Building a Reliable Trading System

Master the key strategies for selecting stocks, timing trades, and understanding price action cycles to maximize profits while minimizing losses.

Learning Objectives

- Identify strong growth stocks using earnings and sales data

- Analyze stock price and volume to inform your trading decisions

- Recognize key phases in the stock price cycle for better entry and exit points

- Apply moving averages and multiple time frames for trend confirmation

- Manage risk by using position sizing and logical stop-loss strategies

Identifying Strong Growth Stocks

Earnings and Sales Growth

The foundation of successful trading begins with selecting stocks that demonstrate solid growth potential. Focus on companies showing significant increases in both earnings and sales, as these are key indicators of financial strength and future upward momentum.

Example

A stock showing a 20% year-over-year increase in earnings is a strong candidate for a potential trade.

Price and Volume as Primary Indicators

Price and volume work together to tell the complete story of market demand. Price shows what the market is willing to pay, while volume confirms the strength of that demand. When a stock’s price rises alongside high volume, it signals strong buyer interest and validates the upward momentum.

Timing Your Trades

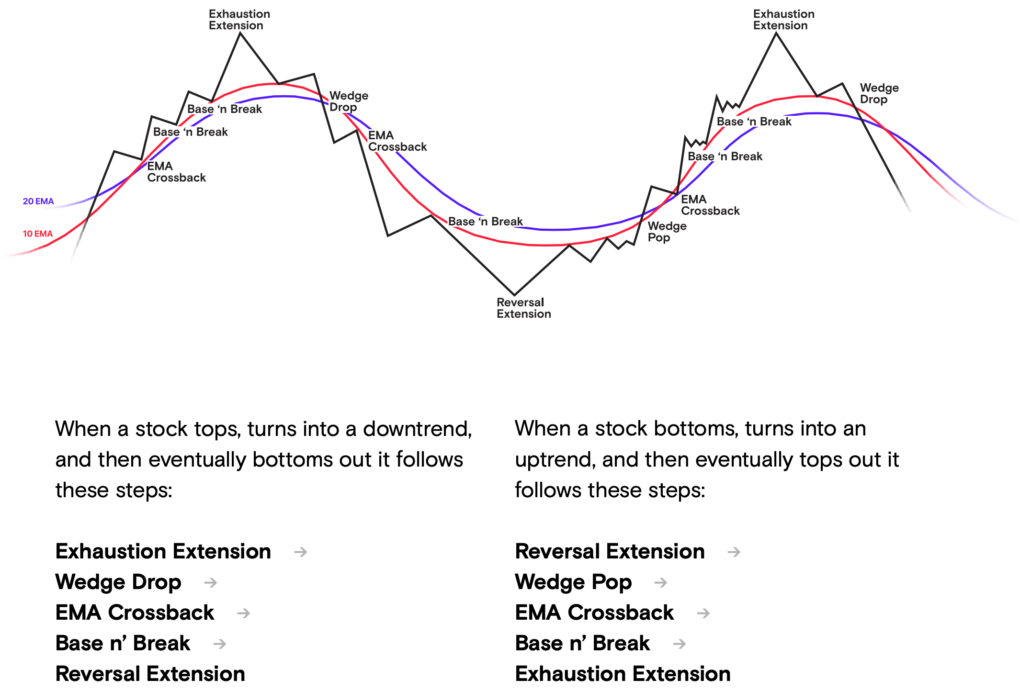

The Cycle of Price Action

Understanding the cyclical nature of price action is critical for effective trade timing. Stocks typically follow predictable patterns that smart traders can exploit for optimal entry and exit points.

The 8-Phase Price Cycle

Managing Losses and Profits

Small Losses, Big Profits

The cornerstone of successful trading is limiting losses while maximizing gains. This principle requires discipline and proper risk management techniques.

Key Risk Management Strategies

- Position Sizing: Never overexpose yourself to any single stock. Proper position sizing limits risk if trades move against you.

- Logical Stops: Set stop-loss orders at technically significant levels based on chart patterns and indicators, protecting capital without premature exits.

The Price Cycle in Detail

Reversal Extension

At the cycle’s lowest point, panic selling drives prices down sharply. Smart traders look for support levels on higher time frames as signs that prices are stabilizing and ready to reverse.

Wedge Pop – The Money Pattern

After reaching its low, the stock rallies through moving averages for the first time. This Wedge Pop indicates potential upward momentum and presents the first major buying opportunity in the new cycle.

EMA Crossback and Base n’ Break

Following the initial pop, stocks often consolidate. The EMA Crossback occurs when price retests moving averages, providing a second entry opportunity. Base n’ Break patterns form when prices move sideways, creating stable platforms before breaking out again.

Exhaustion Extension and Wedge Drop

After strong uptrends, stocks may reach Exhaustion Extension phases—euphoric blow-offs where prices rise too far, too fast. This signals the uptrend’s end, followed by a Wedge Drop as the stock declines back through moving averages.

Oliver Kell’s Trading Approach

Oliver Kell focuses on stocks with the strongest earnings and sales growth, building his strategy around several core principles:

Core Trading Principles

- Price Action: The most critical factor. Clean, simple charts help focus on actual price movements.

- Volume: Confirms price action, particularly during key pivot points and breakouts.

- Moving Averages: Follow price trends and provide secondary signals for trade decisions.

Multiple Time Frame Analysis

Kell uses different time frames to assess the fractal nature of stock price movements:

Reflection

Think about how you can apply the cycle of price action to your current trades. Where do you need to improve your timing or stock selection?

Conclusion

Developing a reliable trading system involves selecting the right stocks, timing your entries and exits with the cycle of price action, and managing risk effectively. By understanding these cycles, using moving averages, and incorporating multiple time frames, you’ll be better equipped to make informed trading decisions. Stay patient in the early stages of a stock’s cycle and become more defensive as it approaches exhaustion. With these tools, you’ll minimize losses and maximize profits as you navigate the stock market.