’ Break, it’s important to recognize the proper buy area:

- Look for a tight price range: As the stock consolidates near its moving averages, a tight price range develops, providing a clear pivot

- Confirm the Breakout: Wait for the stock to break through the pivot with strength (increased volume is a good confirmation) before adding to your position

Managing Risk

The Base n’ Break provides a low-risk opportunity to increase your exposure, but it’s essential to manage risk effectively:

- Place stops below the pivot: If the price fails to hold at the pivot and moves lower, the trade may not be ready. Place stops below the low of the pivot or breakout bar to protect your capital

- Add in pieces: Rather than committing all capital at once, consider adding in smaller increments. This allows you to accumulate shares as the price is supported by the moving averages, then add more as the breakout confirms strength

Understanding the Cycle of Price with Base n’ Breaks

Early vs. Late in the Cycle of Price

As the stock progresses through its Cycle of Price, multiple Base n’ Breaks may occur. Recognizing where you are in the cycle can help you plan your trades and adjust your position size:

- Early in the cycle: A Base n’ Break might occur shortly after an EMA Crossback, offering a prime opportunity to add to your position early in the trend

- Later in the cycle: As multiple Base n’ Breaks form, the stock is likely further along in its cycle. At this stage, be quicker to sell into strength and watch for signs of a potential Exhaustion Extension

Base n’ Breaks at Previous Highs

Sometimes, the Base n’ Break will form near previous highs, especially during market corrections. After an EMA Crossback, a stock may retest its moving averages as it moves up the right side of a larger base. In these cases, the Base n’ Break can align with traditional patterns like the cup and handle or longer basing structures.

Practical Steps for Trading the Base n’ Break

Steps to Enter a Trade

- Wait for the Base to Form: As the stock consolidates, look for a tight price range and a clear pivot to form against the moving averages

- Confirm Strength: Once the stock shows support at the moving averages and breaks through the pivot, enter the trade

- Add in Pieces: Build your position by starting small when the stock is supported by the moving averages, then add more as the price confirms the breakout

Example: AFRM 2023

In 2023, AFRM formed a Base n’ Break after a strong advance. Traders could have entered as the stock pulled back into its moving averages, then added to their position once the price broke through the pivot with increased volume.

Managing Stops and Taking Profits

- Stop Placement: Set your stop just below the pivot or the low of the breakout bar

- Trailing Stops: As the stock advances, use trailing stops to lock in gains while allowing the price to continue moving higher. Raise stops as the stock confirms new highs

- Take Profits into Strength: If the stock shows signs of an Exhaustion Extension or starts to exhibit weakness, consider taking profits as the stock moves higher

Applying Base n’ Break to Indices and Leading Stocks

Identifying Leading Stocks

Leading stocks often form Base n’ Breaks well before the broader market. By screening for relative strength, you can identify which stocks are likely to lead the market once the selling pressure subsides.

Example: ELF 2022

In 2022, ELF exhibited strong price action and formed multiple Base n’ Breaks, well ahead of the market, which was still experiencing volatility. As the market rebounded, ELF was already breaking into new highs.

Timing with Market Cycles

While individual stocks are progressing through their own price cycles, the broader market may be forming its Reversal Extension, Wedge Pop, or EMA Crossback. As the index begins to stabilize and buyers show up, the strongest stocks that have already formed Base n’ Breaks will lead the next uptrend.

Example: STRL 2023

STRL in 2023 provided multiple Base n’ Breaks as it advanced through its price cycle, giving traders multiple opportunities to add to positions while managing risk.

Reflection

As you review your current positions, how can you use the Base n’ Break pattern to add to your winning trades? What signals will you watch for to determine where you are in the Cycle of Price?

Conclusion

The Base n’ Break is an essential pattern for traders looking to add to positions during an uptrend while minimizing risk. By recognizing where a stock is within its Cycle of Price, you can plan your trades more effectively, manage risk through pivots and moving averages, and take advantage of multiple buying opportunities. As stocks form multiple Base n’ Breaks, it’s important to stay aware of the cycle’s progression and be quick to sell into strength as the stock nears its exhaustion point.